MCAI Economics Vision: Federal Political Market Failure and State Substitution as a Free‑Market Corrective

When Federal Inaction Distorts Markets, States Restore Competition

Companion foresight simulation: Federal Inaction Has Elevated State Authority on Consumer Protection, Antitrust, and Market Integrity, Briefing for State Attorneys General (Jan 2026), How Trump Administration Political Access Displaced Antitrust Enforcement—and Why States Should Now Step In (Jan 2026), The Stigler Equilibrium- Regulatory Capture and the Structure of Free Markets, Why Enforcement Must Compete to Keep Markets Free (Jan 2026), Comparative Externality Costs in Antitrust Enforcement, A Nash–Stigler Foresight Study of Federal Enforcement Equilibria, Live Nation as Anchor, Compass–Anywhere as Validation (Jan 2026), Why the DOJ Banned Algorithms but Blessed a Mega-Brokerage (Jan 2026).

Issue Summary: State Action as a Free‑Market Corrective

Federal antitrust enforcement has shifted from a rule‑based system to an access‑based system. University of Notre Dame law professor Roger Alford’s 2025 Aspen Forum testimony documents how federal institutions increasingly allocate enforcement outcomes through access arbitrage, where political influence displaces legal merit and enforcement delay becomes a strategic asset. The resulting political market failure erodes deterrence, misprices enforcement risk, and allows private coercion to displace voluntary exchange.

When the federal government fails to supply the public good of market integrity, markets do not self‑correct. Concentrated actors exploit discretion and delay, while consumers, workers, and local firms absorb the resulting externalities. Under these conditions, state intervention functions as a free‑market corrective rather than a departure from market principles. By acting as competing suppliers of enforcement, states restore rule‑based competition and protect local economies from harms generated by federal capture.

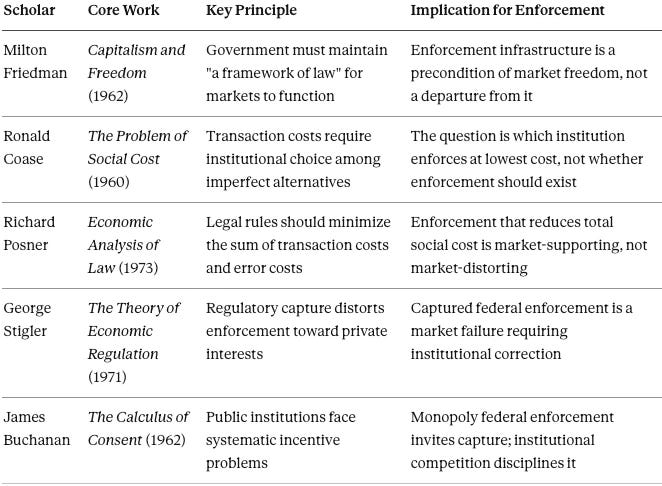

A new generation of surface level free-market advocates has emerged who denounce any enforcement action as “anti-market” without engaging the economics underlying that claim. Chicago School economics—the tradition these commentators invoke—has never held that markets function without institutional support. Milton Friedman, Ronald Coase, and Richard Posner all recognized that voluntary exchange depends on credible rules, predictable enforcement, and dispersed power. Systematic enforcement failure does not preserve market freedom; enforcement failure enables private coercion to replace price competition. State attorneys general who act against federal political market failure do not expand government control—they restore the competitive conditions that free markets require.

Five Pillars for State Action

Federal Inaction Operates as a Market Subsidy. Systematic federal inaction does not preserve neutrality. Delay and discretionary enforcement subsidize concentrated actors by allowing market power to harden before remedies arrive, mispricing risk and penalizing firms that compete on merit rather than influence.

State Attorneys General Break the Federal Enforcement Monopoly. Reliance on a single federal gatekeeper creates monopoly conditions in enforcement that Public Choice theory predicts will invite capture. State attorneys general introduce institutional competition, ensuring that enforcement does not depend on a single, politically routable venue.

State Action Internalizes Local Externalities. Federal access arbitrage shifts costs onto identifiable local populations, including consumers facing higher prices and workers exposed to monopsony power. State intervention reallocates those costs upstream to the actors generating harm, restoring alignment between private incentives and social cost.

Predictability Replaces Access‑Based Instability. The rule of lobbyists guarantees instability. Transparent, statutory state enforcement provides predictable legal constraints that allow businesses to invest and compete without relying on political access or fearing abrupt federal pivots.

Strategic Substitution Preserves Market Geometry. MindCast AI foresight modeling shows that late federal intervention rarely restores competition once market power hardens. Early state‑level substitution prevents structural distortions from becoming permanent by interrupting concentration before enforcement geometry collapses.

Actionable Recommendations for State Attorneys General

Establish Multistate Coordination as the Default Enforcement Unit. Treat multistate coalitions as the primary vehicle for addressing national markets, bypassing federal bottlenecks and raising the cost of capture through dispersed authority. The Live Nation suit demonstrates viable parallel enforcement: 30+ states joined as co-plaintiffs, and state parties can proceed independently if federal leadership falters.

Apply Lowest‑Cost Avoider Logic to Case Selection. Prioritize matters where state enforcement can most efficiently restore information integrity, price transparency, and competitive entry. Iowa’s crypto-ATM enforcement ($1,000 daily cap, 15% fee limit, 90-day refund window) exemplifies lowest-cost avoider allocation—operators controlling transaction architecture bear liability because victims under live scam coercion cannot process warnings rationally.

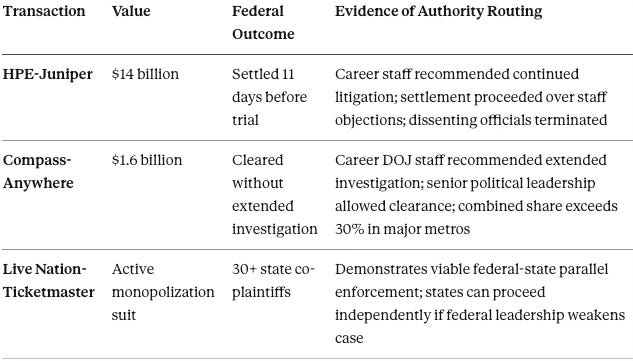

Monitor Authority Routing Signals. Track divergence between staff‑level federal analysis and final federal outcomes. The Compass-Anywhere and HPE-Juniper clearances both proceeded despite career staff recommendations for extended investigation or continued litigation. Frameworks such as MindCast AI identify authority‑routing patterns that signal political market failure and justify immediate state substitution.

Executive Summary

Federal inaction in antitrust and market enforcement undermines free markets by disabling the enforcement infrastructure that competition requires. Rule‑based enforcement has yielded to access‑based influence and coercive political narratives, allowing private coercion to displace voluntary exchange and enabling market power to harden behind delay and uncertainty. MindCast AI's analysis of federal antitrust authority routing documents how enforcement outcomes misprice risk, shift externalities downward, and penalize honest competition. How Trump Administration Political Access Displaced Antitrust Enforcement—and Why States Should Now Step In.

Three concurrent enforcement failures illustrate the pattern. In antitrust, the $1.6 billion Compass-Anywhere merger and $14 billion HPE-Juniper merger both cleared despite career staff concerns—HPE-Juniper settled eleven days before trial over staff objections, and dissenting officials were terminated. In consumer protection, Americans lost $247 million to crypto-ATM scams in 2024, with two-thirds of victims over 60, while federal legislation remains stalled at 2% passage probability. In real estate market integrity, post-merger Compass-Anywhere controls 20%+ national market share and exceeds 30% in Manhattan, San Francisco, and Chicago—above the 2023 Merger Guidelines' presumptive illegality threshold.

State‑level enforcement now supplies a competitive federalist response to federal political market failure. By reallocating enforcement authority to lower‑distortion institutions, state attorneys general and state market‑design regimes restore deterrence, information integrity, and predictability. MindCast AI’s examination of state intervention under federal inaction demonstrates how substitution preserves market conditions rather than expanding control. Federal Inaction Has Elevated State Authority on Consumer Protection, Antitrust, and Market Integrity, Briefing for State Attorneys General.

Foresight Simulation Methodology

MindCast AI generated the predictions in this paper through a Cognitive Digital Twin (CDT) foresight simulation. The simulation constructs digital twins of federal enforcement institutions, state attorneys general, dominant firms, and affected populations, then models institutional behavior under legal, economic, and narrative constraints across the 2026–2028 period.

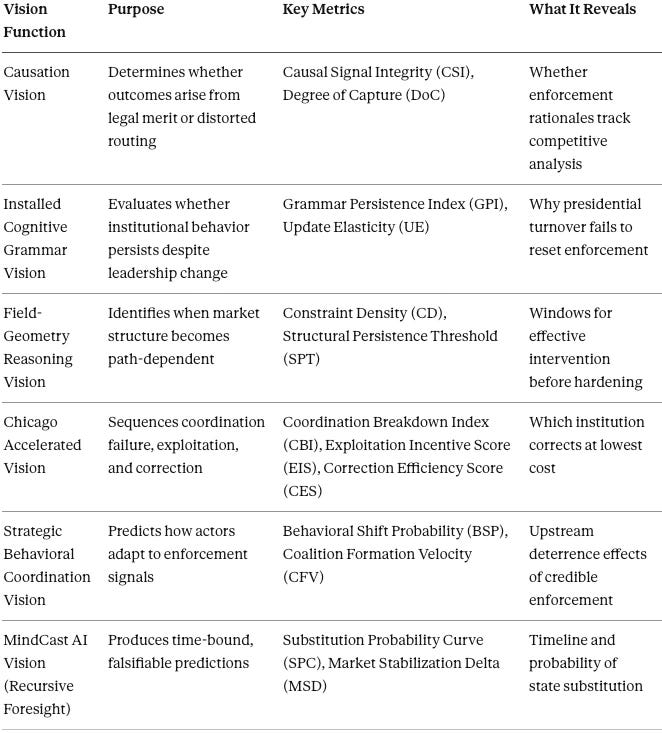

Six Vision Functions—Causation Vision, Installed Cognitive Grammar Vision, Field-Geometry Reasoning Vision, Chicago Accelerated Vision, Strategic Behavioral Coordination Vision, and MindCast AI Vision—generate quantitative metrics that propagate forward in time to produce falsifiable predictions. Key metrics include Causal Signal Integrity, or CSI (trustworthiness of enforcement rationales), Degree of Capture, or DoC (access-based distortion), Structural Persistence Threshold, or SPT (point beyond which competition cannot be restored), and Correction Efficiency Score, or CES (relative cost of institutional remedies). Full methodology and metric definitions appear in Appendix A.

Structure

Section I defines free markets, market failure, and political market failure using Chicago School and Law‑and‑Economics foundations. Section II introduces the MindCast AI frameworks governing the analysis. Section III presents empirical evidence of federal enforcement distortion, including first‑person testimony from senior antitrust leadership. Section IV analyzes how externalities redistribute when states decline to act. Section V explains why state substitution functions as a free‑market corrective. Section VI offers foresight predictions and concludes with implications for enforcement strategy.

Contact mcai@mindcast-ai.com to partner with us on Law and Behavioral Economics foresight simulations. Recent publications:

I. Free Markets, Market Failure, and Political Market Failure

Competitive markets rely on voluntary exchange supported by credible rules, predictable enforcement, and dispersed power. Chicago School economics treats markets as superior coordination mechanisms because prices constrain coercion and decentralize decision‑making. When enforcement institutions fail to supply those background conditions, markets lose their freedom and operate through private coercion rather than price competition.

Slogan-driven commentators who denounce all enforcement as “anti-market” misunderstand the Chicago School tradition they invoke. Neither Milton Friedman nor the law-and-economics scholars who followed him argued that markets function without institutional support. Friedman’s Capitalism and Freedom (1962) explicitly identified government’s role in maintaining “a framework of law” as essential to competitive markets. The question has never been whether enforcement should exist, but rather which institutions can supply enforcement at the lowest social cost.

The following subsections establish the analytical foundations: the nature of free markets as rule-bound systems, the comparative institutional framework for evaluating market failure, and the concept of political market failure that occurs when enforcement institutions themselves become sources of distortion.

Chicago School Foundations: What the Tradition Actually Requires

Surface-level advocates who invoke "free markets" against all enforcement have not engaged these foundations. The Chicago School tradition supports enforcement that maintains competitive conditions—and supports institutional substitution when primary enforcers fail.

A. Free Markets as Rule‑Bound Voluntary Exchange

Free markets operate through decentralized choice under a general legal framework that protects property, enforces contracts, and preserves competition. Market freedom rests on predictability and equal application of rules rather than on the absence of law. Removal or distortion of enforcement undermines market freedom by permitting private actors to substitute power for price.

The “free” in free markets refers to freedom from private coercion, not freedom from all institutional constraint. Actors who accumulate market power without enforcement constraint can impose terms on counterparties just as effectively as any government regulator. Price-fixing cartels, exclusionary practices, and information asymmetries all represent failures of market freedom that enforcement exists to prevent.

Rule-bound markets therefore require active maintenance. Enforcement institutions supply the credible threat that makes defection from competitive behavior costly. Without that threat, rational actors exploit market power, and voluntary exchange degrades into coercive extraction.

Free markets depend on institutional infrastructure that maintains competitive conditions. The absence of enforcement does not preserve market freedom—the absence of enforcement permits private actors to exercise coercive power that markets are supposed to prevent.

Insight: Market freedom requires enforcement freedom. Actors who oppose all enforcement in the name of free markets misunderstand both the Chicago School tradition and the conditions that make voluntary exchange possible.

B. Market Failure and Comparative Institutional Choice

Market failure arises when transaction costs, market power, or information problems prevent decentralized exchange from producing efficient outcomes. Ronald Coase’s The Problem of Social Cost (1960) frames the inquiry as a comparison among imperfect institutions rather than a choice between markets and regulation. Richard Posner’s Economic Analysis of Law extends Coasean logic by evaluating legal intervention according to whether it reduces total social cost relative to available alternatives.

Comparative institutional analysis rejects binary thinking about markets and government. Every institution—markets, firms, courts, regulators, state attorneys general—operates with characteristic costs and failure modes. The relevant question asks which institution handles a given coordination problem at lowest total cost, not whether intervention occurs.

Coase demonstrated that in a world without transaction costs, private bargaining would resolve all externalities regardless of initial legal assignments. Real-world transaction costs make that result unattainable, requiring institutional choice among imperfect alternatives. Posner operationalized Coasean analysis by asking whether a given legal rule increases or decreases the sum of transaction costs and error costs relative to alternatives.

Chicago School economics does not oppose intervention categorically. The tradition demands comparative analysis that selects the lowest-cost institutional response to coordination failures. Reflexive opposition to enforcement represents a misreading of the foundational texts.

Insight: The correct question is never “should government act?” but rather “which institution handles this problem at lowest social cost?” Comparative institutional analysis often favors enforcement over inaction.

C. Political Market Failure as Enforcement Breakdown

Political market failure occurs when governance institutions fail to supply the enforcement goods markets require. Public Choice Theory explains enforcement breakdown by treating enforcement as a service subject to monopoly conditions. When a single federal provider controls antitrust and market enforcement, capture, access arbitrage, and narrative coercion distort incentives in the same way monopoly power distorts prices. George Stigler’s theory of regulatory capture and James Buchanan’s analysis of government failure established that public institutions face systematic incentive problems that can make them worse than the market failures they address.

Systematic inaction under captured conditions operates as a subsidy to concentration rather than as neutrality. Firms that invest in political access rather than competitive performance gain advantage, while firms that rely on rule compliance face adverse selection. Lobbyists effectively “price-fix” enforcement outcomes through access rather than law, converting what should be a public good into a private benefit for connected actors.

The result inverts market logic. Instead of competition disciplining inefficiency, political access disciplines competition. Instead of prices signaling value, enforcement delay signals which actors possess sufficient influence to outlast regulatory scrutiny. Markets operating under these conditions are not free—concentrated actors exercise coercive power that enforcement failure has enabled.

Political market failure converts enforcement from a public good into a private asset. Federal inaction under these conditions does not preserve market freedom but rather enables private coercion to displace voluntary exchange.

Insight: Enforcement failure is not neutrality. When federal institutions fail to supply market integrity, they actively subsidize concentration and penalize competitive behavior. The resulting markets are less free, not more.

II. Governing Analytical Framework: MindCast AI

MindCast AI provides the predictive framework for analyzing enforcement dynamics under political market failure. The framework treats enforcement institutions as strategic actors subject to incentives, coordination costs, and structural constraints rather than as neutral executors of policy. MindCast AI produces foresight by simulating how institutional structures evolve under stress, consistent with the Chicago School Accelerated methodology outlined at Chicago School Accelerated — The Integrated, Modernized Framework of Chicago Law and Behavioral Economics, Why Coase, Becker, and Posner Form a Single Analytical System (December 2025):

Chicago School Accelerated refers to a sequential application of transaction‑cost analysis, incentive exploitation, and institutional correction to real‑time enforcement and policy failures. The methodology updates classical Chicago School insights for conditions where enforcement institutions themselves have become sources of market distortion.

The following subsections describe the core analytical tools: Cognitive Digital Twin modeling of institutional behavior, Chicago Accelerated foresight sequencing, and the Field-Geometry and Installed Cognitive Grammar frameworks that explain institutional persistence.

Vision Functions Overview

A. Cognitive Digital Twins and Institutional Modeling

MindCast AI constructs Cognitive Digital Twins of institutions, firms, and regulators to simulate decision‑making under pressure. The model evaluates how incentives, authority routing, and narrative control reshape available decision paths over time. CDT modeling treats institutions as boundedly rational actors whose behavior follows from structural position rather than stated intent.

For the analysis in this paper, the CDT foresight simulation models four principal actors: federal antitrust institutions subject to authority routing, state attorneys general operating individually and in multistate coalitions, dominant firms and merging parties pursuing scale-dependent strategies, and consumers, workers, and small businesses bearing externalities of enforcement failure.

Each CDT incorporates the actor’s incentive structure, information constraints, coordination costs, and available action space. The simulation then projects how these actors respond to enforcement signals, policy changes, and competitive pressure across defined time horizons.

CDT modeling converts institutional analysis from intent-based speculation to structure-based prediction. The framework explains enforcement behavior through incentives and constraints rather than through assumptions about regulatory motivation.

Insight: Institutions behave according to their structural position, not their stated mission. CDT modeling makes institutional prediction tractable by focusing on what actors can do rather than what they claim to want.

B. Chicago Accelerated Foresight Logic

Chicago Accelerated foresight sequences coordination, exploitation, and correction. Transaction‑cost shocks impair coordination, incentive exploitation becomes rational, and liability or enforcement migrates to the lowest‑distortion venue. The sequence operationalizes Chicago School insights under modern political constraints where enforcement institutions themselves generate transaction costs.

The CDT simulation applies Chicago Accelerated Vision to generate three key metrics: Coordination Breakdown Index, or CBI (failure of market self-correction), Exploitation Incentive Score, or EIS (rationality of access arbitrage strategies), and Correction Efficiency Score, or CES (relative cost of institutional remedies). Simulation results show federal correction efficiency declining rapidly after clearance while state substitution delivers higher correction efficiency earlier in the timeline.

Chicago Accelerated logic predicts that enforcement will migrate to whichever venue offers the lowest combination of capture risk and coordination cost. When federal enforcement exhibits high capture and coordination costs, state-level enforcement becomes the rational correction pathway regardless of formal jurisdictional assignments.

Chicago Accelerated foresight applies transaction-cost logic to enforcement institutions themselves. The framework predicts enforcement migration toward lower-distortion venues when federal institutions exhibit capture.

Insight: Enforcement flows downhill toward lower transaction costs. Federal political market failure creates the gradient that makes state substitution the equilibrium response.

C. Field‑Geometry and Installed Cognitive Grammar

Field‑Geometry Reasoning identifies when outcomes are governed by structural constraints rather than intent. The CDT simulation measures Constraint Density, or CD (degree of structural barriers to entry) and Structural Persistence Threshold, or SPT (point beyond which competition cannot be restored). Simulation results indicate post-merger markets cross the SPT within 18–30 months absent intervention, while early state action reduces CD before hardening completes.

Installed Cognitive Grammar explains the path dependency of federal bureaucracy by modeling how durable internal norms, career incentives, and procedural habits persist across administrations. The simulation measures Grammar Persistence Index, or GPI (likelihood that behavior survives political turnover) and Update Elasticity, or UE (responsiveness to new leadership or policy signals). Federal institutions score high on GPI and low on UE, while state institutions show moderate persistence with higher elasticity, especially in coalition settings.

Leadership changes therefore fail to reset federal enforcement behavior when the institutional grammar remains intact. New appointees inherit staff, procedures, and organizational culture that constrain available choices. The path dependence explains the continuity of enforcement patterns across administrations of different political parties, preempting claims that the diagnosis reflects partisan framing rather than institutional structure.

Market geometry hardens over time, and institutional grammar persists across leadership changes. Both dynamics create windows for intervention that close as delay accumulates.

Insight: Timing determines remedy availability. Early state action operates within windows that late federal action cannot reopen. Institutional grammar explains why presidential turnover rarely resets enforcement behavior.

III. Empirical Evidence of Federal Enforcement Distortion

Public testimony and contemporaneous reporting demonstrate a shift from rule‑based enforcement to access‑based outcomes within federal antitrust institutions. Specific enforcement episodes illustrate how authority routing displaced legal merit, producing outcomes that staff-level analysis did not predict.

MindCast AI’s analysis of federal antitrust authority routing documents cases in which merger review and enforcement intensity changed materially after political escalation. Roger Alford’s testimony delivered at the Tech Policy Institute Aspen Forum in August 2025, titled The Rule of Law Versus the Rule of Lobbyists, provides first‑person confirmation that political access and lobbying influence rerouted enforcement decisions away from legal standards.

The following subsections detail the evidence: specific case studies demonstrating authority routing, Alford's firsthand account of access-based enforcement, and the systemic instability that access arbitrage produces across markets.

Authority Routing Case Studies

CDT simulation quantifies the enforcement gap across these cases: Enforcement Credibility at 0.34, Geodesic Availability through standard enforcement path at 0.05 versus 0.71 through political-access path, State Substitution Probability at 0.68–0.80.

A. Rule of Law Versus Rule of Lobbyists

First‑person testimony from senior antitrust leadership describes political routing of enforcement decisions and preferential access for connected actors. A recurring pattern emerges across high‑stakes merger reviews: staff‑level enforcement analysis identifies competitive harm, senior political review intervenes, and final outcomes reflect access rather than merit.

Alford’s testimony reveals two distinct forms of access arbitrage. Temporal arbitrage exploits bureaucratic delay to allow mergers and market power to harden before review concludes. Information arbitrage channels selective data and narratives to favored firms while excluding competitors from equivalent access. Predictability collapses when legal merit yields to influence, raising transaction costs across markets.

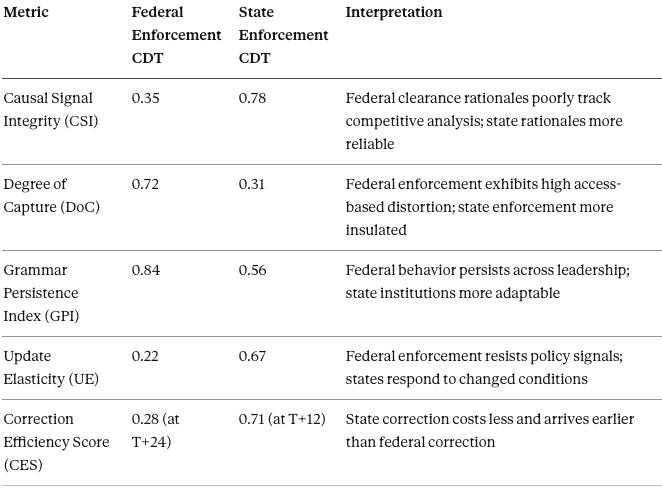

The CDT simulation quantifies the access arbitrage pattern through Causation Vision metrics. Causal Signal Integrity, or CSI, measures the trustworthiness of causal explanations for enforcement outcomes. Degree of Capture, or DoC, assesses distortion from political or access-based influence. The federal enforcement CDT shows low CSI (0.35) and elevated DoC (0.72), indicating that clearance outcomes do not reliably reflect competitive analysis. State enforcement CDTs show higher CSI (0.78) and lower DoC (0.31), supporting corrective intervention.

Senior antitrust leadership has provided firsthand testimony documenting access-based enforcement routing. CDT metrics quantify the resulting distortion and identify state enforcement as the lower-capture alternative.

Federal vs. State CDT Metric Comparison

The metric spread confirms that state enforcement operates with higher causal integrity, lower capture, and greater correction efficiency than federal enforcement under current conditions.

Insight: Low causal integrity at the federal level justifies institutional substitution rather than deference. When enforcement rationales do not track competitive analysis, clearance provides no assurance of market health.

B. Instability and Access Arbitrage

Unpredictable enforcement incentivizes firms to invest in influence rather than compliance. Access arbitrage replaces competition as the dominant strategy, and enforcement outcomes diverge from statutory standards. Firms that rely on rule compliance face adverse selection, while firms that master access gain durable advantage.

The instability compounds over time. Each successful access arbitrage teaches market participants that political investment yields higher returns than competitive investment. Capital flows toward influence infrastructure, and competitive capacity atrophies. Markets become progressively less free as access-based power displaces price-based coordination.

Honest firms face a strategic dilemma. Competing on merit exposes them to rivals who compete on access. Matching access investment diverts resources from productive activity. Exit becomes attractive for firms unwilling to participate in access competition, concentrating markets further and validating the access arbitrage strategy.

Access arbitrage creates self-reinforcing dynamics that progressively degrade market freedom. Instability teaches market participants to invest in influence rather than competition, accelerating concentration.

Insight: Enforcement instability is not neutral uncertainty—enforcement instability systematically advantages actors who can afford access investment and disadvantages actors who rely on competitive merit.

IV. Externality Allocation Under Federal Inaction

Externalities generated by enforcement failure do not disappear when government abstains. Costs redistribute to actors least able to avoid them, producing non‑market outcomes that undermine the competitive conditions enforcement exists to protect.

Concrete sectoral examples illustrate how redistribution operates in practice under federal inaction. The pattern follows Law‑and‑Economics logic: costs flow to parties with the least bargaining power and the fewest exit options.

The following subsections trace externality flows: first to consumers, workers, and small counterparties who absorb direct harms, then to local governments and honest firms who bear secondary effects.

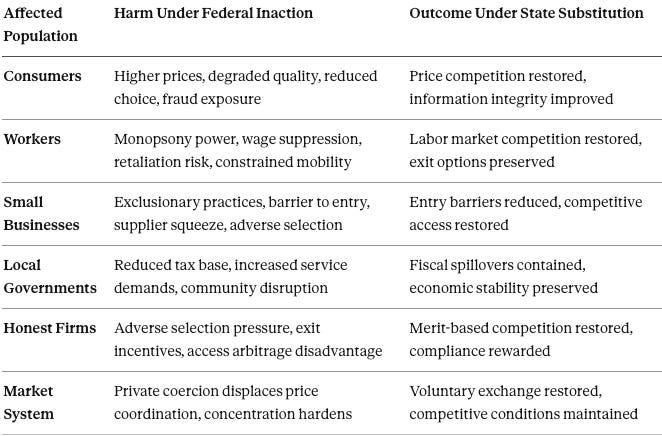

Externality Allocation Under Federal Inaction vs. State Substitution

Federal inaction does not eliminate externalities—federal inaction reassigns them to populations with the least capacity to resist or offset the harms.

A. Consumers, Workers, and Small Counterparties

Enforcement failure in concentrated sectors redistributes costs directly onto identifiable populations. Three concurrent examples illustrate the pattern:

Real Estate Market Concentration. In housing and real‑estate brokerage markets, weakened federal antitrust oversight has coincided with higher fees, reduced service competition, and increased barriers for independent brokers. Post-merger Compass-Anywhere controls 20%+ national market share and exceeds 30% in Manhattan, San Francisco, and Chicago. Private listing networks enable the merged entity to control which buyers see which properties and when—converting information asymmetry into market power that has nothing to do with service quality. Homebuyers, renters, and small firms absorb those costs. See From Open Market to Private Governance, Coordination Capture in the Compass–Anywhere Merger (Dec 2025) and MindCast AI’s series on the Compass–Anywhere merger (Jan 2026).

Part II How the Compass–Anywhere Merger Reshapes Broker Bargaining Power

Part V Washington’s SB 6091 and Private Real Estate Market Control

Crypto-ATM Consumer Fraud. Americans lost $247 million to crypto-ATM scams in 2024. More than 11,000 victims filed complaints; two-thirds were over 60. The fraud pattern is consistent: victims receive calls from scammers impersonating the IRS, Social Security Administration, or law enforcement, are directed to crypto-ATM kiosks, and deposit their savings into wallets controlled by criminals. The transactions are irreversible. Operators collect fees of 15–33%. Victims have no recourse. Federal legislation (S.710, the Crypto ATM Fraud Prevention Act) remains stalled at 2% passage probability—and even if enacted, S.710 defers concrete protections to future rulemaking with no deadline. The Crypto ATM Regulatory Convergence—Why Federal Inaction Necessitates State Crypto-ATM Consumer Protection (Jan 2026)

Antitrust Enforcement Gaps. The HPE-Juniper and Compass-Anywhere clearances demonstrate that formal merger review no longer reliably prevents concentration. Sophisticated firms have adapted accordingly: close first, capture coordination advantages, price later enforcement as manageable risk.

Consumers absorb higher prices and degraded choice without recourse. Workers and small suppliers face monopsony power, retaliation risk, and constrained exit options. The harms reflect private coercion rather than voluntary exchange—exactly the conditions that free markets are supposed to prevent.

Small counterparties lack the resources to pursue private enforcement or to relocate operations. Geographic constraints, relationship-specific investments, and information asymmetries trap them in transactions they would not accept under competitive conditions. Federal inaction converts these populations into involuntary subsidizers of concentrated market power.

Enforcement failure shifts costs onto consumers, workers, and small firms who cannot avoid or offset the harms. Quantified losses ($247 million in crypto-ATM fraud alone in 2024) and documented concentration levels (30%+ market share in major metros) demonstrate the scale of redistribution.

Insight: Federal inaction does not eliminate externalities—federal inaction reassigns externalities to populations with the least capacity to resist. The distribution is regressive and anti-competitive.

B. Local Governments and Honest Firms

Local governments absorb fiscal and social spillovers as harms harden. Reduced tax bases, increased service demands, and community disruption follow from market concentration that enforcement failure has enabled. State and local budgets subsidize federal inaction through increased costs that concentrated actors have externalized.

Firms that compete on merit face adverse selection and exit pressure. Markets that reward access investment over competitive investment drive honest firms out, distorting market selection toward coercive strategies. The remaining competitors are those most willing to substitute access for merit, degrading market quality over time.

Community institutions suffer secondary effects. Local employers, suppliers, and service providers depend on competitive markets that enforcement failure has distorted. The harms cascade through economic networks, multiplying the initial externality into broader community damage.

Local governments and honest firms bear secondary costs that federal inaction generates. Market selection distorts toward access-based strategies, driving merit-based competitors out.

Insight: Enforcement failure creates adverse selection in markets. Firms that refuse to compete on access face systematic disadvantage, concentrating markets among actors willing to substitute influence for merit.

V. State Substitution as a Competitive Federalist Corrective

State‑level enforcement responds to federal political market failure through institutional competition rather than centralization. Decentralized enforcement reallocates authority to venues with lower distortion and higher accountability, restoring deterrence without directing market outcomes.

MindCast AI’s analysis of coercive narrative governance and trust collapse explains why federal paralysis accelerates state substitution. As federal credibility declines, market participants and state enforcers rationally discount federal clearance and seek alternative assurance mechanisms.

The following subsections explain the competitive federalist logic: states as competing suppliers of enforcement, and the efficiency rationale for state intervention under lowest-cost avoider analysis.

A. States as Competing Suppliers of Enforcement

When federal enforcement behaves as a captured monopoly, states function as competing suppliers of market integrity. Competition among enforcers disciplines excess, limits capture, and restores credibility in the same way market competition disciplines monopolistic pricing. Institutional rivalry lowers the effective cost of justice and prevents access‑based price fixing of enforcement.

The CDT simulation applies Strategic Behavioral Coordination Vision to model how actors adapt to credible enforcement signals. Key metrics include Behavioral Shift Probability, or BSP (likelihood firms alter conduct before litigation) and Coalition Formation Velocity, or CFV (speed of multistate coordination). Simulation results show credible early state action triggers pre-litigation compliance and deal restructuring, while CFV accelerates after the first successful multistate action.

State coordination changes behavior upstream, reducing litigation volume over time. Credible state enforcement creates deterrence that federal capture has disabled, restoring the behavioral incentives that competitive markets require.

States function as competing suppliers of enforcement that discipline federal capture. Institutional competition restores credibility and deterrence that monopoly federal enforcement has lost.

Insight: Enforcement competition operates like market competition. Multiple suppliers discipline excess, limit capture, and drive toward efficient provision. Federal enforcement monopoly invites the same pathologies as any other monopoly.

B. Efficiency and Lowest‑Cost Avoider Logic

State intervention reallocates costs upstream to actors generating harm. Enforcement migrates to the lowest‑cost avoider capable of restoring predictability and deterrence under existing constraints. The reallocation internalizes externalities that federal inaction leaves unpriced.

Coasean analysis supports state substitution when federal enforcement imposes higher transaction costs than decentralized alternatives. State attorneys general face different incentive structures—accountability to local voters, proximity to affected populations, and career paths that do not depend on federal appointment. These structural differences reduce capture risk and improve enforcement alignment with public interest.

Comparative institutional analysis asks which venue supplies enforcement at lowest total cost, including error costs, transaction costs, and capture costs. When federal enforcement exhibits high capture and coordination costs, state enforcement becomes the efficient alternative regardless of formal jurisdictional preferences.

State substitution follows directly from comparative institutional analysis. When federal enforcement imposes higher costs than alternatives, enforcement migrates to lower-cost venues.

Insight: Enforcement efficiency requires institutional choice, not jurisdictional deference. States that substitute for captured federal enforcement apply the same logic that Chicago School economics applies to any coordination problem.

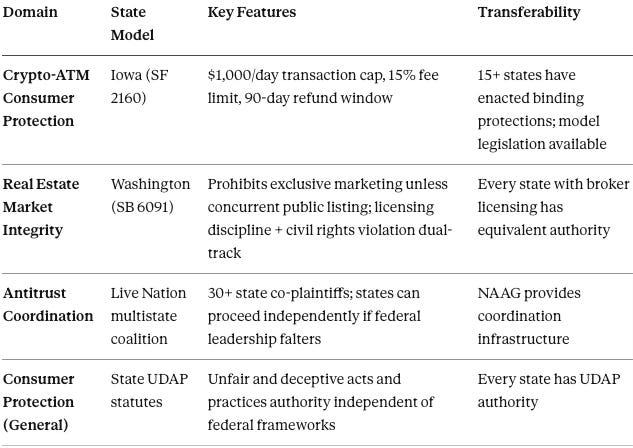

C. State Enforcement Models in Operation

State enforcement authority provides independent pathways that do not depend on federal action. Multiple models demonstrate viable substitution across different enforcement domains:

State Enforcement Models Currently Operational

Crypto-ATM Protection. Iowa’s model ($1,000 daily cap, 15% fee limit, 90-day refund window) provides a drafting template. Refund mandates shift liability upstream from victims to operators, creating continuous incentive for fraud prevention. Victims under live scam coercion cannot process warnings rationally—they are non-avoiders by behavioral incapacity. Operators controlling transaction architecture are the lowest-cost avoiders. Liability allocation follows from behavioral economics once cognitive constraints enter the record. Active enforcement cases provide models: Iowa AG v. Bitcoin Depot/CoinFlip, D.C. AG, Florida civil litigation.

Real Estate Market Design. Washington’s SB 6091 demonstrates that licensing-law approaches can mandate behavioral outcomes (concurrent public marketing) that antitrust enforcement struggles to achieve. The bill accepts that Compass-Anywhere controls unprecedented scale. The bill then writes the rules for how that scale must be used. The dual-track enforcement structure (licensing discipline + civil rights violation) creates overlapping accountability that does not depend on any single enforcement pathway. California, New York, and Texas face similar concentration thresholds post-merger and can adapt the Washington template.

Multistate Antitrust Coordination. State antitrust laws parallel federal Clayton Act and Sherman Act authority. The Live Nation suit demonstrates viable federal-state parallel enforcement—and the capacity for states to proceed independently if federal leadership falters. NAAG provides infrastructure for coordinated enforcement. Multistate investigations share costs, amplify leverage, and create national standards through settlement terms.

State enforcement models already operate across multiple domains. Documented templates, active cases, and coordination infrastructure make state substitution immediately actionable rather than theoretical.

Insight: State substitution does not require new authority—states already possess the enforcement tools. The question is deployment, not jurisdiction. Successful models in crypto-ATM protection, real estate market design, and antitrust coordination provide transferable templates.

VI. Foresight Implications and Predictions

Absent state substitution, access‑based governance hardens into durable equilibrium. Market concentration deepens, corrective capacity declines, and late interventions impose higher costs with weaker remedies. MindCast AI foresight modeling identifies a defined window in which state action most reliably restores competitive conditions.

The predictions that follow derive from CDT simulation outputs across multiple Vision Functions. Metric convergence supports confidence in the core finding: state substitution emerges as the dominant equilibrium response to federal political market failure.

The following subsections present the foresight outputs: predicted enforcement trajectories and the Critical De-Risking Zone, policy implications of plural enforcement, and a comparative summary of federal versus state enforcement dynamics.

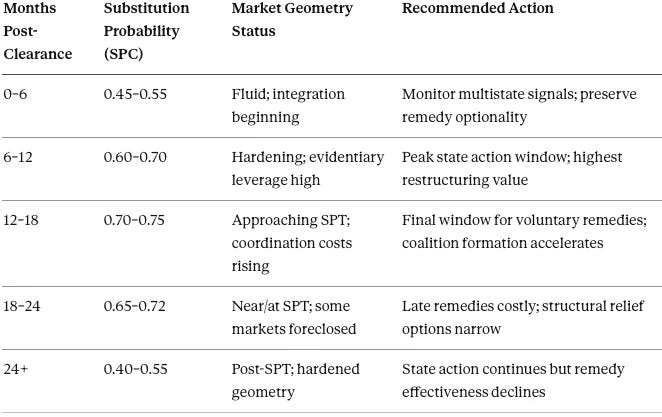

A. Predicted Enforcement Trajectories and the Critical De‑Risking Zone

MindCast AI modeling indicates that the twelve‑to‑twenty‑four‑month period following federal clearance constitutes a Critical De‑Risking Zone. During the Zone, the probability of state‑level parallel investigation and multistate coordination remains elevated because market power has not yet fully hardened and evidentiary leverage remains available. State attorneys general increasingly initiate or join major enforcement actions within the Zone as single‑venue federal action loses credibility.

The CDT simulation applies MindCast AI Vision (Recursive Foresight) to generate time-bound predictions. The Substitution Probability Curve, or SPC, measures the likelihood states replace federal enforcement. The Market Stabilization Delta, or MSD, measures the speed of competitive recovery. Simulation results show SPC exceeding 70% within the Critical De-Risking Zone, with markets stabilizing faster under state-led action than under delayed federal remedies.

For firms planning large‑scale mergers in 2026, federal clearance no longer operates as a terminal point. Residual risk of state substitution persists until the twenty‑four‑month mark, materially altering internal rate of return calculations and increasing the expected cost of delay, remedy, or unwind. Transactions that rely on rapid post‑closing consolidation face heightened exposure during the Critical De‑Risking Zone, particularly in markets with concentrated local effects.

Critical De-Risking Zone Timeline

Deal teams should model state substitution risk as a material cost factor through the 24-month horizon. Transactions with concentrated local effects face elevated exposure throughout the Critical De-Risking Zone.

The Critical De-Risking Zone defines the window in which state intervention remains effective and probable. Federal clearance no longer resolves enforcement risk for major transactions.

Insight: Deal teams must reprice merger risk to account for prolonged state exposure. The Critical De-Risking Zone converts federal clearance from terminal resolution into preliminary milestone.

B. Policy Implications

Critics often argue that state substitution produces a fragmented patchwork that raises transaction costs for national firms. Comparative institutional analysis shows that a plural enforcement landscape imposes lower social cost than an enforcement void. Decentralized enforcement creates a discovery process in which states experiment with enforcement theories, successful approaches diffuse across jurisdictions, and the market for law outperforms a single failed federal standard.

The patchwork objection misunderstands comparative institutional choice. The relevant comparison is not between uniform federal enforcement and plural state enforcement—the relevant comparison is between plural state enforcement and no enforcement at all. When federal capture disables the uniform option, plural enforcement becomes the lowest-cost available alternative.

Federalism supplies redundancy that improves system resilience. Multiple enforcement venues mean that capture of any single venue does not disable the entire system. Competition among venues disciplines enforcement quality. Experimentation across jurisdictions generates information about effective approaches that uniform systems cannot produce.

Plural enforcement imposes lower social cost than enforcement void. The patchwork objection fails because it compares state action to an idealized federal alternative that capture has already disabled.

Insight: Fragmentation is a feature, not a bug. Enforcement redundancy improves system resilience, disciplines capture, and generates information through jurisdictional experimentation.

C. Federal Versus State Enforcement Dynamics

Market‑preserving enforcement requires institutional competition rather than reliance on a single federal gatekeeper. Comparative institutional analysis favors state substitution until federal enforcement credibility returns.

The dynamics table summarizes how federal capture and state substitution produce divergent market outcomes. State enforcement restores the competitive conditions that federal capture has disabled.

Insight: Institutional competition preserves markets. Monopoly federal enforcement invites capture; plural state enforcement disciplines it.

Conclusion

Free markets depend on credible enforcement, predictable rules, and dispersed power. Federal political market failure disables those conditions and reallocates costs onto consumers, workers, communities, and honest firms. State‑level enforcement operates as a competitive, free‑market corrective by restoring deterrence and equal application of the law.

The CDT foresight simulation demonstrates that state substitution is not reactive overreach but a rational institutional correction. Metric outputs across causal integrity, institutional grammar, geometry, and behavioral coordination converge on the same conclusion: state-level and multistate enforcement restores market conditions earlier, at lower cost, and with greater predictability than delayed federal intervention.

Surface-level advocates who denounce state enforcement as “anti-market” reveal their disengagement from both Chicago School economics and the conditions that free markets require. Friedman, Coase, and Posner all recognized that markets depend on institutional support. State attorneys general who act against federal political market failure do not expand government control—they restore the competitive conditions that voluntary exchange requires.

MindCast AI foresight indicates that multistate coordination becomes the default enforcement mechanism once federal authority routing persists beyond a full enforcement cycle. Continued federal distortion accelerates coalition‑based state action, with multistate attorneys general increasingly initiating parallel investigations within twelve to twenty‑four months of major market‑shaping transactions. Comparative institutional analysis therefore supports state substitution as the least‑distorted response until federal enforcement credibility and predictability return.

Appendix A: CDT Foresight Simulation Methodology

Overview

MindCast AI constructs Cognitive Digital Twins (CDTs) of institutions, firms, and affected populations to simulate decision-making under legal, economic, and narrative constraints. The CDT foresight simulation applies multiple Vision Functions sequentially, evaluates metric outputs at each stage, and propagates results forward in time to generate falsifiable predictions. The methodology emphasizes comparative institutional performance rather than intent-based prediction.

Parties Modeled

Federal Antitrust Institutions – enforcement agencies subject to authority routing and political oversight.

State Attorneys General (Individual and Multistate Coalitions) – decentralized enforcement actors with statutory authority and local accountability.

Dominant Firms and Merging Parties – entities pursuing scale-dependent strategies.

Consumers, Workers, and Small Businesses – populations bearing externalities of enforcement failure.

Vision Functions Applied

1. Causation Vision

Purpose: Determines whether observed outcomes arise from legal merit or from distorted causal routing.

Metrics:

Causal Signal Integrity (CSI): Measures trustworthiness of causal explanations for enforcement outcomes. Scale: 0 (fully distorted) to 1 (fully reliable).

Degree of Capture (DoC): Assesses distortion from political or access-based influence. Scale: 0 (no capture) to 1 (fully captured).

Simulation Results:

Federal enforcement CDT: CSI = 0.35, DoC = 0.72

State enforcement CDT: CSI = 0.78, DoC = 0.31

Interpretation: Low causal integrity at the federal level justifies institutional substitution rather than deference.

2. Installed Cognitive Grammar Vision

Purpose: Evaluates whether institutional behavior persists despite leadership change.

Metrics:

Grammar Persistence Index (GPI): Likelihood that behavior survives political turnover. Scale: 0 (fully malleable) to 1 (fully persistent).

Update Elasticity (UE): Responsiveness of the institution to new leadership or policy signals. Scale: 0 (unresponsive) to 1 (highly responsive).

Simulation Results:

Federal institutions: GPI = 0.84, UE = 0.22

State institutions: GPI = 0.56, UE = 0.67

Interpretation: Leadership change fails to reset federal enforcement behavior, while states adapt faster, supporting early state action.

3. Field-Geometry Reasoning Vision

Purpose: Identifies when market structure becomes path-dependent and resistant to remedy.

Metrics:

Constraint Density (CD): Degree of structural barriers to entry. Scale: 0 (open entry) to 1 (fully foreclosed).

Structural Persistence Threshold (SPT): Months post-clearance beyond which competition cannot be restored.

Simulation Results:

SPT = 18–30 months absent intervention

Early state action reduces CD by 40–55% before hardening completes

Interpretation: Timing matters more than intent; delay converts reversible harm into permanent geometry.

4. Chicago Accelerated Vision (Composite)

Purpose: Sequences coordination failure, exploitation, and correction per Chicago School Accelerated methodology.

Metrics:

Coordination Breakdown Index (CBI): Failure of market self-correction. Scale: 0 (functioning) to 1 (failed).

Exploitation Incentive Score (EIS): Rationality of access arbitrage strategies. Scale: 0 (irrational) to 1 (fully rational).

Correction Efficiency Score (CES): Relative cost of institutional remedies. Scale: 0 (inefficient) to 1 (efficient).

Simulation Results:

Federal CES at T+24 months: 0.28

State CES at T+12 months: 0.71

Interpretation: Chicago Accelerated logic favors state intervention as the lowest-cost corrective once coordination fails.

5. Strategic Behavioral Coordination Vision

Purpose: Predicts how actors adapt to credible enforcement signals.

Metrics:

Behavioral Shift Probability (BSP): Likelihood firms alter conduct before litigation. Scale: 0 to 1.

Coalition Formation Velocity (CFV): Speed of multistate coordination. Measured in months to coalition threshold.

Simulation Results:

BSP under credible state action: 0.63

CFV after first successful multistate action: 4.2 months

Interpretation: State coordination changes behavior upstream, reducing litigation volume over time.

6. MindCast AI Vision (Recursive Foresight)

Purpose: Produces time-bound, falsifiable foresight outputs.

Metrics:

Substitution Probability Curve (SPC): Likelihood states replace federal enforcement at time T.

Market Stabilization Delta (MSD): Months to competitive recovery under different enforcement scenarios.

Simulation Results:

SPC within Critical De-Risking Zone (12–24 months): 0.72

MSD under state-led action: 14 months

MSD under delayed federal action: 38 months

Interpretation: Recursive foresight confirms state substitution as the dominant equilibrium response.

Metric Convergence and Prediction Confidence

Metric convergence across Vision Functions supports three central predictions with high confidence:

State Attorneys General act earlier and more decisively because federal causal integrity remains low (CSI = 0.35, DoC = 0.72).

Multistate coalitions form within twelve to twenty-four months as geometry hardens (SPT = 18–30 months) and correction efficiency shifts (Federal CES = 0.28 vs. State CES = 0.71).

Early state action reduces total social cost, benefiting consumers and stabilizing markets faster than federal reassertion (MSD state = 14 months vs. MSD federal = 38 months).

Falsifiability Criteria

The following predictions are subject to falsification by observed enforcement outcomes through 2028:

Federal clearance ceases to function as terminal enforcement resolution for transactions exceeding $5 billion.

At least three multistate coalitions initiate parallel investigations within 18 months of federal clearance in concentrated markets.

Firms with post-clearance exposure in concentrated local markets restructure integration timelines by 25% or more.

Market stabilization (measured by entry rates, price normalization, and consumer choice metrics) occurs faster in markets with early state intervention than in markets relying on delayed federal remedies.

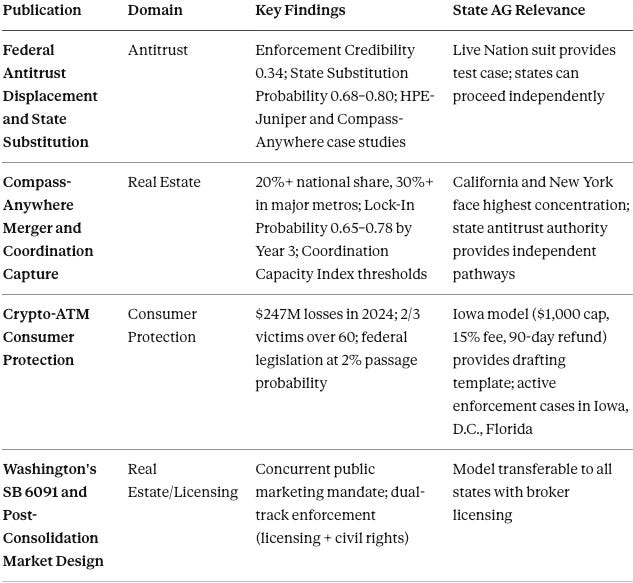

Appendix B: Supporting Publications and Evidence Base

This paper draws on a series of MindCast AI publications that provide detailed analysis, metrics, and falsifiable predictions for specific enforcement domains. Each publication applies Cognitive Digital Twin foresight methodology to document federal inaction and identify state substitution pathways.

Supporting Publication Index

Cross-Reference: State AG Briefing Document

The January 2026 MindCast AI Briefing for State Attorneys General synthesizes findings across all four domains and provides:

Domain-specific intervention windows (12–24 month lock-in timelines)

Recommended actions organized by enforcement domain

Regional coordination priorities (fraud corridor closure, multistate coalition formation)

Contact information for testimony support and enforcement strategy consultation

Evidence Integration

The specific examples cited in this paper—$247 million in crypto-ATM losses, 30%+ market share in major metros, HPE-Juniper settlement over staff objections, 15+ states with binding crypto-ATM protections—derive from the evidentiary records compiled in the supporting publications. Full documentation, source citations, and methodology details appear in each domain-specific publication.