MCAI Economics Vision: The Compass Astroturf Coefficient at the Washington State Senate

How Coordinated Non-Disclosure Distorted the Legislative Record at Washington’s SB 6091 Hearing

Companion study to: Washington’s SB 6091 and Private Real Estate Market Control (Jan 2026), Windermere and Compass, Two Philosophies of Real Estate (Jan 2026), Compass–Anywhere, When Scale Becomes Liability (Jan 2026), Compass vs. SB 6091, Narrative Pre-Installation and the Infrastructure of Exception Capture (Jan 2026), HB 2512 and the Collapse of Compass’s Coordinated Opposition (Jan 2026), How Compass’s State Legislative Testimony Undermined its Federal Antitrust Claims (Jan 2026), The Collapse of Compass’s Co-Conspirator Theory (Jan 2026), Compass vs. Competition: The Case for SB 6091 / HB 2512 Without an Opt-Out Exception (Feb 2026).

The astroturf analysis documents coordinated non-disclosure by Compass-legacy agents. The methodology cross-referenced sign-in records against Compass agent rosters specifically. No Anywhere-legacy brand agents (Coldwell Banker, Century 21, Sotheby’s International Realty, Better Homes and Gardens Real Estate) were identified in the opposition testimony pool. The Compass-Anywhere merger closed January 10, 2026—thirteen days before the hearing. The absence of Anywhere-brand participation, despite post-merger integration, is a finding, not a methodological limitation.

I. Executive Summary

Prior MindCast AI publications establish how institutional processes degrade under concentrated economic pressure when disclosure, attribution, or enforcement mechanisms weaken, including The Stigler Equilibrium: Regulatory Capture and the Structure of Free Markets (January 2026) and Comparative Externality Costs in Antitrust Enforcement (January 2026). Those analyses demonstrate that once transparency constraints erode, dominant actors predictably shift from substantive defense to coordination, access control, and narrative management.

The Washington State Senate Housing Committee hearing on SB 6091 presents a state-level legislative analogue of the same equilibrium dynamics previously observed in federal antitrust enforcement: concentrated beneficiaries mobilize at scale, diffuse victims remain unorganized, and institutional decision-makers are left to infer public preference from a record that may no longer reveal underlying structure.

Legislative hearings are not preference polls. They are information-production mechanisms. Their function is to allow legislators to distinguish between distributed citizen concern and concentrated economic interest, and to weigh testimony accordingly. That distinction depends on organizational disclosure. Without it, the legislative record cannot perform its evidentiary role, and numerical participation becomes indistinguishable from coordinated advocacy.

SB 6091—a bill requiring concurrent public marketing of residential real estate listings—presented a textbook case for evaluating whether that information function held. The bill implicates a narrow set of firms with concentrated economic exposure and a broad set of diffuse market participants with limited individual incentives to organize. Under those conditions, disclosure norms determine whether legislators see genuine preference aggregation or manufactured consensus.

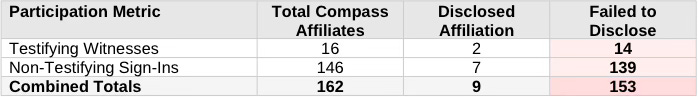

Compass Real Estate mobilized 162 affiliated individuals to register opposition to Washington Senate Bill 6091 at the January 23, 2026 Housing Committee hearing. Only 9 disclosed their Compass affiliation. The remaining 153 registered without organizational attribution, manufacturing the appearance of grassroots opposition while concealing coordinated corporate mobilization.

Table 1. Consolidated Participation Metrics

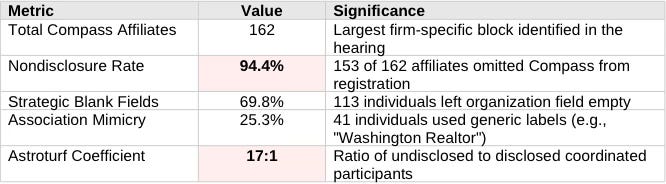

Disclosure Rate: 5.6%. Non-Disclosure Rate: 94.4%.

The Astroturf Coefficient (AC)—the ratio of undisclosed to disclosed coordinated participants—reached 17:1. For every participant who identified Compass affiliation, seventeen concealed it. AC quantifies the gap between apparent organic opposition and actual coordinated corporate mobilization.

MindCast AI’s Cognitive Digital Twin (CDT) foresight simulation applies the Enforcement Capture Equilibrium framework to legislative settings, measuring how concentrated beneficiaries manufacture apparent consensus through systematic affiliation concealment. The simulation registers Capture Presence = High, Behavioral Convergence = Stable, and Advocacy Arbitrage = Active—metrics indicating that Compass’s participation strategy constitutes structural information environment distortion, not isolated non-compliance. MindCast AI applies the Coercive Narrative Governance (CNG) framework developed in prior research—specifically Coercive Narrative Distortion and Boundary Integrity (December 2025) and Coercive Narrative Shock and the Displacement of Public Trust (October 2025)—to document how coordinated participation without disclosure distorts legislative information environments.

This analysis does not allege unlawful conduct. It evaluates disclosure behavior and coordination patterns observable in public legislative records and assesses their informational effects on legislative deliberation.

SB 6091 requires concurrent public marketing of residential real estate listings—the legislative response to Compass’s private listing networks documented in Part V of this series (Washington’s SB 6091 and Private Real Estate Market Control, January 2026). The hearing participation patterns analyzed here reveal how Compass opposes that containment through coordinated advocacy designed to appear organic. Quantifying that coordination provides legislators with information the sign-in record alone conceals.

Contact mcai@mindcast-ai.com to partner with us on predictive Law and Behavioral Economics foresight simulations. See Chicago School Accelerated — The Integrated, Modernized Framework of Chicago Law and Behavioral Economics (December 2025).

II. Disclosure Norms and Their Violation

Legislative testimony depends on organizational attribution to function as evidence. Legislators calibrate testimony weight based on disclosed affiliations—distinguishing independent citizen concern from coordinated corporate advocacy. When 94.4% of Compass-affiliated participants omit that affiliation, the legislative record misrepresents coordinated opposition as organic dissent. Section II establishes the disclosure baseline against which Compass’s participation pattern constitutes violation.

II.A. Organizational Attribution as Epistemic Infrastructure

Washington’s legislative sign-in system requires organizational disclosure because affiliation determines evidentiary weight. Washington Realtors testimony carries trade-association weight. Habitat for Humanity testimony carries housing-advocacy weight. Zillow testimony carries platform-company weight. Legislators apply appropriate skepticism when they know the speaker’s institutional position.

Twenty independent homeowners expressing similar concerns signals broad organic opposition. Twenty employees of the same company expressing similar concerns signals coordinated corporate messaging. The organizational field enables legislators to distinguish these scenarios. Without attribution, legislators cannot assess whether opposition reflects distributed preference or concentrated mobilization.

II.B. Disclosed Participation Demonstrates Norm Availability

Pro-SB 6091 witnesses uniformly disclosed organizational affiliations, demonstrating that disclosure norms function when participants choose compliance. Bill Clark and James Fisher identified Washington Realtors. OB Jacobi identified Windermere Real Estate. Ryan Donahue identified Habitat for Humanity. Anna Boone identified Zillow. Nicole Bascom-Green identified Bascom Real Estate Group. Ken Short identified the Association of Washington Business. Adria Buchanan identified the Fair Housing Center of Washington.

Compass-affiliated participants could have disclosed. Brandi Huff registered “Compass Washington/Seattle” and testified as Compass Managing Director. Michael Orbino disclosed Compass affiliation verbally during testimony. Two participants demonstrated that disclosure was possible; 153 demonstrated that concealment was chosen.

Disclosed participation establishes the baseline; Compass’s systematic non-disclosure constitutes deviation requiring explanation. Section III quantifies that deviation through forensic analysis of participation records.

III. Quantifying Coordinated Non-Disclosure

MindCast AI cross-referenced legislative sign-in records against Compass agent rosters, Washington State licensing databases, and LinkedIn profiles to identify 162 Compass-affiliated participants. The methodology is conservative: only current, verifiable affiliations were counted; ambiguous matches were excluded. Section III presents the resulting metrics and introduces the Astroturf Coefficient as the measure of coordinated concealment.

III.A. Testifying Witness Analysis

Sixteen Compass-affiliated individuals signed in to testify. Two disclosed: Brandi Huff registered with “Compass Washington/Seattle” and testified as Managing Director; Michael Orbino registered without attribution but disclosed Compass affiliation verbally. Fourteen registered with blank organization fields or non-Compass labels. Jennifer Ng registered “Realtors Association” rather than her Compass brokerage affiliation while delivering testimony paralleling Compass talking points about senior sellers and privacy.

III.B. Non-Testifying Sign-In Analysis

One hundred forty-six Compass-affiliated individuals signed in opposing SB 6091 without testifying. Seven disclosed: Greg Rosenwald (#40), Jenny Chen (#44), Jennifer Suemnicht (#85), Daniel Renne (#138), Sinead Keogh (#163), and Marius Ion (#164) registered “Compass” in the organization field. One hundred thirty-nine registered with blank fields or generic labels, creating numerical opposition volume without corporate attribution.

III.C. Methods of Concealment

Compass affiliates employed two primary concealment methods. Strategic Blank Fields: 113 individuals (69.8%) left the organization field empty, appearing as unaffiliated citizens. Association Mimicry: 41 individuals (25.3%) listed generic professional labels (”Washington Realtor,” “Washington State Realtor”) rather than their employing brokerage—a pattern that obscures corporate affiliation behind trade-association identity.

Table 2. Institutional Visibility Index

Leadership-Level Nondisclosure: Caitlin Sullivan (Managing Broker, Seattle) and Samuel Cunningham (Renovatio 1-26) registered opposition without disclosing Compass affiliation—indicating identity masking extended to management, not only rank-and-file agents.

III.D. The Astroturf Coefficient Defined

AC measures coordinated concealment intensity: AC = Undisclosed Affiliates / Disclosed Affiliates = 153 / 9 = 17. An AC of 1.0 indicates equal disclosure and non-disclosure. An AC approaching zero indicates full transparency. An AC of 17 indicates that coordinated participation operated overwhelmingly through concealment.

Legislators reviewing the sign-in record see 162 opponents and reasonably conclude broad-based opposition exists. AC reveals that one firm generated that opposition through coordinated mobilization with systematic identity masking. Section IV analyzes the testimony record to show how concealment enabled narrative deployment that disclosure would have undermined.

IV. The Pivotal Exchange: Business Model Exposure

Senator Emily Alvarado’s questioning of Brandi Huff produced the hearing’s decisive exchange. Alvarado connected Compass’s merger, its Wall Street backing, and its exclusive listing networks to ask whether opposing SB 6091 served competition or Compass’s business model. Huff’s responses—confident when discussing opt-out amendments, unable to engage when pressed on the unamended bill—revealed that Compass’s opposition is structural, not principled. Section IV documents that exchange and analyzes its significance for interpreting the undisclosed participation patterns.

IV.A. Senator Alvarado’s Structural Question

Senator Alvarado framed the competition question directly (45:22):

“You said you were with Compass... My understanding is that recently the Trump administration approved a merger that makes Compass now the largest Wall Street-backed real estate brokerage in the country. And then when you layer on an exclusive network, I’m wondering what that means for broader competitiveness of housing selling and buying in our state. It makes me think about this as a pro-competition bill, and I’m wondering how your business model syncs with that.”

Alvarado’s question synthesized merger scale, Wall Street financing, private listing networks, and competitive effects—the structural elements that Compass’s testimony had avoided. The question forced engagement with the bill’s unamended form, not the opt-out version Compass sought.

IV.B. The Conditional Concession

Huff responded with a revealing conditional (45:22): “I feel fully confident to say that the Compass business model would not be affected by this bill, specifically with the amendments for the sellers to have the right to make their own choice.”

Chair Bateman isolated the concession (45:34): “But without the amendments?”

Huff’s reply exposed the structural stake (45:37): “I will tell you this. That is probably above what I feel comfortable speaking to because my job currently is to support the brokers in our community. As far as the merger and acquisition and higher level business model, that’s probably above. But I’m happy to put those things in writing, too, at a later date.”

IV.C. Analytical Significance of the Exchange

Huff’s initial response conceded that SB 6091 as written would affect Compass’s business model—neutrality existed only “with the amendments.” The opt-out amendments Compass seeks are not neutral good-government reforms; they preserve private listing capacity against the bill’s transparency mandate.

Huff’s inability to defend the unamended bill reflects structural impossibility, not personal limitation. Compass cannot publicly explain why restricting buyer access to listings serves anyone other than Compass. The question of competition versus business-model protection was “above” what disclosed corporate testimony could address.

Disclosure enabled scrutiny. Because Huff identified her Compass affiliation, Senator Alvarado could probe commercial interests underlying the testimony. The 153 undisclosed Compass participants faced no such examination—their arguments were evaluated as independent citizen concerns rather than coordinated corporate messaging.

MindCast AI’s Cognitive Digital Twin simulation registers Huff’s response pattern as Defensive Deferral—retreat to process claims (”happy to put those things in writing at a later date”) rather than substantive defense. The simulation records Advocacy Arbitrage = Active and Truth Revelation = Suppressed, indicating that public testimony no longer performs its information-revelation function when structural questions threaten business-model exposure.

Across all Con testimony, no witness addressed the structural question Senator Alvarado posed: How does restricting buyer access to listings serve anyone other than Compass? Huff deferred. Orbino inverted—positioning Compass as protecting consumers from "large corporate interests" while representing the nation's largest Wall Street-backed brokerage. Ng offered vulnerable seniors without explaining how fewer bidders produce higher prices. The narratives were present. The market logic was absent.

The Huff exchange reveals why 153 Compass affiliates concealed their affiliation: disclosed participation invites the structural scrutiny that Compass cannot survive. Section V situates that concealment within the Stigler capture framework, explaining systematic non-disclosure as equilibrium behavior rather than coincidence.

IV.D. The Wisconsin Model and Federal Litigation Strategy

Huff’s testimony explicitly proposed the Wisconsin model as Compass’s preferred amendment (42:15):

“We’re seeking an amendment to the bill of section one and four adding, and I quote, ‘or if the homeowner requests otherwise in writing.’ This simple change would ensure that the homeowner, not the state, decides the marketing strategy for their home... And this is how in Wisconsin, a similar statute has been handled. In Wisconsin, it provides a homeowner can opt out of public marketing by completing and signing a disclosure and an opt out.”

When Senator Shewmake asked how opt-out would comply with fair housing requirements, Huff responded (46:45):

“The disclosure would give them the opportunity to not only opt out of public marketing, but to understand fully fair housing. So I think it’s just giving the seller the right to choose when and how their house is marketed, but still enforcing fair housing in the way that we always have.”

As documented in Washington’s SB 6091 and Private Real Estate Market Control (January 2026),opt-out regimes fail at platform scale. The Wisconsin model is not a compromise; it is Compass's preferred outcome dressed as consumer protection.

Compass is simultaneously pursuing two federal antitrust lawsuits attacking MLS public-marketing requirements as anticompetitive—one against Northwest MLS in Washington, another against major MLSs and Zillow nationally. SB 6091 would codify that requirement in state law, potentially mooting Compass’s litigation strategy by converting private MLS rules into sovereign regulation. Compass’s opposition to SB 6091 is not incidental to its federal litigation; it is the legislative front of the same campaign.

V. The Stigler Mechanism in Legislative Settings

George Stigler’s 1971 theory of regulatory capture identifies structural conditions producing enforcement failure: concentrated beneficiaries, diffuse victims, organizational asymmetry, and information dependence. When these conditions hold, capture emerges as equilibrium regardless of institutional intent. MindCast AI's foundational framework—The Stigler Equilibrium: Regulatory Capture and the Structure of Free Markets (January 2026)—establishes the Enforcement Capture Equilibrium (ECE) methodology and core metrics: Degree of Capture (DoC), Grammar Persistence Index (GPI), and Update Elasticity (UE).

The SB 6091 hearing exhibits these conditions translated to legislative advocacy. Section V applies the Stigler mechanism to explain why 94.4% non-disclosure is predictable rather than anomalous.

Harm Clearinghouse Dynamics. MindCast AI interprets this hearing as a Harm Clearinghouse event—a phenomenon documented in Federal Antitrust Breakdown as Nash-Stigler Equilibrium, Not Accident (January 2026). When federal antitrust enforcement enters inaction phase, dominant firms seek to standardize conduct through state legislative exceptions.

V.A. Structural Conditions at the Hearing

Concentrated Beneficiary: Compass controls the nation’s largest residential brokerage following its January 2026 merger with Anywhere Real Estate. SB 6091 threatens Compass’s private listing networks—the business model Brandi Huff acknowledged would be affected “without the amendments.” Compass’s stake in defeating or amending the bill is substantial and identifiable.

Diffuse Victims: Homebuyers excluded from private listing networks, independent brokers locked out of inventory, and sellers receiving constrained offers all bear costs from private listing practices. Each individual’s stake is small relative to Compass’s concentrated interest. No individual buyer harmed by a private listing network travels to Olympia to testify.

Organizational Asymmetry: Compass mobilized 162 employees to register positions through internal communication at trivial cost. Diffuse victims cannot organize equivalent participation because coordination costs exceed individual stakes.

Information Asymmetry: Compass-affiliated participants presented testimony framed as independent professional expertise, consumer protection, and concern for vulnerable populations. Legislators received coordinated messaging without the attribution necessary to identify its coordinated source.

MindCast AI’s Cognitive Digital Twin simulation registers Capture Presence = High. A 94.4% nondisclosure rate indicates reputational cost has attached to institutional identification—the signature of contested regulatory supply.

V.B. Identity Masking as Dominant Strategy

Identity masking emerges as the dominant strategy when disclosing affiliation lowers credibility while non-disclosure preserves access. Individual Compass agents face a simple calculus: disclosure invites scrutiny (as the Huff exchange demonstrates); non-disclosure enables arguments to be evaluated as independent citizen concerns. Neither the firm nor individual agents improve outcomes by deviating from non-disclosure.

MindCast AI’s Cognitive Digital Twin simulation registers Behavioral Convergence = Stable and Deviation Incentives = Low. Future legislative contests will reproduce similar masking behavior unless attribution rules change or disclosure costs decrease.

V.C. Bootleggers and Baptists Coalition Formation

Bruce Yandle’s Bootleggers-and-Baptists model explains how capture coalitions form. Every successful capture coalition includes Baptists (parties providing public-interest justification) and Bootleggers (parties capturing economic rents). The SB 6091 hearing exhibited classic coalition structure.

Baptist Narrative: “Seller choice,” “homeowner autonomy,” “protecting vulnerable seniors,” “privacy concerns.” Jennifer Ng’s testimony about seniors in crisis situations exemplifies Baptist argument—genuine concern deployed in service of outcomes benefiting Compass.

Bootlegger Interest: Compass’s business model depends on private listing capacity. Opt-out amendments preserve that capacity. Economic rents flow to Compass; Baptist narratives legitimize the outcome.

Participants expressing genuine concern for seller privacy do not understand they provide cover for coordinated corporate advocacy. Legislators see aligned voices—professionals, consumer advocates, concerned citizens—and conclude the outcome serves multiple interests. AC quantifies coalition effectiveness: 17 concealed corporate participants for every one who disclosed.

V.D. Agenda Access Versus Affiliation

The testifying versus non-testifying divide is more probative than stated affiliation because agenda access determines which signals enter the legislative record. A numerically small but coordinated pro-SB 6091 coalition dominated live testimony (~18-20 speakers). The overwhelming majority of participants (~170-185 con sign-ins) were confined to non-testifying status.

Procedural compression means the legislative record measures coordination capacity, not breadth of support. Compass’s 162 affiliates produced less legislative impact than a handful of disclosed industry witnesses because agenda access, not numerical participation, governs outcomes.

MindCast AI’s Cognitive Digital Twin simulation registers Geodesic Availability = Low and Agenda Dominance = High. Procedural transition from public hearing to closed executive session collapses accessible influence pathways, favoring actors with centralized legal and lobbying infrastructure.

These metrics derive from the Field-Geometry Reasoning (FGR) framework established in Field-Geometry Reasoning: A Unifying Framework for Structural Explanation in Law, Economics and Artificial Intelligence (January 2026).

The Stigler mechanism explains why 94.4% non-disclosure is equilibrium, not anomaly. Section VI contrasts Compass’s concealment strategy with the transparent participation of the pro-SB 6091 coalition, demonstrating that disclosure norms function when participants choose compliance.

VI. The Transparent Coalition: Disclosed Opposition to Private Listings

Pro-SB 6091 witnesses uniformly disclosed organizational affiliations and delivered testimony engaging structural competition questions that Compass witnesses avoided. Section VI documents the transparent coalition’s testimony, highlighting that the firm with the most to gain from private listing networks—Windermere Real Estate—testified in support of the bill. Disclosed participation enables the structural scrutiny that coordinated concealment prevents.

VI.A. MindCast AI Testimony: Structural Threat Identification

Noel Le, Founder of MindCast AI, testified in support of SB 6091, identifying Compass’s coordinated federal litigation and acquisition strategy:

“Compass is suing multiple Washington firms—NWMLS and Zillow, and naming other Washington firms as co-conspirators—in separate federal courts, claiming listing requirements are antitrust violations because they block Compass’ 3 Phase Marketing strategy, while completing the largest brokerage consolidation in U.S. history. The litigation attacks coordination infrastructure; the acquisition eliminates competitors.”

Le identified the economic mechanism Compass’s private listing strategy exploits:

“Compass markets Private Exclusives as generating higher prices. The economics say otherwise—restricting buyer access reduces competitive bidding, the mechanism that maximizes sale price. Compass captures both buyer-seller sides when sellers receive offers from constrained demand.”

Le explained why opt-out amendments—the relief Compass seeks—fail at platform scale:

“Opt-out legislations fail at platform scale. Compass can embed opt-outs in listing agreements and train agents to frame it as ‘premium service.’ SB 6091 ensures transparency with no opt-out. No ability for Compass to leverage scale to monopolize.”

“SB 6091 is pro-market. It preserves competition: brokers see all marketed inventory at the same time, then compete on merit. Preventing SoftBank-subsidized market entry from becoming durable market exclusion.”

Le’s testimony articulated the through-line connecting participation analysis to market structure: Compass acquired scale through capital subsidies, seeks to convert that scale into information control, and deploys federal litigation and state legislative advocacy to preserve that control. The hearing patterns documented here—162 Compass affiliates with AC of 17:1—manifest that strategy in the legislative process.

VI.B. Windermere’s Decisive Testimony

OB Jacobi, President of Windermere Real Estate, delivered testimony that inverts Compass’s competition framing (51:14):

“Windermere is the largest brokerage in Washington State by a lot. We have 4,000 agents... We enjoy a 25% market share across all price points and a 35% in the luxury space... To say that no other company would reap the benefits of a private listing network would be Windermere. We would clean house, if you would, if this bill doesn’t pass, which sounds ridiculous. We’ve worked really, really hard for decades to create a fair and open marketplace that’s transparent. And this bill continues to push transparency, and we just urge you to support and pass this bill.”

Jacobi’s testimony is analytically decisive. The largest Washington brokerage—the firm with the most to gain from private listing networks—testified that passing SB 6091 serves market integrity even at cost to its own competitive advantage. Windermere recognizes that private listings serve platform consolidation, not market competition. Compass’s framing collapses: if private listings served consumers, Windermere would oppose the bill.

VI.C. Coalition Breadth with Full Disclosure

Bill Clark, Washington Realtors (38:28): “This bill does not ban private marketing. It ensures concurrent public marketing... You can still market a house to a targeted group. You just can’t only do that. Once you do that, then you also have to market that property publicly so that everybody has a chance to buy that house.”

Clark’s framing rebuts the “seller choice” narrative directly. SB 6091 preserves seller flexibility while eliminating information asymmetry that private-only listings create.

Anna Boone, Zillow (59:08): “There’s a growing trend within parts of the real estate industry to systematically hide available inventory, only providing access to select groups of buyers or brokers within private listing networks. This practice moves us backward toward a closed, opaque system where access to housing information is no longer equal.”

Adria Buchanan, Fair Housing Center of Washington (1:08:34): “Open listings are essential to fulfilling the state’s obligation to affirmatively further fair housing. When homes are publicly listed and broadly advertised, they reach the very communities that have historically been excluded from housing opportunities... Pocket listings reduce access, limit competition, and shut people out before they even have a chance to participate.”

The transparent and apparent coalition—Washington Realtors, Windermere, Habitat for Humanity, Zillow, Fair Housing Center, Association of Washington Business—represents genuinely diverse interests aligned on transparency principles. Full disclosure enabled legislators to assess interests and weigh testimony accordingly. The contrast with Compass’s participation pattern is structural: one side operated through transparency; the other through concealment. Section VII projects implications of this analysis for the January 30 executive session and subsequent legislative proceedings.

VII. Foresight Projections and Falsifiable Predictions

MindCast AI’s Cognitive Digital Twin simulation generates falsifiable predictions for the period following the January 23 hearing. Section VII presents near-term projections for Compass’s advocacy strategy and identifies conditions under which the simulation’s outputs would require revision. Publication of AC analysis prior to the January 30 executive session enables real-time evaluation of predictive accuracy.

VII.A. Legislative Recalibration

Publication of AC analysis provides legislators with information the sign-in record alone concealed. Legislator assessment of opposition weight recalibrates once the Astroturf Coefficient is known. What appeared as 153 independent opponents becomes one company deploying coordinated messaging through undisclosed voices. Evidentiary weight of opposition testimony adjusts accordingly.

VII.B. Executive Session Prediction

Prediction: Compass will consolidate lobbying capacity in the narrow window preceding the January 30 executive session. Live testimony revealed conditional advocacy: Compass asserted neutrality only if opt-out amendments pass, while declining to address impact under the bill as written. High mobilization with identity masking indicates latent coordination capacity not yet expressed through direct institutional engagement.

Executive sessions, unlike public hearings, are closed, amendment-focused, and staff-driven—favoring actors with centralized legal and lobbying infrastructure. Compass’s public-hearing strategy (numerical opposition through undisclosed participation) will shift to private-channel strategy (direct staff outreach emphasizing “homeowner autonomy” and “privacy” rather than platform effects).

Expected Observable Actions (January 24–30, 2026):

Direct outreach to committee members and staff emphasizing “homeowner autonomy” and “privacy” rather than platform effects

Circulation of proposed amendment language mirroring the “homeowner requests otherwise in writing” carve-out

Alignment with external counsel or trade intermediaries to frame SB 6091 as over-inclusive rather than anti-competitive

Falsification Condition: Predictions are falsified if no Compass-aligned amendment language, staff outreach, or coordinated messaging emerges prior to the January 30 executive session.

VII.C. Post-Consolidation Containment Activation

Federal antitrust clearance of the Compass-Anywhere merger without structural remedy forecloses federal relief. SB 6091 functions as Post-Consolidation Containment (PCC)—behavioral standardization substituting for blocked structural enforcement. State legislatures become the site of market-repair rules that federal enforcement decline enabled.

MindCast AI’s Cognitive Digital Twin simulation registers PCC Activation = Likely and Structural Remedy Probability = Very Low. Dominant firms will contest state-level transparency rules via amendment, preemption, or litigation rather than compliance.

VII.D. Cross-Jurisdictional Pattern Recognition

The methodology demonstrated here—cross-referencing legislative sign-ins against employment databases—is replicable. Similar analysis of legislative participation in other states considering private listing restrictions (California, New York, Texas) will likely reveal comparable patterns. Compass’s coordinated opposition strategy is unlikely to be Washington-specific; AC provides a metric for measuring its deployment across jurisdictions.

Section VIII concludes with the core finding: SB 6091 would require transparent marketing of residential real estate; opposition to that transparency requirement was itself conducted without transparency.

VIII. Conclusion: Transparency Requirements Opposed Through Concealment

SB 6091 would require public marketing of residential real estate listings. Compass opposed that transparency requirement through systematic affiliation concealment. AC of 17:1 quantifies the gap between appearance and reality in the legislative record.

Compass profits from information asymmetry—private listing networks where Compass agents access inventory that outside buyers and brokers cannot see. Compass deployed information asymmetry in the legislative process—coordinated opposition where legislators could not see the coordination. The through-line is consistent: actors with structural incentives to control information flow will do so unless disclosure is mandated.

The hearing record, properly understood, strengthens rather than weakens the case for SB 6091. Compass’s participation strategy demonstrated through behavior exactly why transparency requirements are necessary. Free markets require open information. Democratic deliberation requires transparent participation. SB 6091 advances both principles. Coordinated opposition conducted through systematic concealment confirms why both principles need legislative protection.

Next in the MindCast AI Compass Law and Behavioral Economics of Antitrust Series: The companion publication—The Geometry of Regulatory Capture at the U.S. Department of Justice Antitrust Division (January 2026)—addresses why federal antitrust enforcement failed to act on the Compass-Anywhere merger, demonstrating that no survivable path exists from career-staff investigation to structural remedy. Together, the publications establish that state legislative action is not a substitute for federal enforcement—state action is the only available lever when federal enforcement is geometrically captured.

Appendix A: Methodology

MindCast AI verified Compass affiliations through cross-reference of Senate sign-in records with Compass website agent listings. Only current, verifiable Compass employment or brokerage affiliations were counted. Historical affiliations, ambiguous matches, and unverifiable claims were excluded. The methodology is designed to undercount rather than overcount coordinated participation.

Appendix B: Cognitive Digital Twin Metric Definitions

MindCast AI’s Cognitive Digital Twin simulation computed the following metrics for the SB 6091 legislative event. Metrics are directional and comparative; their value lies in ranking institutional behaviors, not claiming ground-truth measurement.

Capture Metrics

Astroturf Coefficient (AC): Ratio of undisclosed to disclosed coordinated participants. AC = Undisclosed Affiliates / Disclosed Affiliates. Observed: 17:1. Values >5:1 indicate severe information environment distortion.

Capture Presence: Categorical assessment of whether regulatory/legislative supply is contested rather than neutrally administered. Observed: High. Threshold: Nondisclosure rates >80% among coordinated participants trigger High designation.

Behavioral Equilibrium Metrics

Behavioral Convergence: Assesses whether identity masking has stabilized as dominant strategy. Observed: Stable. Convergence is Stable when >90% of coordinated participants adopt the same disclosure strategy.

Deviation Incentives: Measures whether participants would benefit from unilateral deviation. Observed: Low. Deviation Incentives are Low when disclosure reduces credibility without compensating benefit.

Truth-Revelation Metrics

Advocacy Arbitrage: Assesses whether advocacy has shifted from substantive explanation to access preservation. Observed: Active. Arbitrage is Active when witnesses defer substantive questions to off-record channels.

Truth Revelation: Assesses whether adversarial advocacy performs information-revelation function. Observed: Suppressed. Truth Revelation is Suppressed when business-model scrutiny produces deferral rather than defense.

Procedural Geometry Metrics

Geodesic Availability: Measures whether traversable paths exist from public participation to outcome influence. Observed: Low. Geodesic Availability is Low when procedural transition collapses accessible influence pathways.

Agenda Dominance: Assesses whether agenda access rather than preference aggregation governs outcomes. Observed: High. Agenda Dominance is High when testifying/non-testifying divide predicts influence better than stated position.

State Substitution Metrics

Post-Consolidation Containment (PCC) Activation: Assesses likelihood that state behavioral rules substitute for unavailable federal structural remedies. Observed: Likely. PCC Activation is Likely when federal clearance forecloses structural relief and state licensing authority provides alternative vector.

Structural Remedy Probability: Estimates probability that structural antitrust relief remains available. Observed: Very Low. Probability is Very Low when merger has closed, integration commenced, and no enforcement action targets the consolidated entity.

Methodological Note: Metrics are Cognitive Digital Twin simulation outputs, not ground-truth measurements. Value lies in comparative ranking across institutional events and generating falsifiable predictions. Full field-definitions maintained internally by MindCast AI.

Appendix C: Series Bibliography

Core Theoretical Framework

MCAI Economics Vision: The Stigler Equilibrium—Regulatory Capture and the Structure of Free Markets (January 2026). Establishes Enforcement Capture Equilibrium framework and core analytical vocabulary: Degree of Capture, Grammar Persistence Index, Update Elasticity. Develops Bootleggers-and-Baptists coalition analysis. Core theoretical foundation. https://www.mindcast-ai.com/p/stigler-equilibrium

SB 6091 and Compass-Anywhere Series

MCAI Lex Vision: Washington’s SB 6091 and Private Real Estate Market Control—Post Compass-Anywhere Consolidation Developments (January 2026). Analyzes SB 6091 as post-consolidation containment legislation. Documents dual-track enforcement structure and platform-neutral design. Establishes opt-out failure at platform scale. Direct predecessor. https://www.mindcast-ai.com/p/wa-sb-6091

Comparative Externality Costs in Antitrust Enforcement: A Nash-Stigler Foresight Study of Federal Enforcement Equilibria—Live Nation as Anchor, Compass-Anywhere as Validation (January 2026). Establishes $22 billion deadweight-loss baseline. Identifies Live Nation consent decree as anchor case demonstrating remedy insufficiency. Validates Compass-Anywhere as civil case with identical patterns. https://www.mindcast-ai.com/p/nash-stigler-livenation-compass

A Tirole Phase Analysis of Advocacy-Driven Antitrust Inaction at the U.S. Department of Justice (January 2026). Establishes Tirole Advocacy Arbitrage Phase diagnostic. Documents Access Arbitrage agents and channels. Introduces Skrmetti Vector for state enforcement substitution. Source for Defensive Deferral pattern analysis. https://www.mindcast-ai.com/p/tirole-advocacy-arbitrage

Federal Antitrust Breakdown as Nash-Stigler Equilibrium, Not Accident: The Stigler Equilibrium Series, Installment I on Harm Clearinghouse (January 2026). Formalizes Harm Clearinghouse model. Explains how dominant firms standardize conduct through legislative exceptions when federal enforcement enters inaction phase. https://www.mindcast-ai.com/p/stigler-harm-clearinghouse

The Geometry of Regulatory Capture at the U.S. Department of Justice Antitrust Division—Field-Geometry Reasoning, Coercive Narrative Governance, and the Structural Impossibility of Self-Correction (January 2026). Applies Field-Geometry Reasoning to demonstrate why DOJ cannot self-correct. Documents Constraint Density, Curvature Steepness, Geodesic Availability metrics. Companion publication. https://www.mindcast-ai.com/p/geometry-of-capture

Coercive Narrative Governance Framework

Coercive Narrative Shock and the Displacement of Public Trust (October 2025). Source framework for Coercive Narrative Governance mechanisms: Manufactured Consensus, Reality Denial, Role Reversal, Access Control. Foundation for understanding narrative control stabilizing regulatory capture. https://www.mindcast-ai.com/p/cngtrust

Coercive Narrative Distortion and Boundary Integrity (December 2025). Extends Coercive Narrative Governance framework to professional boundary collapse. Source for career staff trajectory analysis under capture conditions. https://www.mindcast-ai.com/p/coercive-boundaries

Foundational Methodology

Chicago School Accelerated: The Integrated, Modernized Framework of Chicago Law and Behavioral Economics (December 2025). Modernizes Chicago School framework by integrating Coase-Becker-Posner efficiency analysis with behavioral economics. Establishes System Coordination Integrity as market diagnostic. https://www.mindcast-ai.com/p/chicago-school-accelerated

Field-Geometry Reasoning: A Unifying Framework for Structural Explanation in Law, Economics and Artificial Intelligence (January 2026). Source framework for Field-Geometry Reasoning parameters: Constraint Density, Curvature Steepness Index, Geodesic Availability Ratio, Attractor Dominance Score. https://www.mindcast-ai.com/p/field-geometry-reasoning