MCAI Lex Vision: Compass–Anywhere, When Scale Becomes Liability

Modernized Framework of Chicago Law and Behavioral Economics, Anchored in Coordination-Cost Economics

Companion study to MCAI Lex Vision: How the Compass–Anywhere Merger Reshapes Broker Bargaining Power, Architectural Monopsony and Lemley’s Labor-Antitrust Framework (Jan 2026) (Part II), Compass’s Technology Trap, How IPO Narrative Became Its Antitrust Liability (Jan 2026) (Part III), Washington’s SB 6091 and Private Real Estate Market Control (Jan 2026) (Part IV).

Stockholders of Compass and Anywhere Real Estate voted to approve the largest residential brokerage merger in American history. Compass shareholders delivered 99% approval; Anywhere shareholders turned out 72.4% of outstanding shares in support.

What happens next is not what most observers expect.

The merger passed because regulators did not block it. The Hart-Scott-Rodino waiting period expired without challenge. But expiration is not approval. No federal agency blessed the transaction. They simply ran out the clock—and post-close enforcement authority remains fully intact. DOJ, FTC, state attorneys general, and private plaintiffs can still act. See How Trump Administration Political Access Displaced Antitrust Enforcement—and Why States Should Now Step In (Jan 2026).

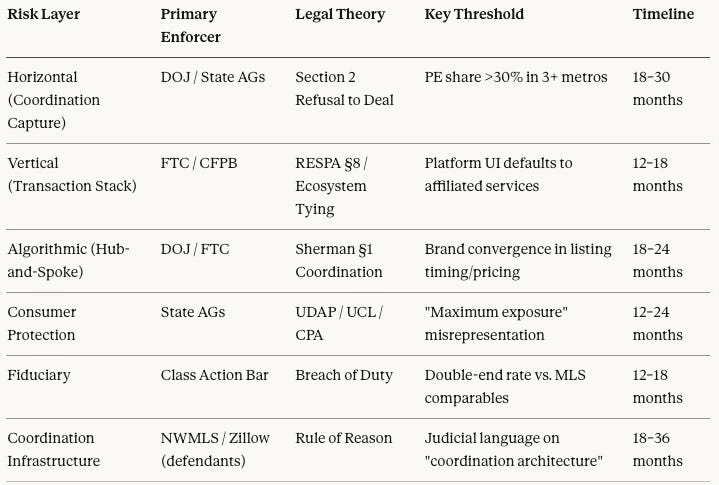

The foresight simulation treats enforcement as more likely than not—and sooner than most observers expect. Under the Hybrid Architecture base case, the model assigns subjective probability bands as follows: formal federal inquiry (CID or investigation) within 24 months: 65–80%; coordinated multistate AG action within 36 months: 55–70%; Private Exclusive class-action filing within 18 months: 45–65%. These risks are correlated rather than independent, so the ‘at least one major action by end of 2027’ estimate is a calibrated band (80–90%), not a simple sum. Threshold triggers—platform default steering, vertical tie-in evidence, and discovery leakage from internal incentive directives—shift these bands upward.

The trigger is not merger size. It is conduct. Compass’s own litigation strategy—suing NWMLS to dismantle coordination rules, suing Zillow to force distribution of off-MLS inventory—has generated a self-created evidentiary record. Pre-merger, those pleadings looked like competitive advocacy. Post-merger, they become exhibits proving exclusionary intent. The arguments Compass made as an insurgent will be cited against Compass as the incumbent. That feedback loop is already closing.

Executive Forecast (2026–2028):

(1) Post-close scrutiny shifts from merger size to conduct evidence created by Compass’s own pleadings. (2) Vertical tie-in and steering in title/escrow/mortgage becomes the fastest enforcement vector. (3) Buyer-side information foreclosure becomes the cleanest Section 2 story in high-share metros. (4) Hybrid Architecture dominates, unless Private Exclusive share breaches tolerance in three or more metros concurrently. (5) The key leading indicator is not price—it is visibility, routing, and default design.

MindCast AI’s Predictive Cognitive AI framework models complex institutional behavior through Cognitive Digital Twins (CDTs)—structured representations of how firms, regulators, platforms, and markets make decisions under constraint. The foresight simulation applies multiple Vision Functions across five actors (Compass, NWMLS, Zillow, regulators, and the industry system), integrating coordination-cost economics, behavioral incentives, and legal response dynamics.

Rather than forecasting outcomes, the model evaluates threshold crossings, feedback loops, and time-sequenced responses by treating litigation records, platform design choices, balance-sheet pressures, and governance rules as causal inputs. Scenarios are weighted qualitatively, not numerically, and predictions are expressed as falsifiable signals observable within defined time windows (12–36 months). The objective is to identify when strategic behavior that is rational at one scale becomes legally and institutionally unstable at another.

Methodology: scenario-weighting and threshold-trigger forecasting across five actors; litigation records, platform design, and incentive constraints are treated as causal inputs.

I. The Coupled System

Most antitrust commentary treats the Compass–Anywhere merger and Compass’s lawsuits against NWMLS and Zillow as separate events. They are not.

Compass is simultaneously litigating against coordination infrastructure, scaling through acquisition, and generating a self-created evidentiary record. Each lawsuit produces pleadings, discovery positions, and governance challenges that document Compass’s strategic intent. Pre-merger, those documents looked like competitive advocacy. Post-merger, they become exhibits in a conduct case.

A feedback loop is now in motion. Litigation generates evidence. Scale amplifies exposure. Regulatory attention follows. The legal mechanism is straightforward: under Federal Rule of Evidence 801(d)(2), statements made by a party in litigation are admissible against that party in subsequent proceedings. Compass’s pleadings from its insurgent phase—arguing that MLS coordination is a restraint, that transparency rules harm competition, that seller choice requires fragmentation—become exhibits in any future conduct case. The arguments Compass made to challenge incumbent rules will be cited to prove exclusionary intent once Compass is the incumbent. The question is not whether the loop closes, but when—and in which metros first.

The simulation runs five actors through MindCast AI’s Vision Function framework: Compass as strategic initiator, NWMLS as coordination infrastructure under stress, Zillow as a platform intermediary caught in the crossfire, regulators as reactive enforcers with lag, and the industry system as emergent outcome. Each actor’s trajectory depends on the others. None can be analyzed in isolation. Coase explains the coordination layer, Becker explains the re-optimization under scale and debt, and Posner explains the lagged institutional correction.

Contact mcai@mindcast-ai.com to partner with us on Law and Behavioral Economics foresight simulations. See recent publications:

MCAI Lex Vision: From Open Market to Private Governance, Coordination Capture in the Compass–Anywhere Merger, Comment on Senators Warren-Wyden Letter to US DOJ and FTC

MCAI Economics Vision: Chicago School Accelerated: Coase and Why Transaction Costs ≠ Coordination Costs for Compass (with five subseries installments on Compass)

MCAI Economics Vision: Chicago School Accelerated, Part II: Becker and the Economics of Incentive Exploitation, Incentives After Coordination Collapse: Compass and the Economics of Litigation Driven Market Control.

II. Compass: The Conduct Amplifier

Compass enters the post-merger period as the largest residential brokerage in America—and the most exposed. The company's litigation strategy, financial structure, and market position have aligned to create a conduct profile that regulators are already watching.

A. Scale and Coordination Capture

Robert Reffkin has been explicit about his goal: 30% market share in 30 markets by 2030. The Anywhere acquisition accelerates that timeline dramatically. In Manhattan, the combined entity may control upwards of 80% of transaction volume in select submarkets. Los Angeles approaches 50%. Seattle, San Francisco, Boston, and Washington, D.C. all exceed the 30% threshold that the 2023 Merger Guidelines treat as presumptively problematic. Exact shares vary by submarket and dataset; the relevant fact is structural—Compass now holds enough volume in multiple metros to shape coordination norms rather than merely participate in them.

Market share is not the binding constraint. The real exposure is coordination capture.

Compass’s litigation theory in the NWMLS case frames mandatory MLS submission as an anticompetitive restraint—a horizontal agreement among competitors that artificially limits seller choice. That argument had coherence when Compass was an insurgent challenging incumbent rules. It loses coherence when Compass controls the infrastructure layer through sheer scale. A company that dominates listing volume cannot credibly claim that transparency rules harm competition. The causal signal breaks down.

The simulation tracks coherence through Causal Signal Integrity, a metric that measures whether an actor’s stated justifications remain internally consistent as conditions change. Pre-merger, Compass’s CSI on MLS-related claims was defensible. Post-merger, it declines. Within twelve to eighteen months, the simulation projects CSI falling below 0.70 in at least one major metro—the threshold at which courts begin questioning whether the plaintiff is seeking competition or seeking control.

B. The Section 2 Exposure

Strategic drift compounds the problem. Compass has committed significant resources to its litigation posture. Institutional momentum pushes toward escalation even as marginal returns decline. The company is likely to continue pressing claims that made sense at smaller scale, generating additional evidence of exclusionary intent that regulators can later cite.

Legal risk sharpens as Private Exclusives scale. At insurgent market share, withholding listings from the MLS is a competitive tactic. At gatekeeper market share, it becomes a potential Section 2 violation. The precedent is Lorain Journal Co. v. United States (1951), where the Supreme Court held that a dominant newspaper could not refuse to deal with businesses that also advertised on a competing radio station. The principle: a monopolist cannot use its power in one market to destroy competition in another. If Compass–Anywhere controls half of Los Angeles listings and withholds them from the shared coordination infrastructure, a court may view that not as seller choice but as an unlawful attempt to destroy the MLS’s viability as a competitive platform. The limiting principle is not “seller choice,” but whether a dominant firm uses control over essential visibility to foreclose rival buyer representation and degrade a shared competitive platform.

C. Buyer-Side Harm

The harm extends beyond sellers. If half the inventory in a major metro is invisible to rival buyer agents, those agents cannot effectively serve their clients. They face an information asymmetry that functions as a barrier to entry. A buyer working with a non-Compass agent in Los Angeles would see only half the market—a structural disadvantage that compounds with each Private Exclusive listing. Control over essential information becomes control over market access. Washington and other states framed the Zillow–Redfin rental deal as a bottleneck that cemented dominance in online rental advertising—an enforcement posture that maps cleanly onto buyer-side visibility foreclosure in residential sales.

D. The Privacy Defense and Its Limits

Compass will defend Private Exclusives on privacy grounds—high-net-worth sellers in Manhattan and Los Angeles prefer discretion, the argument goes, and forcing MLS disclosure compromises their security. Regulators are unlikely to credit this defense at scale. Courts credit privacy justifications when they are narrowly tailored and not materially more restrictive than necessary to protect the interest asserted. In 2024–2025 tech enforcement, the FTC began distinguishing between genuine privacy (protecting the person) and strategic opacity (protecting data to extract economic advantage). A privacy-preserving disclosure regime—showing that a property exists and its general characteristics without revealing the owner’s identity—would satisfy legitimate seller concerns while maintaining market visibility. If Compass resists such middle-ground solutions, the “privacy” defense looks pretextual: the real objective is double-end capture, not client protection.

E. Financial Forcing Functions

Financial structure reinforces strategic drift. Compass priced $850 million in 0.25% convertible notes due 2031 on January 8, 2026, to manage Anywhere’s debt load. The offering is expected to close on or about January 9, 2026. High debt service requirements act as a behavioral forcing function. The Becker framework predicts that rational actors re-optimize when payoff structures change—and Compass’s payoff structure now demands margin extraction at scale. If organic market growth does not materialize, the company must either squeeze agent splits or accelerate Private Exclusive capture to earn both sides of commissions on in-house transactions.

The real liability is not split compression itself—it is the internal communications that split compression generates. If a firm with 40% market share pressures agents—explicitly or implicitly—to push integrated title services and keep listings in-house to meet balance-sheet targets, those emails become discovery gold. Top producers who feel squeezed are the most likely sources of the specific intent evidence that Section 2 cases require. The feedback loop accelerates when internal dissent meets external regulatory interest: disaffected agents provide the documents, regulators provide the subpoenas. Coordination degradation becomes not merely a strategic choice but a financial necessity under stress.

The macro trigger matters. If housing turnover remains depressed—mortgage rates above 6%, transaction volume 30% or more below 2019 baseline—Compass cannot grow into its debt organically. The Becker re-optimization toward Private Exclusive capture becomes not just rational but required. The simulation’s Coordination Collapse scenario becomes more probable when debt covenants interact with slowing transaction volume. Watch the NAR existing-home-sales data: if turnover stays below ~4 million annualized for multiple quarters, the forcing function strengthens.

F. Conduct Remedy Probability

The simulation predicts increased probability of an adverse conduct remedy—data firewalls, access mandates, or nondiscrimination requirements—within eighteen to thirty months. The signal to watch is whether Compass continues escalating litigation despite declining coordination metrics. If it does, the liability window narrows faster.

III. NWMLS: Infrastructure, Not Cartel

Northwest MLS sits at the center of Compass’s litigation strategy and, not coincidentally, at the center of post-merger risk.

Compass sued NWMLS in April 2025, challenging rules that restrict pre-marketing of listings and require timely submission to the shared database. The lawsuit frames these rules as restraints on trade. The Coasean reality is different. Mandatory submission is coordination architecture. It solves a collective action problem that markets cannot solve on their own.

Without a shared visibility layer, buyers face fragmented search. Sellers face fragmented exposure. Agents face fragmented matching. Transaction costs rise. Information asymmetries widen. The market does not become more competitive—it becomes more opaque, with advantages flowing to whoever controls the largest private inventory.

The simulation’s Integrity Vision indicates that NWMLS rules remain internally coherent. They apply uniformly across members. They serve a coordination function that reduces aggregate transaction costs. The risk to NWMLS is not that its rules are indefensible, but that a scaled challenger can reframe governance as exclusionary rulemaking through sheer litigation pressure.

Courts are more likely to narrow MLS rules than to invalidate them. The judicial instinct when a dominant player challenges shared infrastructure is to preserve the infrastructure while adjusting at the margins. Burnett v. National Association of Realtors (2024) struck down mandatory commission sharing but left the MLS coordination function intact—indeed, the settlement presupposed that MLSs would continue operating as shared visibility platforms. Courts apply the Rule of Reason to horizontal restraints like mandatory listing submission, weighing procompetitive benefits against anticompetitive harms. Pre-merger, Compass could argue the balance favored fragmentation. Post-merger, the calculus inverts: if the dominant firm is the one avoiding transparency, the MLS’s rules look less like incumbent protection and more like a necessary safeguard for smaller competitors and consumers.

Expect regulators to pressure MLSs toward explicit nondiscrimination and data-portability safeguards—not because the rules were wrong, but because political economy demands visible response to visible challenge.

The signal to watch is judicial language. If courts begin distinguishing between MLSs as “coordination infrastructure” versus MLSs as “trade associations,” the legal framework is shifting in NWMLS’s favor. That distinction matters enormously for remedy design.

IV. Zillow: Collateral Damage

Zillow did not seek this fight. But Compass's lawsuit demanding forced distribution of Private Exclusives has made the portal a central venue for post-merger conflict—and a potential catalyst for legislative intervention.

A. The Structural Irony

Zillow finds itself in an uncomfortable position. Compass sued the company in June 2025 over its decision to ban private listings from its platform. The lawsuit demands that Zillow distribute inventory that bypassed MLS routing—effectively forcing a portal to participate in coordination degradation.

The irony is structural. Compass attacks MLS transparency rules in one venue while demanding portal distribution in another. Pre-merger, this asymmetry was awkward but manageable. Post-merger, it becomes a liability. Courts and regulators will ask why a company that controls potentially half the listings in major metros needs forced access to a competitor’s distribution infrastructure.

The precedent cuts against Compass. In REX v. Zillow (9th Cir., decided March 3, 2025), the court held that Zillow’s decision to segregate non-MLS listings was a unilateral business choice, not a conspiracy with NAR. Zillow could design its platform as it saw fit. Compass’s lawsuit seeks to override that holding by judicial mandate—forcing Zillow to commingle private listings with MLS inventory. Post-merger, this looks less like a competitive challenge and more like a dominant firm using litigation to extract preferential treatment. Section 2 enforcers treat that pattern as a red flag.

B. Secondary Exposure

Zillow is not the primary target of post-merger scrutiny, but it is exposed to secondary effects. The simulation projects regulatory inquiry within eighteen to twenty-four months—not for Zillow’s standalone conduct, but as a conduit for disputes it did not initiate. Remedies in the Compass litigation could impose disclosure timing changes or distribution mandates that reshape portal economics.

The deeper risk is that remedies sought by Compass, if granted, institutionalize opacity at the platform layer. Forcing portals to display off-MLS inventory without corresponding transparency requirements raises consumer search costs and fragments market information—the opposite of what antitrust enforcement is supposed to achieve.

C. The Legislative Black Swan

A legislative path may prove faster than litigation. If Zillow perceives the Compass–Anywhere transaction stack as an existential threat to portal dominance, it will not only litigate—it will lobby. Legislation can reset default listing visibility rules in months, while antitrust litigation typically takes years. State-level “open listing” mandates, modeled on New York’s recent transparency bills, could reframe listing portability as a consumer right. If Zillow succeeds in that framing, Compass’s Private Exclusive moat evaporates via legislation before the courts rule. Watch for Zillow-backed consumer advocacy around “listing transparency” in California, Washington, and New York during the 2026 legislative sessions.

V. The Transaction Stack

The analysis thus far treats Compass as a brokerage. That framing is incomplete. Post-merger, Compass controls a vertically integrated transaction stack spanning listing, title, escrow, mortgage referral, and closing—creating enforcement exposure that horizontal antitrust theory alone does not capture.

A. Vertical Integration

The analysis thus far treats Compass as a brokerage. Post-merger, it is a transaction stack.

Anywhere brings more than agents and brands. It brings over $1 billion in annual revenue from title insurance, escrow services, and relocation management. The combined entity can now touch every stage of a residential transaction: listing, marketing, buyer matching, mortgage referral, title, escrow, and closing. Horizontal consolidation is only part of the story. Vertical integration across the home-buying journey is the rest.

The 2023 Merger Guidelines address this directly. Guideline 5 concerns whether a merger may limit access to products or services that rivals need to compete. Guideline 6 concerns entrenchment—whether a merger extends or entrenches a dominant position by making entry or expansion harder. Both apply here. Post-merger, the same litigation record that frames MLS rules as unlawful coordination can also be re-read as a blueprint for steering volume into a vertically integrated stack.

B. Ecosystem Tying and Fiduciary Breach

The conduct risk is ecosystem tying. If Compass uses its platform to “default” or “nudge” consumers toward integrated title and escrow services—leveraging listing control to capture downstream revenue—it creates a vertical foreclosure case distinct from the horizontal coordination problem. A seller who lists with Compass may find the path of least resistance leads through Compass title, Compass escrow, Compass mortgage referral. The integrated tech platform makes this frictionless for consumers who don’t know to ask for alternatives, and costly for those who do.

The fiduciary dimension sharpens the harm theory. When a brokerage holds listings off the MLS to capture the buyer side of the transaction—double-ending the commission—it arguably prioritizes firm profit over client exposure. Sellers have a fiduciary expectation that their agent will maximize market reach. Private Exclusives at scale invert that duty: the listing is held back precisely to increase the probability of an in-house match. State attorneys general and the FTC treat cases where antitrust harm overlaps with consumer protection harm as high-value enforcement targets. Coordination fragmentation plus fiduciary breach is a more compelling narrative than either alone.

C. RESPA and the Faster Enforcement Path

Horizontal conduct remedies (data access, nondiscrimination in listings) do not address vertical tying. The FTC would need to examine platform design—how the Compass interface presents service options, what defaults are set, how rivals’ services are disclosed. But the FTC is not the only regulator with jurisdiction. The Consumer Financial Protection Bureau enforces Section 8 of RESPA, which prohibits kickbacks and unearned fees for referrals to settlement services. If platform nudges toward integrated title and mortgage services cross the line from convenience into coerced bundling, RESPA exposure activates. RESPA investigations can present a faster enforcement path than full antitrust litigation, especially when regulators focus on referral practices and settlement-service disclosures. Coase explains why shared visibility lowers total search costs; Becker explains why a levered platform rationally shifts toward capture; Posner explains why agencies respond with conduct remedies once the record exists.

D. The Efficiency Defense

Compass will defend on efficiency grounds. The integrated platform reduces consumer friction, the argument goes. One interface for listing, transaction management, title, escrow, and closing lowers the total cost of moving. Proprietary matching algorithms improve buyer-seller pairing in ways legacy MLS technology cannot. Courts applying the Rule of Reason will weigh these purported efficiencies against coordination harms and vertical foreclosure risks. The simulation does not predict that efficiency arguments fail—only that they must overcome substantial doctrinal headwinds and a political environment where housing affordability is salient. Merger-specific efficiencies that benefit consumers are credited; efficiencies that primarily enhance bargaining leverage against rivals are not.

E. Algorithmic Hub-and-Spoke Risk

A deeper algorithmic risk exists. If Anywhere’s brands—Century 21, Coldwell Banker, Sotheby’s, Corcoran—migrate to the Compass platform, they will share a common software engine for listing timing, pricing suggestions, and Private Exclusive routing. The brands remain nominally independent, but the algorithm coordinates their inventory flow. Following the RealPage and Greystar litigations of 2024–2025, regulators are acutely focused on hub-and-spoke coordination facilitated by software. The theory: even absent explicit agreement, a shared algorithm that manages when listings go public, which buyers see them first, and how pricing is suggested can function as a coordination mechanism. If the Compass platform operates as the hub through which competitor brands route decisions, the algorithmic cartel theory activates—regardless of whether any human explicitly agreed to coordinate. Signal: convergence in listing-timing patterns and Private Exclusive dwell-time across formerly independent brands after platform migration—especially if paired with uniform pricing recommendations surfaced through a shared interface.

The simulation projects elevated probability of FTC or CFPB inquiry into vertical tie-in practices within eighteen months, particularly if consumer complaints accumulate about steering toward integrated services or if RESPA referral-fee structures come under scrutiny.

VI. Regulators: The Lag and the Signal

Federal enforcers let the merger close. That decision reflects resource constraints and procedural timelines, not approval. Post-close enforcement authority remains intact, and DOJ has already signaled heightened scrutiny of coordination-layer conduct in real estate markets.

A. Post-Close Enforcement Authority

Federal antitrust enforcers allowed the merger to close. That does not mean they are done.

The Hart-Scott-Rodino process is a screening mechanism, not a verdict. Agencies review thousands of transactions annually with limited resources. Many close without challenge not because they are procompetitive, but because immediate concentration harm is difficult to prove in fragmented, locally-defined markets. Real estate brokerage is exactly that kind of market—national in brand, local in competition.

Post-close enforcement operates on a different timeline. Agencies can monitor, issue civil investigative demands, coordinate with state attorneys general, and pursue conduct remedies as evidence accumulates. The Warren-Wyden letter of December 17, 2025 already elevated this merger to the federal agenda. DOJ and FTC are watching.

The simulation tracks Regulatory Salience Threshold—the point at which political attention and evidentiary accumulation force agency response. That threshold is crossed. The question now is enforcement lag: how quickly agencies translate attention into action.

B. The DOJ Signal

DOJ has already signaled its doctrinal direction. On December 19, 2025, the Antitrust Division filed a Statement of Interest in Davis v. Hanna Holdings, a homebuyer commission lawsuit in the Eastern District of Pennsylvania. The filing, signed by Assistant Attorney General Gail Slater, argued the court should not apply a heightened standard to plead concerted action or per se violations based on association rules—regardless of form—and emphasized that horizontal price fixing cannot evade per se treatment merely by operating through rules that don’t state a specific price. A potential Compass defense is foreclosed: that challenging or following trade association practices insulates the company from antitrust scrutiny. DOJ is building the doctrinal foundation to treat coordination-layer conduct with heightened skepticism. The evidentiary loop tightens: Compass’s own pleadings arguing that MLS rules constitute unlawful coordination become more damaging when DOJ has indicated it views such coordination as potentially actionable without elaborate rule-of-reason balancing.

C. Political Economy

Institutional Cognitive Plasticity indicates that agencies adapt faster when political signals are present. Warren and Wyden are not marginal figures. Their letter explicitly frames the merger as a threat to housing affordability and market access. Housing is a populist issue with bipartisan resonance. DOJ has demonstrated continued interest in real estate commission practices through the Davis statement of interest.

The simulation projects civil investigative demands within twelve to twenty-four months, triggered by conduct evidence rather than size. Within twenty-four to thirty-six months, probability of coordinated state attorney general action exceeds sixty percent.

VII. The State AG Coalition

State attorneys general have emerged as the most aggressive antitrust enforcers in housing markets. The RealPage litigation established the template: bipartisan coalitions, housing affordability framing, and willingness to move faster than federal agencies.

A. Coalition Leaders

State attorneys general have become aggressive antitrust enforcers, particularly in housing markets. The RealPage algorithmic pricing litigation established the template: bipartisan coalitions targeting conduct that raises housing costs.

Three states stand out as likely coalition leaders.

Washington has the most direct exposure. NWMLS is headquartered in Kirkland. Compass’s Private Exclusives blitz in Seattle during March 2025 generated local controversy and documented evidence of coordinated rule-breaking. The Washington Attorney General’s office, now led by Nick Brown, maintains the third-largest state antitrust division in the country—fifteen attorneys, behind only California and New York. Former AG Bob Ferguson built that capacity over twelve years before becoming governor. The institutional infrastructure for aggressive enforcement exists and is staffed.

California has the largest antitrust division and the highest concentration exposure. Los Angeles approaches 50% combined market share. San Francisco and the Bay Area exceed 30%. Attorney General Rob Bonta has made antitrust enforcement a signature priority, with pending legislation to increase Cartwright Act penalties and active litigation against RealPage. California also has direct consumer protection jurisdiction over real estate practices.

New York has already demonstrated willingness to act. Attorney General Letitia James filed suit against Zillow and Redfin in 2025 over alleged anticompetitive agreements in multifamily rental advertising. Manhattan and Long Island represent enormous Compass/Anywhere concentration. The political economy of New York housing makes enforcement attractive.

B. Secondary States

Oregon and Massachusetts carry political weight beyond their market size. Wyden and Warren authored the letter urging federal scrutiny. Their home-state attorneys general face implicit pressure to follow through. Portland and Boston both exceed coordination thresholds.

Texas is the wild card. Attorney General Ken Paxton has pursued aggressive antitrust enforcement, primarily in ESG-related cases, but the framework applies. Dallas-Fort Worth represents roughly one-third of top-twenty brokerage volume post-merger. Houston and Austin both exceed 30% thresholds. Texas antitrust penalties are significant, and Paxton has shown willingness to lead multistate coalitions on issues aligned with his priorities.

C. Coalition Formation

The coalition formation trigger is typically a federal signal—a statement of interest, a civil investigative demand, or a public enforcement priority announcement. Once that signal arrives, states coordinate through the National Association of Attorneys General’s Multistate Antitrust Task Force. The infrastructure for rapid coalition assembly exists and has been used recently in RealPage, generic drug, and technology platform cases.

D. The UDAP Bypass

State AGs may also bypass the antitrust path entirely. Unfair or Deceptive Acts and Practices (UDAP) statutes—California’s UCL, Washington’s CPA—do not require complex market definition. The theory is simpler: sellers are promised “maximum exposure” while the brokerage systematically withholds inventory to increase double-end probability. That is a deceptive practice claim, not an antitrust claim. UDAP litigation moves faster, requires less economic modeling, and carries significant statutory penalties. AG Bonta and AG Brown both have strong consumer protection divisions with UDAP experience. If the antitrust path looks slow or contested, expect state enforcers to open a second front on consumer protection grounds.

Prediction: first multistate action within twenty-four to thirty-six months, led by California, New York, or Washington, with a coalition of five to ten states.

VIII. The Class Action Accelerant

Regulators move on institutional timelines. The plaintiffs' bar does not. The same attorneys who reshaped real estate commission economics through Burnett are now watching Compass—and the Private Exclusive class theory writes itself.

A. The Burnett Playbook

Regulators move slowly. The class action bar does not.

The Sitzer/Burnett litigation reshaped real estate commission economics before DOJ filed a single enforcement action. A Missouri jury verdict, followed by cascading settlements totaling over $700 million from NAR and major brokerages, rewrote industry practice through private litigation. The plaintiffs’ attorneys who built that case—primarily Ketchmark & McCreight and Cohen Milstein—have demonstrated they can identify coordination failures, frame them as consumer harm, and extract industry-restructuring settlements.

Those attorneys are watching Compass.

B. The Private Exclusive Class Theory

The class action theory writes itself. Sellers engage brokerages with a reasonable expectation of maximum market exposure. Private Exclusives systematically withhold listings to increase double-end probability—prioritizing brokerage profit over client outcomes. In high-share metros, sellers using Compass may have received materially less exposure than sellers using brokerages that submit to the MLS, resulting in longer days-on-market, lower sale prices, or both.

The damages model is straightforward: compare transaction outcomes for Private Exclusive listings against MLS-listed comparable properties in the same submarket. If Private Exclusives systematically underperform on price or time-to-sale, the delta is the damages base. Exposed transactions number in the tens of thousands across Compass’s high-share metros.

C. Procedural Advantages

Private plaintiffs have procedural advantages regulators lack. Class certification requires only numerosity, commonality, typicality, and adequacy—not the complex market definition that antitrust cases demand. A breach-of-fiduciary-duty theory sidesteps antitrust standing requirements entirely. State consumer protection statutes (California’s UCL, New York’s GBL § 349) provide statutory damages, fee-shifting, and sometimes trebling—creating settlement pressure that regulatory enforcement cannot match.

Discovery is the accelerant. A class action complaint triggers document preservation obligations and opens the door to internal communications about Private Exclusive strategy, agent compensation tied to in-house transactions, and platform design decisions. The “discovery gold” discussed in Section II becomes accessible to private plaintiffs, not just regulators. Disaffected agents who feel squeezed can serve as named plaintiffs or opt-in class members, providing both standing and insider evidence.

D. Timeline and Interaction Effects

The simulation projects meaningful probability of a Private Exclusive class action filing within twelve to eighteen months—faster than federal regulatory action, potentially contemporaneous with state AG inquiries. The first complaints will likely target high-share metros (Los Angeles, Manhattan, Seattle) where damages are largest and class numerosity is clearest.

Interaction effects matter. A class action complaint creates public evidentiary record that regulators can cite. A regulatory investigation provides credibility for class certification motions. State AG UDAP actions and private consumer protection claims can proceed in parallel, creating multi-front litigation pressure that accelerates settlement dynamics.

The Burnett plaintiffs’ bar proved it can move an industry. Private Exclusive foreclosure is a natural successor theory—same basic claim (brokerage self-dealing at consumer expense), same procedural pathway, same defendants with deep pockets and reputational sensitivity. Expect the first complaint within eighteen months of this publication.

IX. Industry Trajectory: Three Paths

The simulation models three macro-scenarios for industry structure through 2028. Probability weights depend on Private Exclusive proliferation rates, enforcement timing, and whether Compass adapts before regulators force the issue.

A. Hybrid Architecture (55–60% Probability)

The most likely path is Hybrid Architecture. Under this scenario, MLS systems survive but with weakened focal-point integrity. Private Exclusive share stabilizes between 15% and 30% nationally, higher in Compass-dominated metros. Coordination degrades but does not collapse. Regulators impose conduct remedies that limit the worst excesses without restructuring the market. Consumers face higher search costs and reduced visibility, but the basic infrastructure of shared listings persists.

B. Coordination Collapse (20–25% Probability)

The tail risk is Coordination Collapse, concentrated in select metros. Under this scenario, Private Exclusive proliferation exceeds tolerance thresholds. MLS participation becomes optional in practice even where mandatory in rule. The market fragments into competing private networks with limited interoperability. Search costs rise sharply. Information asymmetries widen. Smaller brokerages lose access to inventory. Consumers cannot reliably discover what is for sale without engaging multiple platforms and agents. Regulators intervene aggressively but after significant damage.

C. MLS Stability (Remaining Probability)

The stabilization scenario carries the remaining probability weight. Under this scenario, courts reaffirm MLS coordination architecture as procompetitive. Compass loses leverage in NWMLS and Zillow litigation. Merger scale becomes a net negative in litigation optics. Private Exclusive share remains below coordination tolerance. The industry returns to something resembling pre-2024 structure with incremental technology improvements.

D. Why Hybrid Architecture Dominates

The simulation assigns highest probability to Hybrid Architecture because it requires the least behavioral change from any actor. Compass continues its current strategy at reduced intensity. Regulators impose conduct remedies that satisfy political demands without restructuring markets. MLSs adapt governance to accommodate new realities. No actor fully wins or loses. The market muddles through with degraded but functional coordination.

The signal that would shift probability toward Coordination Collapse is sustained Private Exclusive share above coordination tolerance thresholds in multiple major metros simultaneously. If Seattle, Los Angeles, and New York all cross tolerance within twelve months, the industry structure question becomes urgent.

X. What to Watch

Seven falsifiable predictions anchor this simulation.

First, Compass’s causal signal integrity on MLS-related claims falls below 0.70 in at least one major metro within twelve to eighteen months. The indicator is judicial language questioning Compass’s standing to challenge transparency rules while controlling dominant market share. Falsification: court accepts Compass’s causal theory at trial without reservation.

Second, federal regulators issue a civil investigative demand or open formal investigation within twelve to twenty-four months, triggered by conduct evidence rather than merger size. Falsification: no formal inquiry initiated; monitoring continues without escalation.

Third, probability of coordinated state attorney general action exceeds 60% within twenty-four to thirty-six months. The indicator is multistate investigation announcement or coordinated litigation filing. Falsification: only isolated state actions; no coalition formation.

Fourth, Hybrid Architecture dominates industry structure through 2028, with Private Exclusive share stabilizing between 15% and 30% nationally. Falsification: MLS share returns above 90%, indicating stabilization scenario; or MLS share falls below 70%, indicating collapse scenario.

Fifth, enforcement action targets at least three high-share metros within thirty-six months, with conduct remedies imposed or negotiated. Falsification: no metro-specific enforcement; only national-level action or no action.

Sixth, Compass litigation posture shifts toward settlement or narrowing within eighteen to thirty months as conduct exposure increases. The indicator is dismissal, voluntary narrowing of claims, or negotiated resolution in NWMLS or Zillow cases. Falsification: continued escalation with favorable rulings.

Seventh, FTC or CFPB opens inquiry into vertical tie-in or RESPA Section 8 compliance within eighteen months. The indicator is a civil investigative demand or public investigation announcement concerning whether the Compass platform steers consumers toward integrated title, escrow, or mortgage services—or whether referral structures constitute prohibited kickbacks under RESPA. Trigger event: platform UI defaults that pre-select affiliated settlement providers, or compensation structures that tie agent benefits to affiliated services uptake. The smoking-gun indicator is algorithmic convergence: when pricing suggestions and Private Exclusive dwell-time become uniform across Anywhere’s formerly independent brands—a Coldwell Banker listing and a Sotheby’s listing behaving identically because they share the Compass software engine. Falsification: no vertical conduct or RESPA inquiry; enforcement remains focused on horizontal listing practices.

Leading Indicator (Talent Flight): Net agent retention turns negative among top 5% producers in metros where Compass exceeds 40% share. Compass is not a monolithic corporation—it is a platform hosting independent contractors who carry their own reputational risk. If regulatory heat intensifies, top-producing agents may calculate that association with steering or fiduciary-breach narratives damages their local brand. If elite agents begin decoupling to neutral boutiques, the merger’s scale advantage erodes from within. Platform gravity depends on talent density; talent flees reputational contagion.

XI. The Narrowing Window

The Compass–Anywhere strategy is viable only within a narrowing window.

Scale creates gravity. It intensifies incentives, amplifies coordination capture risk, and attracts regulatory attention. The merger does not create a legal monopoly—concentration in fragmented local markets rarely does—but it creates conditions under which conduct that looked competitive becomes conduct that looks exclusionary.

The litigation-acquisition feedback loop closes when evidence generated by pre-merger advocacy becomes probative of post-merger intent. That transition is underway. The evidentiary record exists. The political attention exists. The state attorney general capacity exists. The question is timing, not whether.

Efficient markets require not only low transaction costs but robust coordination architecture. The merger increases gravitational pull without strengthening shared infrastructure. That asymmetry defines the post-close risk surface.

Compass can still adjust. Adaptive restraint—moderating litigation intensity, accommodating MLS governance, limiting Private Exclusive proliferation—would extend the viability window and reduce conduct exposure. The simulation does not predict whether Compass will adapt, only that the cost of not adapting increases with each month of continued escalation.

The pivot has its own costs. Compass’s equity narrative depends on platform differentiation—the “moat” that justifies premium valuation multiples. Private Exclusives are central to that story: proprietary inventory flow that competitors cannot replicate. An open-data posture or early settlement with NWMLS would be rational risk management but would likely compress the stock. Reffkin faces a classic founder’s dilemma: the strategy that built the company may not be the strategy that sustains it at scale. Whether he has the institutional cognitive plasticity to pivot before regulators force the issue remains the key uncertainty in this simulation.

Without adaptation, the simulation projects a shift from litigation leverage to regulatory constraint within the 2026–2028 horizon.

XII. Implications by Stakeholder

Foresight without action is commentary. The simulation identifies risks; what follows is guidance on what different actors should do with that information—whether hedging exposure, preparing for discovery, lobbying for legislative intervention, or simply asking better questions before signing a listing agreement.

For Compass Investors: The equity narrative depends on platform differentiation. If enforcement actions or settlements require open-data concessions, the “moat” thesis compresses. Hedge exposure to conduct-remedy risk. Watch for CID disclosures in SEC filings and monitor agent retention in high-share metros as a leading indicator of narrative stress.

For Compass Leadership: The window for adaptive restraint is narrowing. Settling NWMLS before a CID lands preserves optionality. Continuing escalation generates additional exhibits. The cost of pivoting now is stock price pressure; the cost of pivoting later is court-mandated remedies with no negotiating leverage.

For Competing Brokerages: Document everything. If Compass Private Exclusives affect your agents’ ability to serve buyers, that documentation becomes evidence in multistate actions or class litigation. Coordinate with state REALTOR associations on MLS governance—regulators will look for industry voices defending coordination architecture.

For MLS Executives: Expect pressure from both directions: Compass litigation challenging your rules, and regulators demanding you prove those rules are procompetitive. Prepare Rule of Reason defenses now. Develop privacy-preserving disclosure alternatives that neutralize the “seller choice” argument. The distinction between “coordination infrastructure” and “trade association” will determine remedy design.

For State AG Offices: The enforcement surface is wide. UDAP claims (deceptive “maximum exposure” promises) move faster than antitrust and skip market-definition fights. California, Washington, and New York have the capacity and the political incentive. The federal signal (Davis statement of interest) has already landed—coalition formation infrastructure is ready.

For Plaintiffs’ Attorneys: The class theory is straightforward: sellers expected maximum exposure, received systematic withholding, suffered price or time-to-sale harm. Damages model compares Private Exclusive outcomes against MLS-listed comparables. Discovery opens internal communications about double-end incentives and platform steering. First-mover advantage in lead plaintiff recruitment is significant.

For Zillow: Litigation is one path; legislation is faster. State-level “open listing” mandates framed as consumer rights could eliminate Private Exclusive inventory advantages without waiting for courts. The 2026 legislative sessions in California, Washington, and New York are the venue. Consumer advocacy groups are potential allies.

For Home Sellers and Buyers: Ask your agent directly: will this listing go on the MLS within 24 hours? If not, why not—and who benefits from the delay? In high-share metros, Private Exclusive status may mean your home reaches fewer buyers or your search misses available inventory. Transparency is a reasonable expectation.

Appendix: Sources and Materials from Dec 2025

Senators Warren, Wyden Push DOJ, FTC to Closely Scrutinize Massive Compass–Anywhere Real Estate Merger, Raise Alarm on Housing Costs. Serves as the central political signal in the memo, urging DOJ and FTC to scrutinize the Compass–Anywhere merger for effects on housing costs, competition, and listing access. Echoes the coordination risks identified in your series: concentration of listing control, potential fee preservation, and reduced transparency for consumers and rivals. The memo uses this letter to demonstrate that coordination-capture concerns are already influencing the federal enforcement agenda.

MCAI Lex Vision: From Open Market to Private Governance, Coordination Capture in the Compass–Anywhere Merger, Comment on Senators Warren-Wyden Letter to US DOJ and FTC. Interprets the Warren–Wyden letter and related political reactions as evidence of a shift from purely structural antitrust concerns to worries about coordination capture, access, and transparency. Translates the senators’ consumer-facing language about housing costs and competition into structural claims about MLS/portal access and private governance of coordination. The memo’s “Political signal” subsection and its linkage between political concern and agency behavior are grounded in this analysis. It supports the memo’s argument that the merger is already on the federal agenda as a coordination-risk case, not merely a volume/price case.

MCAI Economics Vision: Chicago School Accelerated — The Integrated, Modernized Framework of Chicago Law and Behavioral Economics. Why Coase, Becker, and Posner Form a Single Analytical System. The Chicago School Accelerated flagship is the theoretical spine behind the Compass–Anywhere merger memo. It integrates Coase, Becker, and Posner into a single framework that treats coordination capacity, incentive exploitation, and institutional learning as linked state variables. That framework is exactly what the merger memo applies to real estate: coordination capture at the MLS/portal layer (Coase), Compass’s rational shift toward opacity and routing control (Becker), and enforcement lag in DOJ/FTC and state AG responses (Posner). Citing the flagship makes clear that the memo’s predictions are outputs of a declared, testable system rather than standalone conjecture.

MCAI Economics Vision: Chicago School Accelerated, Part I: Coase and Why Transaction Costs ≠ Coordination Costs, . Defines the core distinction between transaction costs and coordination costs, and introduces the extended Coase formula: efficient outcomes require low transaction costs, adequate institutional throughput, and robust coordination architecture. It supplies the theoretical backbone for treating MLS visibility and listing rules as coordination infrastructure rather than cartel behavior. The memo’s “coordination capture” thesis and its emphasis on MLS/portal access asymmetry come directly from this framework. It also provides coordination metrics (CSS, CAI, CVI) that the memo cites as observable indicators of post-merger risk.

Coase Subseries Part I How Private Exclusives Reshape Competition and Threaten MLS Stability. Applies the coordination-cost lens to residential real estate, explaining how MLS systems solve coordination problems (focal points, trust, shared narrative) and how Private Exclusives fragment those mechanisms. Develops three macro-scenarios through 2030—Coordination Collapse, MLS Stability, Hybrid Architecture—with probabilities, which the memo references in discussing industry-wide impacts and “Hybrid Architecture” as the most likely path. The memo’s claims about search friction, fragmented visibility, and metro-level hotspot risk are grounded in this analysis. It also anchors the use of CSS and CVI to identify local markets that are likely targets for post-merger scrutiny.

Coase Subseries Part II The Litigation–Acquisition Monopolization Strategy. Provides the primary structural analysis of the Compass–Anywhere transaction, arguing that the dominant risk is not classic HHI-based monopoly but a coordination architecture shock when litigation and acquisition are combined. Shows how Compass’s lawsuits against NWMLS and Zillow, alongside the merger, function as a unified strategy to reshape coordination rules while consolidating bargaining power. The memo’s “merger as conduct amplifier,” “litigation–acquisition feedback loop,” and “gatekeeper, not monopoly” framing come directly from this publication. It also informs the memo’s assessment of why regulators let closing proceed yet are likely to intensify post-consummation conduct enforcement.

Coase Subseries Part III Coordination Costs, MLS Governance and the Compass Litigation. Focuses on MLS governance and the Compass v. NWMLS litigation, recasting mandatory submission and transparency rules as coordination architecture rather than horizontal restraints. Provides the detailed analysis underlying the memo’s discussion of how the merger affects Compass’s posture in NWMLS-related disputes, including loss of “insurgent” status and heightened gatekeeper optics. Supplies the remedy toolkit—nondiscrimination, data portability, governance constraints—that the memo cites as likely forms of conduct relief. It also functions as the memo’s main case study for NWMLS, grounding bargaining-leverage and remedy design in specific pleadings and governance facts.

Coase Subseries Part IV Platform Routing, Portal Power, and the Zillow Litigation. Analyzes Compass’s lawsuit against Zillow through the coordination-cost lens, framing the dispute as competition between two scaled system-actors: a portal/platform and a super-brokerage/platform. Highlights the structural inconsistency in Compass’s positions—attacking MLS transparency rules while simultaneously demanding access to Zillow’s distribution for off-MLS inventory. The memo’s “Structural asymmetry problem (Compass–Zillow)” and its expanded vertical-integration and self-preferencing narratives in Section III.B derive from this publication. It also informs the memo’s prediction that post-merger, this inconsistency becomes more salient to courts and regulators evaluating foreclosure theories.

Coase Subseries Part V Coordination Costs, Platform Antitrust, and the Modern Chicago School of Law and Behavioral Economics. Applies the modern Chicago-school extensions (Coase + Becker + coordination architecture) directly to Compass’s business model and litigation strategy. Integrates incentive response, trust, and coordination integrity into a single predictive lens, which the memo uses in the Executive Frame and Bottom Line to argue that scale without shared coordination architecture raises conduct risk. The memo’s “gravity” metaphor and its assertion that coordination capacity must be designed rather than assumed are rooted in this synthesis.

MCAI Economics Vision: Chicago School Accelerated, Part II: Becker and the Economics of Incentive Exploitation, Incentives After Coordination Collapse: Compass and the Economics of Litigation Driven Market Control. The Becker prong explains why Compass’s post-merger behavior predictably shifts toward opacity, litigation leverage, and routing control once MLS coordination weakens. It treats Compass’s conduct in NWMLS and Zillow not as anomalous aggression but as rational incentive exploitation in a degraded coordination environment, using CDT metrics like Behavioral Drift Factor and Incentive Alignment Index to quantify that shift. Formal model for litigation, Private Exclusive proliferation, and platform-routing demands foresight simulations.

MCAI Economics Vision: Chicago School Accelerated, Part III: Posner and the Economics of Efficient Liability Allocation, Why Behavioral Economics Transforms the Lowest-Cost Avoider Calculus in AI Hallucinations. Shows why Posner’s ‘law evolves toward efficiency’ mechanism breaks down in ‘wicked’ environments where feedback is delayed, fragmented, and adversarially manipulated. For the Compass–Anywhere memo, it underpins the claim that institutional learning lags anticompetitive strategy, explaining why DOJ/FTC and courts will react to coordination capture with a delay rather than preventing it ex ante. It supports the memo’s focus on conduct-based remedies and upstream liability migration once harm becomes visible.

MCAI Economics Vision: Chicago School Accelerated — Integrated Application- Trust, Coordination, Narrative Power in Residential Brokerage, The High Trust Dependent Brokerage Market. Develops the trust and narrative components of coordination capacity, showing how trust density and narrative alignment determine whether market actors interpret platform behavior as cooperative or predatory. The memo’s references to trust, visibility, and routing as determinants of “coordination capture” draw on this work. It supports the prediction that post-merger, Compass’s conduct will be interpreted differently once it is seen as a dominant gatekeeper instead of an insurgent challenger.