MCAI Economics Vision: MindCast AI Economics Frameworks

Predictive Foresight in Law and Behavioral Economics

See companion publication: Runtime Geometry, A Framework for Predictive Institutional Economics (Jan 2026).

MindCast AI applies Chicago School law and behavioral economics to predict antitrust enforcement, regulatory policy, and institutional behavior. The firm produces forward-looking analysis—predictions that can be tested, tracked, and falsified—not retrospective commentary.

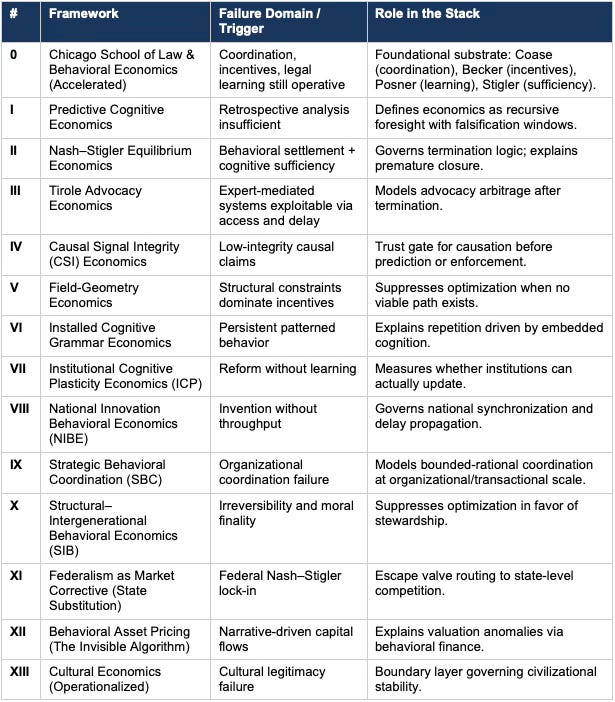

This document maps MindCast AI’s fourteen economic frameworks to their flagship publications. The frameworks form a predictive control stack: each governs a distinct failure domain where standard incentive, coordination, or equilibrium logic breaks, and each introduces a decision rule that determines whether optimization applies, must be gated, or must be suppressed.

MindCast AI does not arrive at conclusions by grinding through data and then “discovering” a thesis. Each framework begins with a clear, testable insight drawn from first principles in law, economics and cognitive science. We start by stating the insight explicitly, then build the analytical machinery to evaluate it. Our predictive control stack is designed to test these insights in real time; when the evidence contradicts an initial hypothesis, the framework is revised or abandoned.

The forward stance sets us apart from retrospective commentary: we don’t reverse‑engineer explanations after the fact, we begin with the insight and invite falsification.

The core insight: Most policy analysts treat enforcement and regulatory outcomes as products of political will, institutional competence, or corruption. MindCast AI models them as equilibrium outcomes—the predictable result of incentive structures, coordination costs, information economizing, and strategic gaming. When enforcement fails to correct obvious harm, the firm asks not ‘what went wrong?’ but ‘at which step did the system lock?’

The architecture: Chicago Law & Behavioral Economics provides the foundational substrate. Higher frameworks govern termination (when enforcement stops), causal trust (which claims get believed), structural dominance (when constraints override incentives), institutional learning (whether agencies can update), national throughput (whether innovation translates to advantage), and cultural coherence (whether institutions retain legitimacy). Together, these frameworks determine which economic logic applies and when analysis must stop.

The validation record: MindCast AI frameworks have produced documented forward predictions—GPU export corridors identified seven days before DOJ indictments, transmission delays predicted within 10%, succession crises forecast 36 months in advance. The validation cases in this document are pre-registered predictions that have since resolved, not post-hoc explanations.

The Computational Engine: Cognitive Digital Twins (CDTs) MindCast operationalizes its economic theory through Cognitive Digital Twins (CDTs)—autonomous AI agents that simulate specific market actors, from regulators and competitors to consumers. Rather than relying on static historical data, CDTs function as a dynamic “wind tunnel” for strategy, allowing us to model how stakeholders will react to new incentives or pressures in real-time. By imbuing these agents with specific constraints and biases, we move economic analysis from retrospective case studies to predictive, ex-ante simulation.

Connecting Method to Theory Crucially, CDTs serve as the diagnostic tool for navigating the MindCast “Control Stack.” We do not guess which economic framework applies; we compute it. By observing the interactions of these Digital Twins, we empirically identify the active market state: if agents efficiently clear the market, we apply Chicago School principles; if they lock into destructive cycles, we escalate to the Nash-Stigler-Tirole Loop; if they act against rational self-interest, we trigger the Narrative Economics framework. This ensures that our strategic guidance is grounded not in philosophical preference, but in the falsifiable, computational behavior of the market itself.

Contact mcai@mindcast-ai.com to partner with us on Law and Behavioral Economics foresight simulations.

MindCast AI publications are dense and cumulative, belonging to a series of themed instalments. To extract patterns across multiple pieces efficiently, consider pasting the URLs into a modern large‑language model (such as ChatGPT, Gemini, Claude or Perplexity) or viewing them in an AI‑enabled browser. These tools can help you query themes, trace recurring frameworks and see how individual publications accumulate into a larger analytical structure, reducing reading time while preserving the substance of the work.

I. Issues MindCast AI Is Structurally Built to Handle

MindCast AI is designed for problem environments where conventional economic, legal, and behavioral analysis systematically breaks down. These failures do not arise from lack of data or analytical rigor, but from structural features of institutional behavior that standard models assume away. The following issue classes define the domains where MindCast AI’s predictive control frameworks dominate.

Termination Without Structural Resolution.

Many institutional processes reach procedural or political sufficiency before resolving underlying harm. Enforcement halts not because correction has occurred, but because inquiry has stabilized. Traditional analysis treats termination as an endpoint; MindCast AI treats it as a priced outcome. Nash–Stigler equilibrium detection allows MindCast AI to model when and why enforcement stops, and to quantify the externalized costs of that termination.

Multi-Level Institutional Evasion and Venue Substitution.

When actors arbitrage across federal agencies, state enforcement, courts, legislatures, and private standard-setting bodies, single-venue analysis fails. MindCast AI models institutional substitution paths explicitly, forecasting where pressure migrates once a given channel closes. This enables foresight across escalation ladders rather than post-hoc explanation within isolated domains.

Behavioral Capture Masquerading as Compliance.

In advanced regulatory systems, actors often optimize against enforcement itself while maintaining formal compliance. Standard incentive models treat rules as fixed constraints; MindCast AI treats enforcement as an adaptive environment subject to capture. By integrating Becker-style optimization with Stigler-style regulatory dynamics, MindCast AI identifies when compliance signals conceal exploitative equilibria.

Geometry-Dominated Failure Modes.

Some outcomes are governed primarily by institutional structure rather than intent, bias, or incentives. In these environments, personnel changes and marginal policy tweaks cannot alter outcomes because viable paths are structurally unavailable. Field-Geometry Reasoning allows MindCast AI to detect when topology, constraint density, and path dependence dominate causation, suppressing misleading intent-based explanations.

Late-Stage Market Failure and Irreversibility.

Certain systems cross thresholds where optimization logic no longer applies because losses are irreversible or corrective capacity has collapsed. Conventional welfare analysis assumes reversibility; MindCast AI explicitly gates optimization when termination, entrenchment, or infrastructural decay forecloses meaningful correction.

Narrative-Driven Institutional Drift.

Public narratives increasingly shape enforcement behavior, inquiry scope, and institutional priorities faster than formal rule changes. Where narrative becomes a causal force rather than background noise, MindCast AI models disclosure timing, framing incentives, and cognitive grammar to forecast institutional drift before it hardens into policy.

Together, these issue classes define the operating domain of MindCast AI: environments where institutional behavior stabilizes before problems resolve, incentives invert under enforcement pressure, and standard analytical tools misattribute causation. The frameworks that follow are designed to detect, model, and price these failure modes in real time.

II. MindCast AI: A Free Market Law & Behavioral Economics Firm

MindCast AI operates within the Chicago School tradition—not as a departure from free market economics, but as its operational completion. The firm accelerates Chicago School analysis by adding the behavioral and predictive mechanisms that Coase, Becker, Posner, and Stigler assumed but never formalized.

The Chicago Foundation

Coasean Coordination. MindCast AI treats coordination costs as the primary variable determining whether markets can self-correct. When transaction costs are low and parties can bargain, private ordering works. The firm doesn’t assume government intervention—it models when intervention becomes necessary because coordination has failed.

Beckerian Incentive Realism. The framework assumes actors respond to incentives rationally within constraints. MindCast AI doesn’t moralize about market behavior—it predicts it. The question is never ‘should firms behave this way?’ but ‘given these incentives, what will they do?’

Posnerian Legal Learning. Courts and regulators are modeled as learning systems that update doctrine based on feedback. MindCast AI’s enforcement analysis assumes the legal system can correct—the question is whether it will before harm compounds.

Stiglerian Information Economics. Cognitive sufficiency—the point at which institutions stop gathering information—is treated as an equilibrium outcome, not a failure. Markets and regulators economize on information. MindCast AI models when that economizing produces premature closure.

The Behavioral Completion

Chicago School economics assumes rational actors but historically lacked the mechanism to predict how rationality breaks down under specific conditions. MindCast AI completes this gap by integrating Kahneman and Tversky on cognitive constraints, Thaler on bounded rationality, and Schelling on focal points and coordination. The result: predictions about when Chicago assumptions hold and when they fail—without abandoning the incentive-based, market-oriented framework.

Free Market Positioning

MindCast AI is not a regulatory advocacy firm. It does not assume markets fail or that intervention is presumptively correct. Higher frameworks in the MindCast AI stack activate only when free market coordination, incentive alignment, legal learning, and information markets have demonstrably failed. The default is Chicago Accelerated. The stack exists to handle exceptions.

Enforcement, when warranted, is treated as a market-completing function—restoring the conditions under which private ordering can resume—not a market-replacing one.

III. The Unified Control Loop: How Modern Enforcement Stabilizes

The Nash–Stigler–Tirole control loop governs how markets, enforcement, and regulation reach equilibrium—and why that equilibrium often arrives before harm stops.

Understanding this loop is the single most important insight for applying the MindCast AI stack. Every validation case, every Active Issues analysis, and every foresight simulation routes through this architecture.

The Sequence

Tirole constrains the feasible game → Nash settles behavior → Stigler locks inquiry → Termination becomes self-reinforcing

Tirole (Pre-Game). Before equilibrium forms, sophisticated actors shape the structure of engagement through advocacy arbitrage—controlling access, timing, venue, and narrative complexity. The game is constrained before it is played.

Nash (Settlement). Within the constrained game, actors reach behavioral stability. No party can unilaterally improve. The equilibrium reflects the constrained game, not the theoretically optimal one.

Stigler (Closure). Institutions declare cognitive sufficiency—further inquiry costs more than it yields. The system locks at whatever settlement Nash produced.

Terminal State. Once settlement and sufficiency align, termination becomes self-reinforcing. New evidence no longer reopens inquiry. Actors optimize against the stopping rule itself.

Why It Matters

Most analysis treats enforcement failure as breakdown. The control loop reframes it as equilibrium—the system working exactly as its incentive structure predicts. The loop explains Live Nation, Compass, DOJ–China Chips, Diageo, and every other validation case in the stack.

IV. Narrative Economics: Computable Contagion

MindCast AI treats Narrative Economics—a concept popularized by Robert Shiller—not as soft social science, but as a computable, viral economic force that drives asset pricing, policy outcomes, and institutional behavior.

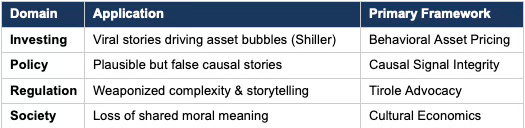

In the MindCast stack, narratives are modeled as contagions that decouple price from value (in markets) or perception from reality (in regulation). This work is primarily housed in Framework XII (Behavioral Asset Pricing) and Framework IV (Causal Signal Integrity), with applications extending to Framework III (Tirole Advocacy) and Framework XIII (Cultural Economics).

1. The Invisible Algorithm (Shiller’s Narratives)

Framework XII integrates Robert Shiller’s work on viral economic narratives with Richard Thaler’s behavioral bias and Vernon Smith’s bubble mechanics. The Thesis: In the AI era, capital flows are driven less by discounted cash flow (DCF) and more by ‘Narrative Contagion.’ MindCast models how these stories spread, mutate, and create valuation anomalies that defy standard efficiency logic.

2. Causal Signal Integrity (Narrative Quality Control)

While Shiller studies how narratives spread, MindCast’s Causal Signal Integrity (CSI) framework studies why false narratives dominate policy. Policy environments often select for ‘plausible narratives’ over ‘true causation.’ CSI treats this as a signal integrity failure, filtering out high-viral, low-truth stories before they enter the prediction model.

3. Strategic Narrative Weaponization (Tirole Advocacy)

Framework III applies Narrative Economics to adversarial settings—courts and regulators. Sophisticated actors use complex, curated narratives to ‘jam’ regulatory learning. This is Tirole Advocacy Arbitrage—using information asymmetry to tell a story that fits the regulator’s bias, causing enforcement to terminate early.

4. Cultural & Civilizational Narratives

At the highest level, an economy relies on a shared ‘moral narrative’ (trust, legitimacy). When this narrative fragments, institutions collapse even if they are financially efficient. Framework XIII (Cultural Economics) governs this domain.

V. The Control Stack

The control stack consolidates MindCast AI's fourteen economic frameworks into a single operational architecture. Each framework governs a distinct failure domain—the condition under which standard economic logic breaks—and specifies a decision rule that determines whether optimization applies, must be gated, or must be suppressed. The stack is hierarchical: Chicago Accelerated serves as the default; higher frameworks activate only when Chicago assumptions demonstrably fail.

The table below consolidates Frameworks 0–XIII into a single operational view.

Publication Links:

[0] Chicago School Accelerated — https://www.mindcast-ai.com/p/chicago-school-accelerated

[I] Predictive Cognitive Economics — https://www.mindcast-ai.com/p/predictivecai

[II] Nash–Stigler Equilibrium — https://www.mindcast-ai.com/p/the-nash-stigler-equilibrium

[III] Tirole Advocacy Arbitrage — https://www.mindcast-ai.com/p/tirole-advocacy-arbitrage

[IV] Causal Signal Integrity — https://www.mindcast-ai.com/p/causal-signal-integrity

[V] Field-Geometry Reasoning — https://www.mindcast-ai.com/p/field-geometry-reasoning

[VI] Installed Cognitive Grammar — https://www.mindcast-ai.com/p/installed-cognitive-grammar

[VII] Institutional Cognitive Plasticity — https://www.mindcast-ai.com/p/institutional-cognitive-plasticity

[VIII/IX] NIBE and SBC Synthesis — https://www.mindcast-ai.com/p/nibesbc

[X] Structural–Intergenerational Behavioral — https://www.mindcast-ai.com/p/structural-intergenerational-behavioral-vision

[XI] Federal Political Market Failure — https://www.mindcast-ai.com/p/federal-political-market-failure

[XII] The Invisible Algorithm — https://www.mindcast-ai.com/p/the-invisible-algorithm

[XIII] Gladwell Economics — https://www.mindcast-ai.com/p/gladwelleconomics

The control stack is not a theoretical taxonomy. It is a routing system that determines which framework governs analysis before prediction begins. Misrouting—applying Nash-Stigler where Chicago suffices, or Chicago where Field-Geometry dominates—produces systematic forecast error. Correct routing is the first-order analytical task; prediction follows.

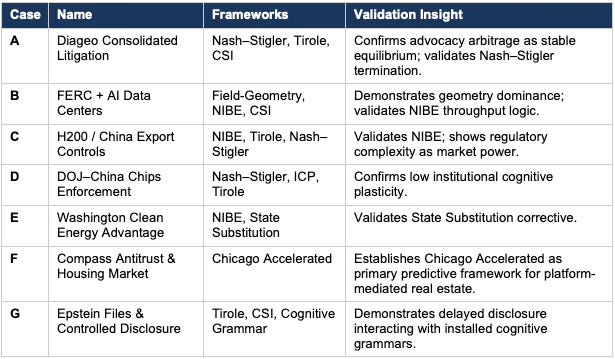

VI. Validation Cases

MindCast AI's frameworks are tested against real-world outcomes, not defended through post-hoc narrative. The cases below represent forward predictions—published before events resolved—that have since been confirmed or falsified. Each case activates specific frameworks from the control stack and documents the resulting validation insight.

Publication Links:

[A] Diageo Consolidated — https://www.mindcast-ai.com/p/diageo-consolidated

[B] FERC AI Data Centers — https://www.mindcast-ai.com/p/ferc-ai-dcs

[C] H200 China Validation — https://www.mindcast-ai.com/p/h200-china-validation

[D] DOJ China Chips — https://www.mindcast-ai.com/p/dojchinachips

[E] Washington Clean Energy — https://www.mindcast-ai.com/p/nibewa

[F] Chicago School Accelerated — https://www.mindcast-ai.com/p/chicago-school-accelerated

[G] Epstein Files — https://www.mindcast-ai.com/p/epsteinfiles

MindCast AI operates as predictive infrastructure grounded in Chicago School law and behavioral economics. The fourteen frameworks documented here form a control stack—not a menu of options, but a routing system that determines which economic logic applies to a given problem and when analysis must terminate.

The validation record demonstrates that this architecture produces measurable foresight: predictions that resolve, frameworks that falsify, and enforcement patterns that become legible before they stabilize. The stack exists to make institutional behavior predictable, not to explain it after the fact.

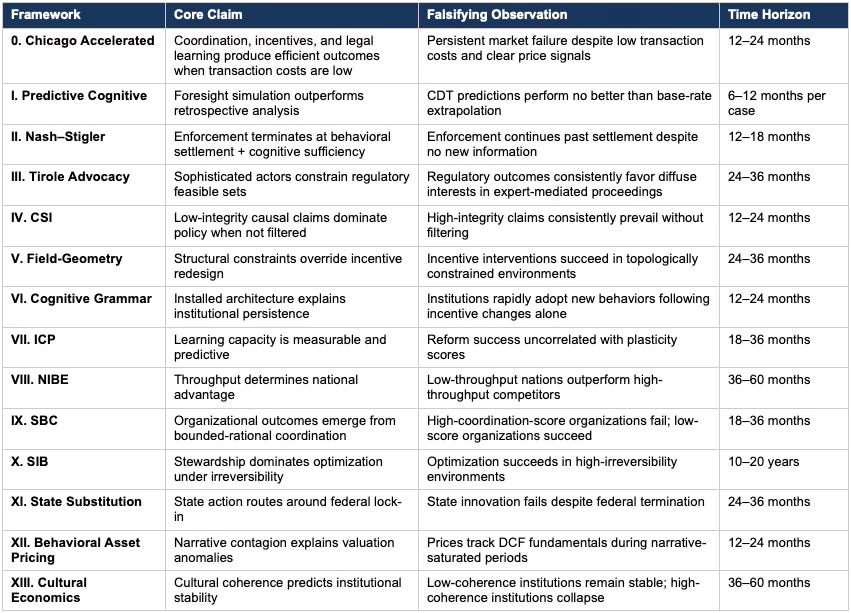

VII. Falsification Standards

MindCast AI claims to be predictive infrastructure, not narrative analytics. That claim requires falsifiability. Each framework specifies an observable signal, a time horizon, and a condition that would disconfirm its core thesis. If the predicted pattern fails to materialize within the specified window, the framework is wrong—not the world.

VIII. When Chicago Accelerated Is Sufficient

Not every analysis requires the full stack. Chicago School of Law & Behavioral Economics (Accelerated) remains the primary and often sole framework when coordination is functional, incentives are aligned or realignable, legal learning is operative, and information markets clear.

Higher frameworks activate only when Chicago Accelerated assumptions demonstrably fail. Over-theorization is treated as analytical failure.

Examples: When Escalation Was Refused

Compass Antitrust (Chicago-Only). The Compass case was analyzed using Chicago Accelerated alone because the core dynamics—coordination breakdown in MLS structures, incentive distortion in brokerage commissions, legal learning in DOJ and state enforcement—are fully explicable through Coase, Becker, and Posner. Escalation to Nash–Stigler was considered and rejected: enforcement had not terminated; courts were actively updating doctrine; the DOJ consent decree process remained open.

Standard Merger Review (Chicago-Only). Routine horizontal merger analysis requires no framework beyond Chicago Accelerated. Tirole Advocacy was considered and rejected for a 2024 tech acquisition because the merger review followed standard DOJ procedures without evidence of advocacy arbitrage, venue shopping, or narrative manipulation.

Crypto-ATM Regulation (Chicago-Only). MindCast AI’s SB 5280 analysis used Chicago Accelerated to model industry lobbying and legislative response. Field-Geometry was considered and rejected: the policy space remained open; multiple viable regulatory paths existed; no topological constraint locked outcomes.

Guardrails

1. Default to Chicago. Every analysis begins with the question: ‘Can Chicago Accelerated explain this?’

2. Burden of Proof on Escalation. Invoking a higher framework requires identifying which Chicago assumption has failed and what observable evidence supports that failure.

3. Single-Framework Preference. Where possible, use one framework. Over-theorization signals analytical weakness, not sophistication.

IX. Multi-Framework Application

Most MindCast AI analyses require only one or two frameworks. But complex institutional failures—particularly those involving regulatory capture, structural lock-in, and strategic gaming—activate multiple frameworks in sequence. The routing is not arbitrary: each framework hands off to the next when its failure domain is exhausted and a new constraint becomes binding. Chicago Accelerated explains coordination until termination locks; Nash-Stigler explains termination until advocacy arbitrage exploits it; Tirole explains exploitation until structural constraints foreclose all paths. Understanding these handoff patterns is essential for diagnosing where intervention can succeed and where the system has already locked.

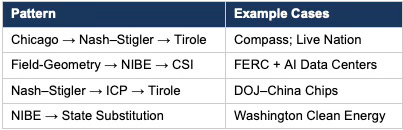

Complex cases activate multiple frameworks in sequence. The table below shows canonical routing patterns.

Publication Links:

Chicago → Nash–Stigler → Tirole (Compass; Live Nation):

https://www.mindcast-ai.com/p/chicago-school-accelerated, https://www.mindcast-ai.com/p/nash-stigler-equilibria, https://www.mindcast-ai.com/p/tirole-advocacy-arbitrage, https://www.mindcast-ai.com/p/nash-stigler-livenation-compass

Field-Geometry → NIBE → CSI (FERC + AI Data Centers):

https://www.mindcast-ai.com/p/field-geometry-reasoning, https://www.mindcast-ai.com/p/nibesbc, https://www.mindcast-ai.com/p/ferc-ai-dcs

Nash–Stigler → ICP → Tirole (DOJ–China Chips):

https://www.mindcast-ai.com/p/nash-stigler-equilibria, https://www.mindcast-ai.com/p/tirole-advocacy-arbitrage, https://www.mindcast-ai.com/p/china-two-gate-h200

NIBE → State Substitution (Washington Clean Energy):

https://www.mindcast-ai.com/p/nibesbc, https://www.mindcast-ai.com/p/nibewa

Multi-framework routing distinguishes MindCast AI from single-theory analysis. The question is never "which framework is correct" but "which framework governs at this stage of the system's evolution." The canonical patterns above recur because institutional decay follows predictable sequences—and predicting the sequence is the point.

X. Structural Insight

Each framework performs a distinct control function: Chicago School defines the substrate and baseline. Predictive Cognitive Economics defines method. Nash–Stigler defines termination. Tirole Advocacy governs regulatory gaming. CSI, Field-Geometry, and Cognitive Grammar define dominance. ICP, NIBE, and SBC define learning, throughput, and coordination limits. Federalism/State Substitution provides escape routing. Behavioral Asset Pricing gates valuation analysis. SIB and Cultural Economics define moral and civilizational boundaries.

Together, these flagships form a control stack, not a school—determining which economic logic applies, when optimization is valid, and when analysis must terminate.

XI. Terminology Note: Termination

In MindCast AI, termination is a formal system condition, not a metaphor. Termination occurs when an economic, legal, or regulatory system stops updating beliefs, strategies, or remedies by rule, even though the underlying problem may persist. A system terminates when both behavioral settlement (Nash) and cognitive sufficiency (Stigler) are satisfied. A termination state becomes terminal when it is self-reinforcing: new evidence no longer reopens inquiry, and actors adapt their strategies to exploit the stopping rule itself.

The conception is grounded directly in Chicago Law & Behavioral Economics. MindCast AI integrates these two Chicago primitives into a single termination rule, treating stopping as an endogenous equilibrium outcome rather than an exogenous political failure.

Insightful. I'm trully reflecting on how your predictive control stack's decision rule determines when optimization applies, is gated, or even suppressed across diverse failure domains.