MCAI Lex Vision: Compass's Technology Trap

How IPO Narrative Became Its Antitrust Liability

Companion to MCAI Lex Vision: Compass–Anywhere, When Scale Becomes Liability, Modernized Framework of Chicago Law and Behavioral Economics, Anchored in Coordination-Cost Economics (Jan 2026) (Part I), How the Compass–Anywhere Merger Reshapes Broker Bargaining Power, Architectural Monopsony and Lemley’s Labor-Antitrust Framework (Jan 2026) (Part II), Washington’s SB 6091 and Private Real Estate Market Control (Jan 2026) (Part IV). See also See also How Trump Administration Political Access Displaced Antitrust Enforcement—and Why States Should Now Step In (Jan 2026).

Executive Summary

Compass spent a decade telling investors it was a technology company. The IPO narrative emphasized platform differentiation, proprietary data, network effects, and agent productivity tools that competitors could not replicate. Wall Street rewarded the story with a $7 billion valuation at IPO and premium multiples relative to traditional brokerages.

Stanford law and economics professor Mark Lemley’s 2025 framework The Implications of Labor Antitrust for Merger Enforcement (available at SSRN) explains why that narrative is now a Section 7 liability under the Clayton Act.

Lemley's scholarship supplies the grammar that converts technology narratives into labor-market evidence. Once applied, Compass's IPO disclosures no longer describe innovation—the disclosures describe exit barriers. The pitch that justified the valuation is the admission that establishes monopsony capacity (buyer-side market power over labor). The analysis operationalizes Lemley's SSNDW test—Small but Significant and Non-transitory Decrease in Wages—the labor-market analog to the consumer-side SSNIP (Small but Significant and Non-transitory Increase in Price) test used in traditional antitrust analysis.

The Documentation Trap: Securities law required Compass to explain its moat. Antitrust law now uses that explanation as evidence. Discovery is unnecessary because compliance already did the work.

The central distinction in this analysis is not innovation versus restraint, but portability versus capture.Productivity gains that travel with the worker are efficiencies; productivity gains that remain with the platform are transfers enabled by exit barriers. Every feature Compass cited as a competitive moat—sticky platform, integrated workflows, non-portable data, agent lock-in—is precisely what Lemley identifies as a barrier to exit under Section 7. Compass did not merely build exit barriers; the company documented the barriers, quantified them, and celebrated them as proof of sustainable competitive advantage.

Core thesis: Technology-as-moat and technology-as-exit-barrier are the same thing described to different audiences. Compass cannot disclaim one without abandoning the other.

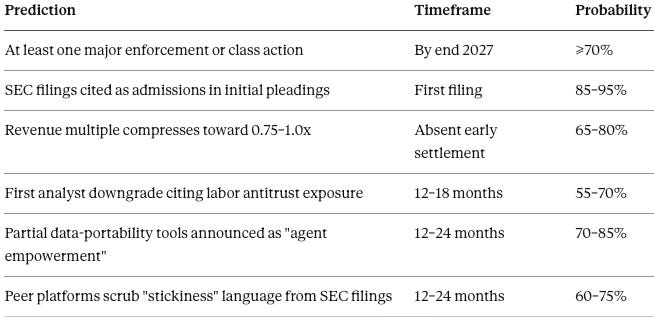

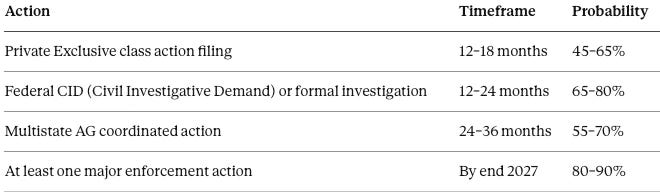

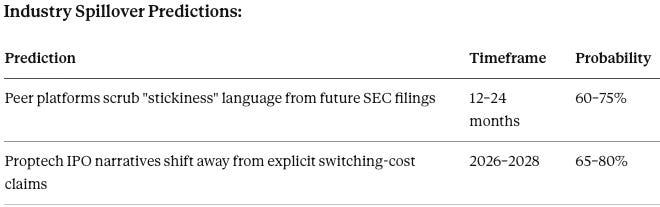

Foresight Simulation Predictions, Cognitive Digital Twin (CDT) Execution:

CDT = Cognitive Digital Twin; SEC = Securities and Exchange Commission. The predictions below split into (i) Unconditional forecasts (P by T) and (ii) Scenario-conditional forecasts (‘if X, then Y’). Only the unconditional forecasts are claims about what will occur.

Falsification conditions: The analysis is falsified if two or more of the following occur: (1) no enforcement or investigation by end 2027; (2) SEC language unchanged through 10-K 2027; (3) large-scale agent exit without compensation increases; (4) Compass multiple expands relative to peers despite litigation.

Roadmap: Section I documents the technology narrative Compass told investors—platform differentiation, switching costs, and retention metrics. Section II translates that narrative into labor-antitrust terms using Lemley’s framework. Section III explains why the evidence is inescapable: the Documentation Trap. Section IV examines valuation consequences. Section V maps enforcement vectors across federal, state, and private litigation. Section VI specifies testable indicators with falsification conditions. Section VII presents foresight simulation results. Section VIII extends the framework to peer platforms. Section IX concludes with takeaways for stakeholders.

This analysis applies MindCast AI’s foresight simulation methodology—combining Section 7 incipiency doctrine, labor-market exit-barrier analysis, and institutional response modeling—to generate testable predictions. For MindCast AI, ‘prediction’ means a falsifiable forecast derived from a CDT state-transition model (architecture → incentives → institutional response), not a claim of certainty.”

MCAI Lex Vision: From Open Market to Private Governance, Coordination Capture in the Compass–Anywhere Merger, Comment on Senators Warren-Wyden Letter to US DOJ and FTC

MCAI Economics Vision: Chicago School Accelerated: Coase and Why Transaction Costs ≠ Coordination Costs for Compass (with five subseries installments on Compass)

MCAI Economics Vision: Chicago School Accelerated, Part II: Becker and the Economics of Incentive Exploitation, Incentives After Coordination Collapse: Compass and the Economics of Litigation Driven Market Control.

I. Narrative Claim: The IPO Story Compass Told

Understanding the Documentation Trap requires examining the narrative Compass constructed for investors. The S-1 registration statement and subsequent SEC filings present a consistent story: Compass differentiated itself through technology that created switching costs, retained agents through platform dependency, and deserved software-style valuation multiples. Each element of the narrative becomes evidence when viewed through Lemley’s labor-antitrust lens. The post-merger communications reinforce rather than retreat from the technology thesis—extending the platform’s reach to approximately 340,000 agents globally and committing to an 18-month migration timeline.

A. Platform Differentiation

Compass positioned itself as a “cloud-native, mobile, AI-powered platform” designed to replace fragmented, paper-driven processes with an all-digital, end-to-end experience. By mid-2025, the company had invested nearly $1.5 billion in its technology platform. The company’s own description states: “Compass provides an end-to-end platform that empowers its residential real estate agents… The platform includes an integrated suite of cloud-based software for customer relationship management, marketing, client service, brokerage services, and other critical functionality, all custom-built for the real estate industry.”

The S-1 filing and investor presentations emphasized four pillars of differentiation:

Proprietary technology stack: End-to-end platform covering listing, marketing, CRM (Customer Relationship Management), transaction management, and analytics—representing “$1.5 billion invested to create the industry’s leading technology platform for real estate agents”

Data advantages: Accumulated transaction data, agent performance metrics, and market intelligence unavailable to competitors

Network effects: More agents → more data → better tools → more agents

Switching costs: Platform integration creates “stickiness” that traditional brokerages cannot match

The differentiation narrative served its purpose: investors accepted that Compass was building something competitors could not easily replicate.

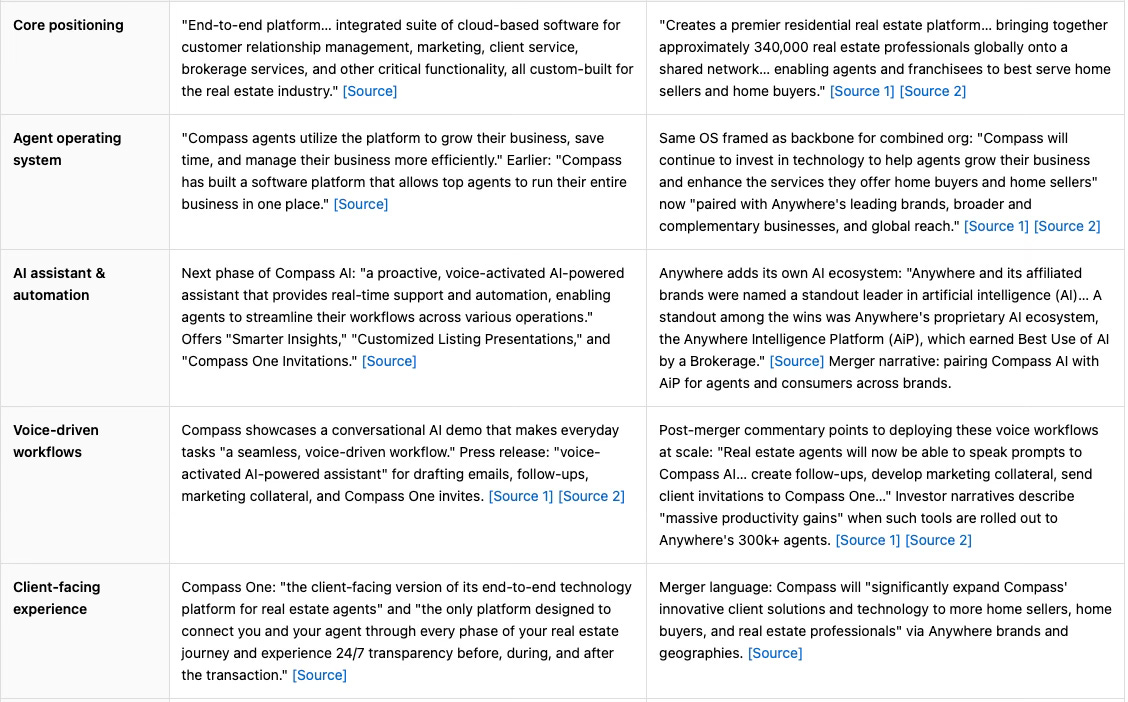

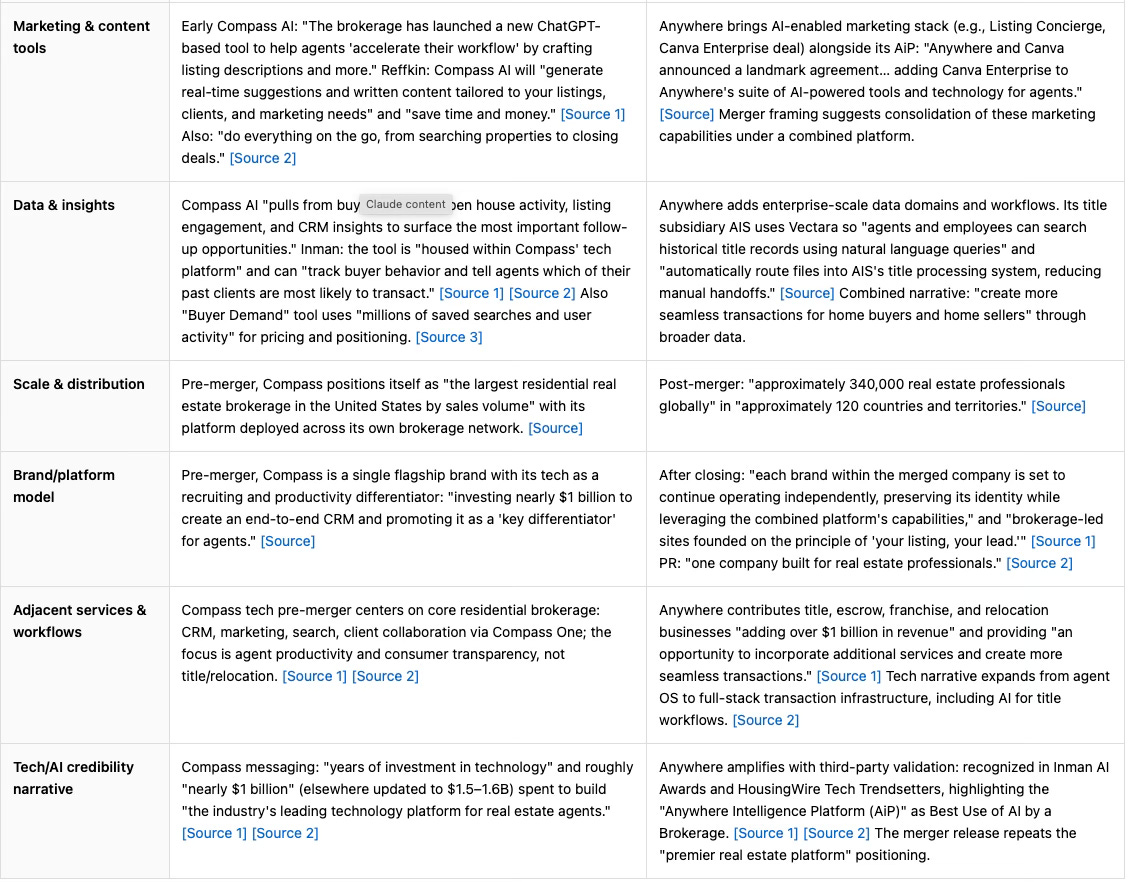

B. The Agent Operating System as Moat

The Agent Operating System (AOS) was central to the investment thesis—a proprietary suite of cloud-based software that integrated CRM, marketing, client service, and brokerage functions into a single interface. Compass described the platform as enabling agents to “run their entire business in one place.” The technical architecture represents a shift from fragmented third-party tools to a vertically integrated “Operating System” for the entire real estate lifecycle.

Core Architecture:

Unlike traditional brokerages that use a “patchwork” of third-party apps (separate CRM, separate marketing software, separate transaction management), Compass built a custom-integrated suite. The platform is cloud-native, using Go Modules and Java for back-end services, designed to process millions of data points across the national network. The integration replaces 5+ third-party tools with a single unified login—and a single point of forfeiture upon exit.

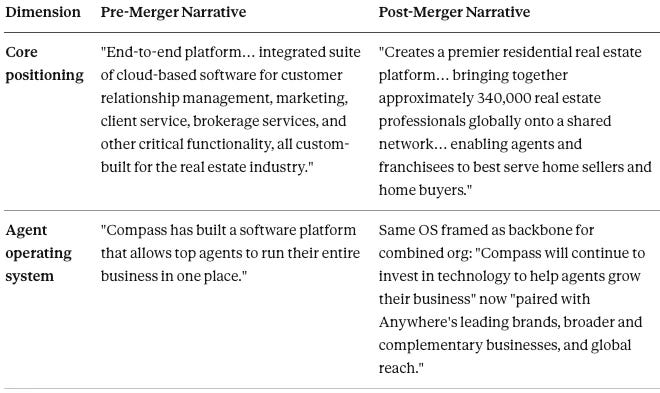

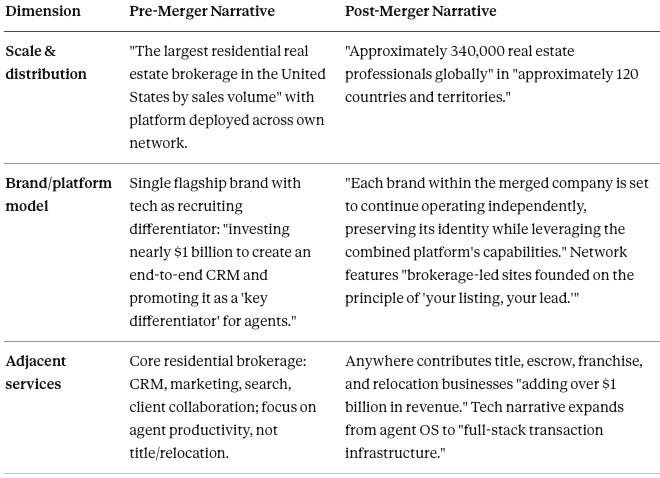

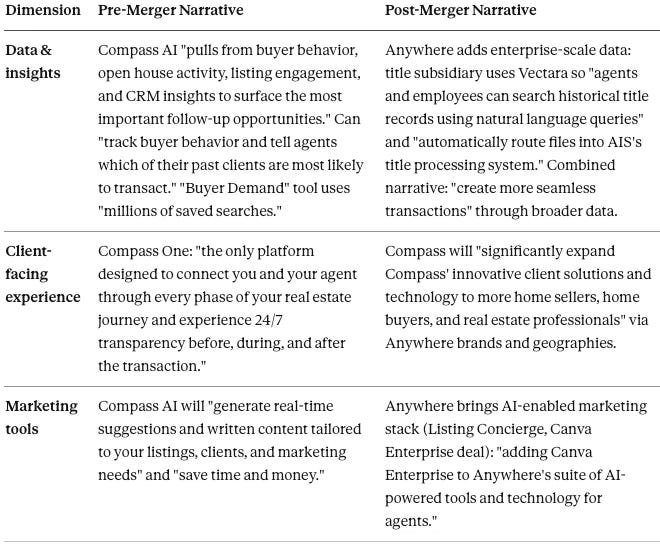

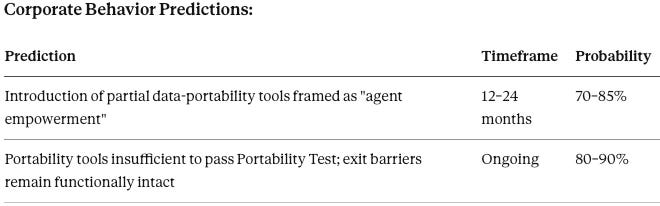

Pre/Post-Merger Platform Positioning:

Sources: Compass-Anywhere merger announcement; SEC investor deck (Ex. 99.1); YouTube platform overview.

Key Proprietary Tools:

Compass Collections: A “Pinterest-style” collaborative workspace where agents and clients organize, rate, and discuss properties in real-time, with instant alerts on price changes and status updates. The platform functions as a private, interactive search hub—data that cannot be exported.

Likely to Sell (LTS): A machine-learning model analyzing millions of home and homeowner data points to identify contacts in an agent’s CRM with the highest probability of listing within 12 months. Since its 2020 launch, approximately 8% of recommended leads have resulted in listings within a year. The 8% conversion rate represents a quantifiable informational advantage that is entirely non-portable. The model’s predictive accuracy depends on Compass network data; agents who leave cannot take the model or its predictions. More significantly, agents contribute their own CRM data to train the model—then forfeit access to the predictive asset they helped build. Under Lemley’s framework, this constitutes forfeiture of labor-market capital: the agent’s own data, processed through proprietary infrastructure, becomes a switching cost.

Buyer Demand: A real-time insight tool showing agents and sellers the exact number of “serious buyers” in the Compass network searching for homes at specific price points, based on millions of saved searches. The data provides concrete pricing intelligence unavailable outside the network.

Compass Insights: An AI tool for analyzing local market trends, comparable sales, and buyer demand to set optimal listing prices—replacing agent “gut feeling” with network-derived analytics.

Compass One: An integrated buyer dashboard streamlining property searching, financing (via OriginPoint), and transaction management. Described as “the only platform designed to connect you and your agent through every phase of your real estate journey”—a 24/7 “transaction command center” for tracking milestones, managing tours, and monitoring contingency deadlines.

Private Exclusives: A technical “walled garden” allowing Compass agents to share off-market inventory within the network before listings hit public portals like Zillow or the MLS (Multiple Listing Service). The feature creates competitive advantage for agents inside the network and information disadvantage for agents outside. Note: Private Exclusives accelerates exposure; the feature is not required for it. The platform architecture alone—CRM lock-in, non-portable analytics, accumulated transaction history—suffices to establish exit barriers under Lemley’s framework. If Compass rebrands or softens Private Exclusives, the underlying architectural control remains.

3-Phased Marketing Strategy: Pre-marketing tools providing sellers with custom market valuations and real-time visibility into neighborhood trends.

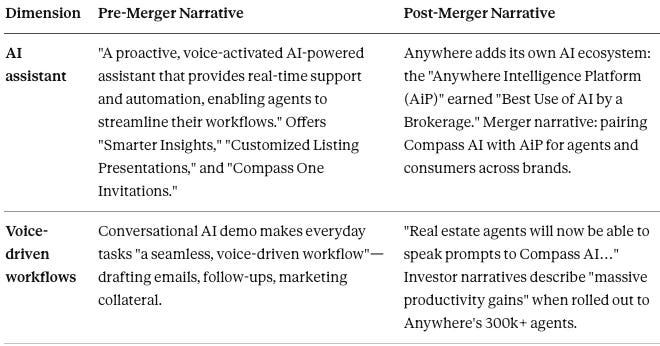

AI & Productivity Integration:

In 2025, Compass integrated Google Workspace with Gemini to help agents transform complex data (contracts, market reports) into client-ready content and allow legal teams to analyze thousands of contracts efficiently. The “Compass AI 2.0” rollout focused on automating high-friction tasks: a voice-activated, conversational AI assistant that crafts listing descriptions, social media posts, and daily task digests. The platform reportedly reduces agent administrative tasks by approximately 30%—productivity gains that evaporate upon exit.

Pre/Post-Merger AI & Automation:

Sources: Compass AI press release; WAV Group analysis; Inman coverage; Anywhere AI awards.

The “Soft Mandate” Architecture:

CEO Robert Reffkin has explicitly committed to “no mandates or policies” requiring agents to use specific features like Private Exclusives. The official stance is “platform migration” without “policy mandates.” The distinction is legally significant but operationally hollow: the system is designed as a walled garden where agents are encouraged to use the internal platform to access off-market inventory, creating natural incentives to stay within the Compass tech ecosystem to remain competitive.

Guideline 10 of the 2023 DOJ/FTC (Department of Justice / Federal Trade Commission) Merger Guidelinesaddresses precisely this dynamic. The Guidelines recognize that platform defaults can function as de facto mandates even absent formal policy requirements. When Private Exclusives is the path of least resistance for inventory access—when the architectural default steers agent behavior toward the walled garden—the absence of a policy mandate is irrelevant. The technical defaults are the mandate. Agents who decline to use platform features face competitive disadvantage against agents who do; the choice is formally free but economically coerced.

The “soft mandate”—where the technology is so integrated that leaving becomes prohibitively costly even without contractual requirements—is precisely what Lemley’s framework identifies as an architectural exit barrier. The absence of formal mandate does not eliminate the barrier; the architecture is the mandate. Under Guideline 10, regulators can treat default-driven behavior as evidence of platform power even when participation appears voluntary.

Why the Technical Details Matter for Antitrust:

Each proprietary tool represents accumulated platform capital that agents forfeit upon exit. The 8% LTS conversion rate demonstrates concrete economic value—value that exists only inside the network. The 30% administrative reduction represents productivity gains that do not travel with the agent. The explicit acknowledgment of what departing agents lose is precisely what Lemley’s framework makes actionable under Section 7.

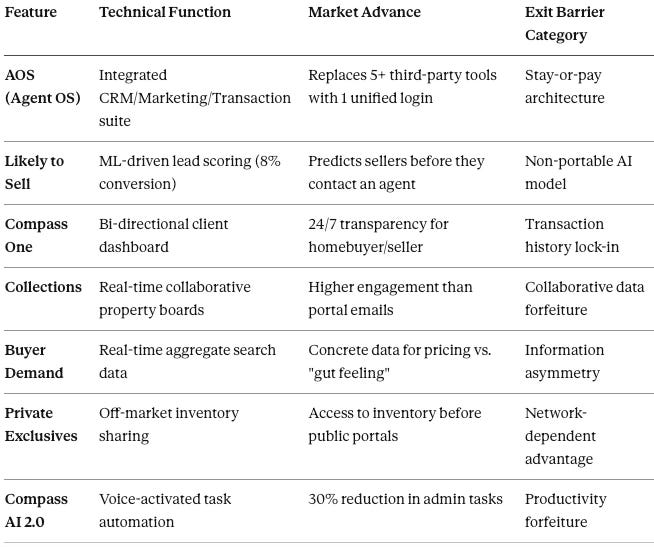

C. Technology Components Summary

The following table summarizes Compass’s proprietary technology stack and maps each component to its antitrust relevance under Lemley’s framework:

Each row represents documented exit-barrier evidence under Lemley’s framework. The “Market Advance” column captures Compass’s investor narrative; the “Exit Barrier Category” column captures the antitrust translation.

D. Retention as Proof of Value

Compass cited agent retention rates as evidence that the platform worked. High retention demonstrated three things simultaneously:

Product-market fit (agents chose to stay)

Switching costs (agents found leaving costly)

Network effects (value increased with scale)

Investor presentations framed retention as a leading indicator of lifetime value. The higher the retention, the more valuable the platform—and the more defensible the moat. Under Lemley’s framework, the same retention data supports a different inference: agents stay not because the platform is superior, but because leaving is prohibitively costly.

E. The Valuation Multiple

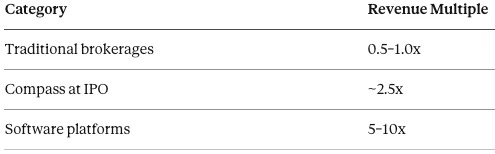

Wall Street accepted the technology narrative and priced Compass accordingly. Compass traded at multiples closer to software companies than to real estate brokerages:

The premium reflected the belief that Compass was building a durable technology moat, not merely assembling a large brokerage through agent recruitment and acquisition. The valuation multiple now creates a problem: if the moat is the antitrust liability, the premium must compress.

F. Post-Merger Technology Thesis: From Growth Moat to Unified Operating System

Compass’s technology strategy shifted from a proprietary “growth moat” used to disrupt traditional brokerages to a “unified operating system” designed to consolidate the world’s largest residential real estate network. The merger with Anywhere Real Estate created a new parent company, Compass International Holdings, with an enterprise value of approximately $10 billion.

The transaction framing reinforced the technology narrative: “This transaction pairs Compass’ years of investment in technology, innovative marketing offerings, and real estate professionals with Anywhere’s leading brands, broader and complementary businesses, and global reach.”

Scale and Migration — The Incipiency Period:

340,000 agents globally: “This transaction will bring together approximately 340,000 real estate professionals globally onto a shared network”

18-month migration: CEO Robert Reffkin has committed to migrating all Anywhere agents (including Coldwell Banker, Sotheby’s, Century 21, and other brands) onto the Compass platform within 18 months

120 countries: The pro-forma goal is to evolve Compass into a “unified operating system for residential real estate” serving 120 countries and territories

The 18-month migration window constitutes the “Incipiency Period” under Section 7 of the Clayton Act.Regulators do not need to wait for demonstrated harm; Section 7’s incipiency standard requires only a showing of tendency toward monopoly or monopsony. The observable event is the migration itself: agents moving from portable, third-party tools to a proprietary platform where exit barriers activate upon adoption. Each agent who completes migration loses portability; each completed migration extends the monopsony architecture. The act of migrating 340,000 agents from open systems to a closed platform is the cognizable Section 7 event—not a future harm to be monitored, but a present tendency to be enjoined.

Synergy Targets:

Cost synergies: Net synergy target revised upward to $225–$300 million annually, largely by eliminating Anywhere’s redundant legacy systems and scaling the Compass tech stack

Revenue diversification: The merger adds over $1 billion in high-margin revenue from Anywhere’s franchise, title, escrow, and relocation operations—shifting Compass away from pure reliance on commission splits

Pre/Post-Merger Scale & Business Model:

Sources: Compass One press release; Real Estate News; Chicago Agent Magazine; Anywhere merger announcement.

The Walled Garden Strategy:

The post-merger positioning reveals a “walled garden” approach to inventory control. The network will feature “brokerage-led sites founded on the principle of ‘your listing, your lead.’” The Private Exclusives program—withholding inventory from public portals like Zillow—positions the merged entity to control listing distribution, potentially turning Zillow into a secondary platform for “stale” listings. Under Lemley’s framework, control over listing-distribution software allows the firm to dictate labor-market terms for its massive agent pool.

Why the Post-Merger Narrative Tightens the Trap:

The merger communications confirm that Compass intends to extend the same platform architecture—the same switching costs, the same integrated workflows, the same non-portable data—to a workforce three times larger. Under Lemley’s framework, the merger does not merely consolidate market share; the merger extends monopsony architecture to 340,000 agents who previously operated on “fragmented third-party tools” with greater portability. The 18-month migration timeline creates a testable indicator: as agents move onto the unified platform, exit barriers rise and the SSNDW test becomes applicable to the combined workforce.

The platform architecture functions as a continuous merger of labor into a single bargaining counterparty; the Anywhere transaction accelerates that process rather than initiating it. Section 7 analysis applies prospectively to the expansion—the cognizable event is the migration itself, not the corporate combination.

Section I establishes what Compass told investors—both before and after the merger. The narrative emphasized platform differentiation, switching costs, and retention—exactly the features that become exit barriers under Lemley’s translation. Section II applies that translation systematically.

II. Architectural Barrier: The Lemley Translation

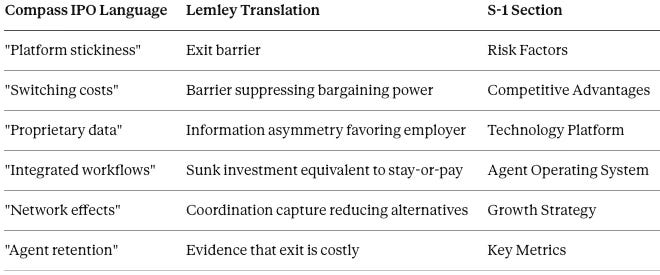

Section I documented what Compass told investors. Section II translates that narrative into labor-antitrust terms using Lemley’s framework. As detailed in Part II of the trilogy, Lemley’s scholarship recharacterizes platform stickiness as exit barriers and retention as evidence of lock-in rather than preference. The S-1 provides the quantitative support for that recharacterization—in Compass’s own words.

A. The Translation Matrix

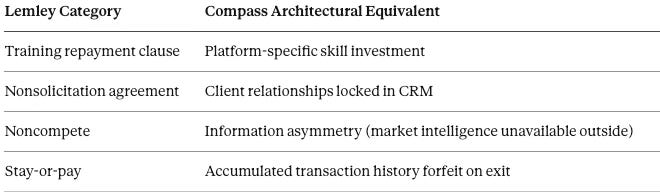

Every moat feature maps to a Lemley exit-barrier category. The translation is mechanical, not interpretive:

The matrix reveals a structural reality: the same features, described to different audiences, carry opposite valences. Securities analysts reward stickiness; antitrust enforcers penalize stickiness. Compass cannot change what the words mean—only who reads them.

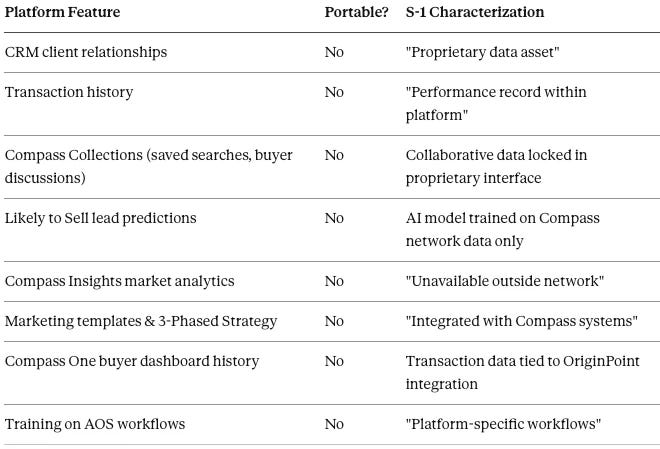

B. The Portability Test

The critical diagnostic for distinguishing value creation from value capture is portability. The question is simple:

Does the productivity gain travel with the agent, or does it remain with the platform?

Two categories emerge from the answer:

Value creation: Tools that raise gross productivity regardless of employer

Value capture: Tools whose value is forfeited upon exit

Lemley does not condemn value creation. Lemley condemns architectures where value creation is inseparable from employer-specific capture. Compass’s own documentation answers the Portability Test repeatedly—and unfavorably:

When every productivity-enhancing feature is non-portable, the platform is not creating value for agents—the platform is capturing value from agents. Productivity gains that do not travel with the worker are not efficiencies under antitrust law; they are transfers enabled by exit barriers. The distinction matters for Section 7 analysis: captured value is monopsony rent, not efficiency gain. The 18-month migration of 340,000 Anywhere agents onto the unified platform will extend this capture architecture to agents who previously had access to portable, third-party alternatives.

C. The Three-Part Retention Diagnostic

Part II of the trilogy developed the SSNDW test (Small but Significant and Non-transitory Decrease in Wages) as the labor-market analog to the consumer-side SSNIP test. Applied to Compass, the question becomes operational:

Can Compass reduce effective compensation by 5% without significant agent exit?

The three-part diagnostic converts retention from metric to evidence:

Retention remains high — Compass cites 90%+ retention in investor materials

Effective compensation declines or stagnates — Splits, lead quality, support resources

Comparable outside options exist in theory but not in practice — Other brokerages exist, but platform lock-in makes switching costly

When all three conditions hold, retention is not preference—retention is evidence of suppressed exit. Compass’s SEC filings provide the retention data. Post-merger compensation trends and agent mobility data will test conditions two and three. The evidentiary framework is already built; only the time-series data remains to be collected.

D. Technology Investment as Stay-or-Pay

Lemley identifies “stay-or-pay” clauses—contractual provisions requiring employees to repay training costs if they leave—as explicit exit barriers. Compass’s platform investments function identically, but through architecture rather than contract:

Agents who leave forfeit accumulated platform capital. The forfeiture is not a contractual penalty—the forfeiture is an architectural one. The effect is identical: exit becomes costly even without explicit restraint. Courts evaluating Section 7 claims will recognize the functional equivalence.

E. Data Moat as Information Asymmetry

Compass emphasized proprietary data as competitive advantage in multiple SEC filings and investor presentations:

Market analytics unavailable elsewhere

Agent performance benchmarking

Pricing and timing recommendations

Client behavior insights

Under Lemley’s framework, proprietary data creates information asymmetry between employer and worker. Agents inside the network have access to market intelligence; agents outside do not. Leaving Compass means accepting an information disadvantage—a cost that suppresses exit even without contractual restraint. The S-1’s description of data advantages is simultaneously a disclosure of information asymmetry; the same sentence serves both functions depending on the audience reading it.

Pre/Post-Merger Data & Client Experience:

Sources: Compass AI press release; Inman; HousingWire (Vectara); Anywhere-Canva announcement.

Section II translates Compass’s investor narrative into Lemley’s labor-antitrust categories. The Translation Matrix, Portability Test, and three-part diagnostic convert moat language into exit-barrier evidence. Section III examines why the evidence cannot be escaped—the Documentation Trap itself.

III. Legal Consequence: The Documentation Trap

Sections I and II established what Compass said and how the statements translate under Lemley’s framework. Section III addresses why the evidence is inescapable. The Documentation Trap operates through a mechanism plaintiffs rarely enjoy: the defendant created the evidentiary record itself, filed the record with federal regulators, and cannot now disclaim the record without triggering different liability.

A. The Trap Defined

The core insight is straightforward:

Securities law required Compass to explain its moat. Antitrust law now uses that explanation as evidence. Discovery is unnecessary because compliance already did the work.

The Documentation Trap represents the novel contribution of the present analysis. The trap operates through regulatory arbitrage in reverse: compliance with one regime creates liability under another.

The mechanism unfolds in five steps:

SEC disclosure requirements demand specificity about competitive advantages

Compass explained how the platform creates switching costs, why agents find leaving difficult, what data and tools agents lose upon departure

Under Federal Rule of Evidence 801(d)(2), statements by a party opponent are admissible against that party

Compass’s SEC filings are party admissions available to plaintiffs without discovery

The evidentiary record is already public, already authenticated, already attributed

No subpoenas required. No contested discovery motions. The evidence exists in EDGAR, available to anyone who searches for it.

B. The 10-K Risk Factor as Admission

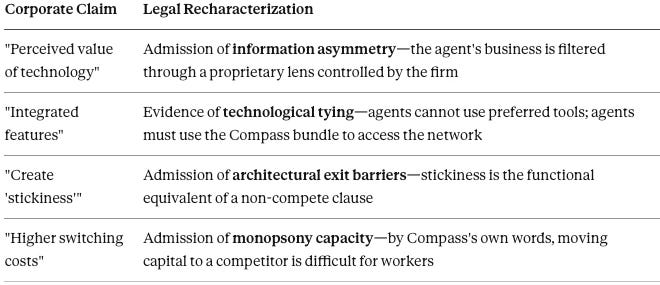

The SEC’s Item 1A requires companies to disclose material risks candidly. In satisfying the requirement, Compass documented exactly what Lemley’s framework makes actionable. The corporate language reads as competitive positioning to investors; the same language reads as admission to plaintiffs.

Source Material: Compass S-1 Registration Statement and 10-K Annual Reports

The Corporate Text:

“Our ability to retain agents depends in part on the perceived value of our technology platform... We have invested significantly in integrated features—including CRM, marketing automation, and proprietary data—that create ‘stickiness’ and higher switching costs for agents familiar with our ecosystem.”

The Plaintiff’s Translation:

The translation is not interpretive characterization—the translation is direct mapping. The same language serves opposite functions depending on whether the audience is the SEC or a federal court.

C. Applying the Wage-Suppression Test to Compass’s Own Data

Plaintiffs will use Compass’s disclosed retention metrics to satisfy Lemley’s SSNDW test. The roadmap follows four steps:

Step 1 — Establish the Baseline: Compass reports 96.9% principal agent retention in its Q4 2024/FY 2024 earnings release (SEC Filing).

Step 2 — Identify the Trigger: Post-merger with Anywhere, Compass–Anywhere reduces lead-generation support, increases desk fees, or compresses effective splits—a 5% effective compensation cut.

Step 3 — Observe the Response: Because of the “high switching costs” documented in the S-1, agents do not leave despite the pay cut. Retention remains above 90%.

Step 4 — Draw the Conclusion: The 10-K admission of “stickiness” proves that Compass has the power to suppress labor compensation without losing its workforce—the literal definition of monopsony power under Lemley’s framework.

The switching cost acts as a wedge, allowing Compass to lower effective agent compensation without triggering exit. The cost of leaving the platform exceeds the loss in compensation. The analysis aligns with Guideline 10 of the 2023 DOJ/FTC Merger Guidelines, which addresses harms to workers through increased switching costs.

D. The Securities Liability Feedback Loop

The trap becomes inescapable through a feedback mechanism linking antitrust defense to securities exposure. The mechanism functions as a litigation deterrent: aggressive antitrust defense triggers parallel securities liability.

The Dilemma:

If Compass’s legal team argues in antitrust proceedings that “the platform isn’t actually that sticky and agents can leave easily,” the legal team has effectively admitted that S-1 and 10-K disclosures were materially misleading.

Dual-Track Litigation Scenario:

The feedback loop creates a concrete litigation pathway. If Compass mounts an aggressive antitrust defense claiming exit barriers do not exist:

Plaintiffs’ securities counsel monitors antitrust proceedings for statements disclaiming platform stickiness

Any such statement becomes evidence in a Rule 10b-5 securities fraud class action

The securities theory: Compass’s IPO and subsequent offerings were premised on technology moat disclosures; if Compass now admits the moat was illusory, investors purchased shares based on material misrepresentations

Damages model: The difference between the technology-premium valuation (~2.5x revenue) and traditional brokerage valuation (~0.75x revenue) represents the securities fraud damages class

Class period: From IPO (April 2021) through any statement disclaiming exit barriers

The dual-track scenario functions as a litigation deterrent. Compass’s defense counsel cannot aggressively contest exit barriers in antitrust proceedings without creating a roadmap for securities plaintiffs. The rational defense strategy is settlement or narrow procedural challenges—not substantive denial of platform stickiness.

The feedback loop is closed. Defending one claim exposes the other. The dynamic opens the door for Rule 10b-5 securities fraud class actions running parallel to antitrust enforcement—with the same documents serving as evidence in both proceedings.

E. The Complete Evidentiary Record

Multiple categories of public documents support the Documentation Trap analysis.

SEC Filings as Admissions

Compass’s S-1 registration statement, 10-K annual reports, and 10-Q quarterly filings contain detailed descriptions of how the platform creates switching costs, why agents find leaving difficult, what data and tools agents lose upon departure, and how retention metrics demonstrate platform lock-in. The descriptions are not allegations to be proven—the descriptions are admissions already made. Plaintiffs need only cite them.

Earnings Call Transcripts

Robert Reffkin and Compass executives have discussed platform stickiness, retention drivers, and competitive moats on quarterly earnings calls. Specific statements include characterizations of switching costs as strategic advantage, explanations of why agents do not leave, descriptions of platform features designed to increase lock-in, and retention metrics presented as proof of moat durability. Earnings call transcripts are public record, and plaintiffs can cite transcripts as evidence of intent without subpoena.

Investor Presentations

Compass prepared investor decks for IPO roadshows and subsequent capital raises. The decks typically include visualizations of the “flywheel” or “network effect,” competitive positioning against traditional brokerages, agent economics showing platform-dependent productivity, and retention cohort analysis demonstrating stickiness. Investor presentations distributed to securities analysts are discoverable and often publicly available through SEC filings or analyst reports.

F. The Inescapable Bind

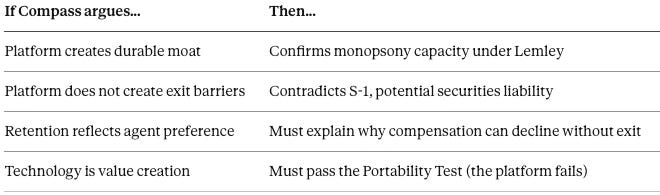

Compass cannot claim the platform does not create switching costs without contradicting its own SEC filings. The securities narrative and the antitrust defense are incompatible:

The trap is structural, not rhetorical. Compass documented the evidence against itself because securities law required documentation. The same law that compelled disclosure now supplies the record for enforcement.

Section III establishes why the evidence is inescapable. The Documentation Trap closed the moment the S-1 was filed. Section IV examines what the trap means for Compass’s valuation—and why repricing is inevitable.

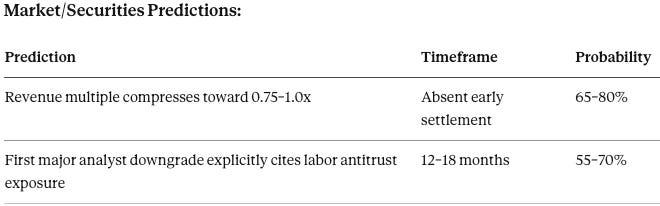

IV. The Pricing Problem

The Documentation Trap creates legal exposure. Section IV translates legal exposure into financial consequence. Markets priced Compass as if the technology moat were risk-free; Lemley’s framework converts that moat into a contingent liability. The question is not whether repricing occurs, but through which mechanism and on what timeline.

A. The Moat Paradox

Compass’s valuation depends on the moat, and the moat is the antitrust problem.

If Compass argues in litigation that the platform does not create meaningful exit barriers, the argument undermines the investment thesis that justified premium multiples. If Compass maintains the technology narrative, the narrative confirms the monopsony capacity Lemley’s framework makes actionable. The paradox admits no resolution that preserves both the valuation and the legal defense.

B. Multiple Compression Paths

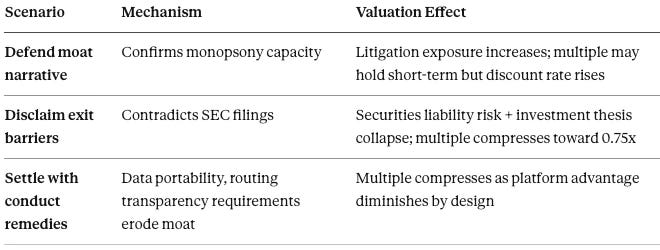

Three scenarios capture the range of outcomes. Each scenario implies valuation pressure through different mechanisms:

All three scenarios imply valuation pressure. The question is not whether repricing occurs, but through which mechanism and on what timeline.

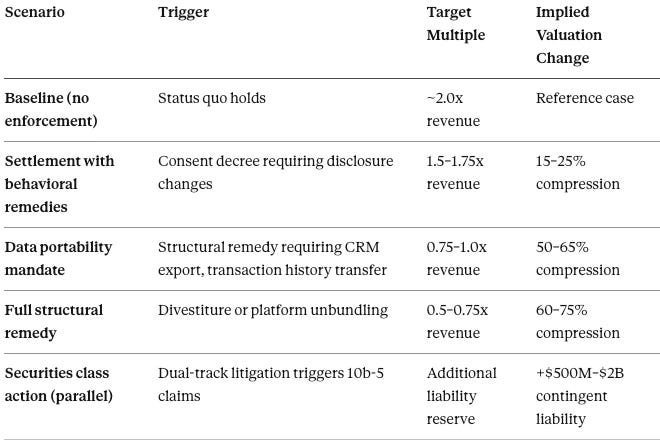

Scenario Analysis — Quantified Multiple Compression:

Why Data Portability Compresses to Traditional Brokerage Multiples:

If regulators impose a data portability mandate as remedy, the multiple should compress toward the traditional brokerage peer group (~0.75x revenue) because:

Exit barriers eliminated by design: Agents can take CRM data, transaction history, and client relationships to competitors

Retention becomes preference, not lock-in: High retention would need to reflect genuine platform superiority rather than switching costs

Moat narrative invalidated: The technology differentiation story cannot survive mandatory portability

Comparable set changes: Compass would trade as a large brokerage with technology tools, not as a technology platform with brokerage revenue

The portability remedy scenario represents the most likely structural outcome if enforcement proceeds—and produces the most severe valuation impact short of divestiture.

C. Analyst Coverage Implications

Securities analysts covering Compass have relied on the technology narrative. Lemley’s framework forces a model revision, not merely a sentiment shift. Analysts must now add a new discount rate input: antitrust contingent liability. The questions are structural:

Is the moat a liability?

Should retention metrics be discounted for lock-in effects?

What is the appropriate multiple for a brokerage with cognizable labor-market exposure?

How should enforcement probability be priced into DCF (Discounted Cash Flow) models?

Analyst reports that continue parroting the moat narrative without incorporating antitrust risk as a valuation input may face credibility challenges as litigation develops. The first analyst to add labor-antitrust exposure as an explicit discount factor will force model revisions across coverage.

Section IV translates legal exposure into pricing consequences. The moat paradox admits no clean resolution. Section V identifies the enforcement vectors through which liability will materialize.

V. Enforcement Roadmap

Sections I–IV established the legal exposure and pricing consequences. Section V maps the enforcement vectors through which liability will materialize. Federal agencies, state attorneys general, and private plaintiffs each present distinct paths to action—and the paths are not mutually exclusive. Coordinated enforcement across multiple vectors is the probable scenario.

A. Federal Vectors

DOJ Antitrust Division

The December 2025 Statement of Interest in Davis v. Hanna Holdings signals doctrinal direction. Horizontal coordination through association rules receives heightened scrutiny without elaborate rule-of-reason balancing. Compass’s litigation record (NWMLS, Zillow) provides exhibit-ready evidence of coordination-capture intent. The arguments Compass made as an insurgent will be cited against Compass as the incumbent.

FTC Bureau of Competition

Vertical tie-in exposure exists through integrated title, escrow, and mortgage referral services. If the Compass platform steers consumers toward affiliated settlement services through defaults or nudges, Section 5 unfair methods of competition authority applies. RESPA (Real Estate Settlement Procedures Act) Section 8 (kickback prohibition) provides a parallel enforcement path through CFPB (Consumer Financial Protection Bureau)—potentially faster than full antitrust litigation.

B. State Vectors

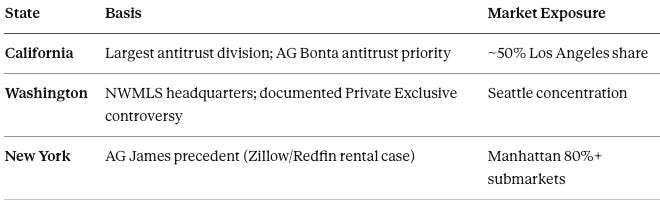

Priority Jurisdictions

Three states present the highest enforcement probability based on market exposure and institutional capacity:

The UDAP (Unfair and Deceptive Acts and Practices) Bypass

State consumer protection statutes (California UCL [Unfair Competition Law], Washington CPA [Consumer Protection Act], New York GBL [General Business Law] § 349) do not require complex market definition. The theory is simpler: sellers promised “maximum exposure” received systematic withholding to increase double-end probability. Deceptive practice claims move faster than antitrust, skip market-definition fights, and carry statutory damages with fee-shifting.

C. Private Litigation

Class Action Theory

The Sitzer/Burnett plaintiffs’ bar (Ketchmark & McCreight, Cohen Milstein) has demonstrated capacity to reshape industry practices through private enforcement. The Private Exclusive class theory writes itself:

Sellers engaged brokerages with reasonable expectation of maximum market exposure

Private Exclusives systematically withheld listings to increase double-end probability

Sellers received materially less exposure, resulting in longer days-on-market, lower sale prices, or both

Damages model compares Private Exclusive outcomes against MLS-listed comparables

Discovery opens internal communications about double-end incentives and platform steering—the “discovery gold” that Section 2 cases require.

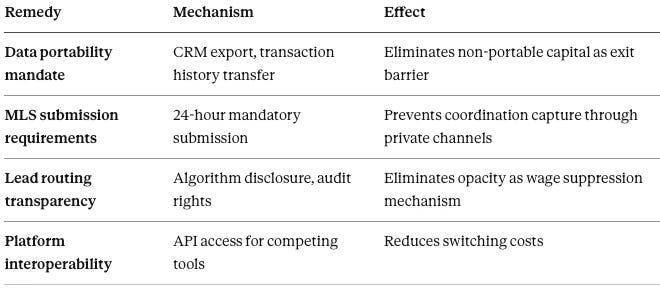

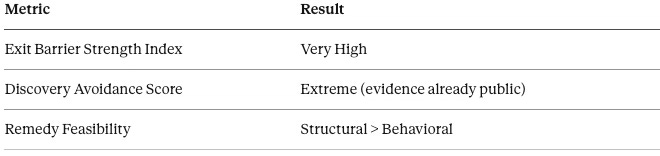

D. Remedy Framework

Lemley’s framework indicates that behavioral remedies are “rarely enforced and have proven ineffective.” Structural or self-executing remedies are required:

The governing principle: remedies should change market structure, not rely on ongoing good behavior.

Section V maps enforcement vectors. Federal, state, and private paths present distinct timelines and theories—but all paths lead to the same evidentiary record. Section VI specifies testable indicators that will validate or falsify the analysis.

VI. Testable Indicators

The analysis generates falsifiable predictions. Section VI specifies testable indicators with defined timeframes, data sources, and falsification conditions. Tracking the indicators will determine whether the Documentation Trap thesis is validated by events or requires revision.

A. Securities-Side Indicators

Indicator 1: Analyst reports incorporate antitrust risk into Compass valuation models within 12 months.

Data sources: Sell-side research; valuation methodology disclosures; price target revisions

Trigger: First major bank publishes note addressing Lemley framework or labor-market exposure

Falsification: Analyst coverage continues 12+ months without antitrust risk acknowledgment

Indicator 2: Compass’s valuation multiple compresses toward traditional brokerage peers (from ~2x revenue toward ~0.75x) within 18 months, independent of broader market movements.

Data sources: Public market comparables; enterprise value / revenue ratios

Falsification: Multiple remains stable or expands relative to sector

Indicator 3: Institutional investors reduce Compass holdings citing litigation or regulatory risk within 12 months.

Data sources: 13-F filings; institutional ownership tracking; investor letters

Falsification: Institutional ownership remains stable or increases

B. Litigation-Side Indicators

Indicator 4: Plaintiffs in class action or regulatory proceedings cite Compass SEC filings as evidence of exit-barrier intent within 24 months.

Data sources: Court filings; complaint exhibits; regulatory submissions

Trigger: Complaint explicitly quotes S-1 moat language as admission

Falsification: No citation of SEC filings in litigation

Indicator 5: Compass faces securities litigation alleging that moat disclosures were materially misleading given antitrust exposure within 36 months.

Data sources: Securities class action filings; SEC enforcement

Falsification: No securities litigation related to moat/antitrust intersection

C. Corporate Response Indicators

Indicator 6: Compass modifies technology narrative in SEC filings or earnings calls to de-emphasize switching costs and platform lock-in within 12 months.

Data sources: 10-K/10-Q language changes; earnings call transcript analysis

Trigger: Removal or softening of “switching costs,” “stickiness,” “retention” language

Falsification: Technology narrative remains unchanged

Indicator 7: Compass announces data portability or agent transition assistance programs as preemptive defense against lock-in claims within 18 months.

Data sources: Press releases; product announcements; agent communications

Trigger: CRM export tools, transaction history portability, or similar features

Falsification: No portability or transition initiatives announced

Indicator 8: Anywhere brand agents complete migration to unified Compass platform within the announced 18-month timeline (by July 2027).

Data sources: Earnings calls; integration progress reports; agent communications

Trigger: Migration completion announcements; platform adoption metrics

Falsification: Migration delayed beyond 24 months or abandoned

Antitrust relevance: Successful migration extends exit-barrier architecture to 340,000 agents; delays may indicate integration friction or regulatory pressure

D. Timeline Expectations

Probability bands for enforcement actions reflect correlated rather than independent risks:

Trigger events—discovery of internal compensation directives, agent whistleblower disclosures, documented routing stratification—shift bands upward.

Section VI specifies falsifiable predictions. The indicators provide accountability for the analysis. Section VII extends the framework beyond Compass to the broader industry.

VII. Foresight Simulation Results

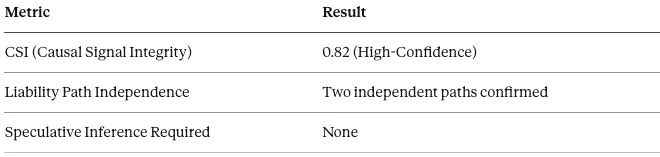

Sections I–VI established the Documentation Trap through doctrinal analysis. Section VII operationalizes the analysis through MindCast AI’s Vision Function CDT (Cognitive Digital Twin) methodology—executing forward predictions against the Compass–Anywhere post-merger entity. The objective is not descriptive analysis but falsifiable forecasting: how institutions, markets, and enforcement bodies are likely to behave given the documented architecture, incentives, and evidentiary record.

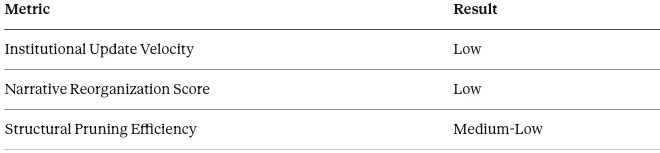

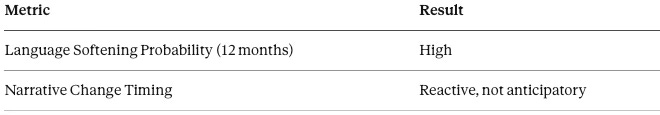

A. Vision Function Results Summary

Causation Vision CDT — Causal Trust Gate

Key Finding: Compass’s SEC-mandated explanations of its technology moat causally produce exit-barrier evidence. The causal chain does not rely on future conduct—liability attaches to existing architecture + documented intent. The same disclosures generate two independent liability paths: labor antitrust (Section 7) and securities exposure (Rule 10b-5).

Lex Vision CDT — Legal Exposure & Remedy Simulation

Key Finding: Section 7 exposure does not require market-definition-heavy pleading. SEC filings qualify as party admissions; discovery friction is minimal. Behavioral remedies (promises, disclosures) score poorly; structural remedies score high. Compass is a procedurally efficient enforcement target—attractive not because the case is novel, but because proof is inexpensive.

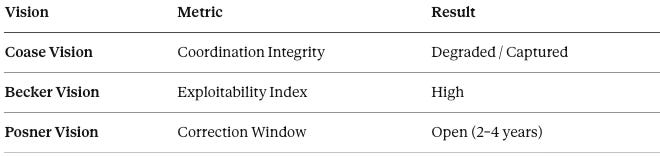

Chicago Law & Behavioral Economics Composite CDT

Interpretation:

Coase: MLS-based coordination is displaced by platform governance. Agents no longer coordinate through neutral infrastructure but through employer-controlled systems—coordination-through-architecture replaces coordination-through-rules.

Becker: Once exit becomes costly, rational actors reduce compensation growth and increase internal capture (double-ending, routing advantages). The incentive structure favors exploitation. The December 2025 DOJ Statement of Interest in Davis v. Hanna Holdings establishes that coordination mechanisms are subject to antitrust scrutiny. Compass has moved beyond trade association coordination into Private Governance: the merged entity is not merely a brokerage participating in MLS-based coordination but a rule-setting entity for 340,000 agents operating outside traditional MLS oversight. When Compass controls listing distribution, lead routing, and inventory access, Compass exercises governance power previously held by neutral industry infrastructure.

Posner: Courts and agencies are capable of updating doctrine quickly post-NAR. The institutional learning environment is “kind” (adaptive); liability correction is feasible before norms lock in again.

Institutional Cognitive Plasticity Vision (ICP Vision)

Key Finding: Compass lacks sufficient institutional plasticity to unwind exit barriers without undermining valuation. The organization is cognitively locked by its own past disclosures. Adaptive response will lag enforcement pressure.

Disclosure Vision CDT — Narrative Change Detection

Key Finding: Disclosure changes will follow, not precede, credible enforcement signals. Language shifts in SEC filings act as lagging indicators of legal pressure.

B. Integrated Foresight Interpretation

Across all Vision Functions, the system converges on a single structural conclusion:

Compass is not facing a contingent legal risk. The company is carrying a latent liability already embedded in its disclosures, architecture, and incentives.

The merger amplifies rather than creates the exposure by extending the same exit-barrier architecture to a vastly larger labor pool. The 18-month migration of 340,000 agents onto the unified platform converts latent liability into active exposure.

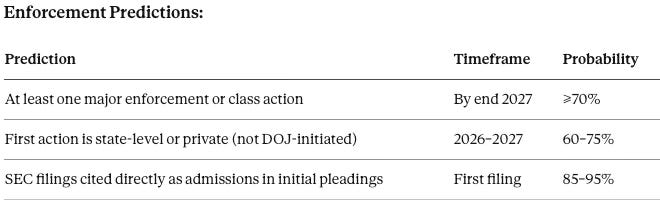

C. Time-Bound Predictions

D. Falsification Conditions

The foresight simulation is falsified if two or more of the following occur:

No enforcement action or credible investigation by end 2027

SEC filing language remains unchanged across two filing cycles (through 10-K 2027)

Large-scale agent exit occurs without compensation increases (>10% annual churn with flat or declining splits)

Compass valuation multiple expands relative to brokerage peers despite litigation

These conditions provide accountability for the analysis. If falsified, the underlying framework requires revision. These are global falsifiers; failure of any single indicator updates the relevant module (Disclosure/Market/Enforcement) rather than collapsing the full thesis unless two conditions fail.

Section VII executes the Documentation Trap through CDT methodology. The Vision Functions converge on latent liability embedded in existing disclosures. Section VIII extends the framework beyond Compass to the broader industry.

VIII. Industry Template

The Documentation Trap is not unique to Compass. Section VII demonstrates how the same analytical framework applies to any platform that marketed “stickiness” as competitive advantage. Compass is the test case; the template is replicable across proptech and adjacent sectors.

A. The Replicable Playbook

Any platform with SEC filings touting switching costs, retention, or platform lock-in faces potential exposure. The four-step method applies universally:

Identify moat language in SEC filings — Search S-1, 10-K, investor presentations for terms: switching costs, retention, stickiness, network effects, platform lock-in

Map moat features to Lemley’s exit-barrier categories — Apply the translation matrix from Section II

Apply the Portability Test — Does productivity travel with the worker or remain with the platform?

Cite company’s own retention data as evidence of lock-in — Use the three-part diagnostic from Section II

The playbook requires no proprietary information. Public filings provide the complete evidentiary record.

B. Other Exposed Platforms — Exit Barrier Strength Index

Five platforms face potential exposure under the same framework. The Exit Barrier Strength Index scores each platform on the Portability Test criteria: CRM lock-in, data non-portability, information asymmetry, and wage-setting mechanism control.

Zillow Note: Zillow’s exposure is not merely advertising dependency—lead routing control functions as a wage-setting mechanism for agents who rely on the “Housing Super App” for client acquisition. When Zillow controls which agents receive which leads, Zillow effectively sets agent compensation. This is the monopsony mechanism Lemley identifies, operating through a different architectural structure than Compass but producing equivalent labor-market harm.

Different architectures, same labor-market effect. Compass achieves monopsony capacity through platform lock-in; Zillow achieves it through lead-routing control; eXp achieves it through revenue-share dependency. The Portability Test applies across all structures: does the productivity gain travel with the worker, or does it remain with the platform?

Every platform marketing “stickiness” faces potential recharacterization as monopsony capacity once Lemley’s framework gains enforcement traction.

C. The First-Mover Problem

Compass is the test case. If plaintiffs or regulators successfully apply the Documentation Trap framework, others follow. The sequence unfolds predictably:

Compass litigation establishes precedent

Plaintiffs’ bar applies template to next-largest target

Analyst coverage incorporates antitrust contingent liability across sector

Platforms preemptively modify SEC disclosure language (closing the trap for future filings but not past ones)

The window for prophylactic disclosure modification is already closing. Past filings cannot be amended. The evidentiary record exists.

Section VII extends the framework beyond Compass. The template is replicable; the question is which platform faces enforcement next. Section VIII delivers the conclusion.

IX. Conclusion: The Irreversible Claim

The Technology Trap is not a metaphor. Compass’s own words—filed with regulators, repeated to analysts, celebrated in investor presentations—form the evidentiary record for claims Compass must now defend.

The trilogy’s analysis converges on a single structural reality:

Part I Compass–Anywhere, When Scale Becomes Liability showed how litigation generates self-incriminating evidence

Part II How the Compass–Anywhere Merger Reshapes Broker Bargaining Power showed how architectural control creates cognizable labor-market harm

Part III shows why the evidence is already compiled, authenticated, and public—and why the foresight simulation assigns ≥70% probability to major enforcement by end 2027

The trap closed the moment the S-1 was filed. Every subsequent 10-K, every earnings call, every investor presentation tightened the trap. Compass built its valuation on a narrative that documented, in SEC-mandated detail, exactly the exit barriers Lemley’s framework makes actionable. The merger amplified the exposure by extending the same architecture to 340,000 agents who previously had access to portable alternatives.

Once a firm documents exit barriers as competitive advantage, antitrust exposure becomes a balance-sheet variable, not a legal contingency.

For investors: Reprice now. The moat that justified the premium is the liability that compresses it. Waiting for enforcement to materialize means selling into the news. The CDT simulation indicates multiple compression toward 0.75–1.0x revenue absent early settlement—a 50–65% haircut from technology-platform valuations.

For regulators: The case is ready. SEC filings provide authenticated admissions. Discovery is unnecessary because compliance already did the work. Compass is a procedurally efficient enforcement target—attractive not because the theory is novel, but because proof is inexpensive. The 18-month migration window is the incipiency period; acting before migration completes prevents 340,000 agents from losing portability.

For the industry: Scrub your filings. Every platform that marketed “stickiness” as competitive advantage faces the same translation problem. The Documentation Trap is replicable. Peer platforms have 12–24 months before plaintiffs’ counsel applies the same playbook to Zillow, Redfin, eXp, and CoStar.

For Compass: The trilemma has no clean exit. Defending the moat confirms monopsony capacity. Disclaiming exit barriers triggers securities exposure. Settling with conduct remedies erodes the platform advantage that justified the valuation. All paths lead to repricing.

The irreversible claim is not that Compass will lose in court—outcomes depend on judicial interpretation, settlement dynamics, and political context. The irreversible claim is that Compass cannot erase the evidentiary record it created. The Documentation Trap is closed as an evidentiary matter.

The only questions remaining are timing, venue, and price.

Appendix A: Doctrinal Foundation

Primary Framework

Mark A. Lemley, The Implications of Labor Antitrust (2025). Establishes that Section 7 reaches mergers strengthening monopsony power, that barriers to exit—not firm counts—determine labor-market power, and that labor-cost reductions achieved through monopsony are transfers, not efficiencies. Introduces the SSNDW test as the labor-side analog to SSNIP. Key passages: Incipiency standard (pp. 5, 29); Exit barriers (pp. 17–21); Efficiency critique (pp. 26–29); SSNDW test (pp. 15–16); Remedies (pp. 30–33)

Lemley & McCreary, “Exit Strategy” — Emphasizes that acquisitions by dominant platforms can entrench market power and that enforcement should focus on how acquisitions foreclose future competition.

Lemley, “Free the Market: How We Can Save Capitalism from the Capitalists” — Discusses how increased concentration and lax merger enforcement harm workers and consumers.

Regulatory Authority

DOJ & FTC 2023 Merger Guidelines — Guideline 10 (Platforms) and Guideline 11 (Labor Markets) provide regulatory authority to treat platform effects and switching costs as cognizable merger harms.

DOJ Statement of Interest — Davis v. Hanna Holdings, Inc. (December 19, 2025) — Signals DOJ’s aggressive stance on horizontal coordination in real estate; establishes that trade association rules are subject to antitrust scrutiny and may constitute per se violations. Signed by Assistant Attorney General Gail Slater.

FTC Non-Compete Rule — Supports “Technology as Stay-or-Pay” argument by detailing how the FTC views non-contractual barriers as restrictive.

Labor Antitrust Scholarship

Naidu, Posner, Weyl et al. — Labor, Leisure and Law Labor antitrust overviews emphasizing that antitrust historically under-protects labor markets.

Methodological note: Lemley’s framework is designed for Section 7 merger review—prospective analysis of market effects. Applying the framework retrospectively to an already-built platform is an extension. The extension is justified: the platform architecture functions as a continuous merger of labor into a single bargaining counterparty, and Section 7 analysis applies prospectively to its expansion. The January 2026 merger with Anywhere is not merely an acquisition of brands—it is the extension of exit-barrier architecture to 340,000 agents who previously operated on portable, third-party alternatives. That extension is the cognizable merger event.

Appendix B: Key Evidentiary Sources

SEC Filings (Primary Admissions)

Compass S-1 Registration Statement (March 2021) — The foundational admissions document. Describes Compass as “creating the agent support and services platform of the future,” a “cloud-native, mobile, AI-powered platform” that “empowers all agent workflows.” Reports “88%+ of our agent teams used our proprietary technology platform at least once per week” and “principal agent retention rate exceeded 90%. Key sections: “By the Numbers” table, Risk Factors, Competitive Advantages, Technology Platform

S-1/A Amendment — Defines “Net Platform Retention Rate,” explicitly linking recurring revenue to continued use of proprietary platform.

10-K Annual Reports (2021–2025) — Time-series data on retention, platform investment, market share. Describes platform as “an integrated suite of cloud-based software for customer relationship management, marketing, client service, brokerage services and other critical functions.”

Q4 2024/FY 2024 Results — Reports 96.9% principal agent retention and 97.3% quarterly retention.

2025 Annual Report / Proxy — Platform described as allowing agents to “perform their primary workflows… with a single sign-on experience.”

Earnings Calls and Press Releases

FY 2021 Results Press Release — Reffkin: agents join because of “proprietary vertically-integrated technology platform that provides a critical edge.” Reports “industry leading principal agent retention of over 90%” plus cohort study showing top 25% of teams by platform usage retain at 98% annually vs. 86% for bottom 25%.

Q3 2025 Earnings Call Transcript — Management explains AI integration “supercharges the adoption of the Compass platform” and higher usage drives “enhanced agent economics, productivity and retention.”

Quarterly Results / IR Page — Links to letters and presentations highlighting retention alongside platform adoption.

Sample S-1 Language for Translation

Valuation and Analyst Coverage

Compass IPO Executive Summary (Evolve Capital) — Summarizes Compass’s pitch as “a technology company in the real estate space,” discusses Modus acquisition, notes premium valuation relative to legacy brokerages.

Compass Company Profile (DataInsights) — Describes Compass as “agent-first real estate brokerage” with “differentiated technology platform.”

Post-Merger Technology Communications

Merger Completion Press Release (January 9, 2026) — “Compass provides an end-to-end platform that empowers its residential real estate agents… The platform includes an integrated suite of cloud-based software for customer relationship management, marketing, client service, brokerage services, and other critical functionality.”

Transaction Announcement (Anywhere site) — “This transaction pairs Compass’ years of investment in technology, innovative marketing offerings, and real estate professionals with Anywhere’s leading brands, broader and complementary businesses, and global reach.” States intent to bring “approximately 340,000 real estate professionals globally onto a shared network.”

Compass One Launch — “Compass One is the only platform designed to connect you and your agent through every phase of your real estate journey and experience 24/7 transparency before, during, and after the transaction.”

Investor Analysis (Kavout) — “By deploying this technology across Anywhere’s network of 300,000 agents—many of whom currently rely on fragmented third-party tools—Compass has the potential to unlock massive productivity gains.”

Post-Merger Brand Model (Chicago Agent) — “The network will feature brokerage-led sites founded on the principle of ‘your listing, your lead.’”

Platform Overview (Compass recruiting) — “Discover how Compass’s $1.5 billion investment in its all-in-one technology platform empowers agents.”

Appendix C: Pre/Post-Merger Technology Narrative Table

The table below documents Compass’s technology positioning before and after the January 9, 2026 merger with Anywhere Real Estate. Each row demonstrates how the “growth moat” narrative transforms into “unified operating system” positioning—while the underlying architectural features (switching costs, integrated workflows, non-portable data) remain constant. Under Lemley’s framework, each dimension represents a documented exit barrier.

Compass–Anywhere Real Estate Merger | January 9, 2026

Dimension |Pre-Merger Compass Tech Narrative |Post-Merger Compass + Anywhere Tech Narrative

Antitrust Translation: Each dimension in the table represents a documented exit barrier under Lemley’s framework. The “Data & insights” row shows information asymmetry. The “Agent operating system” row shows stay-or-pay architecture. The “Scale & distribution” row shows coordination capture. The post-merger column shows each barrier extending to 340,000 agents who previously had access to portable, third-party alternatives.

Appendix D: Industry Template Sources

Zillow “Housing Super App”

GeekWire — CEO Rich Barton describes “single digital experience that connects all the fragmented pieces of the moving process.”

Mike DelPrete Analysis — Explains Zillow’s move from lead-gen to “housing super app” designed to capture more of the transaction.

RealTrends — Zillow’s super-app vision as “central hub for consumers’ housing journeys.”

Redfin Integrated Model

Notorious R.O.B. — Describes Redfin as “end-to-end, vertically and horizontally integrated brokerage technology system.”

Goodwater Capital — “Understanding Redfin” explains technology-enabled brokerage model and hybrid human-plus-tech approach as moat.

eXp Cloud Brokerage

PESTEL Analysis — History of eXp World Holdings describing “fully cloud-based brokerage model” and virtual world.

Market Data

RealTrends 500 — Brokerage rankings and agent headcount for market share analysis.

Anywhere Real Estate Investor Overview — Traditional brokerage baseline for comparable multiples.

Appendix E: Series Bibliography

Coordination Economics

MCAI Lex Vision: Compass–Anywhere, When Scale Becomes Liability, Modernized Framework of Chicago Law and Behavioral Economics, Anchored in Coordination-Cost Economics (Jan 2026) Provides the high‑level coordination‑cost and modern Chicago‑school antitrust framework within which The Technology Trap is situated, casting the Compass–Anywhere deal as a coordination‑architecture shock rather than a conventional HHI‑based merger. It connects the labor‑antitrust “Documentation Trap” thesis to the broader system narrative of MLS governance, platform routing, and litigation–acquisition strategy, so that the technology‑and‑labor analysis functions as Part III of an integrated merger framework rather than as an isolated case study.

MCAI Lex Vision: From Open Market to Private Governance, Coordination Capture in the Compass–Anywhere Merger, Comment on Senators Warren-Wyden Letter to US DOJ and FTC (Dec 2025) Provides the forward‑looking coordination‑capture analysis that explains why the Compass–Anywhere merger is dangerous even without immediate price effects, modeling how internalized listing visibility and routing convert MLS‐based open coordination into private governance that is extremely hard to unwind once lock‑in thresholds are crossed. It supplies the simulation architecture (coordination metrics, state‑transition model, lock‑in probabilities, and falsification checkpoints) that turns the rest of the Compass/Technology Trap work from doctrinal argument into a CDT‑style, testable foresight environment for regulators and readers.

Labor Antitrust

MCAI Lex Vision: How the Compass–Anywhere Merger Reshapes Broker Bargaining Power, Architectural Monopsony and Lemley’s Labor-Antitrust Framework (Jan 2026) Shows how the Compass–Anywhere merger creates architectural monopsony over broker‑contractors by applying Mark Lemley’s labor‑antitrust framework (SSNDW, exit‑barrier analysis) directly to MLS access, listing visibility, lead routing, and workflow tools. Translates the coordination‑cost story into a labor‑side Section 7 theory of harm, defining the broker labor market, specifying monopsony channels, and generating Lemley‑consistent, testable indicators and remedy designs that The Technology Trap then operationalizes through the “Documentation Trap” and platform‑architecture evidence.

Chicago School Accelerated Series

MCAI Economics Vision: Chicago School Accelerated — The Integrated, Modernized Framework of Chicago Law and Behavioral Economics, Why Coase, Becker, and Posner Form a Single Analytical System (Dec 2025) Defines the integrated Chicago School Accelerated framework—joining Coase (coordination vs. transaction costs), Becker (incentive exploitation), and Posner (efficient liability allocation under behavioral constraints) into a single law‑and‑behavioral‑economics system. Provides the theoretical backbone for treating MLS rules, platform routing, and labor monopsony as coordination‑infrastructure problems and for using Cognitive Digital Twin foresight simulations, which the Compass–Anywhere and Technology Trap pieces then deploy in a concrete merger‑antitrust setting.

Together, these three installments build the Chicago School Accelerated foundation that The Technology Trap and the Compass–Anywhere series rely on, extending the work of Ronald Coase, Gary Becker, and Richard Posner into a single system of law and behavioral economics.

MCAI Economics Vision: The Chicago School Accelerated Part I, Coase and Why Transaction Costs ≠ Coordination Costs, A Foresight Simulation of OpenAI’s Governance Breakdown and the Musk Multi-Entity Portfolio (Dec 2025) The Coase article formalizes coordination costs and coordination-viability metrics.

MCAI Economics Vision: The Chicago School Accelerated Part II, Becker and the Economics of Incentive Exploitation, Incentives After Coordination Collapse: Compass and the Economics of Litigation Driven Market Control (Dec 2025) The Becker article models how incentives push rational actors toward opacity and litigation once coordination fails.

MCAI Economics Vision: The Chicago School Accelerated Part III, Posner and the Economics of Efficient Liability Allocation, Why Behavioral Economics Transforms the Lowest-Cost Avoider Calculus in AI Hallucinations (Dec 2025) The Posner article explains why liability must move upstream in complex, behaviorally constrained environments—tools and concepts later applied directly to multiple listing service governance, platform routing, and labor-side merger risk in the Compass analyses.