MCAI Economics Vision: Predictive Institutional Economics Architecture for AI Foresight Simulation

The National Innovation Behavioral Economics, Strategic Behavioral Coordination, Cognitive Digital Twin Framework

The Vision Statement specifies the formal architecture of Predictive Institutional Economics—a synthesis of Chicago law-and-economics, behavioral economics, game theory, and national innovation traditions into a unified simulation framework for institutional foresight. The NIBE/SBC/CDT stack (National Innovation Behavioral Economics, Strategic Behavioral Coordination, Cognitive Digital Twins) models institutional dynamics through three integrated layers:

NIBE assesses whether institutional conditions permit bargaining at all;

SBC evaluates coordination capacity, trust accumulation, and exploitation drift among actors who can bargain;

CDT parameterizes individual agents with behavioral constraints, aspiration levels, and bounded horizons.

The framework computes aspiration equilibria—stable behavioral patterns in which agents satisfice under bias, coordination, and enforcement constraints—rather than optimization-based Nash equilibria that assume rationality the evidence does not support.

Validated against three prediction clusters in 2024–2025 (DOJ export-control enforcement timing, NVIDIA NVQLink technical specifications, DOE–FERC AI-infrastructure federalization), the framework demonstrates that conditional, falsifiable institutional foresight is tractable when behavioral realism, game-theoretic discipline, and explicit validation criteria are jointly imposed. MindCast AI advances this work as a defined research program—Predictive Institutional Economics—with formal objects, sequencing rules, validation norms, and cross-domain portability.

Readers can upload this document into an LLM to explore the structure interactively—asking the model to trace scenarios through the MindCast AI foresight simulation pipeline, vary institutional assumptions, or map real-world cases to the defined state variables. This kind of exploration helps build intuition about institutional dynamics and causal pathways. It does not, however, provide access to MindCast AI’s proprietary foresight simulation engine, decision thresholds, or prediction outputs; the LLM can reason within the public architecture, but the execution layer remains proprietary.

The MindCast AI Vision Statement is for

Economists and law-and-economics scholars seeking a formal synthesis of Chicago, behavioral, and institutional traditions with explicit state variables, update rules, and equilibrium concepts.

Policy analysts and regulatory strategists who need predictive frameworks for institutional dynamics in domains where standard equilibrium models systematically fail—AI governance, platform antitrust, export controls, national innovation policy.

Systems thinkers and complexity practitioners looking for a bridge between agent-based intuitions and formal economic structure, with explicit treatment of path dependence and feedback loops.

Strategic decision-makers in litigation, M&A, infrastructure investment, and institutional design who require forward-looking analysis grounded in both behavioral realism and game-theoretic discipline.

This document is not for readers who want opaque predictions without engaging the framework’s structure, who expect traditional regression-based econometric estimation instead of simulation with explicit validation rules, or who require single-point forecasts rather than scenario-conditional projections with uncertainty and sensitivity analysis.

I. The Synthesis

MindCast AI’s economics work represents a revival and recombination of several intellectual traditions: a modernized Chicago law-and-economics core, fused with behavioral, game-theoretic, institutional, and national-innovation traditions into a unified simulation architecture.

The Chicago School Accelerated series establishes that Coase, Becker, and Posner form a single analytical system—retained but completed by coordination and behavioral metrics. The Coase analysis explicitly rebrands the tradition as a Chicago School of Law and Behavioral Economics, treating transaction costs, incentives, and liability as still-valid pillars whose domain of validity must be sharply specified.

Kahneman, Tversky, Thaler, Simon, and behavioral game theory are deployed to formalize when Chicago-style incentive logic breaks because of bias, cognitive load, or trust collapse. The Becker analysis reframes behavioral economics from descriptive anomalies into a quantitative input layer for Predictive Cognitive AI, so bias and coordination failure become forward-simulable variables rather than post-hoc explanations.

Schelling and behavioral game theory reappear through focal points, coordination games, and behavioral drift metrics that quantify movement from efficiency competition to rent extraction. The Posner analysis models strategic interaction as repeated, high-velocity games where litigation, opacity, and routing are chosen strategies inside a payoff matrix—not legal noise at the margin.

Institutional and law-and-economics lines resurface through detailed treatment of MLS rules, platform governance, antitrust doctrine, and litigation as economic instruments in the Compass Modern Chicago analysis. Courts, agencies, platforms, and firms are each given update velocity and cognitive plasticity metrics, reviving institutionalist concerns in a formal, measurable way.

The National Innovation Behavioral Economics (NIBE) framework brings back national-innovation and growth thinking, recast around institutional throughput, coordination capacity, and strategic behavior. NIBE synthesized with Strategic Behavioral Coordination (SBC) functions as a macro-micro bridge, echoing Schumpeterian and institutional traditions while embedding them in simulation-ready indices.

Contact mcai@mindcast-ai.com to partner with us on Institutional Economics Foresight Simulations.

II. The Architecture

Simultaneous System, Sequential Implementation

The framework treats interaction between schools as simultaneous in theory but implements it through sequences of moves in practice, with NIBE/SBC and Cognitive Digital Twins (CDTs) stitching the layers together. The NIBE/SBC synthesis establishes this architecture.

A MindCast AI Cognitive Digital Twin is a transparent, parameterized model of an actor’s decision-making—specified by aspiration levels, bias coefficients, time horizons, trust thresholds, and narrative anchors—used to simulate how that actor behaves under different institutional and strategic scenarios. CDTs are developed by combining behavioral economics baselines (for biases and loss aversion), observed features of the real actor (e.g., litigation posture, risk tolerance, investment patterns), and iterative calibration against timestamped predictions, so the CDT’s behavior matches how that actor responds to changing enforcement, incentives, and coordination structures over time.

The core thesis: outcomes emerge from joint interaction of strategic structure (game theory), bias patterns (behavioral), and bounded rationality through CDTs—not from any layer independently. In simulation terms, each CDT carries behavioral parameters, faces a game-theoretic structure, and operates inside an institutional environment. Equilibrium is whatever pattern stabilizes under those jointly applied constraints.

Operationally, this is implemented as iterative relaxation: each pass through the pipeline (NIBE → SBC → CDT convergence) updates parameters that feed back into the next iteration. Over multiple time steps, the system behaves as if all layers are co-evolving even though any single pass has a defined order. This is computationally tractable in a way that solving a truly simultaneous system across all dimensions would not be.

The NIBE Layer: Can a Game Exist?

NIBE is deliberately defined as the “can a game exist at all?” layer. The NIBE framework assesses whether the institutional environment permits bargaining before game-theoretic analysis becomes relevant. If institutional metrics—rulemaking latency, delay propagation, governance alignment, enforcement posture—exceed certain thresholds, the model treats bargaining and coordination games as structurally blocked, not just inefficient.

Only when NIBE indicates a viable playing field does SBC analyze the incentive gradients and coordination architecture that determine whether behavior tends toward efficiency competition or exploitation, as demonstrated in the Coase and Becker analyses. This ordering makes methodological sense: checking whether the playing field exists before modeling the plays.

The SBC Layer: Coordination Dynamics

SBC formally encodes that agents satisfice rather than optimize. The Legacy Framework shows how equilibria are computed as aspiration-satisfying patterns subject to bias, coordination architecture, and narrative cues—not as pure Nash fixed points. This addresses a persistent problem with behavioral-game-theory integration: pure Nash equilibrium assumes optimization, but bounded rationality says agents cannot optimize.

The move to aspiration-satisfying patterns preserves the predictive structure of equilibrium analysis while relaxing the rationality assumptions that make it empirically fragile. Trust, narrative coherence, and coordination capacity are treated as state variables that accumulate or decay based on observed cooperation, defection, and enforcement credibility.

The CDT Layer: Agent Dynamics

Critical clarification: Cognitive Digital Twins are parameterized agents, not learned black boxes. Each CDT is specified by explicit parameters—aspiration levels, bias coefficients, horizon lengths, trust thresholds—derived from behavioral economics literature and calibrated to observable features of the actors being modeled. CDTs are not neural networks trained on data; they are structured behavioral models with transparent assumptions. When machine learning components are incorporated (for pattern recognition or parameter estimation), this is explicitly flagged. The default CDT is a transparent, inspectable agent.

CDTs are parameterized with explicit aspiration levels, trust densities, narrative anchors, and bias profiles, as detailed in the Smith Lineage and MindCast Vision II documents. Each CDT carries behavioral parameters (anchoring, availability, loss aversion coefficients), faces a game-theoretic structure, and operates inside the institutional environment defined by NIBE.

The feedback loop is explicit: institutional moves update NIBE indices; those re-parameterize CDT expectations (horizons, defection risk, perceived enforcement); SBC metrics then recompute deviation from efficiency competition, yielding new equilibria for the next time step. This dynamic is applied in the Licensing Strategy and AI Infrastructure Priority analyses.

III. Formal Framework

State Space

Note on decision thresholds: The framework employs proprietary decision thresholds for triggering regime transitions, blocking conditions, and equilibrium selection. These thresholds are calibrated from historical case analysis and validated against prediction accuracy. The threshold values themselves are not disclosed in this public specification; they are available under engagement with MindCast AI. What follows are the state variables and their roles in the architecture.

NIBE Variables (Institutional Environment)

τrule ∈ [0,1]: Rulemaking latency index

Ecred ∈ [0,1]: Enforcement credibility

Galign ∈ [0,1]: Governance alignment

Iopen ∈ [0,1]: Information channel openness

δprop ≥ 0: Delay propagation rate

SBC Variables (Coordination Dynamics) with Observable Proxies

SBC variables are the most judgment-laden layer in the framework. To ensure ex ante observability rather than post hoc rationalization, each SBC variable is anchored to 2-3 observable proxies. These proxies are noisy but not arbitrary; measurement error is expected, but the direction of bias is characterized.

T ∈ [0,1]: Trust stock

Accumulates/decays based on observed cooperation/defection.

Observable proxies:

• Contract renewal rates and renegotiation frequency in the relevant actor network

• Litigation initiation rates between previously cooperating parties

• Public statement sentiment divergence (measured via NLP on earnings calls, regulatory filings, press releases)

Ncoh ∈ [0,1]: Narrative coherence

Measures alignment of stated rationales across actors.

Observable proxies:

• Semantic similarity scores across public justifications (regulatory filings, court documents, press statements)

• Frequency of contradictory position-taking by the same actor over trailing 12 months

• Expert/analyst forecast dispersion on the same institutional question

Ccap ∈ [0,1]: Coordination capacity

Measures structural ability of actors to coordinate, independent of willingness.

Observable proxies:

• Network density metrics: board interlocks, shared counsel, joint venture history

• Information channel latency: time from event to documented response across actor network

• Prior coordination success rate: fraction of past multi-party initiatives reaching stated objectives

θexploit ∈ [0,1]: Exploitation tilt

Measures drift from efficiency competition toward rent extraction.

Observable proxies:

• Margin dispersion: variance in profitability across nominally competitive actors

• Fee/price opacity indicators: fraction of transactions with non-disclosed or variable pricing

• Barrier-to-entry investment: disclosed spending on regulatory capture, lobbying, or exclusionary practices relative to R&D

CDT Variables (Agent Parameters)

Ai: Aspiration level for agent i

Bi: Bias vector (anchoring, availability, loss aversion coefficients)

Hi: Horizon length

Eiperceived: Perceived enforcement (may diverge from Ecred)

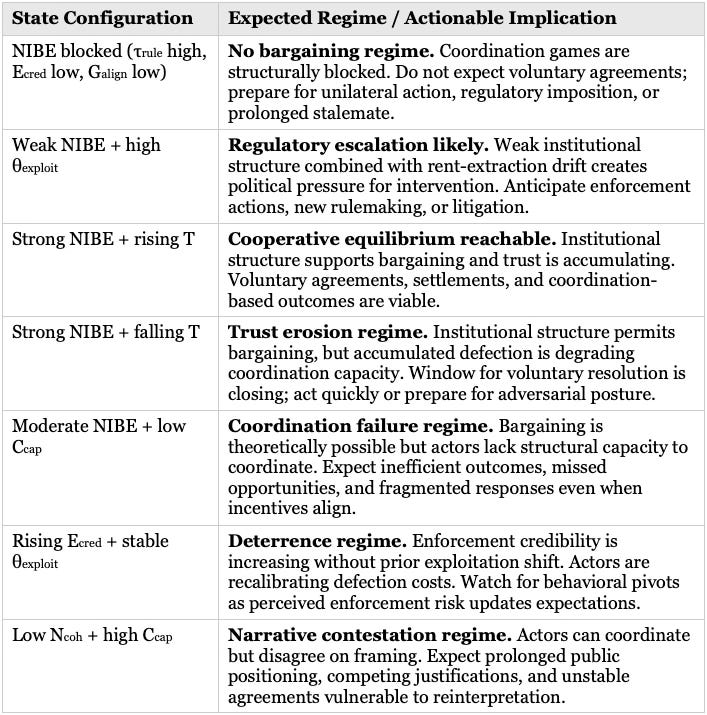

Regime Classification

The following table maps state-variable configurations to expected regime types. This allows operators to translate framework outputs into actionable postures without requiring access to proprietary threshold values.

Note: This table provides directional guidance. Precise regime boundaries depend on proprietary threshold calibrations available under MindCast AI engagement.

Update Rules

Discrete-time dynamics where t indexes periods:

NIBE(t+1) = f(NIBE(t), institutional_moves(t), SBC_outcomes(t))

CDT_expectations(t+1) = g(CDT(t), NIBE(t+1), observed_behavior(t))

SBC(t+1) = h(CDT_expectations(t+1), game_structure(t))

Equilibrium Concept

Aspiration Equilibrium: A behavioral pattern σ* such that:

(1) Each CDTi achieves Ai given σ*-i and bias constraints Bi

(2) No CDTi can improve toward Ai by unilateral deviation within horizon Hi

(3) The pattern is stable under NIBE-consistent perturbations

IV. Minimal Worked Example

A stylized two-agent, two-period example demonstrating the NIBE → SBC → Aspiration Equilibrium → Perturbation → Updated Outcome pipeline.

Setup

Agents: Firm A (incumbent platform), Firm B (challenger)

Context: Data-sharing rule under regulatory consideration

Question: Will the parties reach a voluntary data-sharing agreement, or will litigation/regulation be required?

Period 1: Initial State

NIBE Assessment:

τrule = 0.7 (high rulemaking latency; regulator slow to act)

Ecred = 0.4 (moderate enforcement credibility; mixed track record)

Galign = 0.5 (split governance; legislative and executive misaligned)

NIBE verdict: Game exists but is weakly structured. Bargaining is possible but fragile.

SBC Assessment:

T = 0.3 (low trust; prior disputes, no joint ventures)

Ncoh = 0.4 (moderate narrative coherence; both cite “innovation” but define it oppositely)

Ccap = 0.6 (reasonable coordination capacity; shared counsel, prior settlement experience)

θexploit = 0.5 (neutral; neither pure competition nor pure rent extraction)

CDT Parameters:

Firm A: AA = 0.8 (high aspiration; wants to preserve data moat), HA = 2 quarters, loss aversion = 2.0

Firm B: AB = 0.6 (moderate aspiration; needs access but can pursue alternatives), HB = 4 quarters, loss aversion = 1.5

Period 1 Aspiration Equilibrium:

σ*1 = Prolonged negotiation with signaling. Both parties engage in talks but neither concedes. Firm A delays (high aspiration + short horizon + loss aversion favors status quo). Firm B continues negotiating while developing alternatives (moderate aspiration + longer horizon). No deal in Period 1.

Perturbation: Enforcement Signal

Between Period 1 and Period 2, the regulator issues an enforcement action against a similar incumbent in an adjacent market. This is an institutional move that updates NIBE.

Period 2: Updated State

Updated NIBE:

Ecred rises from 0.4 → 0.65 (enforcement action demonstrates willingness to act)

Other NIBE variables unchanged

Updated CDT Expectations:

Firm A: EAperceived rises from 0.35 → 0.60. Firm A now perceives meaningful enforcement risk. This shifts Firm A’s defection cost upward.

Updated SBC:

T rises marginally (0.3 → 0.35) as enforcement signal creates common knowledge of consequences. θexploit drops (0.5 → 0.4) as rent-extraction becomes riskier.

Period 2 Aspiration Equilibrium:

σ*2 = Negotiated settlement. Firm A’s loss aversion now weighs regulatory risk more heavily than data-moat preservation. Firm A’s aspiration-satisficing calculus shifts: a negotiated deal at AA = 0.65 (below original 0.8) now satisfices given the updated risk landscape. Firm B accepts. Deal closes.

What This Example Demonstrates

1. NIBE-first ordering: The game structure is assessed before strategic analysis begins.

2. SBC as coordination layer: Trust, narrative, and coordination capacity shape which equilibria are reachable.

3. CDT parameterization: Agent behavior follows from explicit parameters, not black-box learning.

4. Aspiration equilibrium: Outcomes satisfy aspirations under constraints, not maximize utility globally.

5. Perturbation response: Institutional moves update state variables, which flow through the pipeline to alter equilibria.

6. Path dependence: The Period 2 outcome depends on the Period 1 trajectory; a different perturbation (or no perturbation) yields a different equilibrium.

V. Path Dependence as First-Class Object

Path dependence is not merely an emergent property noticed after the fact but a modeled variable with explicit accumulation dynamics. The Legacy Framework and Gladwell Economics analyses give path dependence predictive content rather than just explanatory convenience.

Trust, narrative anchors, and coordination capacity are treated as path-dependent accumulations. Early coordination architectures lock in which equilibria are reachable later. Different trajectories with the same end-state rules can yield different stable patterns because the accumulated state variables differ.

Trust is defined as a state variable with update functions: decaying with observed defection, spiking with credible enforcement. The NIBE Washington analysis demonstrates that reachable equilibria in later periods depend on those states, not just on current rules. In repeated games with behavioral agents, trust is not just a parameter—it is a state variable that evolves based on observed defection rates, narrative consistency, and enforcement credibility.

If early institutional moves erode trust—through inconsistent enforcement posture or perceived bad-faith litigation—that constrains which cooperative equilibria are reachable later even if the formal rules have not changed. The game structure is the same; the reachable equilibria are different.

This produces a crucial distinction between rule changes and trust regime changes. The question is not just “what are the rules?” but “what coordination patterns have accumulated under those rules, and how do proposed changes interact with existing trust stocks and defection expectations?” That is a different analytical object than conventional analysis focused on market structure and explicit restraints.

VI. Failure Modes: When Not to Trust the Framework

No framework applies universally. Voluntary boundary-setting increases credibility. The NIBE/SBC/CDT architecture should not be trusted—or should be applied with extreme caution—in the following conditions:

1. Rapid Regime Collapse

The framework assumes institutional structures persist long enough for iterated dynamics to play out. When regimes collapse rapidly—revolutionary political transitions, sudden state failure, catastrophic institutional breakdown—the NIBE layer becomes undefined. There is no “rulemaking latency” when there is no rulemaking authority. The framework will generate predictions, but they are not meaningful.

Diagnostic: If NIBE variables are changing faster than the model’s update cycle (typically quarterly), treat outputs as speculative scenarios, not predictions.

2. Exogenous Shocks Overwhelming Institutional Lag

The framework models institutional dynamics with characteristic time constants. Exogenous shocks that move faster than institutional response—pandemics, sudden technological discontinuities, natural disasters, large-scale wars—can render the feedback loops irrelevant. The system is in free-fall before the update rules engage.

Diagnostic: If the shock’s characteristic time scale is shorter than the shortest institutional response lag in the model, the framework will underpredict disruption magnitude.

3. Radical Preference Discontinuities

CDT parameters (aspiration levels, bias coefficients, horizons) are calibrated from historical behavior and behavioral economics baselines. If actors undergo radical preference shifts—religious conversion, ideological transformation, existential threat response—the calibrated parameters become invalid. The CDT will predict behavior consistent with the old preference structure, not the new one.

Diagnostic: If key actors are signaling or demonstrating preference shifts outside historical ranges (e.g., willingness to accept losses previously rejected, time horizons collapsing or extending dramatically), recalibration is required before predictions are trusted.

4. Domains with No Observable Proxies

SBC variables require observable proxies for ex ante measurement. In domains where information is radically opaque—covert operations, closed authoritarian systems with no reliable reporting, pre-formation markets with no transaction history—the SBC layer cannot be grounded. The framework becomes purely speculative.

Diagnostic: If fewer than two observable proxies can be identified for each SBC variable, the coordination layer is under-identified. Treat outputs as scenario exploration, not prediction.

5. Single-Shot, Non-Repeated Interactions

The framework is designed for iterated games with feedback. One-shot interactions—a single negotiation with no future shadow, a terminal transaction—do not generate the path-dependent dynamics the framework is built to capture. Standard game theory may be more appropriate for genuinely single-shot settings.

Diagnostic: If the interaction has no future shadow and no reputational spillovers, the SBC accumulation dynamics are irrelevant.

VII. Validation Architecture

The framework addresses a chronic problem with behavioral models: critics often say behavioral economics is unfalsifiable because one can always posit some bias to explain any outcome. The 2025 Year in Review documents the validation architecture that imposes discipline pure behavioral storytelling lacks.

Validation Criteria

Equilibrium Consistency: σ* satisfies conditions (1)-(3) of the aspiration equilibrium definition

Behavioral Plausibility: Bi parameters fall within empirically-documented ranges from behavioral economics literature

Perturbation Robustness: Small changes to NIBE inputs do not flip equilibrium qualitatively

Predictive Accuracy: Timestamped forecasts versus observed outcomes

Falsification discipline: Each prediction is associated with a time window and observable outcome that would falsify the forecast if unmet. This is not optional rigor; it is the condition for scientific status.

The Prediction-Validation Discipline

Academic economics often produces frameworks that are tested years later with retrospective data. The MindCast approach creates falsifiability in real time through timestamped predictions on concrete outcomes. The 2025 Year in Review documents three validated prediction clusters: DOJ export-control enforcement (Malaysia/Thailand GPU corridors, November 2025 indictments), NVIDIA NVQLink quantum-AI coupling (five technical metrics matched, October 2025), and DOE-FERC AI infrastructure federalization (Section 403/FERC jurisdiction, December 2025–January 2026).

Projections are checked for equilibrium consistency (no violation of game-theoretic stability), behavioral plausibility (bias- and trust-constrained), and robustness under perturbations to institutional inputs. Case studies are reformulated as instantiations of the formal framework: here is how the state variables were calibrated, here is the aspiration equilibrium the model predicted, here is how timestamped outcomes tracked against that prediction under the robustness criteria.

VIII. Applied Domains

The framework has been applied across multiple institutional domains, each serving as a laboratory for validation:

Real Estate and Antitrust

The Compass Modern Chicago analysis applies NIBE/SBC/CDT to MLS governance, Clear Cooperation enforcement, and settlement dynamics. The question is not just “what are the MLS rules?” but “what coordination patterns have accumulated under those rules, and how do proposed changes interact with existing trust stocks and defection expectations?”

AI Infrastructure and Export Controls

The AI Infrastructure Value Shift, NVIDIA H200 China, and Broadcom Cataclysmic analyses apply the framework to semiconductor supply chains, licensing dynamics, and regulatory arbitrage under export controls.

National Innovation Systems

The NIBE Washington analysis applies the framework to clean energy transition, demonstrating how early institutional sequencing shifts which innovation windows open and which coalitions can form.

Legacy Institutions

The Legacy Framework, Modern Legacy, and Gladwell Economics analyses apply the framework to institutional coordination failures, demonstrating how early coordination architectures lock in which equilibria are reachable later.

IX. Research Program

The stated goal across the economics and innovation verticals is to synthesize Chicago, behavioral, game-theoretic, institutional, and innovation traditions into a single Predictive Cognitive AI architecture—tested by explicit, time-stamped predictions. The MindCast Vision and Predictive Cognitive AI documents establish this as the central research objective.

With a formal specification, MindCast AI moves from sophisticated foresight practice to originator of a defined research program in National Innovation Behavioral Economics and Strategic Behavioral Coordination. The Stanford MCAI analysis explores how the framework creates something that other groups can engage with: implement simplified variants, test on different institutional domains, and compare predictive performance against standard rational or static institutional models.

The 2024-2025 validation track record—DOJ export-control enforcement timing (Malaysia/Thailand GPU corridors), NVIDIA NVQLink specifications matching CDT forecasts (five technical metrics), and DOE-FERC AI infrastructure federalization (Section 403/FERC jurisdiction dynamics)—provides empirical grounding across regulatory, technical, and institutional domains. The framework is codified after demonstrating predictive power, not before. That is a stronger position than the usual “here is our theory, we will test it later.”

The synthesis positions Predictive Institutional Economics as a field, not a one-off analysis. It enables what was not previously tractable: real-time institutional foresight with formal structure, empirical validation, and theoretical rigor drawn from the best of multiple intellectual traditions—each preserved where valid, completed where incomplete.

X. References

Core Framework and Vision

MCAI National Innovation Vision: National Innovation Behavioral Economics (November 2025). Summary: Introduces NIBE as a macro-level framework measuring institutional throughput, governance alignment, and regulatory latency to assess whether coordination games are structurally viable. Relevance:Defines the NIBE layer’s state variables and establishes the “can a game exist?” threshold logic central to the architecture.

MCAI Economics Vision: Synthesis in National Innovation Behavioral Economics and Strategic Behavioral Coordination (December 2025). Summary: Integrates NIBE (macro-institutional) with SBC (micro-coordination) into a unified pipeline where institutional viability gates coordination analysis. Relevance: Provides the macro-micro bridge and iterative relaxation logic that structures the NIBE → SBC → CDT pipeline.

MCAI Legacy Vision: The Coordination Problem Hiding Inside Every Family Enterprise (December 2025). Summary: Analyzes how multi-generational institutions fail through coordination collapse rather than capital depletion, treating trust and narrative as accumulating state variables. Relevance: Grounds the SBC layer’s treatment of trust stocks and path-dependent coordination capacity.

MindCast AI Vision Statement: Your Legacy and Future Speak To You Through Predictive Cognitive AI (July 2025). Summary: Establishes MindCast AI’s core thesis that cognitive simulation of institutional actors enables predictive foresight unavailable to static models. Relevance: Articulates the foundational claim that CDT-based simulation constitutes a distinct predictive methodology.

MindCast AI Vision Statement: AI Era Law and Behavioral Economics (December 2025). Summary: Positions the framework as a modernization of law-and-economics for AI-era institutional dynamics where update velocity exceeds traditional analytical cycles. Relevance: Explains why traditional Chicago School analysis requires behavioral and coordination extensions in high-velocity domains.

MCAI Innovation Vision: The Predictive Cognitive AI Infrastructure Revolution (July 2025). Summary: Describes Predictive Cognitive AI as a distinct category combining behavioral parameterization, institutional simulation, and real-time validation. Relevance: Positions CDTs as the agent-level implementation of the broader Predictive Cognitive AI architecture.

MindCast AI 2025 Year in Review: AI Era Law and Behavioral Economics (December 2025). Summary: Documents three validated prediction clusters: DOJ export-control enforcement timing (Malaysia/Thailand GPU corridors, November 2025 indictments), NVIDIA NVQLink quantum-AI coupling specifications (five technical metrics matched, October 2025), and DOE-FERC AI infrastructure federalization (AI computing as federal infrastructure under Section 403/FERC jurisdiction, December 2025–January 2026). Relevance: Provides the empirical validation evidence across regulatory, technical, and institutional domains that grounds the framework’s scientific status.

Chicago School Accelerated Series

MCAI Economics Vision: Chicago School Accelerated (December 2025). Summary: Argues that Coase, Becker, and Posner form a single analytical system that remains valid but requires behavioral and coordination completions. Relevance: Establishes the intellectual genealogy positioning NIBE/SBC/CDT as extension rather than rejection of Chicago tradition.

MCAI Economics Vision: The Chicago School Accelerated Part I, Coase and Why Transaction Costs ≠ Coordination Costs (December 2025). Summary: Distinguishes transaction costs (friction in exchange) from coordination costs (failure to reach mutually beneficial arrangements even when transaction costs are low). Relevance: Motivates the SBC layer as capturing coordination failures that Coasean analysis assumes away.

MCAI Economics Vision: The Chicago School Accelerated Part II, Becker and the Economics of Incentive Exploitation (December 2025). Summary: Extends Becker’s rational-choice framework to model when incentive structures drift from efficiency competition toward rent extraction. Relevance: Defines the exploitation tilt variable (θ_exploit) and behavioral drift metrics in the SBC layer.

MCAI Economics Vision: The Chicago School Accelerated Part III, Posner and the Law-and-Economics of High-Velocity Systems (December 2025). Summary: Applies Posnerian efficiency analysis to settings where institutional update velocity exceeds judicial and regulatory response times. Relevance: Grounds the NIBE layer’s treatment of rulemaking latency and enforcement credibility in high-velocity domains.

Applied Case Studies: Economics, Law, and Markets

MCAI Lex Vision: Compass’s Coasean Coordination Problem Part V – Compass Modern Chicago (December 2025). Summary: Applies NIBE/SBC/CDT to MLS governance and Clear Cooperation enforcement, modeling settlement dynamics as coordination games with accumulated trust stocks. Relevance: Demonstrates the framework’s application to platform antitrust and real estate litigation complexes.

MCAI Market Vision: The Phase Transition in AI Infrastructure Value (December 2025). Summary: Analyzes how AI infrastructure value is migrating across the stack as compute scarcity, licensing, and integration dynamics shift competitive positions. Relevance: Illustrates NIBE/SBC application to technology market structure and value chain evolution.

MCAI Market Vision: AI Infrastructure, Priority Under Scarcity (December 2025). Summary: Models how compute scarcity creates priority queues and allocation games among AI infrastructure participants with heterogeneous time horizons. Relevance: Demonstrates CDT parameterization for agents with different aspiration levels and horizon lengths under resource constraints.

MCAI National Innovation Vision: Foresight Analysis in Illegal GPU Export Channels – DOJ China CHIPS(November 2025). Summary: Forecasts DOJ enforcement timing and targeting in semiconductor export-control violations using CDT models of regulatory actor behavior. Relevance: Provides timestamped validation case for enforcement credibility dynamics in the NIBE layer.

MCAI National Innovation Vision: Foresight Simulation of NVIDIA H200 China Constrained SKUs (December 2025). Summary: Simulates NVIDIA’s product strategy under export controls, predicting SKU configurations and compliance positioning. Relevance: Demonstrates CDT application to corporate strategic response under regulatory constraint.

MCAI Market Vision: Broadcom’s Cataclysmic $10B OpenAI Deal (September 2025). Summary: Analyzes the strategic logic and market implications of major AI infrastructure licensing deals using coordination game framing. Relevance: Illustrates SBC analysis of high-stakes bilateral negotiations with asymmetric information and time pressure.

How Quantum Computing Overcomes AI Data Center Bottlenecks (October 2025). Summary: Documents validated predictions on NVIDIA NVQLink specifications and AI infrastructure technical trajectories. Relevance: Provides empirical validation of CDT forecasts against observable technical outcomes.

MCAI Market Vision: The Economic Strategy Behind Licensing (December 2025). Summary: Models licensing as a coordination game where timing, exclusivity, and relationship dynamics determine value capture. Relevance: Demonstrates the feedback loop between institutional moves (licensing terms) and CDT expectation updates.

Private Equity & Patent Litigation in AI Data Centers (2026–2028) (October 2025). Summary: Forecasts multi-year litigation trajectories in AI infrastructure with falsifiable KPIs and timeline commitments. Relevance: Exemplifies the falsification discipline: predictions with explicit time windows and observable outcomes.

National Innovation and Geopolitical Analysis

MCAI Innovation Vision: Washington’s Clean Energy Advantage, a National Innovation Behavioral Economics Case Study (November 2025). Summary: Applies NIBE to Washington State’s clean energy transition, showing how early institutional sequencing determines which innovation windows open. Relevance: Demonstrates path dependence as first-class object: different trajectories yield different stable patterns.

MCAI National Innovation Vision: The Global Innovation Trap (November 2025). Summary: Analyzes how nations can become trapped in suboptimal innovation equilibria through coordination failures and institutional lock-in. Relevance: Illustrates NIBE application at national scale with path-dependent equilibrium selection.

The TSMC China License and the Limits of Hardware Export Controls (January 2026). Summary: Examines the strategic dynamics of semiconductor licensing under export controls using game-theoretic and institutional analysis. Relevance: Demonstrates NIBE/SBC application to geopolitical technology governance with multi-actor coordination constraints.

Legacy, Coordination, and Cognition

MCAI Legacy Vision: Institutional Legacy Innovation in a High-Velocity World – Modern Legacy (October 2025). Summary: Analyzes how legacy institutions can adapt to high-velocity environments through coordination architecture redesign. Relevance: Connects institutional update velocity (NIBE) to organizational adaptation capacity (SBC).

How Four Economists Decode the AI Investment Boom – Smith Lineage (November 2025). Summary: Traces intellectual lineage from Adam Smith through behavioral economics to show how CDT parameterization updates classical economic agency. Relevance: Grounds CDT agent specification in the history of economic thought on bounded rationality and behavioral parameters.

The Economic Architecture Behind Malcolm Gladwell’s Worldview (December 2025). Summary: Decodes the implicit economic models in popular social science, showing how narrative and coordination dynamics shape public understanding. Relevance: Illustrates narrative coherence (N_coh) as measurable variable affecting coordination outcomes.

MCAI Legacy Innovation Vision: When Family Offices Reach Systemic Scale (December 2025). Summary: Analyzes coordination challenges when private capital pools reach scale where their actions affect market structure. Relevance: Demonstrates SBC application to institutional actors whose coordination capacity (C_cap) creates systemic effects.

Cognitive AI and Institutional Intelligence

MCAI Innovation Vision: The Rise of Predictive Cognitive AI (July 2025). Summary: Distinguishes Predictive Cognitive AI from other AI approaches by its focus on behavioral parameterization and institutional simulation. Relevance: Clarifies that CDTs are parameterized agents, not learned black boxes—the critical clarification in Section II.

MCAI Innovation Vision: From Individual Minds to Institutional Intelligence – Stanford MCAI (July 2025). Summary: Explores how individual cognitive models aggregate into institutional intelligence through coordination architecture. Relevance: Positions the framework for external adoption and research program development.