MCAI Lex Vision: The Collapse of Compass's Co-Conspirator Theory

How Washington State Legislative Testimony Undercut Federal Antitrust Allegations

EXECUTIVE SUMMARY

The Washington State Bills. Senate bill SB 6091 and its House companion HB 2512 would require residential listing brokers in Washington to submit listings to a multiple listing service within one business day of marketing—closing the “private exclusive” loophole that allows brokerages to hold inventory off public markets indefinitely.

The Central Controversy: Compass seeks an amendment adding twelve words—”or if the homeowner requests otherwise in writing”—that would convert the transparency mandate into a scalable opt-out. With that amendment, Compass could embed the opt-out in standard listing agreements, train agents to present it as “premium service,” and preserve the private listing capacity its debt-laden balance sheet requires. Without it, Compass’s 3-Phased Marketing Strategy (Private Exclusive → Coming Soon → Active MLS) cannot survive in Washington.

The Co-Conspirators. Compass’s federal antitrust lawsuits name or imply a coordinated group working to exclude Compass from the market.

In Compass v. Northwest MLS (W.D. Wash.), Compass alleges NWMLS adopted anticompetitive rules at the direction of incumbent brokerages—identifying Windermere Real Estate as the dominant force, with six of fifteen board seats including Chair and Vice Chair.

Windermere Real Estate Services Company - Six of fifteen NWMLS board seats including Chair (David Maider) and Vice Chair (Jill Himlie). Largest brokerage in Washington with ~30% market share in Seattle.

The individual NWMLS Board members acting as representatives of their brokerages:

Coldwell Banker Cascade Real Estate

Century 21 Lund

John L. Scott Real Estate

RE/MAX Platinum Services

Keller Williams Premier Partners

Van Dorm Realty Inc.

Lake & Company Real Estate

Ensemble

Best Choice Realty

In Compass v. Zillow (S.D.N.Y.), Compass frames Zillow’s Listing Access Standards as monopolistic exclusion coordinated with MLS organizations.

Redfin Corp. - Explicitly named as co-conspirator. Adopted virtually identical policy to Zillow Ban. Glenn Kelman called Reffkin 41 minutes after Zillow-eXp announcement, revealed prior coordination with Zillow, urged Compass to “listen to Zillow.”

eXp Realty, LLC - Explicitly named as co-conspirator. Joint press release with Zillow issued same hour as Zillow Ban announcement. Largest brokerage by transaction volume in U.S.

California Regional Multiple Listing Service (CRMLS) - Complaint alleges pre-existing communications with Zillow; “within hours” proclaimed Zillow Ban compliant with IDX rules, suggesting coordination.

NAR - Complaint says Zillow “relied on NAR and the vast majority of local MLSs to further the aims of the conspiracy.”

The implicit theory: Windermere controls NWMLS governance, NWMLS coordinates with Zillow on listing standards, and together they operate a boycott designed to eliminate Compass’s private listing strategy. Every named defendant and implied co-conspirator—Windermere, NWMLS, Zillow—testified in support of Washington’s transparency legislation. The co-conspirator theory requires believing these actors secretly coordinated to harm Compass while publicly advocating for rules that would cost them money.

Compass brands itself as a technology company with a network. But when faced with the task of explaining whether that network is built through market manipulation, Compass simply reiterates its narrative—”Your Home. Your Choice. Your Freedom.”—rather than addressing the structural questions lawmakers pose. Washington’s January 2026 hearings revealed this pattern: each time legislators pressed on business model viability, fair housing enforcement, or competitive effects, Compass doubled down on consumer-choice framing without engaging the substance.

The doubling-down pattern exposes weakness. In the Senate, Chair Bateman asked whether Compass’s model survives “without the amendments.” Managing Director Brandi Huff deflected: “That is probably above what I feel comfortable speaking to.” In the House, Representative Santos asked Huff to cite the existing statutory protections she repeatedly invoked. Huff deferred to the Attorney General—who had testified in support of the bill. Rather than correcting course, Compass persisted with the same narrative across forums, creating a contemporaneous record that defendants can now weaponize.

Core Finding: The Washington record defeats Compass’s co-conspirator theory under the agreement-and-intent logic that drives § 1 conspiracy pleading and proof. The record also weakens the primary claims by strengthening rule-of-reason defenses and by recharacterizing Compass’s alleged injury as harm to a distribution-and-commission strategy rather than harm to competitive process. Over time, Compass’s pattern of narrative persistence—in lobbying, in litigation, in consumer marketing—reveals the corrections its legal strategy cannot afford to make. The primary claims weaken; the co-conspirator theory fails as a matter of agreement inference.

Foresight Outlook: Cognitive digital twin simulation projects that courts will treat the co-conspirator allegations as the weakest component of Compass’s cases and narrow or dismiss them before reaching the merits of primary claims. The simulation predicts defendants will converge on a unified framing—transparency as cooperative infrastructure validated by legislators, AGs, and market participants—while Compass remains locked into narrative commitments that foreclose strategic pivot. Other states will likely reference Washington’s record when considering similar legislation, increasing the cost of Compass’s litigation-first strategy.

ANALYTICAL FRAMEWORK

The following analysis applies three MindCast AI frameworks to the Washington legislative record:

1. The Litigation-Legislation Paradox

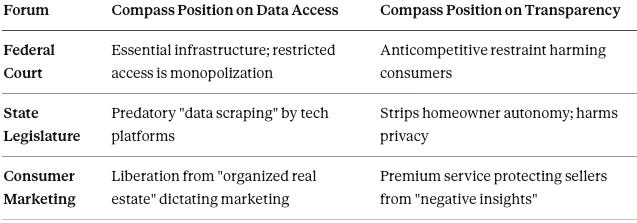

Compass’s arguments in federal court (data access as essential infrastructure unlawfully restricted) contradict its arguments in the statehouse (data access as predatory “scraping” that harms homeowners). The paradox creates an evidentiary stress test: positions that diverge across forums expose intent, undermine credibility, and provide impeachment material. HB 2512 and the Collapse of Compass’s Coordinated Opposition

2. Platform Extraction vs. Cooperative Infrastructure

Windermere views the MLS as cooperative infrastructure ensuring a level playing field for every broker, regardless of size. Compass views the MLS as a utility it should be allowed to bypass to extract premium value through its private platform. The philosophical divergence explains why Windermere—the firm Compass implicitly names as co-conspirator—testified in favor of transparency rules. The “conspiracy” Compass alleges is actually a broad-based defense of cooperative market structure against platform extraction. Compass vs. Windermere: A Clash of Market Philosophies

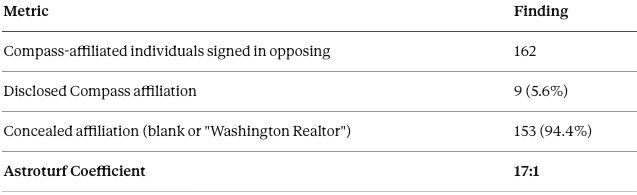

3. Narrative Pre-Installation and the Astroturf Coefficient

Narrative pre-installation differs from traditional lobbying. Traditional lobbying argues for outcomes. Narrative pre-installation assumes outcomes—treating the preferred frame as already reasonable and asking constituents to demand what has been rendered intuitive. The VoterVoice campaign, compass-homeowners.com framing, and coordinated testimony all converge on a single twelve-word amendment without requiring overt coordination. The 17:1 concealment ratio (153 undisclosed vs. 9 disclosed Compass affiliations) documents manufactured grassroots appearance—the Astroturf Coefficient that undermines Compass’s “homeowner choice” narrative.

The three frameworks structure the analysis that follows.

Contact mcai@mindcast-ai.com to partner with us on Law and Behavioral Economics foresight simulations. This publication is part of MindCast AI’s Compass-Washington State Legislature series:

The Astroturf Coefficient: Analyzing the Jan 23 Senate Hearing

HB 2512 and the Collapse of Compass’s Coordinated Opposition

Narrative Pre-Installation and the Infrastructure of Exception Capture

How Compass’s State Legislative Testimony Undermined its Federal Antitrust Claims

Compass vs. Competition: The Case for SB 6091 / HB 2512 Without an Opt-Out Exception

I. THE LITIGATION–LEGISLATION PARADOX

Analysts cannot evaluate Compass’s antitrust posture in isolation from its contemporaneous public advocacy. In early 2026, Compass argued opposite positions in two forums that test the same market facts: federal court and the Washington legislature. Antitrust liability depends on coherent theories of competition and injury; legislative hearings force specificity that pleadings can obscure.

Compass attacked transparency rules in federal court in 2025 through lawsuits against Northwest MLS and Zillow. At the same time, Compass opposed state transparency legislation in Washington. The juxtaposition forces a coherence test: litigation positions must survive contact with public advocacy when the same firm tells lawmakers that transparency harms homeowners while telling courts that restricted visibility harms consumers.

The litigation–legislation paradox is an evidentiary stress test. Once positions diverge across forums, courts gain a basis to question intent, injury, and credibility.

Insight: Antitrust theories fail fastest when the plaintiff advances incompatible definitions of competition across forums.

II. THE FEDERAL LITIGATION LANDSCAPE (STEELMAN)

Before incorporating the Washington record, we must state Compass’s complaints at their strongest. The steelman establishes the baseline Compass asked courts to accept in 2025.

A. Compass v. Zillow (S.D.N.Y.)

Compass frames Zillow’s Listing Access Standards as monopolistic exclusion aimed at preserving Zillow’s lead-generation rents. The complaint alleges:

“The Zillow Ban seeks to ensure that all home listings in this country are steered onto its dominant search platform so Zillow can monetize each home listing and protect its monopoly… It eliminates a new and innovative business model that creates competitive differentiation in the market.”

The passage supplies Compass’s core theory: transparency is a pretext for platform rent extraction, and Compass’s three-phased strategy is an innovation suppressed to protect monopoly revenue.

B. Compass v. Northwest MLS (W.D. Wash.)

Compass alleges horizontal conspiracy through governance control. The complaint asserts:

“NWMLS has successfully prevented any meaningful threat to itself and its owner-brokerages by adopting and enforcing a series of rules designed to force anyone wishing to buy or sell a home… to do so through its platform… its Board of Directors comprises competitors… six affiliated with the largest real estate brokerage in Washington state (Windermere).”

Here Compass identifies structural board control as the plus factor converting neutral rules into a private agreement among incumbents to exclude a disruptive rival.

Standing alone, these pleadings present colorable antitrust narratives. Their fragility emerges only once real-world justifications and admissions enter the record.

Insight: The strength of a conspiracy theory at the pleading stage depends on the absence of independent, lawful explanations.

III. THE WASHINGTON LEGISLATIVE RECORD

Legislative hearings create contemporaneous, attributable evidence under unscripted questioning. When testimony occurs while litigation is pending, it becomes a powerful comparator for assessing coherence and intent. SB 6091 represents post-consolidation containment legislation—an attempt to close the conduct channel before platform-scale extraction becomes entrenched.

A. Senate Housing Committee Hearing on SB 6091 (January 23, 2026)

Supporters reframed private exclusivity as systemic exclusion. Senator Marko Liias, introducing the bill, stated:

“It is fundamentally about competition and fairness in access to housing… We know that these private listings, ultimately, if we allow this model to perpetuate, threaten consumer protection, fair housing, and competition.” (Senate Hearing, 03:27)

Liias quoted U.S. Senators Elizabeth Warren and Ron Wyden:

“These kinds of private markets create a two-tiered system where insiders get to see and compete for real estate inventory earlier and with less competition, while outsiders, including many first-time buyers, immigrants, and lower wealth and lower-income households, may be shut out of equal housing opportunity.”

The Warren-Wyden framing converts Compass’s “innovative staging ground” into a fair-housing risk and anchors transparency rules in public policy rather than private coordination. From Open Market to Private Governance, Coordination Capture in the Compass–Anywhere Merger.

Compass’s response relied on homeowner autonomy. Brandi Huff, Compass’s Managing Director for the Pacific Northwest, argued:

“This bill effectively strips Washington homeowners of the right to decide how their private property is marketed… We must ask who the true beneficiaries are of this bill. It is not the homeowner. It is the dominant third-party platform providers whose business models rely on the harvesting of data of every available listing. The state should not be legislating to protect those data-scraping interests of tech platforms at the expense of homeowners’ rights.” (Senate Hearing, 42:23)

Huff’s framing shifted Compass’s narrative from consumer welfare to property rights—and characterized public listing access as predatory “data scraping”—setting up a direct conflict with Compass’s federal characterization of restricted visibility as harmful to consumers.

B. House Consumer Protection and Business Committee Hearing on HB 2512 (January 28, 2026)

Independent testimony reframed Compass’s “innovation” narrative as platform extraction. Nicole Bascom-Green, an independent broker unaffiliated with alleged conspirators, owner of Bascom Real Estate Group, and a member of the Black Home Initiative, testified in both chambers. In the Senate:

“This is about the largest company in the country wanting to get both sides of the compensation, because they will. The buyer side and the seller side, they will get both sides of the compensation, and they will be able to lock out small brokers like myself who won’t be able to compete in this type of market.” (Senate Hearing, 52:03)

In the House, she elaborated on the market dynamics:

“Imagine the largest brokerage in the country is having pocket listings in marketplaces where ultimately the bottom line is they can control both sides of the transaction… Having pocket listings in a market allows a real estate brokerage to control all the flow of information for specific spaces.” (House Hearing, 01:01:29)

The “Platform Extraction” vs. “Innovation” Reframe: Compass characterizes its 3-Phased Marketing Strategy (Private Exclusive → Coming Soon → Active MLS) as “innovation” that competitors seek to suppress. Bascom-Green reframes the strategy as extraction: “locking out” small brokers to capture “both sides of the compensation.” Her testimony shifts the optics from Compass’s preferred “David vs. Goliath” narrative (innovative disruptor vs. entrenched incumbents) to a “Monolith vs. Main Street” story (Wall Street-backed platform vs. independent, minority-owned brokerages). Under rule-of-reason analysis, protecting small and minority-owned businesses from platform extraction is a cognizable procompetitive benefit.

Adria Buchanan, Executive Director of the Fair Housing Center of Washington, connected market structure to fair housing:

“When homes are publicly listed and broadly advertised, they reach the very communities that housing markets have historically excluded, including communities of color, people with disabilities, and first-time homebuyers. Open listings allow people to identify, pursue, and compete fairly for housing. We are working so hard to get housing online. Our efforts are futile if we cannot facilitate fair competition for that housing.” (House Hearing, 01:03:59)

Buchanan’s testimony supplies a lawful, non-collusive rationale for transparency rules: protecting fair housing goals and small and minority-owned brokerages from extraction by a scaled platform.

The Washington Attorney General’s Civil Rights Division validated the bill’s fair housing purpose while critiquing only the enforcement mechanism. Shalia Stallings, Managing Assistant Attorney General in the Civil Rights Division, testified:

“The Attorney General’s office supports a competitive marketplace and works hard to enforce that... The bill may benefit members of protected classes... And where discrimination isn’t occurring, the WLAD is already a powerful tool that can be used in this space. So if the legislature moves this bill forward, we just ask that you find a more appropriate enforcement mechanism outside of the WLAD.” (Senate Hearing, 48:51; House Hearing, 56:46)

Neutralizing the Pretext Allegation: Compass’s federal complaints allege that “fair housing” is a pretext—a convenient excuse co-conspirators use to coordinate a boycott. The AG testimony destroys the pretext theory. When a neutral state civil rights agency validates the fair housing purpose of transparency rules, the co-conspirators (Zillow, NWMLS, Windermere) move from “defendants with a convenient excuse” to “market leaders aligned with state civil rights policy.” The AG’s only objection was to enforcement mechanics, not purpose.

The Washington record supplies independent public-interest rationales that sit uneasily with Compass’s litigation story.

Insight: Once neutral state actors validate the purpose of challenged conduct, pretext-based conspiracy claims collapse.

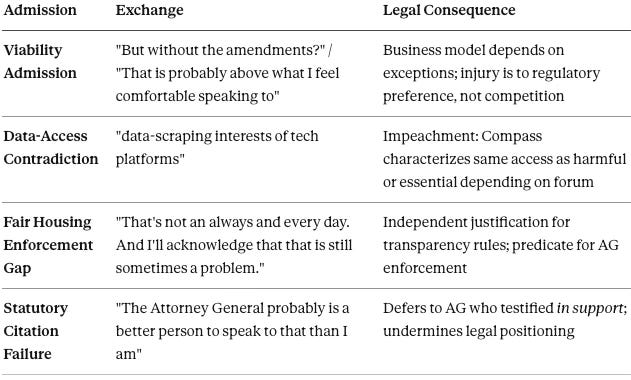

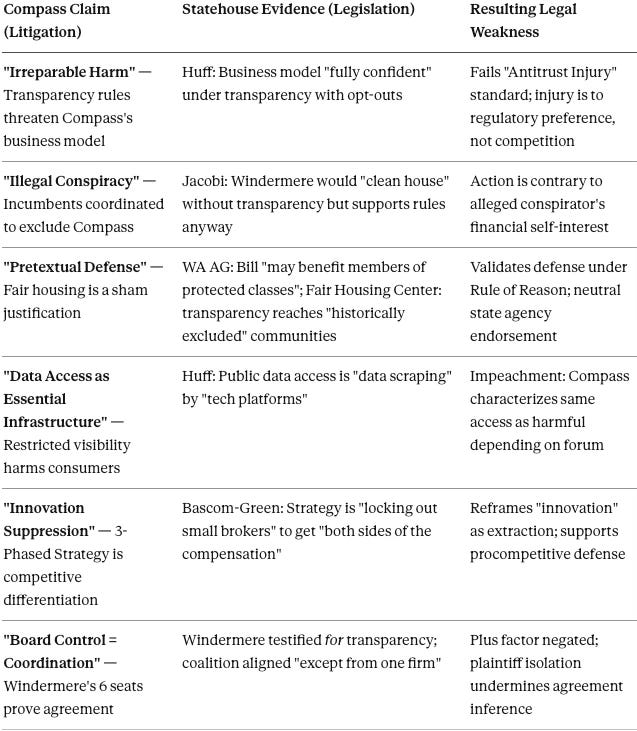

IV. TESTIMONIAL ADMISSIONS THAT SHIFT LIABILITY

Legislative testimony compressed inference distance by producing direct statements about business models, incentives, and enforcement gaps. Four admissions are particularly damaging to Compass’s federal theories.

A. The Viability Admission (The Smoking Gun)

The most damaging admission came under direct questioning from lawmakers about Compass’s business model viability. Senator Alvarado asked Huff how Compass’s model “syncs with” competition given the Trump administration had just approved a merger making Compass “the largest Wall Street-backed real estate brokerage in the country.” The exchange:

SENATOR ALVARADO: “I’m hoping you can help me understand a little bit more about the Compass business model… when you layer on an exclusive network, I’m wondering what that means for broader competitiveness of housing selling and buying in our state. It makes me think about this as a pro-competition bill, and I’m wondering how your business model syncs with that.”

HUFF: “I feel fully confident to say that the Compass business model would not be affected by this bill, specifically with the amendments for the sellers to have the right to make their own choice.”

CHAIR BATEMAN: “But without the amendments?”

HUFF: “I will tell you this. That is probably above what I feel comfortable speaking to because my job currently is to support the brokers in our community. As far as the merger and acquisition and higher level business model, that’s probably above.”

(Senate Hearing, 44:41–45:57)

The Conflict: In federal court, Compass characterizes NWMLS and Zillow rules as existential threats that stifle innovation and exclude Compass from competition. The complaints frame transparency requirements as a coordinated boycott designed to eliminate Compass’s business model.

The Admission: Huff stated she was “fully confident” the business model would not be affected—if homeowners retained an opt-out. When pressed on what happens without the opt-out, she deflected rather than claiming injury.

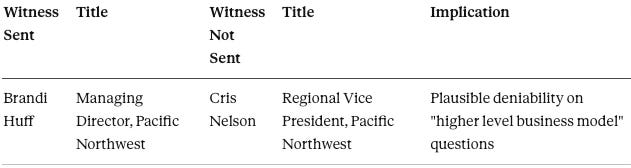

Witness Selection as Evidence of Awareness: The deflection may reflect deliberate witness selection. Compass sent Brandi Huff, Managing Director, rather than Cris Nelson, Regional Vice President for the Pacific Northwest—a choice that created plausible deniability on “higher level business model” questions. A Regional VP could not credibly claim that merger implications and business model viability were “above” her knowledge. By selecting a witness who could plausibly defer strategic questions, Compass attempted to contain the blast radius of legislative testimony. But evasion under direct legislative questioning carries its own inference: Compass understood the question’s implications and chose a witness positioned to avoid answering.

The Narrative Persistence Pattern: Rather than engaging Senator Alvarado’s substance—how does an exclusive network affect “broader competitiveness”?—Huff reiterated the consumer-choice frame: sellers should “have the right to make their own choice.” When that frame failed to satisfy Chair Bateman’s follow-up, Huff deflected entirely. The pattern recurred throughout both hearings: substantive question, narrative response, follow-up pressure, deflection. Compass did not adjust its message to address legislative concerns; Compass repeated its message until the questioning moved on.

Strategic Significance: Defense counsel can use the persistence pattern to argue that Compass’s injury is not “antitrust injury” (harm to competition) but rather a preference for a specific regulatory loophole. If the business model is “fully confident” under transparency laws with narrow exceptions, the claim of a conspiratorial boycott collapses. Antitrust standing requires injury to competition, not injury to a firm’s preferred regulatory environment. The witness selection and narrative persistence patterns reinforce that Compass knew direct answers would undermine its federal litigation posture—and chose repetition over engagement.

B. Data-Access Contradiction

In court, Compass treats restricted data access as exclusionary monopolization—defendants unlawfully withholding essential market infrastructure. Before legislators, Huff characterized broad distribution as predatory “data scraping”:

“The state should not be legislating to protect those data-scraping interests of tech platforms at the expense of homeowners’ rights to decide how their largest asset is marketed.” (Senate Hearing, 42:23)

Defendants can now argue Compass’s data-access position flips based on who controls inventory visibility. When Compass controls access (through private exclusives), restricted visibility is “premium service.” When platforms control access (through listing standards), restricted visibility is monopolization.

C. Fair-Housing Enforcement Gap

When pressed on how opt-outs would ensure fair housing compliance, Huff acknowledged the limits of Compass’s disclosure-based approach:

CHAIR BATEMAN: “How would you ensure that the Fair Housing Act is actually abided by when you’re just marketing it to a select group of people and not opening it up to the public?”

HUFF: “I think our job as a professional is to educate the client on fair housing and make sure that they continue to comply with that to the best of our ability. That’s not an always and every day. And I’ll acknowledge that that is still sometimes a problem.”

(Senate Hearing, 47:31)

Huff’s acknowledgment supplies an independent justification for transparency rules: addressing an enforcement gap that Compass’s own witness concedes exists.

D. Statutory Citation Failure

In the House, Representative Santos pressed Huff to identify the existing statutory protections she repeatedly invoked:

REP. SANTOS: “Would you be kind enough to just let us know where in the current statutes the state protections are that you keep referencing?”

HUFF: “The Washington law against discrimination is fully encompassing of the practices of a real estate broker. And I think the Attorney General probably is a better person to speak to that than I am.”

(House Hearing, 43:44–44:28)

The deflection to the Attorney General—who testified in support of the bill’s purpose—undermines Compass’s legal positioning across forums.

E. Testimonial Admissions Summary

F. Narrative Persistence Pattern

Taken together, these admissions convert Compass’s theory into a credibility and intent problem.

Insight: Admissions under public questioning collapse inference-heavy antitrust theories faster than discovery.

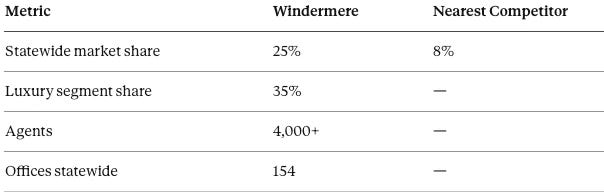

V. THE WINDERMERE FALSIFICATION

A co-conspirator theory depends on aligning incentives. When the actor most positioned to benefit from challenged conduct publicly rejects that conduct and supports the rules plaintiff attacks, the conspiracy inference collapses. The Windermere testimony illustrates the core philosophical conflict: Platform Extraction vs. Cooperative Infrastructure.

Compass’s NWMLS complaint identifies Windermere’s board control—six of fifteen seats, including Chair and Vice Chair—as the plus factor establishing agreement. But Windermere’s leadership testified in favor of transparency legislation, revealing a fundamentally different market philosophy.

OB Jacobi, President of Windermere Real Estate, told the Senate committee:

“My name is Obi Jacobi. I’m the president of Windermere Real Estate Company, and I’m here in support of Senate Bill 6091. Windermere is the largest brokerage in Washington State by a lot. We have 4,000 agents… and 154 offices across the state. We enjoy a 25% market share across all price points and a 35% in the luxury space. And to put it in perspective, the nearest competitor is 8%... And to say that no other company would reap the benefits of a private listing network would be Windermere. We would clean house, if you would, if this bill doesn’t pass, which sounds ridiculous. We’ve worked really, really hard for decades to create a fair and open marketplace that’s transparent. And this bill continues to push transparency, and we just urge you to support and pass this bill.” (Senate Hearing, 50:38)

Lucy Wood, Windermere’s Western Washington Regional Director, elaborated in the House:

“I share these numbers with you because if we were solely driven by profit margins, Windermere would be one of the largest beneficiaries of having a private exclusive listing network. With our market share, we could keep both sides of the transaction in-house and easily recruit brokers to keep growing that market share to the detriment of other brokerages and the consumers. In some communities like Seattle, Bellingham, and Spokane, where we have significant market share, access to real estate information could be controlled by Windermere. And selfishly, while that would be good for us, that is bad for the consumers because it restricts access to the information that both buyers and sellers need to make smart fiscal decisions.” (House Hearing, 49:45)

The Market Philosophy Divergence: As detailed in Compass vs. Windermere: A Clash of Market Philosophies, Windermere views the MLS as cooperative infrastructure that ensures a level playing field for every broker, regardless of size. Compass views the MLS as a utility it should be allowed to bypass to extract premium value through its private platform. The divergence explains why the alleged co-conspirator testified against its own short-term financial interest: Windermere’s market philosophy prioritizes cooperative infrastructure over platform extraction. The difference is not corporate character—it is balance-sheet structure. Compass’s $2.5 billion inherited debt from the Anywhere mergercreates the forcing function that makes transparency structurally unsustainable.

Windermere’s testimony constitutes an admission against interest by the alleged co-conspirator: Windermere acknowledges it would financially benefit from private exclusives, explicitly states such a system would harm consumers, and supports transparency rules despite that financial interest. The “conspiracy” Compass alleges is actually a broad-based defense of cooperative market structure.

When the actor with the most to gain rejects the alleged cartel outcome, conspiracy inference collapses.

Insight: Self-disadvantaging advocacy by a dominant incumbent defeats claims of incumbent-protective collusion.

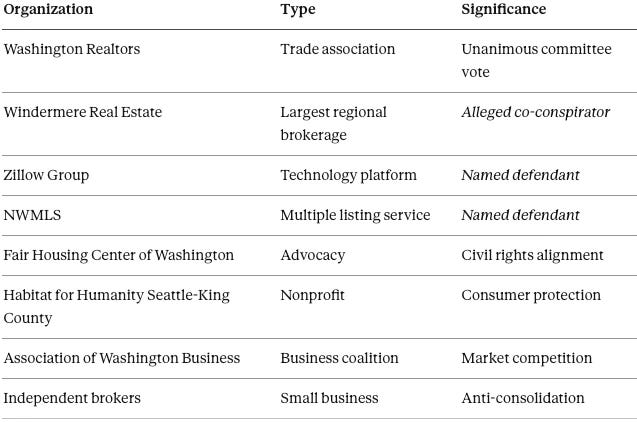

VI. COALITION ISOLATION: “EXCEPT FROM ONE FIRM”

Introduction. Antitrust conspiracy analysis looks for plus factors making agreement more plausible than lawful parallel conduct. Industry-wide alignment against the plaintiff’s position negates the coordination inference.

James Fisher, Vice President of Government Affairs for Washington Realtors, documented the coalition alignment:

“Washington Realtors remains committed to progress, so our Legislative Issues Committee voted unanimously in collaboration with our leadership team to support this bill. Since that time, we’ve heard from a number of our members, brokerages, industry partners across the state, except from one firm. We are proud to support SB 6091.” (Senate Hearing, 38:28)

The supporting coalition included:

The opposing position: Compass, Inc. (sole institutional opponent).

Tracy Choate, owner of a 40-person independent brokerage, explained the market reality:

“I believe private exclusive listing networks are poised to drive brokerage consolidation. The result of this being small brokerages, such as mine, will cease to exist, and consumers may end up with one or two monolithic firms controlling who and how people can buy or sell their real estate.” (House Hearing, 51:49)

The “Broad-Based Industry Survival Movement”: As documented in HB 2512 and the Collapse of Compass’s Coordinated Opposition, the testimony of independent brokers like Nicole Bascom-Green and Tracy Choate shifted the focus from Zillow’s alleged “monopoly” to Compass’s potential to “lock out” small competitors. The hearing established that the opposition to Compass was not a cartel of giants coordinating to exclude a disruptor, but a broad-based industry survival movement—independent brokers, minority-owned firms, fair housing advocates, and consumer protection organizations aligned against platform extraction.

Coalition breadth defeats Compass’s agreement narrative. When alleged co-conspirators, named defendants, fair housing advocates, and small brokerages all support the challenged rules, the inference of coordination to harm Compass vanishes. The “conspiracy” is a public utility defense.

Insight: Plaintiff isolation is a red flag for conspiracy pleading.

VII. THE ASTROTURF COEFFICIENT

Introduction. Rule-of-reason analysis examines whether a plaintiff’s procompetitive justifications are credible. Coordinated non-disclosure of corporate affiliation undermines claims of organic consumer support.

MindCast AI analysis of the January 23 Senate hearing documented systematic affiliation concealment among Compass-affiliated witnesses. The Narrative Pre-Installation study traced the pattern to a three-tier influence apparatus: VoterVoice grassroots manufacturing, compass-homeowners.com consumer framing, and coordinated legislative testimony—all converging on a single twelve-word amendment: “or if the homeowner requests otherwise in writing.”

For every individual who disclosed Compass affiliation, seventeen concealed it.

Example: Jennifer Ng testified as a “nationally certified senior advisor” and licensed real estate broker, focusing her testimony on protecting vulnerable seniors from the burden of public marketing. She did not disclose her role as Sales Manager at Compass Fremont. Her framing presented corporate opposition as citizen concern.

Strategic Significance: Under rule-of-reason analysis, courts evaluate whether a plaintiff’s procompetitive justifications are genuine or pretextual. Compass claims private exclusives protect “homeowner choice.” But when the firm’s opposition required manufactured grassroots appearance—with 94% of affiliated witnesses concealing their connection—courts can question whether the “consumer protection” narrative reflects actual consumer preferences or corporate messaging.

The Astroturf Coefficient also bears on “clean hands” analysis. Compass asks courts to condemn defendants’ transparency rules as anticompetitive while simultaneously deploying coordinated non-disclosure to obscure its own market position before legislators.

Coordinated concealment undermines Compass’s consumer-welfare narrative.

Insight: Astroturf patterns are evidence of narrative construction, not organic market preference.

VIII. THE THREE-FORUM CONTRADICTION

Introduction. Antitrust theories must remain coherent across contexts. When the same firm advances incompatible positions depending on audience, courts can infer opportunism rather than principle.

Forum 1 – Federal Court: Compass argues transparency requirements are anticompetitive restraints that harm consumers by restricting access to innovative marketing options. Data access is essential market infrastructure.

Forum 2 – State Legislature: Compass argues transparency requirements harm homeowners by enabling “data scraping” by tech platforms. Opt-outs protect consumer autonomy.

Forum 3 – Consumer Marketing: On compass-homeowners.com, Compass frames restricted visibility as liberation from “organized real estate” that “dictates how listings must be marketed.”

The three positions cannot coexist. Restricted data access cannot simultaneously be exclusionary monopolization (federal) and consumer protection (legislative). Transparency cannot simultaneously harm competition (federal) and enable predatory scraping (legislative).

The contradiction converts Compass’s theory from a competition story into a coherence problem. Compass has not adjusted its narrative to address the contradictions—the same “homeowner choice” and “data scraping” frames persist across forums despite their mutual incompatibility. The persistence reveals that Compass cannot correct course without abandoning the federal litigation theory or the legislative strategy. Narrative inflexibility is itself evidence of constraint.

Insight: In antitrust, inconsistency across forums is evidence, not spin.

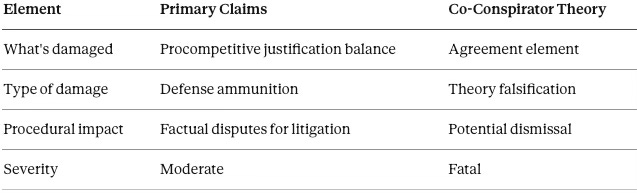

IX. DIFFERENTIAL IMPACT: PRIMARY CLAIMS VS. CO-CONSPIRATOR THEORY

Not all claims fail the same way. The Washington record affects the primary claims and co-conspirator allegations through different legal mechanisms and with different severity.

A. Primary Claims (Weakened)

Rule-of-reason balancing weakens the primary claims against NWMLS and Zillow:

Procompetitive justification: The “data scraping” characterization supplies defendants with a consumer-protection rationale for transparency rules.

Standing questions: The “without the amendments” admission suggests Compass’s injury targets its distribution strategy, not market competition.

State-action immunity: If SB 6091 passes, NWMLS rules implement clearly articulated state policy under Parker v. Brown.

The weaknesses create defense ammunition—factual disputes that complicate Compass’s case but do not necessarily defeat it at the pleading stage.

B. Co-Conspirator Theory (Destroyed)

The co-conspirator theory fails categorically because agreement inference collapses:

Windermere falsification: The alleged board-controlling incumbent publicly supports the rules Compass challenges and acknowledges private exclusives would benefit Windermere but harm consumers.

Coalition unanimity: Alleged co-conspirators unanimously support transparency; only Compass opposes.

Logical incoherence: Compass’s theory requires believing Windermere conspired to adopt rules that prevent Windermere from leveraging its market share.

Under Twombly and Matsushita, lawful independent explanations now dominate, making conspiracy implausible as a matter of law.

The asymmetry matters for litigation strategy. Defendants can use legislative admissions defensively on the primary claims while moving for judgment on co-conspirator allegations that the public record falsifies.

Insight: Conspiracy theories collapse faster than rule-of-reason claims when independent rationales dominate.

SUMMARY: LITIGATION VS. LEGISLATION

The following table maps Compass’s federal litigation claims against the Washington legislative record, identifying the resulting legal weakness for each:

XI. COGNITIVE DIGITAL TWIN FORESIGHT SIMULATION

The following foresight simulation models how institutions are likely to behave once the Washington legislative record exists as a fixed public constraint. The simulation does not restate legal doctrine. Predictions are conditional, falsifiable, and time-bounded.

Modeled Actors and Constraint Geometry

Compass, Inc. Three interacting forces constrain Compass: (i) balance-sheet pressure following post-merger leverage, (ii) installed narrative commitments (”homeowner choice,” “privacy,” “data scraping”), and (iii) an irreversible legislative testimony record created while federal litigation remained pending. The constraints sharply limit Compass’s ability to pivot without abandoning either its litigation theory or its lobbying posture.

Northwest MLS and Windermere. Public, self-disadvantaging testimony affirming transparency as cooperative market infrastructure constrains NWMLS and Windermere. Having acknowledged that private exclusives would financially benefit them but harm consumers, their strategic space now favors consistency and institutional credibility over tactical discretion.

Zillow and Aligned Platforms. A legislative record that reframes listing access standards as market-integrity and fair-housing mechanisms constrains Zillow. Optimal strategy anchors defenses in uniform access, price discovery, and consumer protection rather than competitive rivalry narratives.

State Legislators. An evidentiary record explicitly tying transparency to fair housing and competition constrains legislators. Incentives favor codification without opt-outs to prevent regulatory arbitrage and reduce federal preemption risk.

State Attorneys General. AG offices face constraints from their own testimony validating the purpose of transparency rules and from acknowledged enforcement gaps in private-exclusive regimes. Strategic options increasingly run parallel to consumer-protection and civil-rights enforcement rather than antitrust alignment with Compass.

Foresight Predictions (12–24 Month Horizon)

System-Level Outlook

The simulation indicates a geometry-dominated environment. Once legislative testimony hardens transparency as a public-interest norm, strategic intent yields to constraint. Actors adapt within that geometry rather than attempting to overturn it. Compass’s remaining leverage concentrates in narrow factual disputes within its primary claims, while the conspiracy narrative loses predictive viability.

Insight: When public records harden into constraint, foresight favors institutions that adapt to geometry rather than argue against it.

XII. CONCLUSION: TESTIMONY AS INADVERTENT DISCOVERY

Legislative testimony often functions as inadvertent discovery—contemporaneous, attributable statements made without counsel coaching and under conditions that approximate cross-examination. As established in How Compass’s State Legislative Testimony Undermined its Federal Antitrust Claims, litigation positions must survive contact with public advocacy.

The Pattern of Narrative Persistence: Compass brands itself as a technology company with a network. When legislators asked whether that network depends on market manipulation, Compass did not adjust—it reiterated. When Chair Bateman asked “but without the amendments?”, Huff deflected rather than explaining how transparency serves consumers. When Representative Santos requested statutory citations, Huff deferred rather than defending the legal framework. When Senator Gaynor pressed on fair housing enforcement, Huff acknowledged the gap rather than proposing a mechanism.

The doubling-down pattern reveals what Compass cannot say: that its business model requires exceptions to transparency, that its “innovation” is margin extraction through information control, and that the “conspiracy” it alleges is actually industry-wide recognition that private exclusives harm consumers. Each deflection, each deference, each narrative repetition adds to a record that defendants can cite.

The Washington record provides:

Chair Bateman’s “without the amendments?” follow-up — producing an admission that Compass’s model depends on exceptions to transparency

Windermere’s self-disadvantaging testimony — market-participant expert analysis confirming private exclusives are exclusionary

Coalition documentation — “except from one firm” as contemporaneous evidence of plaintiff isolation

Forum contradiction — “data scraping” characterization directly impeaching federal data-access arguments

Once testimony enters the record, persuasion gives way to constraint. Compass cannot maintain incompatible positions across forums when the same witnesses speak in public hearings while federal litigation is pending.

Washington’s January 2026 record undercuts Compass’s conspiracy narrative and supplies defendants with pro-competitive explanations for the rules Compass attacks. As detailed in Compass’s Strategic Use of the Co-Conspirator Narrative, the co-conspirator theory always depended on inference—requiring courts to conclude that industry-wide support for transparency masked a secret agreement to harm Compass. The legislative record collapses that inference.

The foresight simulation projects what follows: courts narrow or dismiss the co-conspirator allegations before reaching merits; defendants converge on transparency-as-infrastructure framing; other states replicate Washington’s approach; and Compass remains locked into narrative commitments that foreclose strategic pivot. Over time, Compass’s pattern of narrative persistence—refusing to engage substance, reiterating framing, deflecting direct questions—exposes the weaknesses in its lobbying, its litigation, and its market position. The primary claims weaken; the co-conspirator theory fails as a matter of agreement inference.

Insight: When public records harden into constraint, foresight favors institutions that adapt to geometry rather than argue against it.