MCAI Lex Vision: From Open Market to Private Governance, Coordination Capture in the Compass–Anywhere Merger

Comment on Senators Warren-Wyden Letter to US DOJ and FTC

See related study: See also How Trump Administration Political Access Displaced Antitrust Enforcement—and Why States Should Now Step In (Jan 2026).

Executive Summary

The proposed Compass–Anywhere merger materially increases the probability that US residential real estate transitions from an open, coordination-based market to a privately governed access system. The principal risk is coordination lock-in, not immediate price elevation. Once listing visibility, agent routing, and timing control are internalized at scale, rational behavior converges on exclusionary equilibria that resist correction through post-hoc conduct remedies.

Coordination erosion is already observable through private-listing normalization. The merger functions as an accelerant, converting reversible drift into irreversible lock-in before enforcement can adapt.

On December 16, 2025, Senators Elizabeth Warren and Ron Wyden urged the Department of Justice and Federal Trade Commission to closely scrutinize the transaction, warning that the merger “could raise barriers to entry for smaller firms, and threaten the transparency of real estate listings by allowing a dominant brokerage to dictate how listings are shared and with whom.” The concerns raised in that letter align with the coordination capture dynamics modeled in this simulation. Structural intervention prior to consummation is substantially more effective than delayed or conditional remedies. Senators Warren, Wyden Push DOJ, FTC to Closely Scrutinize Massive Compass-Anywhere Real Estate Merger, Raise Alarm on Housing Costs.

The foresight simulation presented here models structural market dynamics in which rational behavior by all participants—agents, sellers, buyers, and the merged entity—converges on exclusionary equilibria once coordination infrastructure is internalized. The resulting harm is architectural rather than discretionary, which is why conduct remedies cannot reliably restore competition once lock-in thresholds are crossed. The simulation does not rely on inferences about firm intent or predictions of specific exclusionary acts.

Insight: The merger’s primary competitive risk is not price elevation but the conversion of shared market infrastructure into private governance—a harm category that existing antitrust tools struggle to detect before it becomes irreversible.

I. Coordination Capture as Competitive Harm

Antitrust doctrine has developed sophisticated tools for analyzing price effects and exclusionary conduct. The Compass–Anywhere transaction presents a different kind of competitive risk—one that operates through coordination capture rather than traditional market power indicators. Understanding why existing frameworks struggle to address coordination capture is essential to evaluating the merger’s structural implications.

The Doctrinal Gap

Traditional merger analysis evaluates harm through two primary lenses: price effects and exclusionary conduct. Both presume that competitive injury manifests through observable outputs—higher prices, reduced output, or identifiable acts that exclude rivals.

The Compass–Anywhere transaction fits cleanly within neither frame. Price effects are ambiguous because residential commission rates face downward pressure independent of market structure following the Sitzer/Burnett settlement, and the merged entity can plausibly claim efficiency gains. Exclusionary conduct is absent because Compass has not announced refusals to deal, predatory pricing, or explicit foreclosure strategies; private listings and “Coming Soon” programs are framed as seller choice and service differentiation.

Yet the absence of traditional signals does not imply the absence of harm. The gap lies in doctrine’s limited capacity to recognize coordination infrastructure as a competitive asset distinct from products, services, or prices.

Insight: The doctrinal gap is not a failure of enforcement will but a limitation of analytical tools. Regulators cannot act on harms they lack frameworks to identify.

Coordination Infrastructure and Its Capture

Multiple Listing Service reciprocity functions as market-making coordination infrastructure—solving a coordination problem that decentralized actors cannot solve independently: ensuring that buyers see available inventory and sellers reach qualified buyers without bilateral negotiation among thousands of firms. Coordination infrastructure is not a product or a price; coordination infrastructure is a precondition for competition itself.

When a firm internalizes that coordination function—controlling which listings enter public visibility, when they enter, who sees them first, and thereby which agents and buyers gain positional advantage in time-sensitive transactions—the firm changes the rules of access in ways that structurally disadvantage external competition regardless of efficiency. No discrete exclusionary act is required. Coordination capture describes the absorption of shared market infrastructure into private governance.

Existing doctrine gestures toward coordination concerns through concepts such as harm to the competitive process, elimination of a maverick, and trends toward concentration. However, existing doctrine lacks operational tools to measure when coordination degradation becomes irreversible.

Insight: Markets require coordination infrastructure to function competitively. When that infrastructure migrates from shared governance to private control, competition degrades regardless of firm intent or formal rule compliance.

Limitations of Existing Precedent

Adjacent precedents illuminate parts of the problem but do not resolve the coordination capture risk. Vertical foreclosure cases treat the controlled input as a discrete product rather than a coordination mechanism. Platform cases address network effects but focus on user lock-in rather than access to unique, non-fungible assets. MLS-specific litigation frames harm as refusal to deal rather than structural capture.

The Compass–Anywhere transaction presents a structural case in which exclusionary outcomes emerge from rational behavior alone once coordination infrastructure is internalized. Rational agents re-optimize toward the network with the highest internal deal probability, producing market segmentation regardless of anyone’s intent.

Insight: The absence of direct precedent is not a reason to defer action but a reason to recognize that existing frameworks require extension to address coordination-based competitive harm.

Forward-Looking Analysis and Enforcement Timing

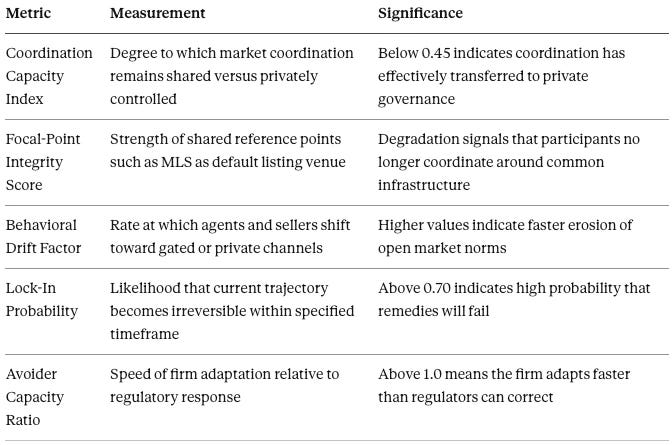

Forward-looking coordination analysis addresses the doctrinal gap by operationalizing coordination integrity as a measurable variable and identifying temporal thresholds beyond which competitive restoration becomes infeasible. Metrics such as the Coordination Capacity Index, Lock-In Probability, and Avoider Capacity Ratio quantify conditions that existing doctrine recognizes implicitly but cannot presently measure.

The relevant regulatory question shifts from whether prices will rise post-merger to whether the merger accelerates coordination internalization past the point of reversibility. That reframing transforms a static effects inquiry into a dynamic timing inquiry.

If coordination capture becomes legally cognizable only after price effects or identifiable exclusionary conduct appear, enforcement necessarily arrives after the competitive structure has degraded. Pre-consummation structural intervention may be the only window in which intervention is structurally effective.

Insight: The window for effective intervention is defined by coordination dynamics, not by litigation timelines. Regulators who wait for judicial certainty may find that certainty arrives after the competitive structure they sought to protect has already degraded.

Having established why coordination capture presents a distinct competitive harm that existing frameworks struggle to address, the simulation now turns to the analytical architecture used to model coordination dynamics and identify intervention thresholds.

Contact mcai@mindcast-ai.com to partner with us on Law and Behavioral Economics foresight simulations. See MindCast AI’s series on the Compass–Anywhere merger.

Part II How the Compass–Anywhere Merger Reshapes Broker Bargaining Power

Part V Washington’s SB 6091 and Private Real Estate Market Control

II. Simulation Architecture

The simulation applies a structured analytical stack to model how coordination dynamics evolve across sequential market states. Each analytical component addresses a distinct dimension of coordination capture, and the architecture specifies the parties whose behavior the simulation models—ensuring that predictions derive from multi-agent dynamics rather than assumptions about any single actor’s intent.

Analytical Components

Six components integrate to form the simulation’s analytical engine:

Coase Vision evaluates coordination integrity and infrastructure control, identifying when shared coordination mechanisms degrade and when private governance substitutes for open market architecture.

Becker Vision models incentive drift and rational re-optimization, predicting how agents, sellers, and buyers realign behavior in response to shifting coordination structures without requiring assumptions about intent or collusion.

Strategic Behavioral Cognitive Vision translates incentive structures into observable conduct, bridging economic incentives and market behavior to model how rational re-optimization manifests in listing decisions, agent affiliations, and buyer search patterns.

Causation Vision with Causal Signal Integrity Gate validates causal linkages between structural changes and predicted outcomes, ensuring that predictions derive from traceable causal mechanisms rather than correlation or speculation.

MindCast AI Foresight Vision forecasts lock-in and irreversibility, identifying temporal thresholds beyond which coordination capture becomes self-reinforcing and remedies lose structural effectiveness.

Posner Vision assesses legal correctability and enforcement timing, modeling the relationship between institutional response velocity and market adaptation speed to predict when enforcement intervention can prevent harm versus when intervention arrives too late.

Insight: Foresight simulation identifies intervention windows—the temporal boundaries within which action remains structurally effective.

Parties Modeled

The simulation models behavior across seven party categories: Compass as an integrated brokerage and technology platform; Anywhere Real Estate contributing franchise networks and legacy infrastructure; MLS systems and residual coordination norms representing shared infrastructure; independent and small brokerages facing competitive pressure from coordination capture; agents, sellers, and buyers as rational actors whose re-optimization drives market-level dynamics; external visibility platforms occupying intermediate positions; and federal and state regulators whose response velocity directly affects lock-in probability.

Insight: Competitive harm in coordination capture does not require a bad actor. Harm emerges from structural dynamics in which every party acts rationally given the incentive environment the merger creates.

With the analytical architecture established, the simulation proceeds to track coordination dynamics across four sequential market states—from baseline open coordination through lock-in and enforcement failure.

III. Simulation Results

The simulation tracks coordination dynamics across four sequential market states, each representing a distinct coordination regime with measurable characteristics and identifiable transition thresholds. The simulation’s value lies in identifying the decision points at which intervention remains effective versus the thresholds beyond which competitive restoration becomes structurally infeasible.

State 1: Open Coordination Baseline

The baseline state represents market conditions under shared MLS coordination, where listing visibility is broadly accessible and competition centers on service quality rather than access control.

Shared coordination infrastructure dominates. Brokerages of varying sizes participate in reciprocal listing arrangements. Buyers access substantially complete inventory through standardized channels. Sellers reach qualified buyers without routing through proprietary networks.

At baseline, the Coordination Capacity Index measures approximately 0.75–0.80, the Focal-Point Integrity Score is high, and the Trust Density Coefficient distributes evenly across market participants. Transaction costs are minimized through shared infrastructure, and entry barriers remain low despite firm size asymmetries. The coordination mechanism is self-enforcing without central governance because all participants benefit from reciprocity.

Insight: Open coordination is not the natural state of markets. Open coordination is an institutional achievement that requires maintenance—and that can be lost.

State 2: Private-Listing Normalization

The second state represents pre-merger drift toward coordination erosion, where large brokerages experiment with private or delayed listings that remain formally optional but reshape incentives.

Private listing programs expand through “Coming Soon” and “Private Exclusive” designations that delay or restrict MLS entry. Agents and sellers test gated pathways as hedges against visibility loss. Coordination erosion begins without explicit exclusion.

The Coordination Capacity Index declines to approximately 0.60, the Behavioral Drift Factor rises to approximately 0.45, and the Switching-Cost Gradient steepens as network effects favor larger brokerages. Rational agents begin re-optimizing toward networks offering visibility advantages. Optional opacity becomes strategically rational at scale, creating a coordination prisoner’s dilemma where individual participants benefit from private channels even as collective coordination degrades.

Under current market structure without consolidation, drift remains bounded. Competitive pressure from independents and regulatory attention constrain private listing expansion, and the Coordination Capacity Index stabilizes at 0.55–0.65 rather than collapsing below 0.45. The merger removes these constraints by consolidating coordination control points, converting reversible drift into irreversible internalization.

Insight: The merger does not create coordination erosion. The merger accelerates erosion and eliminates the competitive and regulatory constraints that would otherwise keep erosion bounded.

State 3: Post-Merger Internalized Coordination

The third state represents the coordination failure threshold, where the merged entity internalizes coordination across franchised brands, agent networks, and proprietary systems, and listing visibility and timing become firm-controlled inputs rather than shared market conditions.

The combined Compass–Anywhere entity controls listing routing across multiple brand networks. MLS participation persists formally but loses economic substance as premium inventory circulates through internal channels before reaching public visibility. Independent brokerages face rising survival costs unrelated to efficiency.

The Coordination Capacity Index declines below approximately 0.45 (the coordination failure threshold), the Incentive Alignment Index runs high internally but low for external participants, and Causal Signal Integrity exceeds 0.80—confirming causal linkage between structural consolidation and coordination degradation.

Dual markets form: internal network transactions dominate price-setting and premium inventory access while open-market listings lag and anchor to inferior comparables. The formal structure of MLS participation remains intact while the economic substance of coordination migrates to private governance.

Once combined local market share exceeds approximately 30%, agent migration toward the dominant network accelerates non-linearly. The Warren-Wyden letter to DOJ and FTC documents that combined post-merger market share already exceeds this threshold in critical metros: $7.8 billion in Manhattan, $20.1 billion in New Jersey, with similar concentrations in California and Florida. State 3 dynamics are already active in these high-concentration markets.

Franchisees gain access to Compass’s private listing network and technology stack as a condition of integration, creating alignment incentives stronger than contractual independence: franchisees who route listings through internal systems capture higher deal probability than those who rely on open MLS channels. Behavioral convergence follows incentive structure, not corporate mandate. Estimated integration lag is 12–18 months, after which franchise brands function as distribution channels for internally coordinated inventory rather than independent competitive units.

Insight: The failure threshold is crossed not when rules change but when incentives realign. By the time formal rules reflect coordination capture, the capture is already complete.

State 4: Lock-In and Enforcement Failure

The fourth state represents durable lock-in, where internalized coordination normalizes, buyers and sellers accept reduced transparency as the market standard, and enforcement lags behind behavioral adaptation.

Market participants treat private listing networks as the default pathway for premium transactions. Reduced transparency becomes the accepted norm rather than an anomaly requiring justification. Independent brokerages consolidate, exit, or accept subordinate positioning within the dominant network’s ecosystem.

Lock-In Probability reaches 0.65–0.78 by Year 3, varying by regional concentration and franchise integration velocity—high-share metros with rapid integration cluster toward 0.78 while markets with resilient independent brokerage presence cluster toward 0.65. Institutional Update Velocity falls below market adaptation speed, and the Avoider Capacity Ratio exceeds 1.2, indicating that firm adaptation outpaces regulatory correction.

The system enters a wicked learning environment where conduct remedies and delayed divestitures fail to restore open coordination because the behavioral adaptations that produced lock-in cannot be reversed through rule changes. Formal compliance masks substantive exclusion.

By Year 5, competitive restoration would require rebuilding shared infrastructure externally rather than correcting firm conduct internally—a challenge exceeding realistic enforcement capacity.

Recent merger enforcement timelines indicate 12–18 month response windows: Microsoft–Activision closed in 10 months despite FTC challenge; Amazon–iRobot terminated after 15 months of regulatory delay. The Compass–Anywhere transaction involves coordination dynamics that regulators have less experience evaluating, and a 12–18 month window is sufficient for State 3 conditions to harden toward lock-in absent pre-consummation intervention.

Insight: Lock-in is not a prediction of certain harm. Lock-in is a prediction that harm, once realized, cannot be undone through the remedial tools available to regulators.

IV. Regulatory Conclusion

The Compass–Anywhere merger presents a forward-looking structural risk centered on coordination capture and access asymmetry—a risk that is predictable, measurable, and time-sensitive.

The concerns articulated in the December 2025 letter from Senators Warren and Wyden to Assistant Attorney General Gail Slater and FTC Chairman Andrew Ferguson reflect the coordination dynamics this simulation models. The Senators warned that the merger threatens market transparency by enabling a dominant brokerage to control listing visibility and timing—precisely the coordination capture mechanism analyzed here.

Coordination lock-in produces consumer harm through identifiable pathways: higher buyer search costs and cognitive load, distorted price comparables from dual-market conditions, reduced seller optionality despite nominal choice, and commission persistence despite post-Sitzer/Burnett structural pressure. These harms accumulate without immediate price spikes, rendering them invisible to static market analysis but material to household affordability at a time when housing access has reached crisis levels.

The simulation does not argue that harm is certain. The simulation argues that harm, if it materializes, will be structurally irreversible by the time traditional indicators confirm its presence. The appropriate response to that risk profile is precautionary intervention rather than wait-and-see enforcement.

Post-hoc remedies are unlikely to restore competition once coordination infrastructure is internalized. Structural intervention prior to consummation remains the most effective safeguard for market integrity, transparency, and long-term consumer welfare.

Insight: Precautionary intervention is not regulatory overreach. Precautionary intervention is the recognition that some competitive harms cannot be corrected after the fact—and that identifying those harms before they become irreversible is the purpose of forward-looking merger analysis.

V. Metric Calibration and Falsification

The simulation’s credibility depends on transparent calibration and falsifiable predictions. Metrics that cannot be validated against observable data are advocacy rather than analysis.

Calibration Inputs

The 15% private listing threshold triggering Focal-Point Integrity Score degradation derives from industry analysis (including Zillow’s Chief Industry Development Officer’s public statements) identifying material information asymmetry effects at that penetration level, consistent with network tipping-point dynamics documented in economic literature (Katz & Shapiro, 1985).

The baseline Coordination Capacity Index is calibrated against MLS participation rates, listing-to-visibility lag times, and inter-brokerage referral frequency in markets with low private listing penetration. Markets with high MLS compliance and rapid public listing entry provide the reference points for baseline coordination capacity.

Metrics are designed for independent verification against National Association of Realtors transaction data, MLS board reporting, and agent mobility statistics. External analysts can replicate calibration using publicly available data sources.

Falsification Checkpoints

The following outcomes would falsify the simulation’s predictions:

If the Coordination Capacity Index remains above 0.60 after 18 months post-merger, the drift prediction fails

If agent migration does not accelerate past approximately 30% combined local share, Becker incentive dynamics are miscalibrated

If enforcement intervenes effectively before Lock-In Probability exceeds 0.70, Posner timing assumptions require revision

These checkpoints convert the simulation from a policy argument into a testable hypothesis that regulators and external analysts can evaluate against observable outcomes.

Insight: The simulation invites scrutiny. Predictions that survive falsification attempts gain credibility; predictions that fail provide learning. Both outcomes advance understanding of coordination dynamics in consolidating markets.

Appendix A: Metric Reference Guide

Regulatory staff and legislative aides may benefit from a brief explanation of core metrics and threshold logic.

The simulation identifies specific thresholds because coordination dynamics are non-linear. Markets reach tipping points beyond which recovery becomes structurally different from prevention. Intervention before these thresholds is categorically more effective than intervention after.

Appendix B: Foundational Publications

The simulation draws on MindCast AI’s coordination economics research program. The following publications provide foundational context for readers seeking deeper engagement.

The Chicago School Accelerated Part I: Coase and Why Transaction Costs ≠ Coordination Costs (Dec 2025)

This piece establishes the coordination‑as‑infrastructure framework, distinguishing coordination costs from transaction costs and introducing coordination capacity, focal points, and trust density as measurable variables. It underpins the simulation’s treatment of MLS reciprocity as shared market infrastructure, justifying why absorption of MLS functions into a private network is a structural harm irrespective of short‑term price effects.

The Chicago School Accelerated Part II: Becker and Incentives After Coordination Collapse (Dec 2025)

This installment develops the incentive‑drift mechanics that describe how rational actors exploit weakened coordination architecture, using CDT/vision functions to model strategic re‑optimization. The Compass–Anywhere simulation draws directly on this Becker layer to explain why agents and sellers predictably migrate toward the merged network once local share crosses roughly 30%, even absent explicit exclusionary rules.

Compass / MLS coordination series

MCAI Lex Vision: Compass’s Coasean Coordination Problem — Modern Chicago School and Platform Antitrust (Dec 2025)

This series‑level flagship integrates platform economics with a “Modern Chicago” lens, arguing that MLS rules function as pro‑competitive coordination infrastructure and that Compass’s litigation plus platform strategy is best understood as coordination capture rather than standard price or output restriction. It gives the foresight simulation an explicit doctrinal bridge to modern antitrust debates, showing how the same coordination‑cost vocabulary can be used to evaluate the Compass–Anywhere merger under existing law and the 2023 Merger Guidelines.

MCAI Lex Vision: Compass’s Coasean Coordination Problem — Compass vs. MLS Coordination (Dec 2025)

This installment provides empirical and scenario‑based analysis of how Private Exclusives and related programs fragment MLS coordination, including quantified predictions about coordination degradation, time‑on‑market, and MLS collapse thresholds. Those scenarios and metrics supply the empirical substrate for the Coordination Capacity Index and lock‑in thresholds used in the Compass–Anywhere foresight simulation to distinguish reversible drift (State 2) from internalized coordination failure (State 3).

MCAI Lex Vision: Compass’s Coasean Coordination Problem — Compass–NWMLS (Dec 2025)

This note applies coordination‑cost analysis directly to the Compass–NWMLS litigation, quantifying integrity and coordination metrics and demonstrating that NWMLS acts as coordination infrastructure rather than a cartel. The same metrics and logic are repurposed in the simulation to argue that weakening or bypassing MLS governance—then consolidating franchise and listing flows via Compass–Anywhere—accelerates coordination capture past the point where post‑hoc remedies can restore open access.

MCAI Lex Vision: Compass’s Coasean Coordination Problem —Compass-Zillow (Dec 2025)

Within the Compass coordination series, this installment treats listing visibility and portal routing as economic chokepoints, distinguishing aggregation from routing control and introducing timing and inventory‑completeness metrics. The Compass–Anywhere simulation leans on that routing framework to characterize “discovery timing” and internal pre‑visibility circulation as core coordination control mechanisms, not neutral product features.

Merger-specific antitrust pieces

MCAI Lex Vision: Antitrust Scrutiny of the Compass–Anywhere Merger (2025)

This piece provides a structure‑first antitrust analysis of the Compass–Anywhere transaction, emphasizing consolidation of coordination control points—across brands, agents, and listing flows—rather than immediate commission effects as the primary risk vector. The foresight simulation builds on this by adding explicit multi‑state dynamics, quantitative coordination metrics, and lock‑in probabilities, effectively turning the earlier Lex Vision analysis into a full CDT‑based simulation environment for regulators.

MCAI Lex Vision: Letter to State Attorneys General — Antitrust Scrutiny of the Compass–Anywhere Merger (September 2025)

This letter operationalizes the merger critique into concrete enforcement asks for state AGs, highlighting the contradiction between Compass’s “excluded challenger” litigation narrative and its simultaneous pursuit of unprecedented brokerage consolidation. It anchors the simulation’s modeling of institutional update velocity and state‑level escalation pathways, showing how CDT‑style foresight can inform early state action before federal review timelines allow coordination lock‑in.