MCAI Lex Vision: Compass vs. SB 6091, Narrative Pre-Installation and the Infrastructure of Exception Capture

A Structural Mechanism Study of the Public Affairs Apparatus Behind Washington's Real Estate Transparency Fight

Companion to January 2026 MindCast AI publications: Windermere and Compass, Two Philosophies of Real Estate , The Compass Astroturf Coefficient at the Washington State Senate , Washington's SB 6091 and Private Real Estate Market Control, HB 2512 and the Collapse of Compass’s Coordinated Opposition, How Compass’s State Legislative Testimony Undermined its Federal Antitrust Claims , The Collapse of Compass’s Co-Conspirator Theory , Compass vs. Competition: The Case for SB 6091 / HB 2512 Without an Opt-Out Exception.

Executive Summary

Compass Real Estate operates a three-tier public affairs apparatus—grassroots manufacturing, consumer framing, and coordinated legislative testimony—engineered to deliver a single amendment to Washington’s SB 6091: “or if the homeowner requests otherwise in writing.” The twelve-word phrase would convert a transparency mandate into a scalable opt-out regime, preserving the private listing capacity that Compass’s debt-laden balance sheet makes essential. The apparatus includes the VoterVoice campaign that scripts constituent pressure, the compass-homeowners.com site that frames inventory sequestration as consumer freedom, and coordinated testimony that delivered the amendment language—including a Compass Sales Manager who did not identify her corporate role during testimony. Compass’s current capital structure increases the payoff to information control and reduces the payoff to cooperative infrastructure. The receipts are below.

In January 2026, Compass completed one of the largest residential brokerage mergers in U.S. history—absorbing Anywhere Real Estate after bypassing DOJ antitrust review by appealing above Antitrust Division chief Gail Slater to Deputy Attorney General Todd Blanche, with Trump-aligned lobbyist Mike Davis facilitating. (Dave Michaels, “Compass hired a Trump-aligned lawyer and won antitrust clearance without detailed probe that some enforcers wanted”, WSJ, January 9, 2026.)

The Anywhere merger added $2.5 billion in debt to Compass’s already-strained balance sheet. Compass–Anywhere, When Scale Becomes Liability (MindCast AI, January 2026). The debt explains everything that followed. Windermere and Compass, Two Philosophies of Real Estate, Cooperative Infrastructure vs. Platform Extraction (MindCast AI, January 2026).

The federal bypass and the state-level apparatus documented below are two fronts in the same campaign. Once the federal conduct channel was cleared through political pressure, Compass pivoted to secure the state channel before SB 6091 could take effect.

Prior MindCast AI analysis established that Compass’s private listing strategy is not a consumer feature—it’s a survival mechanism. Private listings enable dual-end commission capture: when both buyer and seller originate within Compass’s network, the platform keeps 100% of the commission pool. Windermere—the Washington brokerage with the most to gain from private listings—testified for SB 6091: “We would clean house... which sounds ridiculous.” The difference is balance-sheet structure, not corporate character. (Washington’s SB 6091 and Private Real Estate Market Control (MindCast AI, January 2026).

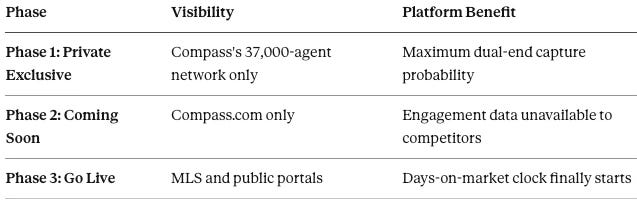

SB 6091 threatens the architecture by requiring concurrent public marketing of residential listings. The bill closes the conduct channel that Compass’s 3-Phase Marketing Strategy exploits. Under SB 6091 as written, Compass cannot hold inventory off the MLS during the critical early-marketing period when buyer interest peaks.

So Compass mobilized. At the January 23 hearing, 162 Compass-affiliated individuals registered opposition—but only 9 disclosed their affiliation. The remaining 153 concealed it, producing an Astroturf Coefficient of 17:1: for every one participant who disclosed a Compass tie, seventeen concealed it. (The Compass Astroturf Coefficient at the Washington State Senate, MindCast AI, January 2026). The prior analysis quantified coordinated non-disclosure. The current publication shows the infrastructure producing it.

The pattern generalizes beyond Compass, beyond real estate, beyond Washington State. When statutory reform threatens to close a conduct channel, dominant firms do not simply comply or openly resist. They reroute influence through narrative infrastructure: consumer-facing “education” platforms, broker-mediated scripts, and manufactured constituency pressure that conditions how lawmakers, regulators, and consumers interpret choice, privacy, and enforcement—before the vote occurs.

Narrative pre-installation differs from traditional lobbying. Traditional lobbying argues for outcomes. Narrative pre-installation assumes outcomes—treating the preferred frame as already reasonable and asking constituents to demand what has been rendered intuitive. The VoterVoice campaign documented below does not argue that seller opt-outs are good policy; it assumes opt-outs are natural and instructs participants to request them. The compass-homeowners.com site does not defend inventory sequestration; it frames sequestration as “Your Home. Your Choice. Your Freedom.”

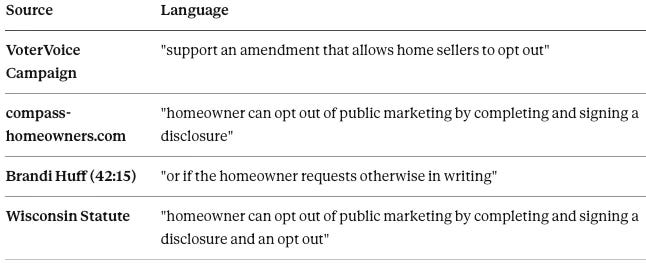

The three tiers—VoterVoice, compass-homeowners.com, and coordinated testimony—converge on a single amendment: “or if the homeowner requests otherwise in writing.” The language would convert SB 6091 from a transparency mandate into a scalable opt-out regime that Compass can embed in listing agreements, train agents to present as “premium service,” and operationalize across its 37,000-agent network.

The contribution here is forensic. But the forensics reveal a structural pattern that regulators and legislators must learn to recognize: once a firm’s survival depends on a regulatory outcome, the firm will invest in shaping interpretation before enforcement begins. SB 6091 addresses conduct. The analysis below documents the cognitive infrastructure designed to ensure the conduct channel remains open.

Definitions and Scope

Narrative Pre-Installation (NPI): Pre-shaping public interpretation of a regulatory outcome before enforcement begins—conditioning how lawmakers, regulators, and consumers understand “choice,” “privacy,” and “protection” so that the preferred frame appears intuitive rather than argued.

Exception Capture: Converting a narrow statutory accommodation (e.g., privacy protection for vulnerable sellers) into a default pathway via standardized paperwork that can be operationalized at platform scale.

Apparatus: A repeatable toolchain—CRM infrastructure, scripted messaging, coordinated testimony—that can be redeployed to future legislative contests once built.

Scope: This study evaluates public materials, legislative records, and disclosed behavior. It does not allege illegality.

I. The Balance-Sheet Forcing Function

The question is not whether Compass intends to harm consumers. The question is whether Compass’s balance sheet creates a constraint field where transparency is structurally unsustainable. When debt-service pressure makes open-market competition insufficient for survival, inventory sequestration becomes the only downhill path—the only strategy that doesn’t burn more capital than it generates. The opt-out amendment doesn’t change Compass’s intent; it creates a survivable route from intent to outcome. Without the amendment, Compass’s current model has no geodesic—no continuous path from where it is to profitability that doesn’t require fundamental business-model change.

Compass accumulated $2.2 billion in losses between 2019 and 2024, funded first by $1.5 billion in SoftBank venture capital and then by public markets following its 2021 IPO. The company did not earn its current scale through superior service—it purchased market share by subsidizing losses that no competitor could match. The January 2026 merger added $2.5 billion in inherited Anywhere debt to an already-leveraged balance sheet. Compass now operates under quarterly debt-service requirements rather than the patient capital timelines that characterized its growth phase.

The causal chain is direct: debt-service pressure increases the marginal value of internal routing; internal routing increases the marginal value of private inventory; private inventory creates the legislative incentive to codify opt-outs.

Understanding this chain is essential. Compass must generate cash flow to service debt. Cash flow in residential brokerage comes from commissions. Commission yield per transaction increases when Compass represents both buyer and seller—dual-end capture. Dual-end capture probability increases when buyers cannot see listings outside the Compass network. Private listings create that information asymmetry. Therefore: debt pressure → dual-end incentive → private listing dependency → legislative defense of opt-out.

Windermere faces the same market but not the same balance sheet. Without $2.5 billion in debt, Windermere can afford to prioritize market health over information control. OB Jacobi’s testimony—”we would clean house... which sounds ridiculous”—reflects that different incentive geometry. Compass’s opposition to SB 6091 is not about consumer choice; it is about debt service.

Profit Timeframe Compression names this dynamic. When profit horizons compress, firms rationally shift from creating value through market health to capturing value through information control. In residential real estate, control manifests as private listings, internal routing, and dual-end capture—mechanisms that monetize access rather than service. As of February 2025, approximately 35% of Compass listings (7,500+ of 22,138 nationally) operate in Private Exclusive or Coming Soon status. Compass, Inc. Fourth Quarter and Full-Year 2024 Earnings Results, specifically the SEC Exhibit 99.1 filing and the associated earnings call held on February 18, 2025.

The opt-out amendment Compass seeks—”or if the homeowner requests otherwise in writing”—would preserve this capacity by converting SB 6091’s transparency mandate into a signature line that agents can embed in standard listing agreements and train to present as “premium service.” Compass’s current capital structure increases the payoff to information control and reduces the payoff to cooperative infrastructure. The apparatus documented below exists because that signature line is a survival requirement, not a policy preference.

Insight: Windermere—the firm with the most to gain from private listings—testified for SB 6091. Compass—the firm with $2.5 billion in debt—testified against. The divergence is not about values; it is about balance sheets.

Contact mcai@mindcast-ai.com to partner with us on Law and Behavioral Economics foresight simulations. We specialize in antitrust, complex litigation and national innovation.

II. The Apparatus: Three-Tier Influence Architecture

The Compass public affairs apparatus operates through three coordinated layers: grassroots manufacturing, consumer framing, and legislative testimony. Each layer performs a distinct function; together they converge on a single deliverable—the opt-out amendment.

II.A. Grassroots Manufacturing: The VoterVoice Campaign

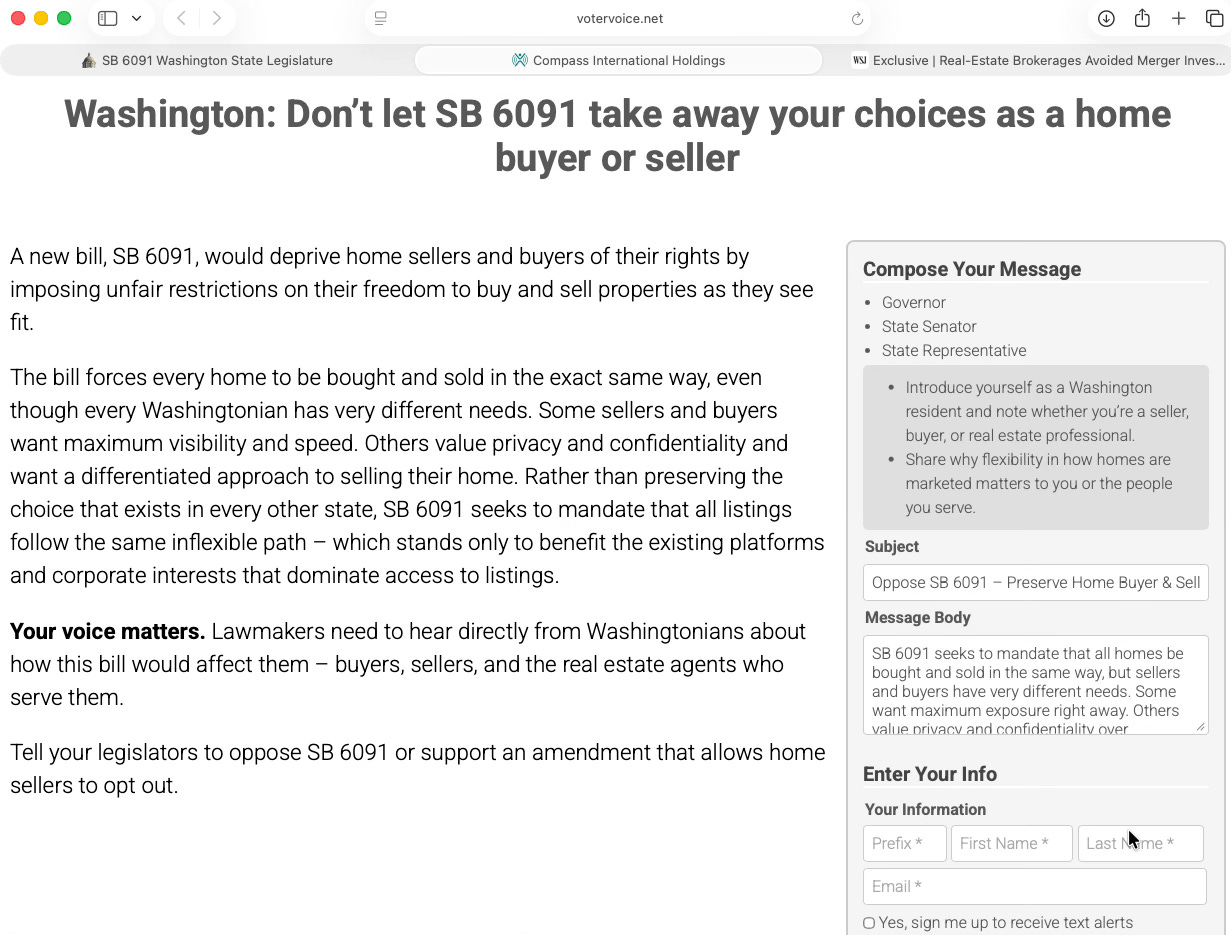

The VoterVoice campaign hosted at www.votervoice.net/CIH/Campaigns/132724 constitutes the grassroots-manufacturing infrastructure.

Operator: Compass International Holdings (CIH)—a corporate vehicle that distances the campaign from “Compass Real Estate” while maintaining operational control.

Pre-Drafted Messaging: The campaign provides scripted constituent messages that converge on the opt-out amendment: “Tell your legislators to oppose SB 6091 or support an amendment that allows home sellers to opt out.”

Data Harvesting: The intake form collects home address, business information, and mobile numbers—building a mobilization database for future legislative campaigns. The form requests text message opt-in “to receive periodic call to action text messages from CIH,” confirming the infrastructure is designed for sustained deployment, not single-use advocacy. The SMS opt-in and mobile number harvesting reveal VoterVoice as a permanent, scalable lobbying CRM being built under cover of a single bill. Once populated, the database can be reactivated for any future transparency legislation—in Washington or other states.

Framing Architecture: “Don’t let SB 6091 take away your choices as a home buyer or seller” positions a transparency bill as an attack on consumer freedom—the same inversion that characterizes the compass-homeowners.com messaging.

The VoterVoice campaign does not argue for the opt-out—it assumes the opt-out is reasonable and instructs constituents to demand it. The assumption-before-argument structure is the operational signature of narrative pre-installation. By the time legislators receive constituent messages, the frame has already been normalized.

Insight: The VoterVoice intake form harvests mobile numbers for “periodic call to action text messages from CIH.” The infrastructure is not a response to SB 6091—it is a permanent lobbying CRM being built under cover of a single bill.

II.B. Consumer Framing Layer: compass-homeowners.com

The compass-homeowners.com site provides the ideological wrapper for inventory sequestration. The site frames private exclusives as giving homeowners “the same advantages as real estate developers and professional homebuilders”—eliding that developers control land banks while homeowners typically sell once per decade.

Core Framing: “Your Home. Your Choice. Your Freedom.” positions platform extraction as consumer autonomy.

Anti-Portal Rhetoric: The site frames Zillow and Redfin transparency features—days on market, price history—as “negative insights” that harm sellers:

“Portal Sites Hurt Homeowners By Displaying Negative Insights That Devalue Homes... Excessive days on market and price drop history can devalue your property in the eyes of buyers.”

The framing inverts reality: transparency features enable price discovery; their absence enables information asymmetry that benefits the platform, not the seller.

Statistical Claims—Marketing Collateral, Not Evidence:

The site claims homes pre-marketed through Compass’s phased strategy achieve:

2.9% higher closing price

20% faster to contract

30% less likely to drop in price

The fine print (visible at bottom of compass-homeowners.com) reveals the study design: “Findings... compare the average of Compass residential listings that went active on a MLS and were pre-marketed as a Compass Private Exclusive and/or Compass Coming Soon vs. the average of Compass residential listings that went active on a MLS but were not pre-marketed.”

The statistics compare Compass-sold homes to other Compass-sold homes—not to the broader market. Selection bias is embedded in the methodology: sellers who opt for private exclusives may systematically differ from those who choose public marketing (higher-value properties, more motivated sellers, luxury segment concentration). The study cannot isolate the effect of private marketing from the characteristics of sellers who choose it. Compass presents correlation as causation while the fine print disclaims: “Correlation does not necessarily equal causation.” The claim is marketing collateral designed to normalize inventory sequestration, not evidence that private listings serve sellers.

The Disclosure Form: The site references a “3-Phased Marketing Strategy Disclosure Form“ that would operationalize exception capture at platform scale. Once “seller request in writing” is codified as a statutory exception, this form becomes the signature line that converts narrow privacy accommodation into default intake pathway. The form is already drafted. The training is already developed. The apparatus awaits only the amendment.

The Three-Phase Strategy Explained:

The strategy holds listings off public coordination infrastructure during the critical early-marketing period when buyer interest peaks. Sequestration increases the probability that both buyer and seller originate within the Compass network, enabling dual-end commission capture. The strategy cannot survive SB 6091 as written—hence the apparatus to secure the opt-out amendment.

Insight: The compass-homeowners.com statistics compare Compass listings to Compass listings—not to the broader market. The fine print admits “correlation does not necessarily equal causation.” The 2.9% claim is marketing collateral, not evidence.

II.C. Coordinated Testimony: The January 23 Hearing

The January 23 hearing confirms these assets function as a unified apparatus. As documented in The Compass Astroturf Coefficient, 162 Compass-affiliated participants registered opposition—153 without disclosing their affiliation. The testimony record reveals how that coordination operated—and the interaction between two Compass figures provides the definitive case study.

The Baptist-Bootlegger Dynamic

Economist Bruce Yandle identified a recurring pattern in regulatory capture: successful coalitions pair a “Baptist”—a party with genuine moral concern whose advocacy provides public-interest legitimacy—with a “Bootlegger”—the party capturing economic benefit from the same policy outcome. The two need not coordinate explicitly; their interests converge on identical regulatory language.

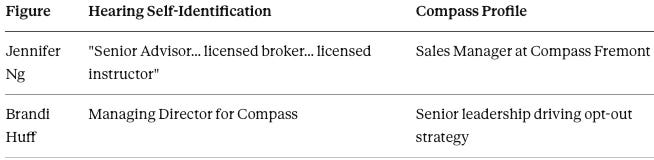

At the January 23 hearing, Jennifer Ng played the Baptist and Brandi Huff played the Bootlegger. One provided emotional legitimacy; the other delivered the technical loophole.

The Baptist — Jennifer Ng (56:04):

Ng identified herself as “a nationally certified senior advisor... a licensed real estate broker, a member of the Washington State Association of Realtors, and a certified licensed instructor for the state of Washington.” She testified about seniors in medical and cognitive crisis:

“I have seen the impact on seniors who have to immediately move into a transition situation after a fall, an acute ailment, rapid cognitive decline, and their homes are a mess. They have hospital beds. They have toilets next to their hospice bed, oxygen tanks... Having a realtor with professional guidance who has access to people who can work with the senior to respect their timeline, respect their privacy, that is what needs to happen.”

The testimony framed opposition to SB 6091 as protection for vulnerable populations—not corporate profit.

The Bootlegger — Brandi Huff (42:15):

Huff, Compass Managing Director, delivered the specific twelve-word amendment that the entire apparatus was designed to secure:

“We’re seeking an amendment to the bill of section one and four adding, and I quote, ‘or if the homeowner requests otherwise in writing.’ This simple change would ensure that the homeowner, not the state, decides the marketing strategy for their home.”

The Non-Disclosure:

Ng is Sales Manager at Compass Fremont—a leadership position within the company. Her Compass profile states: “As Sales Manager at Compass Fremont, I bring a wealth of experience as a Managing Broker, licensed Real Estate Instructor for the state of Washington.” (Source: compass.com/agents/Jennifer-Ng/.) Ng did not identify herself as a Compass Sales Manager during testimony. Every credential she cited appears in her Compass bio—except Compass itself.

Convergence on the Deliverable:

Ng established the need for discretion through high-emotion anecdotes. Huff provided the solution in the form of a legal exception. The amendment language Huff requested is identical to the language the VoterVoice campaign instructs constituents to demand—and identical to the compass-homeowners.com disclosure form already drafted for signature.

The capture is complete once the corporate requirement is indistinguishable from civic virtue. Legislators considering the opt-out don’t see a strategy to protect a SoftBank-backed valuation; they see a compassionate response to vulnerable seniors. Ng’s concern is real. The remedy she advocates—broad seller opt-out—would scale far beyond vulnerable seniors to encompass any seller who signs the form, preserving the private listing capacity that Compass’s debt structure requires.

Why the Wisconsin Model Is Non-Portable to Washington

Huff cited Wisconsin as precedent: “And this is how in Wisconsin, a similar statute has been handled.” The precedent does not transfer.

Wisconsin’s opt-out emerged in a fragmented brokerage market where no single firm dominates inventory flow and no platform is suing the state’s MLS infrastructure. Washington is different. Compass is simultaneously litigating against NWMLS and Zillow in federal court while opposing SB 6091 in the state legislature—attacking coordination infrastructure from one direction and transparency reform from another. At platform scale—where one firm controls 24% of a regional luxury market and operates a 37,000-agent network (reported Compass figure)—opt-out becomes default intake. Compass can embed the opt-out in standard listing agreements, train agents to present it as “premium service,” and convert a narrow privacy accommodation into a systematic inventory sequestration channel.

The Wisconsin model is not neutral precedent; it is the specific mechanism Compass requires to preserve private listing capacity under a transparency statute—in a state where Compass is actively litigating to dismantle the coordination infrastructure that makes transparency enforceable.

The Inversion Frame

Michael Orbino (Compass broker, 1:04:24) completed the narrative architecture by inverting the competition frame entirely:

“If this bill passes in its current form, the main beneficiary of this is large corporate interests and monster private equity firms that use AI to scan homes for sale to add to their rental portfolios... The biggest losers in this bill are first-time buyers with low-down payments who don’t have the ability to compete with 10 other offers.”

Orbino—representing the nation’s largest Wall Street-backed brokerage—positioned Compass as protecting consumers from “large corporate interests.” The inversion is structurally necessary: Compass cannot publicly explain why restricting buyer access benefits anyone other than Compass.

Insight: Jennifer Ng is Sales Manager at Compass Fremont. She did not identify herself as a Compass Sales Manager during testimony. She listed every credential from her Compass bio—except Compass itself.

III. Legislative Validation: The Hearing as Behavioral Test

Section II documented a three-tier apparatus: VoterVoice manufactures grassroots pressure, compass-homeowners.com provides the ideological frame, and coordinated testimony delivers the amendment language. The January 23 hearing tested whether legislators would accept the apparatus’s output—the “seller choice” narrative and opt-out amendment—or probe the business-model interests beneath it.

Legislators probed. The exchanges below reveal what narrative pre-installation is designed to obscure: that Compass cannot defend the unamended bill, that the Wisconsin model fails at platform scale, and that fair housing enforcement remains unresolved.

III.A. The Pivotal Exchange: Business Model Exposure

Senator Emily Alvarado’s questioning of Brandi Huff produced the hearing’s decisive exchange. Alvarado connected Compass’s merger, its Wall Street backing, and its exclusive listing networks:

Senator Alvarado (44:41): “You said you were with Compass... My understanding is that recently the Trump administration approved a merger that makes Compass now the largest Wall Street-backed real estate brokerage in the country. And then when you layer on an exclusive network, I’m wondering what that means for broader competitiveness of housing selling and buying in our state. It makes me think about this as a pro-competition bill, and I’m wondering how your business model syncs with that.”

Brandi Huff (45:22): “I feel fully confident to say that the Compass business model would not be affected by this bill, specifically with the amendments for the sellers to have the right to make their own choice.”

Chair Bateman (45:34): “But without the amendments?”

Brandi Huff (45:37): “I will tell you this. That is probably above what I feel comfortable speaking to because my job currently is to support the brokers in our community. As far as the merger and acquisition and higher level business model, that’s probably above. But I’m happy to put those things in writing, too, at a later date.”

The deflection is structurally necessary. Huff’s initial response conceded that SB 6091 as written would affect Compass’s business model—neutrality existed only “with the amendments.” When pressed on the unamended bill, she could not respond because Compass cannot publicly explain why restricting buyer access serves anyone other than Compass.

Insight: Chair Bateman asked: “But without the amendments?” Huff replied: “That is probably above what I feel comfortable speaking to.” The business model cannot be defended publicly.

III.B. The Windermere Counterpoint

OB Jacobi, President of Windermere Real Estate, delivered testimony that collapses Compass’s competition framing. Windermere holds 25% statewide market share, 35% in the luxury segment, with the nearest competitor at 8%. No firm would benefit more from private listing networks than Windermere. Yet Jacobi testified:

OB Jacobi (50:38): “And to say that no other company would reap the benefits of a private listing network would be Windermere. We would clean house, if you would, if this bill doesn’t pass, which sounds ridiculous. We’ve worked really, really hard for decades to create a fair and open marketplace that’s transparent. And this bill continues to push transparency, and we just urge you to support and pass this bill.”

Jacobi’s testimony is analytically decisive. The largest Washington brokerage—the firm with the most to gain from private listing networks—testified that passing SB 6091 serves market integrity even at cost to its own competitive advantage. If private listings served consumers, Windermere would oppose the bill. Windermere’s support confirms that private listings serve platform consolidation, not market competition.

The divergence between Windermere and Compass is not about corporate character—it is about balance-sheet structure. Windermere operates without the $2.5 billion debt burden and quarterly-earnings pressure that force Compass toward extraction. Same market, same opportunity, different incentive geometry, different behavior.

III.C. The Fair Housing and WALAD Enforcement Seam

Senator Gaynor and Chair Bateman pressed Huff on how fair housing compliance would be ensured under an opt-out regime:

Senator Gaynor (45:59): “If I understood you correctly, you were saying that you would like to see an amendment that would allow the seller to opt out of public marketing... But then you also said that and still meet the fair housing requirements or expectations. So how would that happen?”

Brandi Huff (46:33): “The disclosure would give them the opportunity to not only opt out of public marketing, but to understand fully fair housing. So I think it’s just giving the seller the right to choose when and how their house is marketed, but still enforcing fair housing in the way that we always have.”

Chair Bateman (47:21): “So how would you ensure that the Fair Housing Act is actually abided by when you’re just marketing it to a select group of people and not opening it up to the public?”

Huff’s response—that fair housing would be enforced “in the way that we always have”—provides no mechanism. Disclosure educates sellers about fair housing obligations; it does not enforce them. The apparatus cannot answer the enforcement question because enforcement is incompatible with platform-scale opt-out.

The Attorney General’s office identified a separate vulnerability. Shalia Stallings, Managing Assistant Attorney General in the Civil Rights Division, testified that while the AG supports the policy goal, the enforcement mechanism poses problems:

Shalia Stallings (48:51): “We do have concerns about amending the Washington Law Against Discrimination and using that statute in order to enforce this new law if it passes. The bill may benefit members of protected classes, but it does not expressly include protections based on immutable traits for which anti-discrimination provisions within the WALAD... are really for. And where discrimination isn’t occurring, the WALAD is already a powerful tool that can be used in this space. So if the legislature moves this bill forward, we just ask that you find a more appropriate enforcement mechanism outside of the WALAD.”

The AG testimony creates a visible legislative seam. Compass-aligned advocates can exploit it: “Even the Attorney General has concerns.” But the concern is about enforcement vehicle, not policy merit. The apparatus will push the opt-out amendment into that seam—framing the amendment as resolving the AG’s concern when it actually widens the exception pathway.

Chair Bateman requested staff follow-up on Fair Housing Act requirements. The enforcement mechanism question remains open—and remains a target for the apparatus.

III.D. Coalition Breadth Confirms Market Consensus

The pro-SB 6091 coalition spans the industry:

The opposition consisted of Compass and Compass-affiliated participants—162 individuals, 153 of whom concealed their affiliation.

Noel Le (MindCast AI, 1:01:44) provided the structural analysis connecting Compass’s balance sheet to its legislative strategy:

“Compass didn’t earn its current scale. Compass bought market share with $1.5B in SoftBank capital—subsidizing losses no other brokerage could match. Now it seeks to convert that artificial scale into market control... Opt-out legislations fail at platform scale. Compass can embed opt-outs in listing agreements and train agents to frame it as ‘premium service.’ SB 6091 ensures transparency with no opt-out.”

Sol Villarreal, an independent Seattle realtor since 2014, testified to what the apparatus’s “seller choice” narrative obscures:

Sol Villarreal (1:06:44): “In my 11 years of helping clients buy and sell homes, I’ve never had a seller who asked me if it was possible to restrict the number of people who could see their home. Sellers want to get their homes in front of as many potential buyers as possible, so this isn’t something that’s organically coming from sellers.”

The “seller choice” frame is not responding to seller demand. It is manufacturing a preference that serves platform economics.

The hearing validated the apparatus. The next section states what the validation predicts.

IV. Predictions

Sections I–III documented: (1) the balance-sheet pressure that makes transparency intolerable for Compass, (2) the three-tier apparatus built to secure an opt-out amendment, and (3) the hearing testimony that reveals the apparatus in operation. If the causal model is correct, six observable outcomes follow:

Near-Term (January–March 2026):

Compass will pursue the opt-out amendment at the January 30 executive session or through subsequent legislative channels. The specific deliverable—”or if the homeowner requests otherwise in writing” or functional equivalent—will remain the target.

The VoterVoice infrastructure will remain active through the legislative session. The apparatus is designed for sustained deployment, not single-use advocacy. The mobile number harvesting and SMS opt-in confirm redeployment intent.

Compass-affiliated participation will continue to conceal affiliation in subsequent proceedings. The Astroturf Coefficient (17:1 at the January 23 hearing) reflects equilibrium behavior, not anomaly.

Medium-Term (2026–2027):

If opt-out passes: Compass will operationalize exceptions at rates significantly exceeding independent brokerages—embedding the opt-out in standard listing agreements and training agents to present it as “premium service.” Exception capture converts narrow accommodation into default intake.

If SB 6091 passes without opt-out: Compass will not simply comply. The balance-sheet forcing function predicts pursuit of alternative channels—litigation challenging the statute, federal preemption arguments, or legislative efforts in other jurisdictions.

Cross-Jurisdictional (2026–2028):

Similar apparatus will emerge in California, New York, Texas, or other states where transparency legislation threatens private listing capacity. The VoterVoice/consumer-site/coordinated-testimony model is replicable infrastructure, not Washington-specific response.

Appendix D specifies the falsification conditions: observable outcomes that would require revision of the underlying framework.

V. Convergence as Proof

The forensic contribution is the Infrastructure of Exception: documenting how VoterVoice scripts, compass-homeowners.com framing, and Brandi Huff’s testimony all converge on a single twelve-word amendment without requiring overt coordination.

By the time SB 6091 reaches the January 30 executive session, Compass will have deployed three independent channels—CIH-branded grassroots manufacturing, selection-biased consumer framing, and undisclosed corporate testimony—each delivering the same opt-out language. Consumer sites normalize the frame. VoterVoice mobilizes constituents around the frame. Testimony delivers the amendment that codifies the frame. The apparatus does not lobby for an outcome; it pre-installs a scalable defection channel that would allow a debt-laden platform to sequester inventory behind a signature line in a listing agreement.

Four sources—developed independently, converging identically:

The convergence did not require overt coordination. The apparatus was designed to produce this outcome through distributed action: consumer sites normalize the frame, VoterVoice mobilizes constituents around the frame, and testimony delivers the amendment language that codifies the frame. By the time legislators vote, the opt-out has been pre-installed as reasonable.

The pattern will recur. Once Compass has built the VoterVoice infrastructure, trained the broker scripts, and normalized the “seller choice” frame, these assets can be redeployed against any future transparency requirement. The consumer-facing sites remain indexed. The constituent databases remain populated. The amendment language remains drafted.

Regulatory effectiveness increasingly turns not on detecting lobbying alone, but on recognizing when narrative infrastructure is being used to pre-shape enforcement reality. Legislators considering SB 6091 must understand that they are not merely voting on a disclosure requirement—they are deciding whether to permit or foreclose a scalable defection channel that will determine market structure for the next decade.

The January 30 executive session will determine whether the exception pathway remains open.

Insight: Four independent sources—VoterVoice, compass-homeowners.com, Brandi Huff’s testimony, and the Wisconsin statute—converge on identical opt-out language. The convergence did not require coordination. The apparatus was designed to produce it.

Exhibits: Primary Evidence

Exhibit 1: VoterVoice Intake Fields (votervoice.net/CIH/Campaigns/132724)

Operator: Compass International Holdings (CIH)

Pre-drafted message: “Tell your legislators to oppose SB 6091 or support an amendment that allows home sellers to opt out”

Data collected: Home address, business information, mobile number

SMS opt-in: “I agree to receive periodic call to action text messages from CIH”

Exhibit 2: compass-homeowners.com Anti-Transparency Frame While Touting Transparency

Core framing: “Your Home. Your Choice. Your Freedom.”

Anti-portal claim: “Portal Sites Hurt Homeowners By Displaying Negative Insights That Devalue Homes”

Statistical claims: 2.9% higher price, 20% faster, 30% fewer price drops

Exhibit 3: compass-homeowners.com Fine Print (Methodological Disclosure)

Study design: “Findings... compare the average of Compass residential listings that went active on a MLS and were pre-marketed as a Compass Private Exclusive and/or Compass Coming Soon vs. the average of Compass residential listings that went active on a MLS but were not pre-marketed.”

Disclaimer: “Correlation does not necessarily equal causation.”

Selection bias: Compass-to-Compass comparison, not market-wide

Appendix A: MindCast AI Source Publications

SB 6091 and Compass-Anywhere Series

The Compass Astroturf Coefficient at the Washington State Senate MindCast AI (January 2026) Documents the 94.4% non-disclosure rate among Compass-affiliated participants at the January 23, 2026 Housing Committee hearing. Introduces the Astroturf Coefficient metric (AC = 17:1) for measuring coordinated concealment in legislative proceedings. https://www.mindcast-ai.com/p/jan23-wa-senate-housing-committee

Windermere and Compass, Two Philosophies of Real Estate: Cooperative Infrastructure vs. Platform Extraction MindCast AI (January 2026) Establishes Profit Timeframe Compression as the governing variable that explains divergent firm behavior. Documents Compass’s $2.5 billion inherited debt and the balance-sheet geometry that makes inventory sequestration a survival requirement. https://www.mindcast-ai.com/p/compass-windermere-market-philosophy

Washington’s SB 6091 and Private Real Estate Market Control MindCast AI (January 2026) Analyzes SB 6091 as post-consolidation containment legislation. Documents dual-track enforcement structure and explains why opt-out regimes fail at platform scale. https://www.mindcast-ai.com/p/wa-sb-6091

Compass–Anywhere: When Scale Becomes Liability MindCast AI (January 2026) Analyzes the January 2026 merger and its implications for market concentration. https://www.mindcast-ai.com/p/compass-anywhere-merger

Core Theoretical Framework

The Stigler Equilibrium: Regulatory Capture and the Structure of Free Markets MindCast AI (January 2026) Establishes Enforcement Capture Equilibrium framework. Develops Bootleggers-and-Baptists coalition analysis applied to legislative settings. https://www.mindcast-ai.com/p/stigler-equilibrium

Federal Antitrust Breakdown as Nash-Stigler Equilibrium, Not Accident MindCast AI (January 2026) Formalizes Harm Clearinghouse model. Explains why dominant firms seek to standardize conduct through state legislative exceptions when federal enforcement enters inaction phase. https://www.mindcast-ai.com/p/stigler-harm-clearinghouse

Comparative Externality Costs in Antitrust Enforcement: A Nash-Stigler Foresight Study MindCast AI (January 2026) Establishes $22 billion deadweight-loss baseline. Identifies Live Nation consent decree as anchor case; validates Compass-Anywhere as civil case with identical patterns. https://www.mindcast-ai.com/p/nash-stigler-livenation-compass

Chicago School Accelerated: The Integrated, Modernized Framework of Chicago Law and Behavioral EconomicsMindCast AI (December 2025) Modernizes Chicago School framework by integrating Coase-Becker-Posner efficiency analysis with behavioral economics. https://www.mindcast-ai.com/p/chicago-school-accelerated

Field-Geometry Reasoning: A Unifying Framework for Structural Explanation MindCast AI (January 2026) Source framework for Field-Geometry Reasoning parameters: Constraint Density, Curvature Steepness Index, Geodesic Availability Ratio. https://www.mindcast-ai.com/p/field-geometry-reasoning

Appendix B: Primary Source URLs

Compass Public Affairs Infrastructure

VoterVoice Campaign (Grassroots Manufacturing) https://www.votervoice.net/CIH/Campaigns/132724/Respond?siteNumber=0

Compass 3-Phased Marketing Strategy Site (Consumer Propaganda)

https://www.compass-homeowners.com/

3-Phased Marketing Strategy Disclosure Form https://docs.google.com/document/d/11XXXogG2LbxB2evu5Sv2dOM7-ii2Xc5Ex7XGxRsuHqI/edit?tab=t.0

Legislative Record

January 23, 2026 Senate Housing Committee Hearing (Full Video) https://tvw.org/video/senate-housing-2026011328/?eventID=2026011328

Legislative Sign-In Records https://app.leg.wa.gov/csi/Senate?selectedCommittee=34078&selectedMeeting=33712

SB 6091 Bill Summary https://app.leg.wa.gov/BillSummary/?BillNumber=6091&Year=2025&Initiative=false

Appendix C: Hearing Testimony Timeline

Appendix D: Falsification Conditions

The analysis generates falsifiable predictions. The framework requires revision if:

Near-Term (January–March 2026):

Compass does not pursue the opt-out amendment at the January 30 executive session or through subsequent legislative channels. The analysis predicts Compass will push “or if the homeowner requests otherwise in writing” language or functional equivalent.

Compass-affiliated participants disclose at rates above 50% in subsequent SB 6091 proceedings. The analysis predicts continued coordinated non-disclosure (Astroturf Coefficient > 2:1).

The VoterVoice campaign is deactivated before the legislative session concludes. The analysis predicts sustained mobilization infrastructure through final vote.

Medium-Term (2026–2027):

If opt-out passes, exception adoption rates remain uniform across luxury-platform brokerages and independent brokerages. The analysis predicts Compass will operationalize opt-outs at significantly higher rates than competitors—converting narrow accommodation into default intake.

If SB 6091 passes without opt-out, Compass private listing share in Washington drops below 20%. The analysis predicts Compass will seek alternative channels (litigation, federal preemption arguments, or other state legislatures) rather than comply with transparency mandates.

Compass achieves durable GAAP profitability without expanding dual-end capture share. The analysis predicts the balance-sheet forcing function will drive continued information-control strategies.

Cross-Jurisdictional (2026–2028):

Similar apparatus does not emerge in other states considering private listing restrictions (California, New York, Texas). The analysis predicts the VoterVoice/consumer-site/coordinated-testimony model will redeploy wherever transparency legislation threatens private listing capacity.

Meeting two or more conditions in any category would indicate the causal model requires revision for that domain.

This analysis does not allege unlawful conduct. It evaluates disclosure behavior, coordination patterns, and narrative infrastructure observable in public legislative records and marketing materials, and assesses their informational effects on legislative deliberation.