MCAI Lex Vision: Windermere and Compass, Two Philosophies of Real Estate

Cooperative Infrastructure vs. Platform Extraction

The MindCast AI Private Real Estate Listings series: Washington’s SB 6091 and Private Real Estate Market Control (Jan 2026), The Compass Astroturf Coefficient at the Washington State Senate (Jan 2026), Compass–Anywhere, When Scale Becomes Liability (Jan 2026), Compass vs. SB 6091, Narrative Pre-Installation and the Infrastructure of Exception Capture (Jan 2026), HB 2512 and the Collapse of Compass’s Coordinated Opposition (Jan 2026), How Compass’s State Legislative Testimony Undermined its Federal Antitrust Claims (Jan 2026), The Collapse of Compass’s Co-Conspirator Theory (Jan 2026), Compass vs. Competition: The Case for SB 6091 / HB 2512 Without an Opt-Out Exception (Feb 2026).

Executive Summary

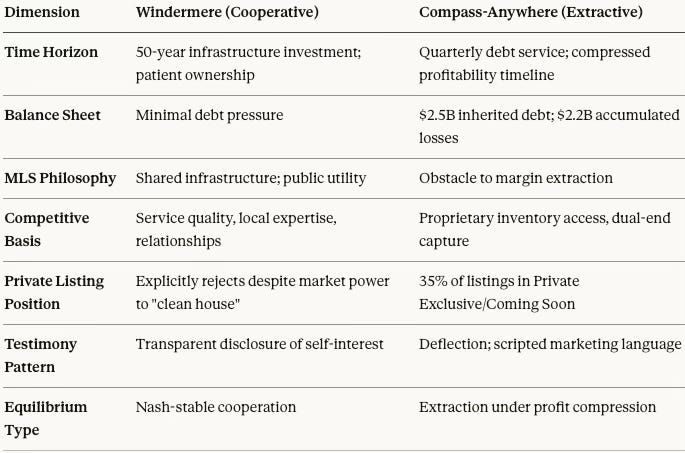

The Washington residential real estate market faces a structural fork. One path preserves cooperative infrastructure—open listings, full inventory visibility, and competition on service quality. The other path enables platform extraction—inventory sequestration, access-based competition, and private capture of public market value.

The following analysis operationalizes the contrast through a comparative study of the Windermere model and the Compass-Anywhere model, drawing on proprietary MindCast AI Cognitive Digital Twin (CDT) foresight simulations to identify the equilibrium behaviors that emerge under different regulatory outcomes.

The January 23, 2026 Washington State Senate Housing Committee hearing on SB 6091 serves as the linchpin for this analysis. The hearing produced direct testimony from both Compass and Windermere leadership, revealing the divergent equilibrium strategies in real time. Compass’s advocacy for broad “seller request” exceptions—documented in The Compass Astroturf Coefficient at the Washington State Senate (January 2026)—provides the primary source material for modeling how platform actors operationalize exception capture.

The hearing transcript functions as a natural experiment in advocacy arbitrage, where the same privacy concerns that protect vulnerable seniors are rhetorically weaponized to secure industry-wide defection channels.

The governing variable is Profit Timeframe Compression (PTC)—the behavioral shift that occurs when firms transition from long-horizon venture growth assumptions to near-term profitability constraints. Following its merger with Anywhere Real Estate, Compass inherited $2.5 billion in corporate debt and now operates under quarterly debt-service requirements rather than the patient capital timelines that characterized its pre-IPO expansion.

When profit horizons compress, firms rationally shift from creating value through market health to capturing value through information control. In residential real estate, that control manifests as private listings, internal routing, and dual-end capture—mechanisms that monetize access rather than service. The theoretical foundation for behavioral prediction is developed in MindCast AI publication The Dual Nash-Stigler Equilibrium Architecture (Jan 2026), which models the conditions under which firms abandon cooperative coordination in favor of capture strategies.

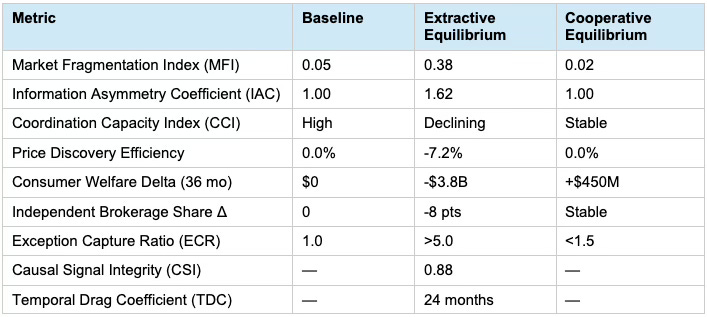

The CDT simulation achieves a Causal Signal Integrity (CSI) score of 0.88, indicating that Compass’s extractive behaviors documented here arise from balance-sheet geometry rather than stated corporate intent. A score above 0.85 validates the causal chain: profit compression creates the forcing function, and private listings provide the margin stabilization mechanism. The Information Asymmetry Coefficient (IAC) for platform-affiliated transactions stands at 1.62, quantifying the access advantage that internal networks enjoy over the public market.

The CSI and IAC metrics are not incidental observations—they are the predictable outputs of a firm whose survival depends on capturing both sides of transactions that would otherwise occur in open competition.

By contrast, Windermere Real Estate exhibits a cooperative equilibrium. Its testimony before the Washington Senate Housing Committee concedes that private listings would be profitable in the short term—Windermere would “clean house” given its 25% statewide market share and 35% dominance in the luxury segment. Yet the firm explicitly rejects that path to preserve the coordination infrastructure that sustains long-run transaction volume and trust.

The Windermere rejection of private listings is not altruism; it is a Nash-stable strategy in which firm value remains tethered to market integrity. The theoretical basis for Windermere’s equilibrium position is developed in MindCast AI publication Federal Antitrust Breakdown as Nash-Stigler Equilibrium, Not Accident (Jan 2026) which explains why dominant incumbents with long time horizons rationally preserve public coordination infrastructure even when defection would yield short-term gains.

The current foresight simulation identifies a critical risk vector: exception capture. High-emotion edge cases—particularly the privacy needs of vulnerable seniors facing medical transitions—are legitimate safety concerns that merit accommodation. But when these concerns are encoded as broad “seller request” opt-outs, as argued by Compass, they become scalable defection channels that platform actors can operationalize through training and paperwork.

The Temporal Drag Coefficient (TDC) indicates a 24-month capture window during which extractive practices become “market standard” before enforcement mechanisms can adapt. Absent immediate statutory clarity through state legislations like Washington’s SB 6091, the exception pathway will convert from a narrow safety accommodation into the default intake route for luxury inventory.

Foresight Simulation Predictions

The federal-to-state escalation pathway is already active. As documented by the Wall Street Journal, Compass bypassed DOJ antitrust scrutiny of the Anywhere merger by appealing above division head Gail Slater to Deputy Attorney General Todd Blanche's office, using Trump-aligned lawyer Mike Davis to close the deal "far earlier than the time frame of at least nine months." The MindCast AI Stigler Equilibrium framework identifies the resulting sequence: Lobbying → Litigation → Federal Preemption.

The January 23 Housing Committee hearing—with its 94.4% Astroturf Coefficient and proposed amendment language—confirms the lobbying phase is advanced. If SB 6091 passes without broad exceptions, litigation follows; federal preemption emerges as the terminal strategy once multistate coalitions form. Preemption is structurally the weakest argument in the sequence—a Hail Mary designed to secure a preliminary injunction blocking enforcement while the case proceeds, not to win on the merits.

Two equilibria emerge from the simulation.

Windermere model: In the cooperative equilibrium (SB 6091 passes as written), exceptions remain narrow, auditable, and time-bounded; price discovery remains robust; competition occurs on merit; and the Market Fragmentation Index (MFI) stays below 0.05.

Compass model: In the extractive equilibrium (SB 6091 fails or includes broad exceptions), the MFI rises to 0.38, meaning over a third of inventory becomes invisible to the public market; sellers lose bidding-war premiums; buyers pay “search taxes” to access sequestered inventory; and the Consumer Welfare Delta reaches negative $3.8 billion over 36 months.

The MindCast AI foresight simulation conclusion is structural, not moral: when firms under profit compression are permitted to privatize coordination infrastructure, the market converts from a public utility into a taxed access system. SB 6091 functions as a barrier against that conversion by preserving mandatory transparency and preventing private debt and profitability pressure from being externalized onto Washington consumers.

The question for the legislature is whether exceptions will remain narrow, auditable, and time-bounded—or whether they will scale into defection channels that fragment the coordination infrastructure that has served Washington homeowners for fifty years.

Contact mcai@mindcast-ai.com to partner with us on Law and Behavioral Economics foresight simulations. See recent work: The Geometry of Regulatory Capture at the U.S. Department of Justice Antitrust Division (Jan 2026), MindCast AI Field-Geometry Reasoning, A Unifying Framework for Structural Explanation in Law, Economics and Artificial Intelligence (Jan 2026).

I. Profit Timeframe Compression

Profit Timeframe Compression (PTC) functions as the governing variable in this analysis because it determines whether a firm’s rational strategy favors market health or market capture. When a firm operates under long-horizon assumptions—patient venture capital, minimal debt service, runway measured in years—the optimal strategy is to build transaction volume by improving market liquidity and trust.

A firm’s value grows with the market’s value. But when profit horizons compress due to debt covenants, quarterly earnings pressure, or investor demands for near-term returns, the calculus inverts. A firm can no longer afford to wait for market-wide growth; it must extract margin from existing transactions, even if that extraction degrades the market for everyone else.

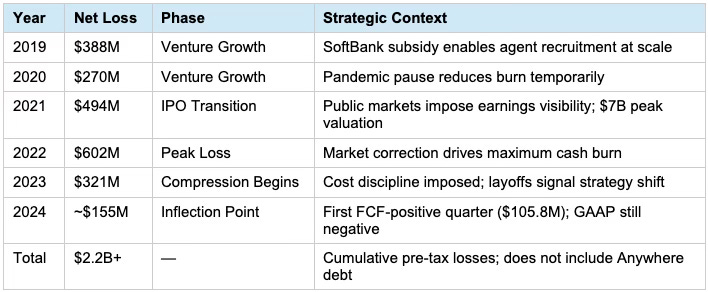

Compass’s financial trajectory illustrates this compression with unusual clarity. The company accumulated $2.2 billion in losses between 2019 and 2024, funded first by SoftBank’s venture capital and then by public markets following its 2021 IPO. The 2024 transition to positive free cash flow—highlighted in management’s Q4 2025 earnings call—marked the inflection point where the growth-phase tolerance for losses ended and the profitability-phase demand for margin capture began. The January 2026 merger with Anywhere Real Estate accelerated this compression by adding $2.5 billion in inherited corporate debt to Compass’s balance sheet.

Compass now operates under debt-service timelines that are incompatible with the patient market-building strategy that characterized its earlier years.

The behavioral shift induced by PTC is stark. Under long-horizon assumptions, the MLS functions as shared infrastructure that benefits all participants by reducing search costs and enabling price discovery. Under compressed timelines, the MLS becomes an obstacle to margin extraction because it routes buyers to the best listing rather than the platform’s listing. The rational response is to withdraw inventory from public coordination and route it through internal networks where both sides of the transaction can be captured.

Compass’s “Private Exclusive” and “Coming Soon” programs accomplish precisely the double-side capture objective: they hold listings off the MLS during the critical early-marketing period when buyer interest peaks, increasing the probability that both buyer and seller originate within the Compass network.

The foundation for Compass’s behavioral prediction is developed in Compass’s Technology Trap, How IPO Narrative Became Its Antitrust Liability (Jan 2026), which explains how proprietary tools create switching costs that prevent agents from defecting even when platform behavior degrades market quality. The analysis shows that “platform stickiness”—which Compass touts to investors as a competitive moat—functions as an exit barrier that enables extraction at scale. Agents who have invested in Compass’s proprietary CRM and AI tools face substantial costs if they attempt to leave, which means the platform can shift toward extraction without losing its agent base. How the Compass–Anywhere Merger Reshapes Broker Bargaining Power (Jan 2026).

The counterfactual symmetry is essential to understanding why PTC, not corporate character, drives the divergence between Compass and Windermere. Both firms would benefit financially from inventory sequestration. Windermere’s OB Jacobi concedes that explicitly in his Senate testimony: with 25% statewide share and 35% in the luxury segment, Windermere would “clean house” if it pursued private listings.

The divergence between Windermere and Compass arises not from market position but from profit horizon and balance-sheet constraints. Windermere operates without the debt burden and quarterly-earnings pressure that force Compass toward extraction. The story is not one of good actors versus bad actors; it is a story of different incentive geometries producing different behavioral outputs under the same market conditions.

The Financial Forcing Function

The following table documents Compass’s cumulative losses and the strategic context that shifted the firm from growth-phase tolerance to profitability-phase extraction:

The Dual-End Capture Mechanism

Dual-End Capture (DEC) provides the margin improvement necessary to sustain profitability under compressed timelines. The mechanism is straightforward: by restricting inventory visibility during the early-marketing period, the platform increases the probability that both buyer and seller are sourced internally. When both sides originate within the network, the platform captures 100% of the commission pool rather than splitting with a cooperating broker.

As of February 2025, approximately 35% of Compass listings (7,500+ of 22,138 nationally) operate in Private Exclusive or Coming Soon status, reflecting the scale at which DEC has been operationalized.

The Information Asymmetry Coefficient (IAC) of 1.62 quantifies the access advantage that platform-affiliated transactions enjoy over the public market. An IAC above 1.0 indicates that platform agents have systematically better access to inventory than non-platform agents; at 1.62, the advantage is substantial enough to constitute a competitive barrier. The coefficient is not an incidental market feature—it is the deliberate product of inventory sequestration designed to route transactions through internal networks. The theoretical framework for understanding IAC as a manufactured product is developed in MindCast AI series Chicago School Accelerated — The Integrated, Modernized Framework of Chicago Law and Behavioral Economics (Jan 2026), which introduces the “search tax” methodology for measuring the welfare costs of artificially restricted information.

Robert Reffkin’s February 2025 investor signal—”I believe 2025 will be the year that the gap between Compass and the industry widens”—confirms that the private listing strategy is central to management’s investment thesis. The “gap” Reffkin references is the margin differential between platforms that capture both transaction sides and brokerages that operate in the open market. The strategy cannot survive SB 6091 without exception capture, which explains the intensity of Compass’s legislative opposition.

PTC creates an environment where market transparency becomes a liability to firm margins rather than a shared asset. The resulting pressure forces a transition from merit-based service competition to access-based inventory control. The policy question is whether Washington will permit this transition or preserve the cooperative infrastructure that has served consumers for decades.

The externalization mechanism is precise: Compass's debt-service requirements create internal margin pressure that the firm resolves by sequestering inventory. But the costs of sequestration—reduced price discovery, lost bidding premiums, search taxes—are not borne by Compass; they are borne by sellers who accept lower prices, buyers who pay for access, and independent brokers who lose market share. The firm converts its balance-sheet liability into a market-wide tax. The structural parallel to other platform extraction patterns is developed in Comparative Externality Costs in Antitrust Enforcement, A Nash–Stigler Foresight Study of Federal Enforcement Equilibria (Jan 2026), which models how debt-laden platforms externalize profitability pressure onto captive market participants.

II. The Documentation Trap

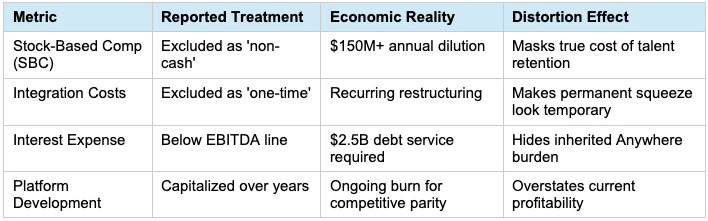

The Documentation Trap exposes the fundamental contradiction between Compass’s investor-facing narratives and its regulatory advocacy. Platform actors cannot simultaneously project market dominance to shareholders and claim vulnerable-underdog status before legislatures; the SEC filings that reassure investors become admissions that constrain testimony. The following analysis documents specific sugar-coating patterns used to mask the velocity of the profit squeeze, drawing on The Geometry of Regulatory Capture at the U.S. Department of Justice Antitrust Division (Jan 20260 for the theoretical framework that explains how capital scale warps competitive dynamics.

The contradiction operates at multiple levels. In SEC filings, Compass describes its platform as an “end-to-end efficiency engine” that delivers superior outcomes for agents—the narrative of market leadership. In SB 6091 testimony, the same firm argues that the market “forces a one-size-fits-all approach” and that homeowners need a “written opt-out” to preserve dignity—the narrative of consumer protection against regulatory overreach.

Compass’s narratives are mutually exclusive. A dominant platform with genuine efficiency advantages does not require regulatory carve-outs to compete; a scrappy defender of consumer autonomy does not tout “platform stickiness” as a competitive moat to investors.

The translation problem is structural. The same features described to investors as sources of competitive advantage translate to regulators as mechanisms of coordination capture. “Platform stickiness” becomes exit barriers; “switching costs” become labor market control; “proprietary data” becomes information asymmetry; “Private Exclusives” become inventory sequestration. The translation is not rhetorical gamesmanship—it reflects the dual nature of platform economics, where features that create value for the platform owner simultaneously extract value from market participants. The theoretical basis for duality is developed in Compass’s Technology Trap (Jan 2026), which explains how Non-Portable Capital functions as both a retention mechanism and an exit barrier depending on whether you’re measuring platform value or agent welfare.

The following subsections document specific sugar-coating patterns in Compass’s financial disclosures. Each pattern serves to project health to investors while concealing the underlying fragility that makes private listing capture essential to survival.

Adjusted EBITDA Engineering

The primary tool for projecting profitability is Adjusted EBITDA, which allows management to strip out costs that define the business model. The following table illustrates the gap between Adjusted EBITDA and economic reality:

Stock-Based Compensation exclusion is particularly significant because SBC has historically exceeded $150 million annually. By treating the cost of talent—the firm’s primary asset in a brokerage model—as a “non-cash expense,” management projects profitability that ignores massive shareholder dilution. In the context of the Anywhere merger, this treatment masks the actual cost of servicing inherited debt because interest payments are real cash outflows that EBITDA ignores by definition.

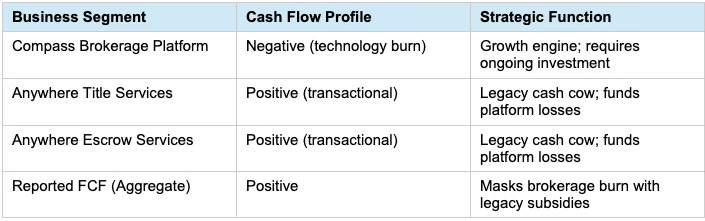

Free Cash Flow Arbitrage

Following the Anywhere merger, management narrative shifted heavily toward “Positive Free Cash Flow” as the lead metric. The arbitrage operates by aggregating high-margin legacy assets with loss-leading technology divisions, creating the appearance that the brokerage platform is self-sustaining when it is actually subsidized by Anywhere’s Title and Escrow businesses:

The Synergy Bucket compounds the distortion. The committed $255 million in “Annualized Synergies” from the merger provides a classification vehicle for moving recurring operational losses into “One-Time Integration Costs.” By labeling layoffs, office closures, and technology sunsets as non-recurring, management makes “Core Operating Expenses” appear lower than they actually are, even when total cash outflows remain unchanged. The reclassification creates the illusion that the profit squeeze is a temporary hurdle rather than a permanent feature of the debt-heavy post-merger state.

Market Concentration and the Exclusion Multiplier

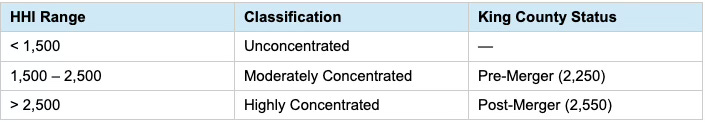

The Herfindahl-Hirschman Index (HHI) for the King County luxury market ($2M+ transactions) provides quantitative support for the behavioral analysis. Sourced from 2025 King County data, 1/1/2025-12/31/2025. Pre-merger HHI stood at approximately 2,250 (moderately concentrated). Post-merger HHI has surged to 2,550 (+300 delta), placing the market in the “Highly Concentrated” range under DOJ/FTC Horizontal Merger Guidelines. Under federal standards, a +300 HHI increase in an already concentrated market is presumptively harmful, particularly in labor-intensive, platform-dependent sectors.

HHI alone understates the competitive harm because it measures static market share without capturing the dynamic exclusion enabled by inventory sequestration. When a firm with 25% market share operates transparently, competitors can still access that inventory through the MLS. When the same firm sequesters inventory in private networks, market share converts into a barrier that denies competing brokers and their clients access to marketed homes. The “Exclusion Multiplier” means that concentration metrics systematically understate the welfare costs of private listing networks.

The Documentation Trap constrains Compass’s public testimony because any defense of the business model confirms coordination capture intent, while any disclaimer of platform stickiness contradicts SEC filings. Deflecting to “seller choice” cannot explain why the model requires that choice to function. The structural bind is inescapable.

Some sellers genuinely prefer speed over price maximization—a quick, quiet sale to a known buyer rather than weeks of showings and competitive bidding. The analysis does not dispute that preference; it disputes scaling that preference into a market architecture. When platform actors convert individual seller choices into default intake pathways, the aggregate effect is coordination capture regardless of any particular seller's intent.

III. Weaponizing Exceptions

Exception Capture represents the primary risk vector for market fragmentation because it converts legitimate safety accommodations into scalable defection channels. The mechanism operates through what MindCast AI research, A Tirole Phase Analysis of Advocacy-Driven Antitrust Inaction at the U.S. Department of Justice (Jan 2026), terms “weaponization risk”: high-emotion edge cases are arbitrage-traded by lobbyists to secure structural business advantages that extend far beyond the original protective intent. In the SB 6091 context, vulnerable seniors facing medical transitions provide the emotional core that Compass leverages to secure a broad “seller request” opt-out applicable to any homeowner.

Federal-to-State Escalation Pathway

Compass's successful deployment of federal lobbying channels to bypass DOJ antitrust scrutiny validates the multi-level advocacy strategy that the CDT foresight simulation predicts will now target SB 6091.

As reported by the Wall Street Journal on January 9, 2026, Justice Department antitrust enforcers wanted to investigate the $1.6 billion Compass-Anywhere merger but were overruled by senior officials. Dave Michaels and Nicole Friedman, “Real-Estate Brokerages Avoided Merger Investigation After Justice Department Rift,” Wall Street Journal, January 9, 2026.

Antitrust division head Gail Slater sought to launch an extended review to weigh whether the merger was anticompetitive, but Compass and its lawyers appealed above her to the office of Deputy Attorney General Todd Blanche, arguing that concerns could be addressed without investigation. Compass had brought on Trump-aligned lawyer Mike Davis—known for his efforts to seat conservative judges and described by former DOJ official Roger Alford as having "corrupted the merger-review process"—to make their pitch directly to Blanche's office.

Having neutralized federal enforcement through political access channels, Compass is now executing the state-level lobbying phase of the escalation pathway that the CDT Stigler Equilibrium Vision identifies as Lobbying → Litigation → Federal Preemption.

The January 23, 2026 Housing Committee hearing—with its 94.4% Astroturf Coefficient and proposed amendment language preserving broad “seller request” opt-outs—confirms the lobbying phase is active and already advanced beyond initial positioning.

The velocity of the federal bypass (merger closed “far earlier than the time frame of at least nine months”) suggests Compass will compress the state-level sequence with equivalent urgency.

The CDT simulation projects that litigation replaces lobbying once behavioral statutes harden; SB 6091’s passage without broad exceptions would trigger this phase transition.

Federal preemption emerges as the terminal strategy once multistate coalitions form and behavioral statutes spread—a trajectory within a 12–24 month capture window.

Preemption is structurally the weakest argument in the sequence—a Hail Mary, not a winning hand. No federal statute expressly preempts state real estate regulation, antitrust preemption requires per se illegality that transparency mandates don't trigger, and state consumer protection remains a traditional police power. The goal is not to win on the merits but to secure a preliminary injunction blocking SB 6091's enforcement while the case proceeds—buying time for extractive practices to entrench before the challenge is dismissed.

Washington’s decision thus operates as a leading indicator: if exception capture succeeds here, it establishes the template for other states; if it fails, Compass faces the litigation-to-preemption escalation under compressed timelines and mounting debt-service pressure. The firm that closed its merger “far earlier than the time frame of at least nine months” by going over the antitrust chief’s head will apply the same above-the-line pressure to state legislators—the question is whether the Housing Committee recognizes the pattern before exception capture succeeds.

Privacy Versus Exclusivity

The distinction between privacy and exclusivity is the definitional firewall that the legislature must maintain. Privacy concerns how a home is shown—controlled showings, safety accommodations, scheduling around medical needs, limiting disruption to household routines. A senior recovering from surgery can list publicly while declining open houses, requiring pre-qualified buyers, or restricting viewing hours. The listing remains visible to all qualified buyers and brokers; market access is preserved while showing conditions are tailored.

Exclusivity concerns who may see or bid—restricting the pool of potential buyers to those within a particular network. A Private Exclusive removes the listing from public view entirely, routing it only through platform-affiliated agents. The practice is not privacy protection; it is inventory sequestration that creates access rents.

SB 6091 does not prohibit privacy accommodations. It prohibits brokers from marketing exclusively to limited groups for extended periods. The rhetorical conflation of these concepts—treating restrictions on exclusivity as attacks on privacy—is itself a capture tactic designed to exploit lawmaker information gaps.

When Compass Managing Director Brandi Huff testified at the January 23, 2026 Washington State Senate Housing Committee hearing that the bill “strips Washington homeowners of the right to decide how their private property is marketed,” she elided the distinction between controlling showing conditions (which remains fully available) and restricting buyer access (which the bill properly limits).

The Astroturf Coefficient for opposition testimony stands at 94.4%, a figure derived from detailed analysis in The Compass Astroturf Coefficient at the Washington State Senate (Jan 2026. The coefficient measures the proportion of nominally “grassroots” testimony that originates from corporate employees or affiliates. At 94.4%, nearly all homeowners testifying against transparency were actually Compass agents or their clients—a coordinated deployment of corporate messaging through ostensibly independent voices. If lawmakers do not recognize the pattern, exception capture succeeds by exploiting the information gap between industry insiders and legislative staff.

Vulnerable Senior Status

Compass broker Jennifer Ng’s testimony provides the legitimate core case for narrow exception. Seniors facing acute health shocks—falls, rapid cognitive decline, medical equipment in the home—require accommodations that standard marketing processes may not provide. The CDT simulation treats Vulnerable Senior Status (VSS) as a time-bounded, fact-triggered condition defined by specific criteria:

Acute health shock creating immediate transition need (falls, acute ailments, rapid cognitive decline)

Home condition constraints that make repeated public showings impractical or unsafe (medical equipment, care conditions, accessibility limitations)

Capacity constraint preventing normal agent selection and marketing oversight (inability to interview agents, urgency to access equity for care placement)

These triggers describe a narrow population facing genuine hardship—not a lifestyle preference for privacy that any affluent seller might claim. The legislative challenge is encoding protections that serve this population without creating pathways that platform actors can operationalize at scale.

The Scaling Mechanism

Exception capture operates through category drift: once a “seller request” opt-out is codified, the exception expands from its original protective scope to encompass increasingly broad populations. The drift sequence is predictable:

“Vulnerable senior” → “elderly seller” → “privacy-oriented seller” → “high-value seller” → “any seller who signs the form”

The mechanism is paperwork normalization. Platform training instructs agents to present the opt-out form as standard intake procedure; seller signatures accumulate without meaningful informed consent; the exception that began as a narrow safety accommodation becomes the default pathway for luxury inventory. The Exception Capture Ratio (ECR)—defined as listings routed through privacy exceptions divided by listings meeting strict VSS triggers—provides the metric for detecting this drift. An ECR approaching 1.0 indicates that exceptions serve their intended population; an ECR exceeding 5.0 indicates systematic corporate capture. Under the extractive equilibrium, CDT simulations project ECR exceeding 5.0 within 18 months.

The Temporal Drag Coefficient (TDC) of 24 months quantifies the enforcement lag during which extractive practices become entrenched. Institutions—including courts, regulatory agencies, and professional licensing boards—adapt too slowly to prevent early-stage exception capture. By the time enforcement mechanisms recognize the drift pattern and develop remedial responses, private listings have become “market standard” and reversal faces incumbent resistance.

State-level statutory intervention through SB 6091 represents the only viable corrective path within the 24 month timeframe when private listings would be entrenched economic reality; federal antitrust enforcement operates on timelines measured in years rather than months.

Some sellers genuinely prefer speed over price maximization—a quick, quiet sale to a known buyer rather than weeks of showings and competitive bidding. The analysis does not dispute that preference; it disputes scaling that preference into a market architecture. When platform actors convert individual seller choices into default intake pathways, the aggregate effect is coordination capture regardless of any particular seller’s intent.

The weaponization of exceptions converts legitimate safety concerns into structural business advantages. The legislature’s task is to honor the genuine needs of vulnerable seniors while foreclosing the scaling mechanisms that would transform narrow protections into industry-wide defection channels.

The TDC makes the foresight conclusions in Section VI time-sensitive rather than theoretical: the 24-month capture window is already open, and once extractive practices normalize, reversal requires structural intervention that the current institutional environment cannot deliver.

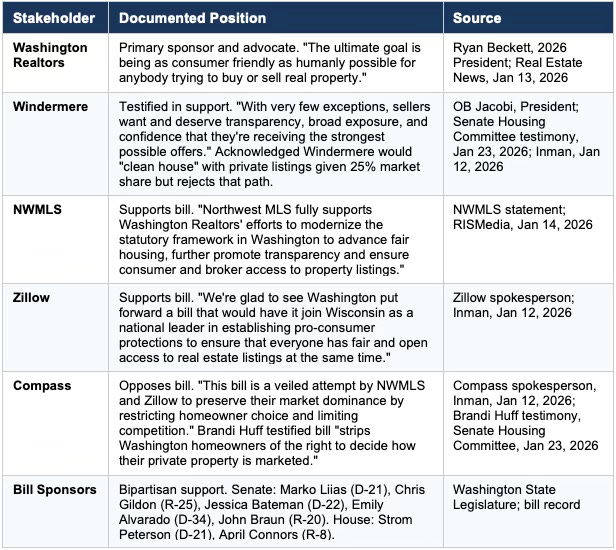

SB 6091 Stakeholder Positions and Coalition Structure

The following positions are drawn from public testimony, official statements, and press reporting.

Coalition Summary

Support SB 6091: Washington Realtors, Windermere, NWMLS, Zillow, bipartisan legislative sponsors

Oppose SB 6091: Compass

Structural Analysis: Incentive Alignment

The following analysis applies the Profit Timeframe Compression framework to stakeholders without documented public positions. Observations are factual; inferences are clearly labeled as analytical interpretation.

Anywhere Brands (Coldwell Banker, Century 21, Sotheby’s, BHGRE)

Observation: No Anywhere-legacy agents appeared in opposition testimony at the January 23, 2026 Senate Housing Committee hearing. The Compass-Anywhere merger closed January 10, 2026—thirteen days prior. All traceable “unaffiliated” opposition testimony originated from Compass-legacy agents, not Anywhere brands.

Analysis: Anywhere brands operated under cooperative MLS norms for decades. Their agent training and culture predates Compass’s Private Exclusive model. The absence of Anywhere-legacy agents from the advocacy campaign suggests the merger has not converted their transparency-first practices. This pattern may indicate internal friction regarding post-merger advocacy strategy, or reflect that Compass leadership chose not to mobilize Anywhere agents for this effort.

John L. Scott

Observation: No public statement on SB 6091 located as of publication date.

Analysis: John L. Scott is a legacy Pacific Northwest brokerage founded in 1931, with NWMLS membership and a market position structurally similar to Windermere. The firm lacks the debt structure and profit timeframe compression that would incentivize inventory sequestration. Structural factors suggest alignment with the transparency coalition, though this inference should not be treated as equivalent to a documented position.

Astroturf Brand Attribution

Research into opposition testimony at the January 23, 2026 hearing identified a pattern in brand attribution. “Unaffiliated” testifiers presenting as independent homeowners or agents traced exclusively to Compass-legacy operations. No Anywhere-legacy brand agents were identified in the opposition testimony pool.

This finding refines the Astroturf Coefficient reported in The Compass Astroturf Coefficient at the Washington State Senate (January 2026). The 94.4% coefficient should be understood as Compass-specific rather than attributable to the combined Compass-Anywhere entity. The opposition advocacy reflects Compass’s pre-merger culture and Private Exclusive business model, not a unified post-merger strategic position.

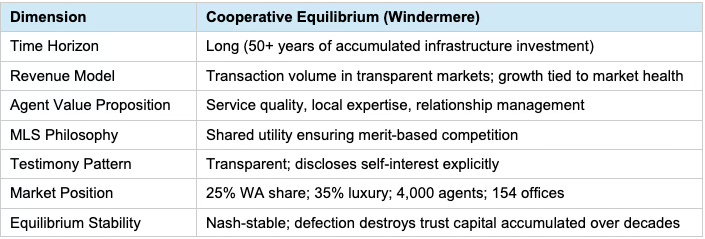

IV. Philosophy One: Cooperative Infrastructure

Windermere Real Estate exemplifies the cooperative equilibrium in which firm value remains tethered to the health of the public marketplace. The commitment to transparency is not ideological; it is a Nash-stable strategy that emerges when a dominant incumbent’s time horizon extends far enough that defection costs exceed defection benefits. The theoretical foundation is developed in Federal Antitrust Breakdown as Nash-Stigler Equilibrium, Not Accident (Jan 2026), which models the conditions under which market leaders rationally preserve coordination infrastructure rather than capturing it.

The cooperative philosophy treats the Multiple Listing Service as shared infrastructure—a public utility that benefits all participants by reducing search costs, enabling price discovery, and creating the trust environment in which high-value transactions can occur efficiently. Under this philosophy, the firm competes on service quality, local expertise, and relationship management rather than on proprietary access to inventory. The firm’s revenue grows with transaction volume, and transaction volume grows with market health; the incentives align toward maintaining the coordination infrastructure that serves buyers and sellers regardless of which broker represents them.

Windermere’s market position makes the cooperative philosophy credible as strategy rather than necessity. With 25% statewide market share, 35% share in the luxury segment, 4,000 agents, and 154 offices, Windermere could “clean house” if it pursued private listings. The firm’s testimony explicitly concedes the point—OB Jacobi acknowledges the short-term profitability of defection while rejecting the path. The concession is analytically significant because it forecloses the interpretation that Windermere supports transparency because it lacks the market power to benefit from opacity. The firm has the power; it declines to exercise it because its 50-year infrastructure investment creates path dependency that makes defection irrational over the relevant time horizon.

The path dependency operates through accumulated trust capital. Windermere’s brand value, agent relationships, and consumer reputation have been built over decades on the foundation of transparent market participation. Defecting to private listings would capture short-term margin at the cost of destroying the trust infrastructure that sustains long-term volume. For a firm with patient ownership and minimal debt pressure, this tradeoff is clearly negative—the present value of sustained cooperative participation exceeds the present value of short-term extraction followed by reputational degradation. The equilibrium is Nash-stable because no unilateral deviation improves the firm’s position given its time horizon and balance-sheet structure.

“Windermere has the largest market share in the state of Washington... about 25% of all the houses sold... in the luxury market it’s about 35%... the nearest competitor is about 8%. If we were to go down a road of private listings, we would clean house. But we have fought for 50 years to have a fair, open, and transparent marketplace for all.” — OB Jacobi, President of Windermere Real Estate [00:50:38]

The cooperative philosophy produces distinctive testimony patterns. Jacobi discloses Windermere’s self-interest explicitly—the firm benefits from a transparent market that rewards service quality—rather than obscuring commercial motivation behind consumer-protection rhetoric. The transparency about incentives is itself a signal of cooperative intent; firms pursuing capture strategies cannot afford such candor because their commercial interests diverge from consumer welfare.

The cooperative equilibrium remains stable absent external disruption because the firms operating within it have internalized the long-run costs of defection. The threat to this equilibrium comes not from internal deviation but from external actors whose different balance-sheet constraints produce different rational strategies—actors for whom defection benefits exceed defection costs because their time horizons have been compressed by debt and investor pressure.

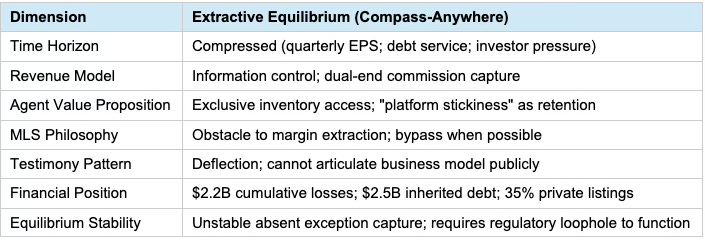

V. Philosophy Two: Platform Extraction

Compass-Anywhere exemplifies the extractive equilibrium in which firm survival depends on capturing value from market infrastructure rather than contributing to it. The behavior is not corporate malice; it is the rational response to balance-sheet constraints that make cooperative participation economically unviable. The theoretical foundation is developed in The Chicago School Accelerated Part I, Coase and Why Transaction Costs ≠ Coordination Costs (Dec 2025), which introduces accounting primitives for measuring the “Externality Load”—the dollar value of market harm when platforms sequester inventory to satisfy internal profitability targets.

The extractive philosophy treats the MLS as an obstacle to margin extraction rather than as shared infrastructure. Under this philosophy, the firm competes on proprietary inventory access—the ability to offer buyers homes they cannot see elsewhere and to offer sellers a “curated” marketing process that happens to route transactions through internal networks. The firm’s revenue grows with transaction capture, and transaction capture grows with information asymmetry; the incentives align toward fragmenting the coordination infrastructure that would otherwise enable competition on service quality.

Compass’s market position makes the extractive philosophy necessary rather than chosen. With $2.2 billion in accumulated losses, $2.5 billion in inherited debt from the Anywhere merger, and quarterly earnings pressure from public markets, Compass cannot afford the patient market-building strategy that sustains Windermere’s cooperative participation. The firm must generate margin improvement now, not in five years; private listings provide that improvement by increasing dual-end capture rates. The 35% of Compass listings operating in Private Exclusive or Coming Soon status as of February 2025 reflects the scale at which extraction has been operationalized.

The extraction philosophy produces distinctive testimony patterns characterized by deflection and constraint. When Senator Alvarado asked directly how Compass’s business model serves competition, Managing Director Brandi Huff responded: “That is probably above what I feel comfortable speaking to.” The deflection is analytically significant because it reveals the Documentation Trap in operation—Huff cannot articulate the business model publicly because any candid description confirms coordination capture intent. The contrast with Jacobi’s transparent disclosure of Windermere’s self-interest could not be sharper.

“This bill, as written, strips Washington homeowners of the right to decide how their private property is marketed... It forces a one-size-fits-all approach that ignores the very real needs for privacy and autonomy.” — Brandi Huff, Managing Director, Compass [00:42:23]

“That is probably above what I feel comfortable speaking to...” — Brandi Huff, Managing Director, Compass [00:45:37] (Response to question about how the business model serves competition)

The Scripted Testimony Alignment (STA) analysis reveals that Huff’s “right to decide” and “one-size-fits-all” phrasing maps verbatim to Compass’s 2024 national marketing materials designed to sell Private Exclusives to homeowners. The testimony was not a spontaneous defense of consumer autonomy; it was a redeployment of brand marketing through the legislative channel. The alignment confirms that Compass’s SB 6091 opposition serves corporate margin requirements rather than homeowner interests.

The extractive equilibrium is inherently unstable because it depends on regulatory permission to sequester inventory. Without broad exception language in SB 6091, Compass cannot maintain the private listing volume necessary to achieve the margin improvements that debt service requires. The instability explains the intensity of the firm's legislative opposition and predicts the escalation path documented in Section III.

The contrast between the two philosophies is not primarily moral—it is structural. Windermere and Compass face the same market conditions and the same potential for profit through inventory sequestration. They respond differently because their balance sheets create different incentive geometries. Understanding this structural divergence is essential for designing policy interventions that preserve cooperative infrastructure without requiring firms to act against their economic interests.

VI. Foresight Simulation: The Two Equilibriums

The CDT foresight simulations model the Washington residential real estate market as a system of interacting agents—brokerages, the MLS infrastructure, regulatory bodies, and consumer populations—operating under the incentive constraints documented in the preceding sections. The simulations do not predict individual firm decisions or transaction outcomes; they identify the equilibrium behaviors that emerge once profit timelines, regulatory pathways, and exception mechanisms settle into stable configurations. The methodological foundation is developed in Chicago School Accelerated — The Integrated, Modernized Framework of Chicago Law and Behavioral Economics (Dec 2025), which provides the framework for measuring institutional integrity and information asymmetry costs under platform competition.

The core finding across all Vision Functions is convergent: under profit timeframe compression, platform actors rationally externalize costs by privatizing coordination infrastructure unless explicitly constrained. The divergence between cooperative and extractive equilibria turns on whether intermediaries compete to improve market outcomes or to internalize both sides of transactions. The question is not one of corporate ethics; it is whether balance-sheet constraints permit cooperative participation or mandate extractive survival strategies.

The simulation horizon extends 24-36 months from the present, capturing the critical window during which regulatory outcomes determine market structure. Beyond this horizon, path dependency effects dominate—whichever equilibrium establishes itself becomes self-reinforcing through accumulated infrastructure, normalized practices, and consumer expectations. Once extractive practices become market standard, reversal requires structural intervention that exceeds the capacity of existing enforcement mechanisms. The policy choice before the legislature is therefore not merely about the next two years; it determines the baseline from which the Washington market evolves for the next generation.

Cooperative Equilibrium: SB 6091 Passes as Written

Under the cooperative equilibrium, SB 6091 passes without broad exception language, maintaining mandatory MLS participation within the prescribed timeline. The behavioral dynamics that follow are determined by the removal of scalable defection channels:

Private listing networks lose their competitive advantage because inventory must appear on the MLS before or concurrent with any marketing. Platform actors can no longer use “Coming Soon” and “Private Exclusive” periods to capture both transaction sides; buyers have equal access to inventory regardless of broker affiliation. The Information Asymmetry Coefficient (IAC) returns to baseline (1.00), eliminating the access advantage that enabled dual-end capture. Competition shifts from inventory control to service quality—the dimension on which cooperative incumbents like Windermere have invested for decades.

Price discovery remains robust because sellers receive exposure to the full buyer pool rather than a platform-curated subset. Bidding competition reflects market depth; sellers maximize equity through broad exposure rather than accepting the first internal offer. The Price Discovery Efficiency metric shows no deviation from the theoretically efficient price (0.0%), compared to the -7.2% deviation projected under the extractive equilibrium. The 7.2% differential represents the “search tax” that buyers pay and the bidding-war premium that sellers forfeit when inventory is sequestered.

The Market Fragmentation Index (MFI) remains below 0.05, indicating that less than 5% of inventory operates outside public coordination mechanisms. Exceptions serve their intended populations—vulnerable seniors, safety-sensitive situations, genuinely private circumstances—without scaling into default intake pathways. The Exception Capture Ratio (ECR) stays below 1.5, confirming that exception utilization tracks the underlying population of legitimate cases rather than expanding through category drift.

Consumer Welfare Delta under this scenario reaches +$450 million over 36 months, reflecting the preserved bidding competition, reduced search costs, and maintained trust infrastructure. Independent brokerage market share remains stable because service quality rather than inventory access determines competitive outcomes.

Extractive Equilibrium: SB 6091 Fails or Includes Broad Exceptions

Under the extractive equilibrium, SB 6091 either fails outright or passes with exception language broad enough to permit “seller request” opt-outs that platform actors can operationalize at scale. The behavioral dynamics that follow are determined by the availability of scalable defection channels:

Private listing share expands rapidly as Compass and other platform actors route luxury inventory through exception pathways. The 35% baseline private listing rate rises toward 50%+ within 18 months as agents are trained to present opt-out forms as standard intake procedure. The Astroturf Coefficient of 94.4% indicates that this expansion occurs under the cover of “homeowner choice” rhetoric while actually serving corporate margin requirements. The Information Asymmetry Coefficient (IAC) rises to 1.62, quantifying the access advantage that platform-affiliated transactions enjoy over the public market.

Price discovery degrades because sellers’ exposure to buyers depends on broker affiliation rather than market depth. Sequestered listings receive bids only from platform-internal buyers; sellers forfeit the bidding-war premiums that broad exposure would generate. The Price Discovery Efficiency metric shows -7.2% deviation from theoretical efficiency, representing systematic underpricing relative to what competitive markets would produce. Buyers who lack platform access pay “search taxes” in the form of reduced inventory visibility and the need to work with platform-affiliated agents to see marketed homes.

The Market Fragmentation Index (MFI) rises to 0.38, indicating that over a third of the market becomes invisible to public coordination mechanisms. The Exception Capture Ratio (ECR) exceeds 5.0, confirming that exception utilization has decoupled from the underlying population of legitimate cases and reflects systematic corporate capture. The Vulnerable Seller Exploitation Risk (VSER) metric rises as VSS-exception listings correlate with reduced market exposure time, increased dual-side capture likelihood, and weaker seller net proceeds compared to open-market comparables.

Consumer Welfare Delta under this scenario reaches -$3.8 billion over 36 months, reflecting lost bidding premiums, increased search costs, and degraded trust infrastructure. Independent brokerage market share contracts by 8 percentage points within 24 months as service quality ceases to be the primary competitive dimension. The concentration of inventory within walled gardens eventually necessitates federal antitrust intervention as the welfare costs become undeniable.

The foresight conclusion is structural, not moral: when firms under profit compression are permitted to privatize coordination infrastructure, the market converts from a public utility into a taxed access system. The -$3.8 billion Consumer Welfare Delta projected under the extractive equilibrium represents the cumulative cost of permitting that conversion—costs borne by sellers who forfeit bidding premiums, buyers who pay search taxes, and independent brokerages whose service-quality advantages become irrelevant when competition shifts to inventory access.

Cognitive Digital Twin Metric Panel

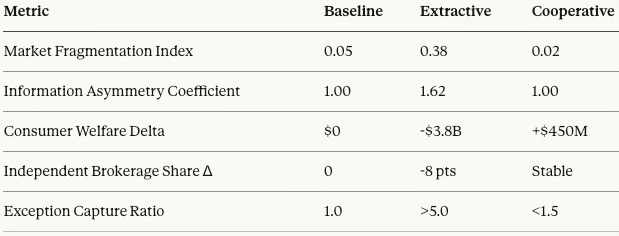

The following table summarizes the quantitative outputs of the 36-month CDT simulation under each equilibrium scenario:

The simulation metrics are not predictions of precise outcomes; they are indicators of equilibrium direction and magnitude. The -$3.8 billion Consumer Welfare Delta under the extractive equilibrium represents a cumulative estimate based on transaction volume, average price effects, and search cost increases. The specific figure carries uncertainty, but the directional finding is robust: inventory sequestration destroys value for consumers while concentrating margin among platform actors.

The policy choice is not between innovation and stagnation; it is between preserving a public market utility and allowing it to be converted into a taxed access system. The CDT simulations converge on a single structural conclusion: under profit timeframe compression, platform actors rationally externalize costs onto public markets unless explicitly constrained by regulation that forecloses scalable defection channels.

VII. Conclusion

The Washington residential real estate market stands at a structural crossroads. The analysis presented here demonstrates that the choice between cooperative infrastructure and platform extraction is not determined by corporate character or regulatory preference; it is determined by the interaction of balance-sheet constraints, time horizons, and the availability of scalable defection channels.

Compass’s pursuit of private listings is the rational response to profit timeframe compression, just as Windermere’s rejection of the same path is the rational response to different incentive geometry. Policy must address the structural conditions that produce extraction rather than assuming that market participants will choose cooperation absent the constraints that make cooperation rational.

SB 6091 provides those constraints by mandating MLS participation within defined timelines and limiting the exception pathways through which inventory can bypass public coordination. The bill does not prohibit privacy accommodations for vulnerable populations; it prohibits the scaling mechanisms through which narrow protections become industry-wide defection channels. The distinction between controlling how a home is shown versus restricting who may bid is the definitional firewall that separates legitimate accommodation from coordination capture.

Absent falsification, the analysis supports legislative action through SB 6091 to preserve the cooperative infrastructure that has served Washington consumers for fifty years. The alternative is to permit the conversion of a public market utility into a private access system—a conversion driven not by consumer preference but by the balance-sheet pressures of firms that cannot survive without capturing both sides of transactions that would otherwise occur in open competition.

Appendix

A. CDT Foresight Simulation

CDT Foresight Simulations Under Profit Timeframe Compression

Metric Definitions

Causal Signal Integrity (CSI): Validates that observed behaviors arise from modeled incentive structures rather than confounding factors. CSI = 0.88.

Information Asymmetry Coefficient (IAC): Platform vs. non-platform inventory access advantage. IAC = 1.62.

Market Fragmentation Index (MFI): Share of inventory invisible to public coordination. Baseline = 0.05; Extractive = 0.38; Cooperative = 0.02.

Exception Capture Ratio (ECR): Listings routed through privacy exceptions ÷ listings meeting strict VSS triggers. Extractive = >5.0; Cooperative = <1.5.

Temporal Drag Coefficient (TDC): Enforcement lag during which extractive practices normalize. TDC = 24 months.

Astroturf Coefficient (AC): Proportion of “grassroots” testimony originating from corporate employees or affiliates. AC = 94.4%.

Scorecard (36-Month Simulation)

Falsification Contracts

The falsification conditions for this analysis are explicit. The simulation is falsified if Compass achieves durable GAAP profitability without expanding private listing market share; if exception adoption rates remain uniform across luxury-platform and independent brokerages; if independent broker market share stabilizes or grows despite bill failure; or if the Astroturf Coefficient drops below 50% in subsequent hearings. Meeting two or more of these conditions would indicate that the causal model underlying the foresight simulation requires revision.

The analysis is falsified if two or more occur within 24 months:

Compass achieves durable GAAP profitability without expanding private listing share beyond 35%.

Exception adoption rates remain uniform across luxury-platform and independent brokerages.

Independent broker market share stabilizes or grows despite bill failure.

B. SEC Filing Sources

Compass, Inc. Form 10-K (FY 2024) — Stock-Based Compensation and Adjusted EBITDA reconciliation (Note 14, Equity)

Compass, Inc. Form 10-Q (Sept 30, 2025) — Platform burn vs. reported FCF; Technology cost reclassifications

Anywhere Real Estate, Inc. Form 10-Q (Sept 30, 2025) — FCF $92M; Net Corporate Debt $2.5B

Compass/Anywhere Joint Proxy Statement (Form S-4, Nov 2025) — Transaction terms; $255M Annualized Synergy target