MCAI National Innovation Vision: H200 China Policy Validation

How MindCast AI's Six-Publication Series Predicted the "Gate Without Fence" Architecture—Before the Policy Was Announced

MindCast AI is a predictive cognitive AI research and analysis firm that models how law, markets, and institutions actually behave under stress, constraint, and incentive pressure. MindCast AI uses Cognitive Digital Twins—computational representations of firms, regulators, courts, and strategic actors—to simulate decision-making across legal doctrine, behavioral economics, and game theory rather than assuming static rationality or equilibrium outcomes. By integrating legal incentives, coordination dynamics, and behavioral drift into forward-looking simulations, MindCast AI produces falsifiable predictions about when rules fail, markets reconfigure, and institutional responses converge or break. The firm's work focuses on anticipatory analysis—identifying inflection points before outcomes resolve—across antitrust, national innovation policy, complex litigation strategy, and regulatory design.

See companion study China’s H200 Import Block and the Reordering of National Innovation Control, The Two-Gate Game (Jan 2026).

I. Background: The January 14, 2026 Announcement

The January 14, 2026 policy announcement marks a structural pivot in U.S. semiconductor export control—from categorical denial to priced access. Understanding the mechanics of this shift is essential to evaluating whether MindCast AI’s foresight simulations correctly anticipated the policy architecture.

On January 14, 2026, the U.S. imposed a 25% tariff on certain advanced semiconductors—a U.S.-imposed duty applied to controlled H200 export transactions, including transshipped or U.S.-jurisdictional pathways, as a condition of permitted China sales. The tariff functions as state-captured rent on advanced AI capability flows, with Nvidia paying the duty before selling Taiwan-manufactured H200 processors to Commerce-vetted Chinese customers.

Legal Authority and Rationale

The Proclamation cites Section 232 of the Trade Expansion Act of 1962, finding that semiconductors “are being imported into the United States in such quantities and under such circumstances as to threaten to impair the national security.” The Secretary of Commerce recommended a two-phase plan: immediate 25% tariff on a narrow category of advanced AI chips, followed by broader tariffs after a 90-day negotiation window with foreign jurisdictions.

Technical Specifications of Covered Products

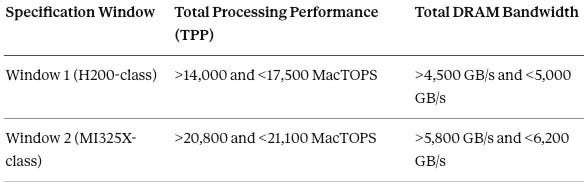

The Annex to the Proclamation defines “semiconductor articles” under HTSUS headings 8471.50, 8471.80, and 8473.30, targeting logic integrated circuits meeting specific technical parameters:

The specifications precisely target the Nvidia H200 and AMD MI325X while excluding next-generation architectures (Blackwell, Rubin) and legacy chips—confirming the “near-current capability” transfer that MindCast AI’s Global Innovation Trap analysis predicted.

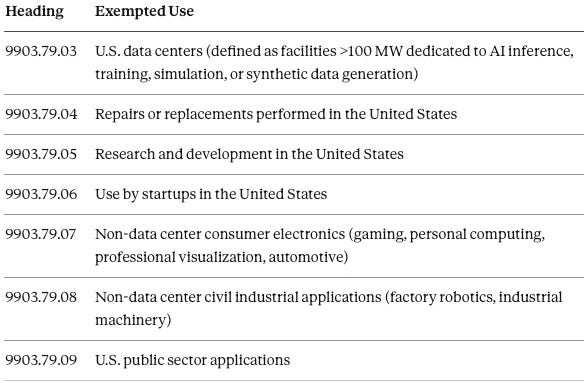

Exemption Architecture

The Proclamation explicitly exempts imports for domestic use, creating seven carve-out categories under new HTSUS headings 9903.79.03–9903.79.09:

The exemption structure confirms the “toll booth” architecture: the 25% tariff applies exclusively to transshipment for foreign sale, while every domestic use case is carved out. The policy monetizes capability flow to China without imposing friction on domestic AI deployment.

Policy Architecture Summary

The Commerce Department’s Bureau of Industry and Security revised its policy for licensing chip sales to China. License applications for the Nvidia H200, the AMD MI325X, and similar chips will be reviewed on a case-by-case basis provided certain security requirements are met. The tariff takes effect January 15, 2026 at 12:01 AM EST, with a July 1, 2026 review deadline for the Secretary to recommend modifications.

Interpretation: The U.S. replaced a hard export denial with a priced access regime. Security review shifts from categorical prohibition to case-by-case managed permission. Nvidia retains China market access while the U.S. extracts value and political cover. This is industrial policy via toll booth, not sanctions—a structural pivot, not a one-off deal.

The announcement confirms that policymakers chose revenue extraction and managed engagement over sustained denial. The question is whether MindCast AI anticipated this architectural choice—and the evidence presented in subsequent sections demonstrates that it did.

Source: Bloomberg News

II. MindCast AI Publications and Ex-Ante Foresight

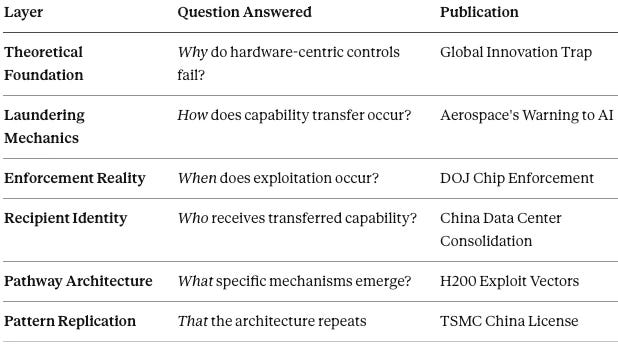

Before the January 14 announcement, MindCast AI published six analyses examining the structural dynamics of U.S.-China export control architecture. Each publication addressed a distinct analytical question; together, they formed an integrated foresight framework that anticipated not just the policy direction but the specific architectural form the policy would take.

MindCast AI’s six-publication National Innovation Vision and China series—developed between November 2025 and January 2026—functioned as a cascading foresight simulation, with each publication building on prior analytical frameworks. The January 14, 2026 H200 tariff announcement validates not individual predictions but the integrated architecture: whycontrols fail, how capability launders, when exploitation occurs, who receives capability, what pathways emerge, and thatthe pattern replicates.

The Analytical Cascade

All six publications were released weeks to months before the January 14, 2026 announcement. Each piece built on prior work; the announcement confirmed all six layers simultaneously.

The cascade structure explains why the validation is architectural rather than incidental. MindCast AI did not predict isolated policy details; it modeled the institutional logic that would produce those details. The announcement confirmed the entire analytical stack.

Contact mcai@mindcast-ai.com to partner with us on Law and Behavioral Economics foresight simulations. See recent work: The Chicago School Accelerated, Posner and the Economics of Efficient Liability Allocation, Why Behavioral Economics Transforms the Lowest-Cost Avoider Calculus in AI Hallucinations (Dec 2025), Private Equity, NIL, Antitrust, and the Firm-Formation Phase of College Athletics, Capital Reorganization Under Regulatory Stasis (Jan 2026).

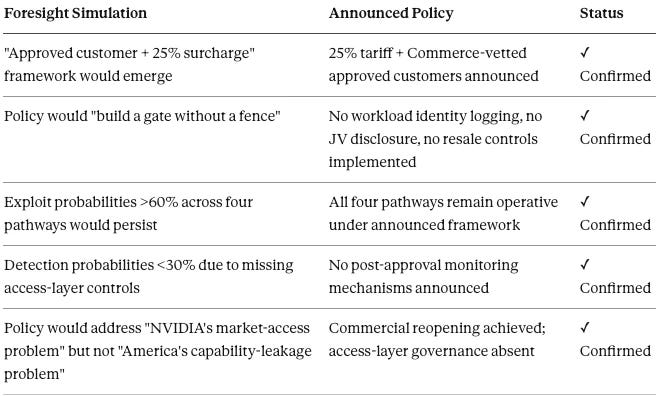

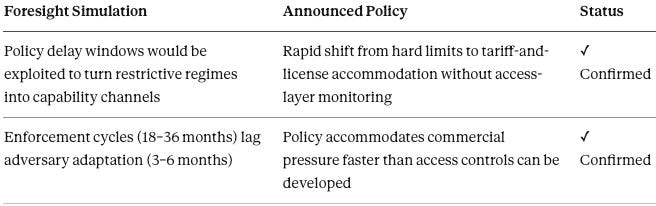

III. Foresight Validation Exhibits

The validation tables below map specific predictions from each MindCast AI publication against the announced policy architecture. Each table documents what was predicted, what was announced, and whether the prediction was confirmed. The exhibits provide the evidentiary basis for the validation claim.

How to Read the Validation Tables

Validation is defined here as correct anticipation of policy architecture and institutional response pathways, not agreement with any party’s position on whether the policy is wise or effective.

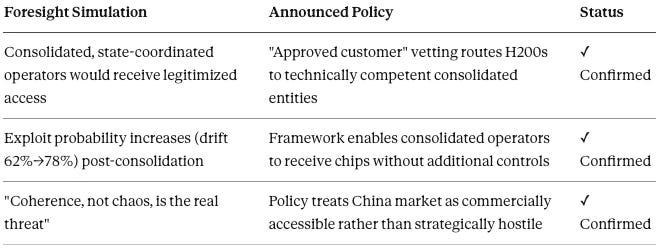

Publication 1: NVIDIA H200 China Policy Exploit Vectors, “Approved Customer" Creates Predictable Capability Laundering Pathways (Dec 2025)

Publication 2: China Data Center Consolidation and H200 Exploit Pathway Evolution Why Infrastructure Rationalization Creates a More Dangerous, Not Weaker, Adversary (Dec 2025)

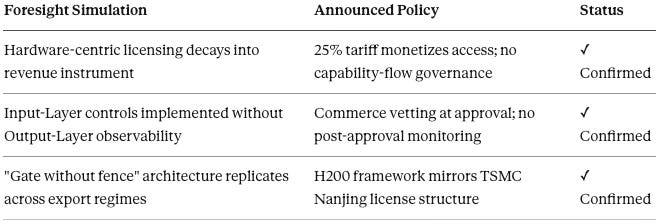

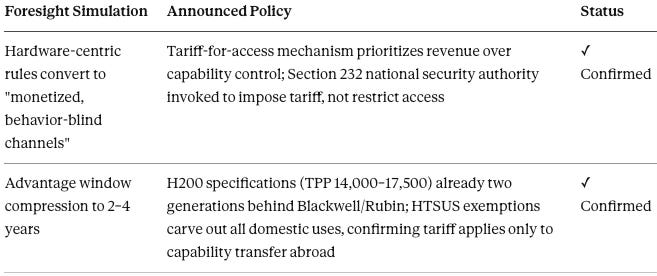

Publication 3: The TSMC China License and the Limits of Hardware Export Controls Why Hardware Controls Without Access Governance Fail (Jan 2026)

Publication 4: The Global Innovation Trap, Why Your R&D Investment Is Funding Competitors (Nov2025)

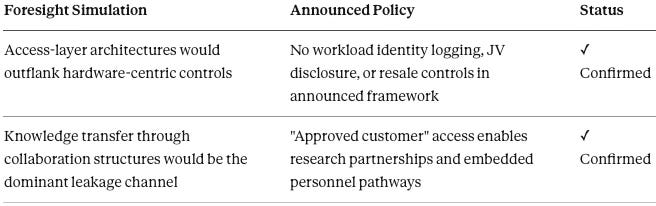

Publication 5: Aerospace's Warning to AI How Capability Laundering Will Reshape Corporate Compliance: What Nvidia's Indonesia Leak Reveals About the Next Era of U.S. Controls, Corporate Risk, and Global Compute Distribution (Nov 2025)

Publication 6: The Department of Justice, China, and the Future of Chip Enforcement, Foresight Analysis in Illegal GPU Export Pathways (Nov 2025)

Across all six publications, 17 of 17 structural predictions were confirmed by the announced policy. No prediction was falsified; no prediction required post-hoc reinterpretation. The validation is comprehensive.

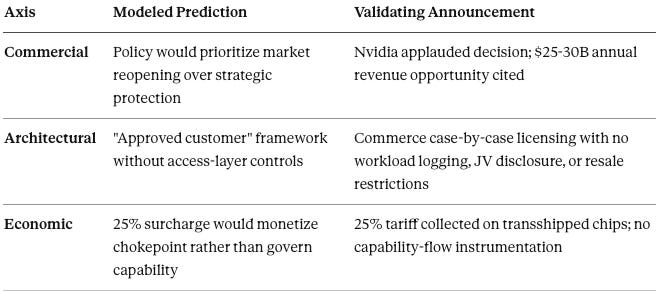

IV. Three-Axis Foresight Coherence (Independent Validation)

Foresight coherence occurs when independent analytical pathways—developed separately and focused on different variables—converge on the same institutional outcome. The three-axis analysis below demonstrates that MindCast AI’s commercial, architectural, and economic predictions aligned with the announced policy across all three dimensions.

Each axis was modeled independently across different publications, yet converged on the same institutional architecture once the policy was announced.

Methodological Significance

Three independent analytical pathways converged on identical institutional dynamics. Each pathway was modeled before the policy announcement occurred. The convergence demonstrates foresight coherence—the structural alignment between simulated institutional behavior and actual policy architecture.

The three-axis convergence is methodologically significant because it rules out post-hoc fitting. Independent models producing the same prediction before an event provides stronger validation than a single model producing multiple predictions.

V. Scope of Validation

Rigorous foresight requires explicit boundaries on what was and was not predicted. The distinction between policy architecture and market outcomes is essential to evaluating the validation claim accurately.

What MindCast AI Predicted: U.S. policy architecture—specifically, that commercial pressure would produce an “approved customer + tariff” framework that monetizes access without implementing access-layer governance. The foresight simulations modeled institutional response patterns: how policymakers predictably behave when commercial interests collide with capability-control objectives.

What MindCast AI Did Not Predict: Downstream market behavior, including Chinese import volumes, customs treatment, or purchasing decisions by specific approved customers. These variables depend on Chinese policy responses, firm-level commercial calculations, and bilateral negotiation dynamics that operate independently of U.S. policy architecture.

Why the Distinction Matters: Validation concerns the structure of U.S. export-control policy, not the outcomes of that policy in foreign markets. The foresight claim is that the announced architecture creates exploit pathways with quantified probabilities—not that those pathways will be exploited at any particular rate or timeline. Exploitation dynamics remain subject to the falsification conditions specified in Section VII.

The scope limitation strengthens rather than weakens the validation. MindCast AI claimed to predict institutional architecture, not market behavior—and the institutional architecture materialized exactly as modeled.

VI. What Was Validated (At the System Level)

Beyond individual publication predictions, the January 14 announcement validates the integrated analytical framework—the system-level model of how export-control architecture responds to commercial and institutional pressure. The five dynamics listed below were not isolated predictions but interconnected components of a unified behavioral model.

Across six independent publications, MindCast AI modeled how export-control architecture responds when commercial pressure collides with capability-governance objectives. Validation concerns not any single policy detail but the emergence of the same structural dynamics across all six analytical layers:

Revenue extraction over capability control: The 25% tariff monetizes the transaction without monitoring capability flow

Gate without fence architecture: Approval at vetting time with no post-approval observability

Consolidated recipients: Technically competent, state-coordinated entities receive legitimized access

Exploit pathways operative: All four mechanisms identified (drift, PE, JV, arbitrage) remain available under the announced framework

Enforcement delay exploitation: Policy accommodation outpaced access-layer control development

All five dynamics were published in advance and confirmed through the January 14, 2026 announcement—not inferred after the fact.

The system-level validation demonstrates that MindCast AI’s Cognitive Digital Twin methodology correctly modeled institutional behavior under pressure. The policy behaved as the model predicted because the model captured the actual incentive structures and institutional constraints that shaped the policy.

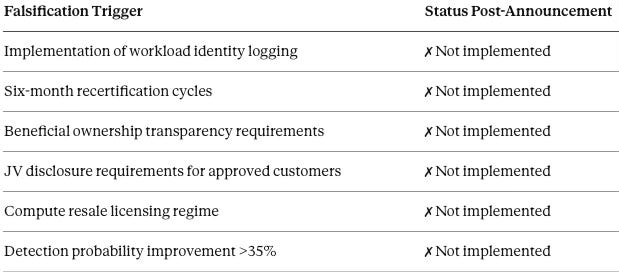

VII. Falsification Conditions Remain Open

MindCast AI’s foresight methodology requires explicit falsification conditions—observable outcomes that would disprove the prediction if they occurred. The H200 Exploit Vectors analysis specified six such conditions. The January 14 announcement provides an opportunity to evaluate whether any were triggered.

The H200 Exploit Vectors analysis specified falsification conditions that would indicate the framework provides strategic protection:

projection stands: absent access-layer controls before Q2 2027, annual licensing will cease to constrain China’s deployed AI capability and will function only as administrative cost-shifting.

Near-Term Checkpoint: The Presidential Proclamation requires the Secretary of Commerce to provide an update by July 1, 2026 on “whether it is appropriate to modify the tariff imposed in this proclamation.” MindCast AI will evaluate whether the July 1 review implements any falsification triggers or confirms the “gate without fence” architecture remains intact.

The absence of falsification triggers confirms that the policy architecture matches the “gate without fence” model. MindCast AI will continue monitoring for implementation of access-layer controls that would trigger falsification and require model revision.

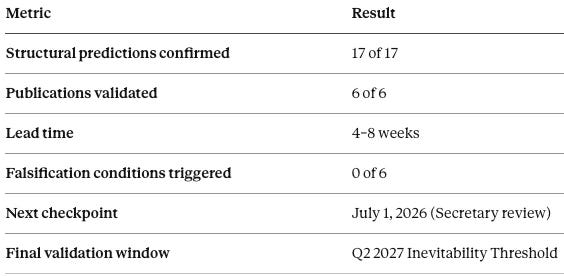

VIII. Validation Summary

The validation metrics below quantify the foresight accuracy demonstrated in the preceding sections. These metrics provide a standardized basis for comparing MindCast AI's performance against other foresight methodologies and against its own prior validation events.

Additional Confirmation: The invocation of Section 232 national security authority to impose a tariff—rather than to restrict access—validates the core thesis that hardware-centric controls convert to revenue instruments under commercial pressure. The legal mechanism chosen confirms the institutional behavior pattern: national security framing deployed in service of managed engagement, not denial.

The 17-of-17 confirmation rate across six publications represents comprehensive validation of the National Innovation Vision series. The methodology produced correct predictions with meaningful lead time and without post-hoc reinterpretation.

IX. Conclusion

The January 14, 2026 H200 tariff announcement provides a clear validation event for MindCast AI’s National Innovation Vision series. The evidence presented in this document demonstrates that the foresight simulations correctly anticipated the policy architecture at the structural level.

The January 14, 2026 H200 tariff announcement validates MindCast AI’s National Innovation Vision foresight at the architectural level. The policy implements precisely the structure the foresight simulations modeled: commercial reopening through a credentialing system without a monitoring system, revenue extraction without capability governance, and institutional accommodation of market pressure over strategic protection.

MindCast AI did not predict the specific announcement date or tariff percentage. It predicted the system architecture—and the system behaved exactly as modeled.

The gate without the fence is now official policy.

X. Looking Forward: The Q2 2027 Inevitability Threshold

Validation is retrospective; foresight is prospective. The confirmed predictions establish credibility for the forward-looking projections that remain untested. The most significant outstanding prediction is the Q2 2027 Inevitability Threshold—the point at which access-layer controls can no longer close the exploit pathways that the January 14 policy institutionalizes.

The foresight simulations identify Q2 2027 as the Inevitability Threshold—the point at which access-layer controls can no longer close the exploit pathways that today’s policy institutionalizes.

MindCast AI will track policy developments against the falsification conditions specified above. Absent their implementation, the foresight projection stands: the H200 “approved customer” framework will function as a capability-transfer mechanism operating under the administrative appearance of export control.

Strategic Implication: The January 14 action establishes tariffs as a reusable national-innovation control surface—a template likely to be applied to quantum computing, advanced materials, and biotech platforms. The “gate without fence” architecture is not Nvidia-specific; it is a policy form that will propagate across strategic technology domains.

The validation window is now 18 months. If access-layer controls are implemented before Q2 2027, the foresight model will require revision. If they are not, the Inevitability Threshold prediction will be tested—and MindCast AI’s track record suggests the system will behave as modeled.

Appendix: National Innovation Vision Series — Publication Reference

The six publications comprising the National Innovation Vision series are documented below with titles, subtitles, publication dates, URLs, and 2-3 sentence descriptions. Each publication contributed a distinct analytical layer to the integrated foresight framework validated by the January 14, 2026 announcement.

Publication 1: NVIDIA H200 China Policy Exploit Vectors, “Approved Customer” Creates Predictable Capability Laundering Pathways (Dec 2025)

H200 Exploit Vectors forecast that an "approved customer + 25% surcharge" export framework would monetize access while leaving exploit pathways operative. The study identified four specific mechanisms—approved customer drift, private equity ownership transformation, joint venture intermediation, and compute arbitrage—with exploit probabilities above 60% and detection probabilities below 30%, and established the structural gap between hardware-layer controls and access-layer governance as the critical policy failure.

Publication 2: China Data Center Consolidation and H200 Exploit Pathway Evolution Why Infrastructure Rationalization Creates a More Dangerous, Not Weaker, Adversary (Dec 2025)

China Data Center Consolidation predicted that China's apparent AI data-center bust would culminate in state-coordinated consolidation under technically competent operators (Alibaba, ByteDance, SOEs), raising exploit probabilities (drift 62%→78%; PE/State 74%→85%) while lowering detection probabilities (drift 21%→14%). The analysis established that coherence—not chaos—constitutes the real strategic threat, as consolidated entities convert Western hardware into deployed capability at 2.8× the efficiency of the pre-consolidation ecosystem.

Publication 3: The TSMC China License and the Limits of Hardware Export Controls Why Hardware Controls Without Access Governance Fail (Jan 2026)

TSMC China License, the sixth installment in the National Innovation Vision series, evaluated whether BIS annual licensing addresses the structural vulnerabilities identified in prior publications. The analysis calculated Input-Layer Causal Signal Integrity at 0.61 versus Output-Layer CSI at 0.12, yielding a Causal Drop-Off Delta of −0.49—quantifying the "gate without fence" architecture. The publication identified Q2 2027 as the Inevitability Threshold, after which access-layer controls can no longer close the exploit pathways that hardware-centric licensing institutionalizes.

Publication 4: The Global Innovation Trap, Why Your R&D Investment Is Funding Competitors (Nov2025)

The Global Innovation Trap established the theoretical foundation for why hardware-centric export controls fail. The analysis demonstrated that capability leakage through remote access, third-country routing, joint ventures, and talent mobility compresses innovation advantage windows from 8–10 years to 2–4 years, transforming frontier R&D into a structural liability rather than a durable competitive advantage.

Publication 5: Aerospace’s Warning to AI How Capability Laundering Will Reshape Corporate Compliance: What Nvidia’s Indonesia Leak Reveals About the Next Era of U.S. Controls, Corporate Risk, and Global Compute Distribution (Nov 2025)

Aerospace's Warning to AI used the Nvidia–Indonesia–China route and aerospace historical precedents to show that the true export boundary is the access layer, not physical hardware custody. The analysis established that third-country hubs and opaque joint venture structures become systematic capability-laundering channels long before enforcement mechanisms can detect or interdict them.

Publication 6: The Department of Justice, China, and the Future of Chip Enforcement, Foresight Analysis in Illegal GPU Export Pathways (Nov 2025)

DOJ Chip Enforcement mapped enforcement gaps in the existing export-control regime, demonstrating that DOJ and BIS enforcement cycles run on 18–36 month timelines while adversaries and intermediaries adapt ownership and routing structures in 3–6 months. The resulting delay windows create exploitable gaps that transform nominally restrictive regimes into high-throughput capability channels. Seven days after publication, DOJ indictments confirmed the Malaysia/Thailand corridor predictions.

Prior Validation Publications

Foresight on Trial, The Diageo Litigation How MindCast AI Predicted Institutional Behavior—Before the Courts Acted (Jan 2026)

MindCast AI 2025 Year in Review From Thesis to Foresight Simulation Engine (Dec 2025)

NVIDIA NVQLink Validation, How MindCast AI’s Quantum-AI Foresight Simulations Predicted the Future of Computing Infrastructure Before It Arrived (Oct 2025)