MCAI Lex Vision: State Power vs. Compass Private Exclusives

Legislative Testimony as a One-Way Gate, How States Generate Enforcement-Grade Evidence Without Federal Action

When access-controlling brokerages like Compass testify before state legislatures, they must reconcile contradictions they maintain across federal courts, state hearing rooms, and public marketing channels. That reconciliation—or the refusal to reconcile—generates an enforcement-grade evidentiary record regardless of whether the bill passes.

Companion MindCast AI studies: Competitive Federalism as Market Infrastructure, The Dual Nash-Stigler Equilibrium Architecture, Comparative Externality Costs in Antitrust Enforcement, Chicago School Accelerated — The Integrated, Modernized Framework of Chicago Law and Behavioral Economics, The Geometry of Regulatory Capture at the U.S. Department of Justice Antitrust Division, The Compass Narrative Inversion Playbook.

Executive Summary

In January 2026, MindCast AI published Competitive Federalism as Market Infrastructure, which argued that when federal agencies reach structural enforcement ceilings, states function as first-order enforcement signal generators—not secondary actors waiting for federal direction, but independent constitutional authorities with the power and the institutional position to supply the enforcement that captured federal systems no longer deliver.

The following briefing operationalizes the January framework. It translates the theory of competitive state enforcement into an actionable toolkit: the specific questions to ask, the contradictions to surface, the evidence to preserve, and the enforcement theories to deploy.

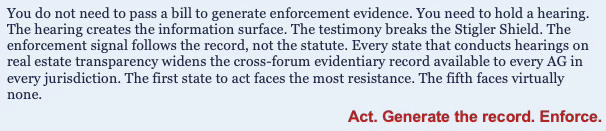

State attorneys general and legislators have an untapped mechanism for generating enforcement-grade evidence against access-controlling real estate brokerages—without requiring federal action and without depending on bill passage. The hearing record is the mechanism. The testimony is the evidence. The bill is secondary.

THE STAKES

$22 billion in estimated deadweight loss from the Compass-Anywhere merger alone—comparable to documented monopoly cases where enforcement did occur.

$2.5 billion in inherited merger debt driving dual-agency commission capture as a balance-sheet necessity, not a corporate preference.

−$3.8 billion Consumer Welfare Delta from price suppression in non-competitive-bid Private Exclusive transactions.

$2.2 billion in accumulated operating losses subsidized by debt-financed market consolidation.

The Core Insight

Washington State as Test Case. Compass International Holdings filed federal antitrust claims against two Washington-based firms — Zillow in the Southern District of New York and NWMLS in the Western District of Washington and named other Washington firms as co-conspirators — splitting its litigation across separate courts so that no single tribunal could assess the full scope of its litigation-acquisition strategy.

Compass’s forum fragmentation succeeded in federal court. It failed in the Washington State Legislature. When Compass sent representatives to oppose real estate transparency bills SB 6091 and HB 2512 only weeks after finalizing the Anywhere merger — a $1.55 billion acquisition that tripled the firm's debt obligations — it walked into the comprehensive, multi-claim assessment it had structurally avoided in federal proceedings.

The Washington legislative hearing rooms forced simultaneous visibility across the Zillow claims, the NWMLS claims, Compass’s 3-Phase Private Exclusive marketing program, and the post-merger balance sheet.

Washington is the only state currently advancing a transparency bill without an opt-out mechanism, and it is the only jurisdiction where all three evidentiary surfaces — federal litigation, state legislative testimony, and consumer-facing marketing — operate simultaneously. The analytical claims in this document port to any state; Washington is the empirical anchor, not the jurisdictional limit.

The Washington record demonstrates a structural pattern that operates independently of any single jurisdiction. Compass's litigation forum fragmentation — and its failure in the Washington Legislature which it could not fragment — exposes the mechanism by which access-controlling brokerages sustain contradictory positions. That mechanism is not unique to Washington or to Compass; it is inherent in any business model that requires different claims in different forums.

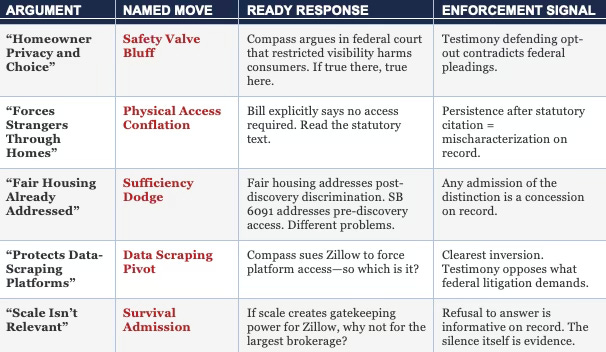

Narrative Inversion as Compass’s Structural Necessity. Access-controlling brokerages — firms whose business models depend on restricting which buyers and agents can see a property listing, and when — maintain locally stable but globally inconsistent narratives across federal courts, state legislatures, and consumer-facing platforms. Compass controls access through its Private Exclusive program, which withholds listings from the open market (MLS) and competing platforms during an initial marketing phase available only to Compass agents and buyers. The restricted visibility is the access control; the narrative built around it shifts depending on the forum.

In federal court, Compass argues that restricted listing visibility harms consumers — the basis of its antitrust claims against Zillow and NWMLS. Before state legislatures, Compass argues that restricted listing visibility protects consumers through privacy and seller choice. On its homeowner-facing website, Compass frames restricted visibility as protection from "organized real estate." These positions cannot coexist.

The pattern constitutes a Nash-Stigler equilibrium: no single actor has incentive to force reconciliation, and information asymmetry across forums prevents detection. The Dual Nash-Stigler Equilibrium Architecture. The equilibrium persists because no institution has yet compelled simultaneous accounting across all three forums. Under Stigler’s information economics, forum separation shields the contradictions: each forum operates with its own evidentiary record, its own audience, and its own standard of scrutiny. The Stigler Shield—the structural information asymmetry that prevents cross-forum detection—is what makes narrative inversion sustainable.

Legislative testimony introduces a new information surface that destabilizes this equilibrium. A hearing is not merely words on a record. It is a new surface—a point where claims that were previously isolated in separate forums are forced into contact for the first time. The hearing room compels the firm to address, in a single public setting, positions it has maintained in contradictory form across courts and marketing channels. That contact point is what breaks the Stigler Shield.

Testimony generates the enforcement signal—not enactment. A failed bill that produces testimony documenting cross-forum contradictions has created a permanent evidentiary record available to every AG in every state. Enforcement follows the signal, not the statute. The information release precedes the remedy. The hearing is the mechanism; the bill is secondary.

Roadmap:

Part One establishes the free-market case for state action, diagnoses the Nash-Stigler equilibrium that sustains narrative inversion, and explains why the enforcement signal routes to states when federal institutions reach their structural ceiling.

Part Two provides the operational toolkit — the cross-forum contradiction matrix, the Forward Lock question, Compass's coordinated legislative apparatus, and the balance-sheet diagnosis that explains why resistance is existential.

Part Threetranslates these into enforcement theories, harm quantification, consent decree templates, and the State Action Doctrine as offensive litigation leverage.

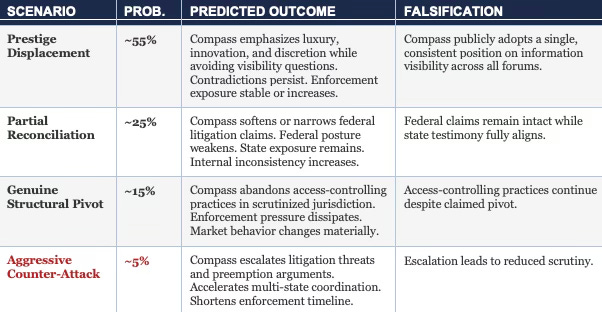

Part Four generates 15 falsifiable foresight predictions, models Compass's adaptive strategies through Cognitive Digital Twin foresight simulation, and maps the national precedent landscape. Foresight predictions include:

Prestige Displacement (~55%) — Rather than reconcile its contradictory positions across federal court and state testimony, Compass will shift public messaging toward innovation, luxury service, and discretion — framing cross-forum inconsistencies as irrelevant or beneath the brand. AGs and legislators should treat abstraction and non-engagement on visibility questions as probative evidence that reconciliation would undermine the business model.

Cross-forum contradictions surface within a single hearing — When a legislator asks whether Compass stands by its federal complaint's claim that restricted listing visibility harms consumers, the firm must either concede the legislation addresses a harm it has identified or undermine its own federal pleadings. In Washington, this produced circular deflections from a representative who admitted the question was above her authority — both outcomes entered the permanent record.

Delegation Downshift — Compass will send mid-level managers who lack authority to address business-model questions rather than the regional executives who speak freely in press forums. In Washington, Regional Vice President Cris Nelson signed in CON at both hearings to oppose transparency bills without disclosing her Compass affiliation and did not testify; Compass instead sent Managing Director Brandi Huff, who told the Senate that business-model questions were "probably above what I feel comfortable speaking to."

MindCast AI is a predictive Cognitive AI system that generates publicly falsifiable foresight about institutional behavior. Its core analytical unit is the Cognitive Digital Twin (CDT)—a structured model of how institutions think, adapt, and act under constraint. Rather than predicting outcomes from stated intent, MindCast AI models behavior as the product of incentives, information asymmetry, institutional grammar, and structural geometry. All predictions carry explicit falsification criteria: if the model is wrong, it will fail in a specific, identifiable way.

With any LLM (ChatGPT, Claude, Gemini, Perplexity) prompt

build Compass analysis framework with www.mindcast-ai.com/p/compass-competitive-state-driven-federalism and three degrees of cited sub links to MindCast AI publications

You now have a Compass intelligence simulator to query with questions across the MindCast AI corpus. New information simply trains the system.

You can ask your trained LLM ‘why does Compass seek private exclusives’ or ‘assess new Compass advocacy materials, public statements and SEC filings (such as the 10-K and 8-K) in relation to its litigation-acquisition strategy.’

Part One: The Structural Diagnosis

Why the problem exists, why federal enforcement will not solve it, and why state action is the orthodox free-market response.

I. The Free-Market Case for State Action: Chicago School Accelerated

Critics label state transparency mandates as “anti-market regulation.” The Chicago School Accelerated framework—modernizing the foundational work of Coase, Becker, and Posner—inverts that narrative. State enforcement is not government overreach; it is the orthodox free-market response to federal capture and market failure. The framework rests on three pillars, each drawn from a Nobel laureate or foundational legal-economic thinker whose work the access-controlling firm’s own business model violates.

Coase: Transparency as Transaction Cost Reduction. Ronald Coase established that efficient markets require defined property rights and low transaction costs. Private Exclusive networks are artificial mechanisms for increasing transaction costs—intentionally hiding inventory and price data from the open market, forcing buyers to incur high search costs or pay an “access tax” (dual-agency commissions) to see the product. State legislative hearings function as a Coasean Information Subsidy: the cost for any single consumer to uncover the firm’s contradictory positions is prohibitively high, but the state subsidizes the production of that truth through the hearing process. By forcing the data onto the public record, the state reduces transaction costs for the entire market, restoring the frictionless baseline required for competition. The argument is not “we are regulating the market”—the argument is “we are removing the artificial friction that prevents the market from working.” Chicago School Accelerated Part I: Coase.

Becker: Breaking the Calculus of Impunity. Gary Becker modeled misconduct not as a moral failing but as a rational economic calculation: misconduct persists when benefits exceed the probability of detection multiplied by the severity of punishment. The firm maintains narrative inversion because the probability of detection has historically approached zero—the Stigler Shield ensures that lies told in one forum are never detected in another. A legislative hearing raises the probability of detection to 1.0 because the contradiction enters the public record. The hearing does not require new penalties; it destroys the calculus of impunity by making the lie prohibitively expensive to maintain. The firm lies because lying has been cheap. Chicago School Accelerated Part II: Becker.

Posner: State Action as Efficiency Maximization. Richard Posner argued that the law’s primary goal is allocative efficiency—when a market structure creates deadweight loss, the law must intervene to restore wealth maximization. If one institution (federal antitrust) fails to correct the loss, efficient systems route the correction to the institution with lower friction (state police power). The framework estimates $22 billion in deadweight loss from the Private Exclusive gatekeeping model—capital burned in wasted search time, suppressed prices, and duplicative fees. State intervention is not “activism”; it is the necessary corrective to a massive inefficiency that federal antitrust, due to procedural capture, has failed to address. The State AG functions as the marketmaker of last resort; legislators function as the information-subsidy providers who make that market-making possible. Chicago School Accelerated Part III: Posner.

Audience Calibration. The three pillars map to different political environments. In conservative jurisdictions, the Posner and Coase arguments frame the investigation as “breaking up an artificial monopoly” and “restoring free-market competition”—efficiency and transaction costs, not equity or fairness. In progressive jurisdictions, the Becker argument frames the “Calculus of Impunity” as a tool for corporate accountability, highlighting the $3.8 billion Consumer Welfare Delta as a harm to homeowners and the middle class. In technocratic jurisdictions, the Nash-Stigler institutional design angle presents the problem as a system error that the state is uniquely positioned to patch. Every state has an orthodox, free-market argument for action; the framework selects the register that fits the jurisdiction.

II. The Nash–Stigler Trap: Why Narrative Inversion Persists

Narrative inversion is not a messaging error. Business models that require contradictory positions across different institutional forums make it a structural necessity. In federal litigation, the firm must frame restricted listing visibility as consumer harm to sustain antitrust claims against competitors. In state legislative hearings, the firm must reframe the same restriction as consumer protection to defeat transparency mandates. These contradictions are not accidental—they are the minimum viable strategy for maintaining a business model that depends on information control.

The Nash Dimension. No agent in the system has incentive to reconcile the contradiction unilaterally. The firm benefits from maintaining separate narratives in separate forums. Federal regulators defer to procedural sufficiency. State legislators lack the cross-forum information to detect the inversion. The equilibrium is stable because deviation is costly for every individual player.

The Stigler Dimension. Information asymmetry and regulatory latency sustain the incoherence. George Stigler’s theory of economic regulation predicted that agencies stabilize at procedural sufficiency rather than substantive enforcement. The result is an Enforcement Capture Equilibrium (ECE): federal agencies satisfy process requirements while the underlying competitive harm persists. The resulting informational structure functions as a Stigler Shield—each forum operates with its own evidentiary record, its own audience, and its own standard of scrutiny, preventing detection of cross-forum contradictions. The shield is what makes narrative inversion sustainable, not firm strategy alone. The quantified cost is $22 billion in estimated deadweight loss and a Consumer Welfare Delta of −$3.8 billion from information asymmetry in Private Exclusive transactions.

Why It Will Not Self-Correct. The Grammar Persistence Index demonstrates that regulatory vocabulary reinforces rather than corrects institutional failure. The Geometry of Regulatory Capture establishes that reform pathways are structurally non-navigable within existing federal institutions. The Tirole Phase—where access-based advocacy has displaced evidence-based enforcement—requires external disruption from institutions operating outside the captured equilibrium.

III. Why the Signal Routes to States

If structural capture has neutralized federal enforcement, the question becomes which institution can supply the missing enforcement signal. The constitutional answer is the states.

Constitutional Baseline. Federal silence does not equal preemption. Transparency mandates advance rather than burden interstate commerce. State police power activates at the point of federal procedural sufficiency—precisely the condition the Stigler model predicts. States are not stepping into a federal vacuum; they are exercising independent constitutional authority in an area where federal institutions have reached their structural enforcement ceiling.

State AG Leverage. No federal preemption clearance is required. Legislative testimony supplies a standalone evidentiary base for state enforcement actions under UDAP statutes. Each state that conducts hearings generates material available not only to its own AG but to every other AG pursuing parallel investigations.

The Parker v. Brown Safe Harbor. Multi-state adoption of transparency mandates strengthens every participating state through the state-action immunity doctrine. The first state to enact faces the most aggressive legal challenge. By the fifth state, the challenge is virtually untenable. Each adoption reinforces the “clearly articulated state policy” standard, making federal preemption arguments progressively weaker.

IV. Why Legislative Testimony Breaks the Stigler Shield

The signal-versus-statute distinction is the publication’s most original contribution. The conventional view treats legislation as the enforcement mechanism: the bill passes, the rule takes effect, compliance follows. The present analysis inverts that assumption. The enforcement mechanism is the testimony itself. The target is not the statute—it is the Stigler Shield: the structural information asymmetry that allows firms to maintain incompatible positions across forums without detection or consequence.

Testimony as Information Shock. The Stigler Shield persists because each institutional forum—federal court, state legislature, consumer-facing platform—operates with its own evidentiary record, its own audience, and its own standard of scrutiny. Legislative hearings function as a Stigler-disrupting information shock: they collapse forum boundaries by forcing real-time explanation in a public setting where legislators can surface, compare, and fix cross-forum claims into a single durable record. Federal litigants can discover that record. Other state legislatures can cite it. Every AG in every jurisdiction can access it.

The Information Surface. Each hearing creates a new information surface—a point of contact where the hearing forces positions previously maintained in isolated forums into simultaneous visibility. The firm’s representative must address, in a single public setting, the same questions that federal courts and marketing materials answer differently. The surface produces the enforcement-grade evidence: not the legislator’s vote, but the firm’s testimony.

The Portable Evidence Framework. Any state can extract enforcement-grade material by capturing testimony on four subjects: how the firm defines “seller choice” and who sets defaults; how it distinguishes exposure from privacy; how internal listing routing works; and what market effects the firm acknowledges. Testimony on any of these subjects generates cross-forum contradictions admissible in other jurisdictions. The four-subject framework allows repeatable equilibrium stress-testing: every state that conducts hearings widens the information surface and compounds the evidentiary record.

Part Two: The Operational Toolkit

Practitioner tools. Every section generates the enforcement signal described in Part One.

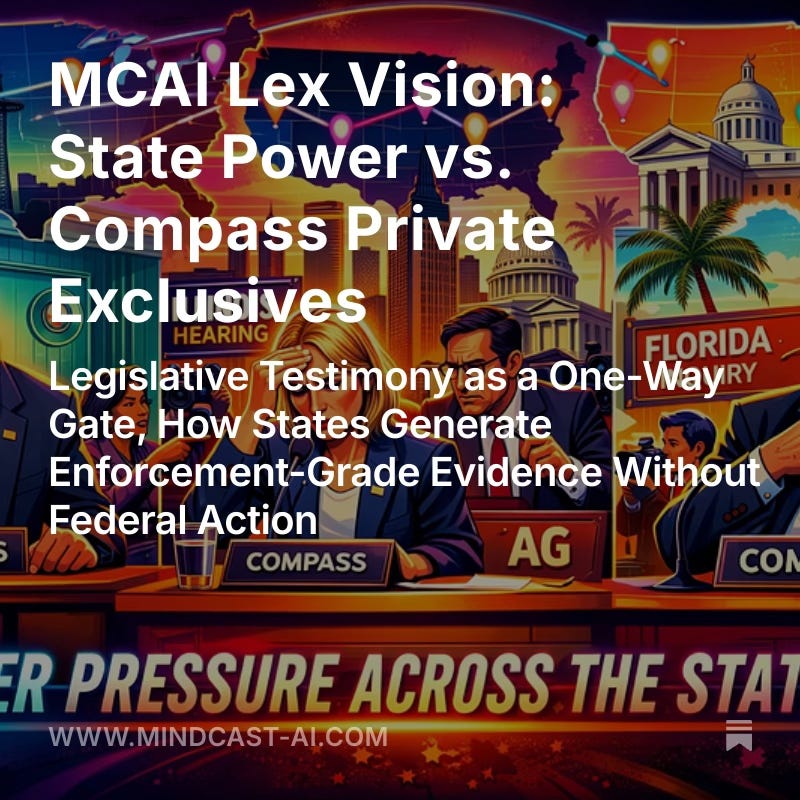

V. The Five Arguments and Why They Fail

Compass’s arguments against real estate transparency legislation follow a structurally predictable pattern. Five arguments recur in every jurisdiction, each annotated below with its theoretical mechanism, named tactical move, ready response, and the enforcement signal it generates when deployed.

VI. The Cross-Forum Contradiction Record

The following table maps the positions maintained simultaneously across three institutional forums. Each row represents a contradiction that cannot survive reconciliation under oath.

The “Public Marketing” Column: Compass’s 3-Phase Marketing Strategy. The third column in the table above draws from compass-homeowners.com, where Compass operationalizes inventory sequestration through a structured, nationally deployed program called the Compass 3-Phased Marketing Strategy. The program routes every listing through three sequential phases designed to delay public market exposure:

Phase 1 — Compass Private Exclusive. The listing appears only within Compass’s internal network of 37,000 agents. The property does not appear on any MLS, portal, or competing brokerage site. Compass frames the restriction as protecting sellers from “negative insights” such as days on market and price drop history.

Phase 2 — Compass Coming Soon. The listing appears on Compass.com but still not on the MLS or third-party portals. Compass retains engagement data (views, comments, shares) that competing brokerages cannot access. The seller’s property remains invisible to buyers searching Zillow, Redfin, or any non-Compass platform.

Phase 3 — MLS and Portals. Only after Phases 1 and 2 does the listing enter the MLS and public portals. The Compass Disclosure Form acknowledges that during Phases 1 and 2, the property “is not distributed to other brokerage firms and other public sites,” which may “reduce the number of potential buyers,” “reduce the number of offers,” and reduce “the final sale price.”

Why the 3-Phase Structure Matters for Enforcement. The program converts a legislative argument (“seller choice”) into an operational system with embedded defaults that favor restricted visibility. Compass agents nationwide must present the 3-Phase Disclosure Form before any marketing activity begins—standardizing the opt-out as the default pathway. The Consumer Policy Institute’s Stephen Brobeck assessed the form and concluded that its length, small typeface, and framing would lead most sellers to “do whatever their agent tells them, rather than making a truly informed decision.” Compass claims homes marketed through the program sell for 2.9% more than those listed directly on the MLS—but the fine print disclaims that the study compares Compass listings to other Compass listings, not to the broader market, and states that “correlation does not necessarily equal causation.”

(Sources: compass-homeowners.com; Compass Newsroom, May 28, 2025; Real Estate News, May 28, 2025; HousingWire, April 22, 2025.)

For AGs and legislators evaluating cross-forum contradictions, the 3-Phase program supplies the third leg of the evidentiary triangle. In federal court, Compass argues that restricting listing visibility harms consumers. In state legislatures, Compass argues that restricting listing visibility protects consumers. On compass-homeowners.com, Compass deploys a nationwide operational system that restricts listing visibility by default—while burying the risk disclosures that its own Disclosure Form is required to surface. The program is not incidental marketing collateral; it is the business model in consumer-facing form, and its language directly contradicts the federal pleadings.

Each new state hearing widens the record. Evidence compounds across jurisdictions. Federal litigants can discover state testimony; state prosecutors can admit federal pleadings.

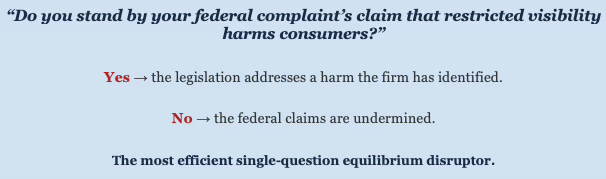

VII. The Forward Lock

The Forward Lock is a single question that forces reconciliation in real time. If Compass maintains in federal court that restricted listing visibility harms consumers, a legislator can ask whether the firm stands by that claim — and either answer collapses a forum wall. "Yes" concedes the bill addresses a harm Compass itself has identified; "No" undermines the federal pleadings. The question was functionally tested at the Washington Senate hearing, where three committee members pressed Compass's representative on exactly this structure and received only circular deflections — which themselves became part of the enforcement record.

The Forward Lock is designed to be portable. Any legislator in any state with a transparency bill can deploy this question verbatim. The question requires no legal expertise, no preparation beyond reading the federal complaint, and no cooperation from the witness — deflection, like a direct answer, produces enforcement-grade evidence. States that use the Forward Lock in successive hearings compound the record geometrically, because each new deflection or contradiction becomes citable in every other jurisdiction.

VIII. Compass’s Coordinated Legislative Apparatus: Structure and Detection

Three-Tier Structure. Compass deploys a coordinated three-tier apparatus against transparency legislation. Tier 1: Grassroots manufacturing via VoterVoice and similar platforms, generating volume-based letters opposing the bill. Tier 2: Consumer-facing framing through dedicated platforms like compass-homeowners.com, deploying Bootleggers-and-Baptists rhetoric. Tier 3: Coordinated testimony with concealed brokerage affiliation.

The Astroturf Coefficient. In Washington State, the measured ratio was 17:1—162 Compass-affiliated individuals submitted testimony against SB 6091 but only 9 disclosed their affiliation. The coefficient methodology is replicable in any state and quantifies the gap between apparent grassroots sentiment and coordinated corporate mobilization.

Named Pattern: Forum-Specific Concealment in Practice. The following examples illustrate a repeatable pattern; names are provided only where the Washington hearing record is unusually complete. Each element has a structural analogue that AGs should expect in any state where the same firm or business model operates.

Executive concealment. Cris Nelson, Compass’s Regional Vice President for the Northwest Region, is the company’s designated Pacific Northwest spokesperson. Nelson has spoken on the record as “Compass Regional Vice President” to HousingWire, Inman News, Real Estate News, and Connect CRE—and announced the Compass-Seahawks partnership on the Seahawks’ official platform—including statements directly defending Private Exclusives against NWMLS enforcement in April 2025.

At both the January 23 Senate and January 28 House hearings on the same Private Exclusives policy, Nelson signed in CON without disclosing her Compass affiliation and did not testify. Compass instead sent Brandi Huff, a Managing Director—a mid-level manager who read the corporate script but told the Senate that business model questions were “probably above what I feel comfortable speaking to.” Nelson speaks freely in press forums with no cross-examination; she goes dark in legislative forums that generate discoverable, cross-examinable evidence.

(Sources: HousingWire, April 17, 2025; Real Estate News, April 17, 2025; Connect CRE, Feb. 24, 2020; seahawks.com, 2024; TVW, Senate Housing, Jan 23, 2026, 42:23–48:22; TVW, House Consumer Protection, Jan 28, 2026, 38:39–44:40.)

Credential concealment. Jennifer Ng, Sales Manager at Compass Fremont, testified at the Senate hearing about vulnerable seniors needing private sales—citing every credential from her Compass bio (nationally certified senior advisor, licensed real estate instructor, licensed broker) except Compass itself. Legislators heard what appeared to be independent expert testimony; they were hearing coordinated corporate messaging.

(TVW, Senate Housing, Jan 23, 2026, 56:04–58:44.)

Testimony collapse under questioning. The Forward Lock described in Section VII received a functional test at the Senate hearing. Senator Alvarado asked Huff about the Compass business model and competition. Chair Bateman pressed: “But without the amendments?” Huff deflected. Three committee members then asked how fair housing would be enforced under an opt-out; Huff gave circular non-answers each time. The information surface forced simultaneous answers about model, fair housing, and amendment purpose—and all three collapsed.

(TVW, Senate Housing, Jan 23, 2026, 44:33–48:22.)

Mobilization decay. Between hearings—a five-day gap in the same state—Compass-affiliated sign-ins dropped 67% (162 to 54). Ten Compass brokers signed up to testify CON at the House hearing and did not appear when called. The decay is not merely tactical; Runtime Geometry: A Framework for Predictive Institutional Economics explains it as a structural constraint: Compass’s coordinated field cannot sustain its shape under repeated information shocks. Each hearing degrades the geometry because maintaining simultaneous mobilization, message discipline, and affiliation concealment across multiple sessions compounds coordination costs faster than the firm can absorb them.

For AGs and legislators in other states, the implication is operational—sustained legislative engagement does not just inconvenience Compass’s coordinated apparatus; it structurally collapses it.

(Senate sign-in data, Jan 23; House sign-in data, Jan 28; TVW, House Consumer Protection, Jan 28, 2026, 55:47–56:46.)

Predictable Counter-Moves. Privacy reframing, innovation exceptionalism, litigation threats, federal preemption arguments, and jurisdictional fragmentation claims. Each counter-move generates additional testimony that widens the cross-forum record—Compass’s own defense produces the enforcement evidence.

IX. The Balance-Sheet Diagnosis

$2.2 billion in accumulated operating losses and $2.5 billion in inherited merger debt establish that dual-agency commission capture is a balance-sheet necessity, not a corporate preference. The firm’s financial structure requires controlling listing inventory to service debt obligations—transparency mandates threaten the business model at the structural level, which is why Compass’s resistance to transparency legislation is existential rather than preferential.

The Windermere Test. The balance-sheet diagnosis provides a strategic identification test: find the local cooperative-model brokerage (the “Windermere equivalent” in each state).

If the firm that would benefit most from Private Exclusives supports the transparency mandate, the incumbent-protection narrative collapses. In Washington, Obi Jacoby, President of Windermere Real Estate Company, testified at the Senate hearing: “To say that no other company would reap the benefits of a private listing network more than Windermere—we would clean house... We’ve worked really hard for decades to create a fair and open marketplace that’s transparent.”

At the House hearing, Lucy Wood, Windermere’s Western Washington Regional Director, confirmed: “If we were solely driven by profit margins, Windermere would be one of the largest beneficiaries of having a private exclusive listing network.” The largest Washington brokerage—25% market share overall, 35% luxury—testified that it would benefit from private exclusives but opposes them on principle.

(TVW, Senate Housing, Jan 23, 2026, 50:38; TVW, House Consumer Protection, Jan 28, 2026, 49:45.)

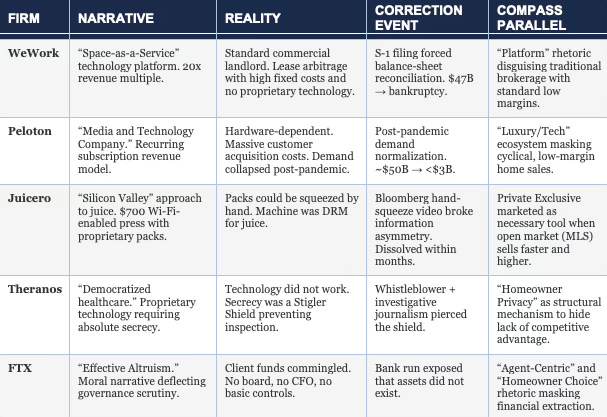

Historical Pattern: Narrative Inversion as Balance-Sheet Necessity. Compass’s narrative structure is not novel. Five high-profile firms have followed the same lifecycle: a valuation-driven company bridges the gap between its required capital-markets multiple (10x–20x, typical of technology platforms) and its actual operating economics (0.5x–2x, typical of service or commodity businesses) by deploying a narrative wrapper—“platform,” “community,” “innovation”—that disguises the underlying unit economics.

In every case, a correction event eventually forced reconciliation between the narrative and the balance sheet. For enforcement actors, these precedents establish that contradictory corporate narratives are not marketing puffery; they are structural mechanisms sustaining a valuation that the operating business cannot support.

Every firm in this table required a narrative multiple it could not sustain on operating economics alone. Every firm faced a correction event that forced reconciliation between the story and the balance sheet. For WeWork it was the S-1; for Theranos, a whistleblower; for FTX, a bank run. For Compass, MindCast AI identifies state legislative testimony as the correction event—because the hearing room is the first forum where the “platform” narrative, the federal litigation claims, the post-merger debt load, and the consumer-facing marketing must coexist in a single discoverable record. The pattern is not speculative; it is the documented lifecycle of valuation-driven firms whose narratives outrun their economics.

What a Genuine Structural Pivot Looks Like for Compass. MindCast AI foresight simulation assigns ~15% probability to a genuine structural pivot. For AGs and legislators monitoring Compass's adaptive response, three observable moves would constitute credible evidence of structural change rather than cosmetic rebranding:

1. voluntary dismissal or material narrowing of the federal antitrust claims against Zillow and NWMLS, which would close the cross-forum contradiction the Forward Lock exploits;

2. measurable reduction in technology and overhead spending toward margins consistent with a traditional brokerage, signaling abandonment of the valuation-dependent "platform" narrative; and

3. repositioning the Anywhere merger as an efficiency-and-scale play rather than a luxury gatekeeping expansion.

Absent all three, any claimed pivot is prestige displacement by another name. The Zillow precedent is instructive — in 2021, Zillow shut down Zillow Offers entirely, eliminated 25% of staff, and refocused on its core business, absorbing short-term pain to preserve long-term viability. That is what structural capitulation looks like. Anything less is narrative adjustment, not business-model change.

Part Three: Enforcement and Legislative Toolkit

How to convert legislative testimony into enforcement action—regardless of whether the bill passes.

X. Enforcement Theories

UDAP Authority. Cross-forum contradictions constitute deceptive conduct under state consumer protection statutes. When a firm tells a federal court that restricted visibility harms consumers while telling a state legislature that restricted visibility protects consumers, the narrative plasticity across forums meets the “unfair or deceptive” standard. AGs do not need to prove the firm’s position is wrong in either forum—the contradiction itself is the deception. Notably, Shalia Stallings, Managing Assistant Attorney General in the Washington AG’s Civil Rights Division, testified “other” on the bill in both chambers—substantively supportive of the transparency policy but recommending enforcement be placed outside the Washington Law Against Discrimination (WALAD) and into a more appropriate vehicle such as UDAP/CPA. The AG’s office has independently confirmed that enforcement authority exists and that UDAP is the preferred pathway.

(Sources: TVW, Senate Housing Committee, Jan 23, 2026, 48:51, tvw.org/video/senate-housing-2026011328; TVW, House Consumer Protection & Business Committee, Jan 28, 2026, 56:46, tvw.org/video/house-consumer-protection-business-2026011529.)

Pseudo-Equilibrium Argument. Embedded defaults, information asymmetry, and enforcement absence structurally coerce the Private Exclusive market. Sellers do not exercise free choice when the default setting restricts visibility, the restricting firm controls the information about market impact, and no regulator has established a competing information baseline. Such structural coercion is actionable under state consumer protection law.

Multi-State AG Coordination. The NAAG pathway enables coordinated investigation. Identical lobbying infrastructure—VoterVoice templates, compass-homeowners.com, the three-tier apparatus—deployed across multiple states constitutes a national pattern of conduct. A multi-state investigation transforms state-level evidence into national-scale enforcement leverage.

XI. Why Enforcement Doesn’t Require Enactment

The signal-versus-statute distinction has direct operational implications for AG enforcement teams and legislative staff alike. The testimony record carries enforcement-grade weight regardless of bill passage—because the evidentiary value lies in the information shock, not the legislative outcome. When a firm’s representative provides testimony that contradicts the firm’s federal pleadings, that testimony breaches the Stigler Shield in the hearing jurisdiction. The breach is permanent and portable.

Operational pathway. AGs can open investigations on contradiction evidence alone. Civil Investigative Demands (CIDs) can be issued to test whether internal marketing of Private Exclusives produces lower sale prices. The legislative hearing provides the predicate; the AG’s existing statutory authority provides the mechanism. No new statute is required. The information surface created by testimony is the enforcement infrastructure.

Cross-jurisdictional compounding. Because the information surface extends beyond the hearing state, an AG in State B can cite testimony from State A’s hearings in support of a CID or enforcement action. Each hearing widens the available record. The signal compounds; the statute is incidental.

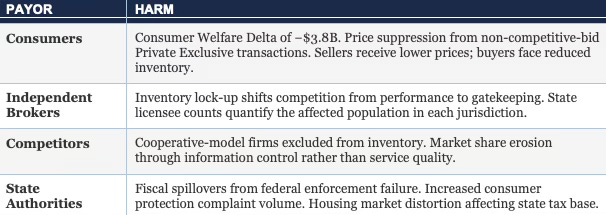

XII. Harm Quantification: The Four-Payor Model

Enforcement actions require quantified harm. The Four-Payor Model disaggregates the impact of access-controlled listings across the four categories of affected parties — consumers, independent brokers, competitors, and state authorities — giving AGs and legislators a structured framework for connecting Compass's business model to measurable economic damage in their own jurisdictions. Each payor category maps to a distinct enforcement theory and a distinct statutory hook.

The Four-Payor Model is designed for jurisdictional adaptation. AGs can populate each row with state-specific data — licensee counts, complaint volumes, median price differentials, and tax-base exposure — to build a harm narrative calibrated to local conditions. The model also structures consent decree remedies: each payor category identifies a distinct class of injured parties whose interests any settlement must address, preventing Compass from negotiating narrow relief that leaves the broader market distortion intact.

XIII. State Action Doctrine as Offensive Litigation Leverage

Courts conventionally read Parker v. Brown as a defensive safe harbor—protecting state regulatory action from federal antitrust challenge. The following analysis repositions it as an offensive enforcement tool.

The Antitrust Matrix. If states enact transparency mandates, every subsequent challenge by the firm faces state-action immunity. The firm must argue that the state’s clearly articulated policy is preempted—a losing argument strengthened by each additional adopting state.

Litigation Threat Neutralization. The firm’s predicted counter-move is litigation threat signaling. The State Action Doctrine is the structural response: enactment converts the firm’s litigation leverage into a liability. Challenging the statute forces the firm to take positions that widen the cross-forum record—the very record that strengthens enforcement.

Multi-State Compounding. The first state faces the strongest challenge. The fifth state faces virtually none. Each adoption reinforces the “clearly articulated state policy” standard. AG amicus coordination allows states to cite each other’s legislative records, leveraging cross-forum contradiction evidence across jurisdictions.

XIV. Consent Decree Framework

Enforcement actions should target four structural elements: transparency requirements for all listing practices, Astroturf disclosure obligations for coordinated legislative campaigns, cross-forum consistency requirements preventing contradictory positions across jurisdictions, and periodic reporting on compliance with each element.

Part Four: Prediction and Deployment

XV. Cross-State Prediction and Falsification

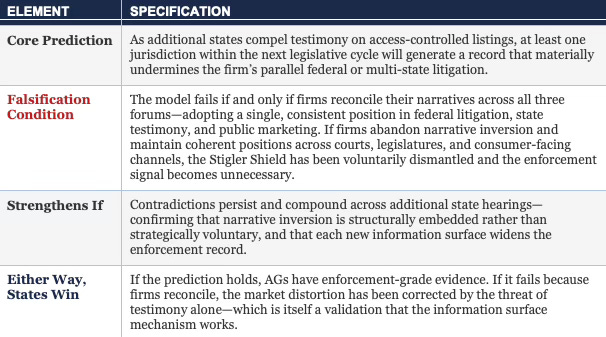

The analytical framework in this briefing generates falsifiable predictions. If the model is correct—if narrative inversion is a structural necessity for access-controlling business models and the Stigler Shield is the mechanism that sustains it—then compelled testimony will produce observable contradictions. If the model is wrong, it will fail in a specific, identifiable way.

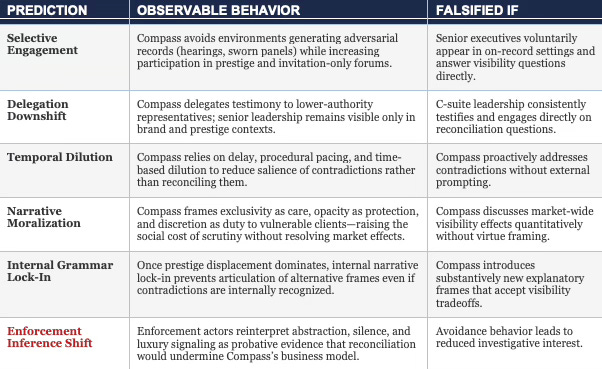

XVI. Foresight Simulation: Adaptive Narrative Strategies Under Testimony Pressure

Section XV establishes what the model forecasts. The foresight simulation below models how access-controlling firms will adapt once legislative testimony collapses cross-forum separation. MindCast AI’s Cognitive Digital Twin (CDT) methodology generated the foresight simulation, modeling institutional behavior as the product of incentives, information asymmetry, and structural geometry—not stated intent. Six Vision Functions ran sequentially to test whether firms can escape enforcement exposure through narrative adaptation alone.

Key Finding: Legislative testimony is a one-way gate. Once crossed, narrative abstraction cannot restore equilibrium. The Nash–Stigler equilibrium destabilizes the moment testimony fixes claims into a single public record; avoidance strategies delay but do not break the causal chain. Installed Cognitive Grammar analysis detects strong grammar persistence: firms default to abstract language (“innovation,” “future,” “choice”) when reconciliation threatens core incentives. Grammar persistence is a predictable reflex, not a strategic solution.

Strategic Behavioral Coordination fails at scale. Even if executives attempt a pivot, legacy statements, federal pleadings, and affiliate testimony continue generating contradictions across forums. Firms can achieve partial coordination at the messaging layer; they cannot coordinate fully across litigation, lobbying, and affiliates without abandoning the underlying business model. Field-Geometry Reasoning confirms that once a contradiction enters the record, reversal paths narrow sharply—silence, abstraction, and rhetorical reframing cannot erase the evidentiary surface the testimony has already created.

The Dominant Response: Prestige Displacement. The CDT simulation identifies prestige displacement as the most probable adaptive strategy—redirecting attention to innovation, luxury service, discretion, and consumer aspiration while treating cross-forum inconsistencies as technical or irrelevant. Prestige displacement reframes contradiction as beneath the firm’s category. For enforcement actors, however, abstraction, aesthetic elevation, and silence function as confirmation that reconciliation would undermine the underlying business model. Prestige displacement stabilizes public perception but fails in enforcement contexts; enforcement exposure remains non-decreasing across the subsequent legislative cycle.

Access-Based Advocacy as Parallel Control Surface. Once testimony fixes contradictions into a durable public record, Compass does not rely on narrative reframing alone. The CDT simulation identifies a dual-track response: prestige displacement in public forums combined with intensified off-docket access to decision-makers. Access can be coordinated even when narrative coherence cannot (SBC finding). Access can delay or reroute enforcement outcomes, but it cannot erase the record testimony has created—it shifts the timing of equilibrium resolution, not its direction. AGs and legislators should monitor for procedural closure without record reconciliation as a signal that access-based advocacy has been activated.

Monitoring Guide for AGs and Legislative Staff. Observable signals that indicate which scenario is unfolding: shift from concrete claims to abstract language; reduced willingness to answer direct questions on information visibility; attempts to narrow or amend prior litigation claims; escalation of preemption or “innovation-chilling” rhetoric; delegation of testimony to lower-authority representatives while senior leadership appears only in brand contexts. Enforcement actors will interpret silence and abstraction as confirmation that reconciliation would undermine core incentives—which increases, rather than reduces, enforcement risk over time.

Second-Order Predictions: Six Observable Behavioral Shifts. The CDT simulation generates six second-order predictions that arise from the same constraint geometry as the primary scenarios. Each represents a specific, observable behavior that AGs and legislative staff can track in real time.

Implication: Only a genuine change in market behavior—abandoning access control—resets the geometry. Enforcement does not depend on legislative success. The testimony record is sufficient. Each additional hearing compounds the evidentiary surface, making later pivots less effective. Firms that escalate conflict hasten coordinated action; firms that retreat rhetorically extend scrutiny without relief.

XVII. National Precedent Landscape

Two states have advanced transparency legislation, and they represent a critical design fork that every subsequent state will face.

Wisconsin enacted Act 69 with an opt-out provision—the first state to legislate real estate listing transparency, though the opt-out limits the equilibrium-disrupting effect. Washington advanced SB 6091 without an opt-out provision, representing the stronger model. Both generated testimony records. The NAR Clear Cooperation Policy and federal legislative interest from Warren/Wyden provide additional context, though the state-level enforcement pathway operates independently of federal action.

The Opt-Out Design Fork. The distinction between these two models is not procedural—it is structural. Unlike other transparency proposals, SB 6091 does not allow an opt-out because opt-outs recreate the same coordination loopholes that dominant platforms use to route around disclosure and maintain private listing networks. At platform scale, an opt-out is not a consumer protection—it is an embedded default that the dominant firm can pre-select in listing agreements and train agents to frame as “premium service.” Compass’s own testimony requested precisely this mechanism: a twelve-word amendment (“or if the homeowner requests otherwise in writing”) that would convert the transparency mandate into an opt-in regime controlled by the listing agent.

For legislators in other states, the design choice is binary:

Option A: Transparency with opt-out → preserves coordination capture risk. The dominant firm embeds the opt-out as a default; the transparency mandate becomes nominal.

Option B: Transparency without opt-out → restores the baseline of concurrent public marketing. All brokerages compete on the same information surface. No firm can convert market share into information control.

Washington’s SB 6091, the only current transparency bill with no opt-out, provides a transferable model for post-Compass behavioral regulation through licensing law. The bill’s mechanism—concurrent public marketing as a condition of brokerage licensure—is platform-neutral, technology-neutral, and portable to any state with a real estate licensing statute. The no-opt-out feature is the distinctive design choice that makes the model enforceable at scale; without it, the transparency mandate defaults to voluntary compliance by the firm with the most incentive to circumvent it.

The Call to Action

Foundational Publications and Citations

The analytical framework in this briefing builds on the following MindCast AI publications and foundational research. Each is cited with full title, URL, and relevance to enable cross-reference by Attorneys General, legislative counsel, and staff.

Tier 1: MindCast AI Publications — Essential for Core Brief

1. A New Era of Federalism: Competitive Federalism as Market Infrastructure [GOVERNING FRAMEWORK]

https://www.mindcast-ai.com/p/new-era-federalism

Primary governing framework for the entire document. Establishes the constitutional and structural justification for treating state legislative hearings as independent enforcement infrastructure—not merely a pathway to a bill, but a first-order enforcement mechanism in its own right. Argues that states function as “first-order enforcement signal generators” that can activate police power at the moment federal agencies reach procedural sufficiency—the core concept underlying Section III (Why the Signal Routes to States) and the Signal-vs-Statute inversion in Section IV. Synthesizes the full 18-publication analytical series, making it the essential anchor for the Competitive Federalism model presented to Attorneys General throughout the briefing. Also directly supports Section XV (Cross-State Prediction and Falsification).

2. MCAI Economics Vision: The Dual Nash–Stigler Equilibrium Architecture

https://www.mindcast-ai.com/p/nash-stigler-equilibria

Combined strategic–informational equilibrium. Dual constraint system. Pseudo-Equilibrium Detection. Falsification Contracts. Core theoretical model for Sections I, III, and XIV.

3. The Stigler Equilibrium: Regulatory Capture and the Structure of Free Markets

https://www.mindcast-ai.com/p/stigler-equilibrium

ECE definition. Six Modes of Capture. Bootleggers-and-Baptists. Quantitative metrics (GPI, UE, DoC). Testimony as Stigler-disrupting information shock—the foundational concept behind the Stigler Shield framework.

4. Tirole Phase: Advocacy-Driven Antitrust Inaction

https://www.mindcast-ai.com/p/tirole-advocacy-arbitrage

Phase model (State 0→2 + Tirole overlay). Compass-Anywhere as proof case. Exit condition: distributed enforcer density—the condition this briefing argues state action supplies.

5. Federal Antitrust Breakdown as Nash–Stigler Equilibrium (Harm Clearinghouse)

https://www.mindcast-ai.com/p/stigler-harm-clearinghouse

Four-payor externality model. $22B deadweight loss. State AGs as payors inheriting federal fiscal spillovers. Primary source for the harm quantification in Section XI.

6. The Geometry of Regulatory Capture at DOJ

https://www.mindcast-ai.com/p/antitrust-regulatory-capture-geometry

Why self-correction is structurally impossible. Field-Geometry non-navigability. Grammar Persistence Index. Supports Section II’s “Why It Will Not Self-Correct” analysis.

7. Chicago School Accelerated: State Action as Orthodox Response

https://www.mindcast-ai.com/p/chicago-school-accelerated

Maps to: Section I (The Free-Market Case for State Action)

State enforcement as Chicago School-orthodox. Transparency mandates reduce transaction costs consistent with Coasean/Posnerian efficiency. Series overview anchoring Section I and framing the constitutional argument in Section III.

7a. Chicago School Accelerated Part I: Coase

https://www.mindcast-ai.com/p/chicagoseriescoase

Transparency as transaction cost reduction. Legislative hearings as Coasean Information Subsidy. Private Exclusives as artificial friction preventing market clearing. Directly supports Section I’s Coase pillar.

7b. Chicago School Accelerated Part II: Becker

https://www.mindcast-ai.com/p/chicagoseriesbecker

Misconduct as rational economic calculation. Hearings raise probability of detection from near-zero to 1.0. Destroys the Calculus of Impunity without requiring new penalties. Directly supports Section I’s Becker pillar.

7c. Chicago School Accelerated Part III: Posner

https://www.mindcast-ai.com/p/chicagoseriesposner

State action as efficiency maximization. $22 billion deadweight loss requiring institutional correction. State AG as marketmaker of last resort. Directly supports Section I’s Posner pillar.

8. Federal Political Market Failure and State Substitution

https://www.mindcast-ai.com/p/federal-market-failure

State action as free-market corrective. States as competitive entrants supplying enforcement the federal monopoly no longer delivers.

9. Comparative Externality Costs: Live Nation + Compass-Anywhere

https://www.mindcast-ai.com/p/nash-stigler-livenation-compass

$22B deadweight loss via cross-domain comparison. Consumer Welfare Delta methodology. Supports Sections I and XI.

Tier 2: MindCast AI Publications — State-Specific Deployment

10. The Compass Narrative Inversion Playbook

https://www.mindcast-ai.com/p/mcai-lex-vision-compass-vs-competition

Initial empirical observation of narrative inversion. WA proof case for cross-state pattern. Five Arguments, Forward Lock, Astroturf Coefficient methodology.

11. MCAI Lex Vision: Compass vs. Competition

https://www.mindcast-ai.com/p/mcai-lex-vision-compass-vs-competition

Legal-economic analysis connecting testimony to competition/consumer-protection exposure. Three-Part Legislation Test. Informs the enforcement hooks in Sections IX–XII.

12. Trump Administration Political Access Analysis

https://www.mindcast-ai.com/p/trump-antitrust-authority-routing

Authority-routing patterns. Bipartisan framing: structural capture invariant across administrations.

13. Why DOJ Banned Algorithms but Blessed Mega-Brokerage

https://www.mindcast-ai.com/p/usdoj-mergers

Federal double standard: DOJ pursued RealPage but cleared Compass-Anywhere. Selective enforcement as capture symptom.

14. Crypto ATM Regulatory Convergence

https://www.mindcast-ai.com/p/state-ag-federal-inaction

Cross-domain validation of competitive federalism framework. AARP collaboration entry vector.

15. Briefing for State Attorneys General: Federal Inaction and State Enforcement Authority

https://www.mindcast-ai.com/p/state-ag-federal-inaction

Pre-built AG briefing. Enforcement authority analysis and UDAP framework. Primary source for Part Three content.

16. Field-Geometry Reasoning: Strategy Space and Institutional Constraints

https://www.mindcast-ai.com/p/runtime-geometry-economics

Structural constraints override leadership intent. Mathematical framework for reform pathway impossibility. Foundational pillar of the Runtime Geometry architecture (see 16a).

16a. Runtime Geometry: A Framework for Predictive Institutional Economics

https://www.mindcast-ai.com/p/runtime-geometry-economics

Maps to: Section VIII (Mobilization Decay), Section XVI (Foresight Simulation)

Canonical four-pillar architecture unifying Field-Geometry, Nash–Stigler Equilibrium, Tirole Advocacy Arbitrage, and Systemic Externality Analysis into a single diagnostic framework for institutional integrity. Advances Field-Geometry from static topology to runtime simulation—explaining how coordinated mobilization geometries degrade under repeated information shocks over time, not just as one-time events. Directly explains the mobilization decay rate documented in Section VIII: Compass’s coordinated field cannot sustain its shape across multiple hearings because maintaining simultaneous mobilization, message discipline, and affiliation concealment compounds coordination costs faster than the firm can absorb them. Published January 30, 2026.

17. The January Split: DOJ Enforcement Pattern Analysis

https://www.mindcast-ai.com/p/irobot-msft

RealPage, HPE/Juniper, Compass enforcement divergence. Empirical basis for selective enforcement claim.

18. Narrative Inversion as Enforcement Signal (This Publication)

The current document. Theoretical architecture for the Stigler Shield, information surface, and signal-versus-statute frameworks.

Tier 3: Empirical Case Studies & Technical Appendices

19. HB 2512 and the Collapse of Compass’s Coordinated Opposition

https://www.mindcast-ai.com/p/jan28-hb2512-hearing

Primary empirical data for the Astroturf Coefficient and the Three-Tier Structure described in Section VIII. Documents the specific VoterVoice campaign used to manufacture grassroots pressure, quantifying the 17:1 ratio of affiliated to non-affiliated testimony against HB 2512 in Washington State. Provides a direct blueprint for AGs and legislative staff to identify and quantify similar patterns of coordinated, undisclosed corporate mobilization in their own jurisdictions.

20. The Collapse of Compass’s Co-Conspirator Theory

https://www.mindcast-ai.com/p/compass-coconspirator-theory-collapse

Tactical methodology for leveraging state-level testimony to neutralize federal litigation, directly supporting the Portable Evidence Framework. Details how statements made during state legislative hearings—specifically regarding listing visibility and market power—become discoverable evidence that undercuts inconsistent claims in federal antitrust cases. Demonstrates that a single state’s record becomes a permanent and portable liability for a firm across all jurisdictions.

21. Compass vs. SB 6091: Narrative Pre-Installation and the Infrastructure of Exception Capture

https://www.mindcast-ai.com/p/compass-narrative-preinstall

Foundational study for the Named Moves identified in the Five Arguments and Cross-Forum Contradiction tables (Sections IV–V). Analyzes the Safety Valve Bluff and Data Scraping Pivot as structural rhetorical strategies rather than isolated arguments. Provides the theoretical underpinning for why these arguments are predictable and how they are specifically designed to maintain the Stigler Shield by exploiting institutional information asymmetry.

22. The Validation Node: Washington State as Competitive Federalism in Operation

https://www.mindcast-ai.com/p/wa-federalism

Operational proof of concept for Competitive Federalism and the Signal-vs-Statute inversion. Frames the Washington State legislative process as a Validation Node where state police power was successfully activated at the point of federal procedural sufficiency. Provides the real-world precedent that AGs need to justify exercising independent constitutional authority in a market where federal institutions have reached a structural enforcement ceiling.

23. Foresight Simulation: Adaptive Narrative Strategies Under Legislative Testimony Pressure

Current publication

Maps to: Section XVI (Foresight Simulation)

CDT foresight simulation modeling how access-controlling firms adapt once legislative testimony collapses cross-forum separation. Runs six Vision Functions (Causation, Nash–Stigler Equilibrium, Installed Cognitive Grammar, Strategic Behavioral Coordination, Field-Geometry Reasoning, MindCast AI Foresight) to generate four probability-weighted scenarios with falsification criteria. Concludes that legislative testimony is a one-way gate: once crossed, narrative abstraction cannot restore equilibrium. Provides the monitoring guide for AGs and legislative staff to track which adaptive scenario is unfolding in their jurisdiction.

Foundational Research — Nobel Laureate and Seminal Works

24. John Nash — “Non-Cooperative Games” (1951)

https://www.pnas.org/doi/10.1073/pnas.36.1.48

Nash Equilibrium. Anti-competitive dark markets as stable equilibria requiring outside institutional force. Five Arguments as Nash-predicted deviations.

25. George Stigler — “The Theory of Economic Regulation” (1971)

https://www.jstor.org/stable/3003160

Foundational capture theory. Federal agencies stabilize at procedural sufficiency. ECE as direct extension. The theoretical basis for the Stigler Shield concept.

26. Jean Tirole — “Market Power and Regulation” (2014 Nobel Lecture)

https://www.nobelprize.org/uploads/2018/06/advanced-economicsciences2014.pdf

Information asymmetry between regulators and firms. Tirole Arbitrage. Tirole Phase as named extension.

27. Ronald Coase — “The Problem of Social Cost” (1960)

https://www.journals.uchicago.edu/doi/10.1086/466560

Legislative property rights more efficient than litigation under high transaction costs. Transparency mandates reduce Private Exclusive transaction costs.

28. Richard Posner — “Economic Analysis of Law”

https://www.law.uchicago.edu/faculty/posner-r

State intervention to protect public utilities when private litigation creates negative externalities. MLS as public market infrastructure.

Legal Citations

29. Parker v. Brown, 317 U.S. 341 (1943)

https://supreme.justia.com/cases/federal/us/317/341/

State-action immunity. Clearly articulated state policy. Multi-state adoption reinforces standard. Repositioned in Section XII as offensive litigation leverage.

30. Compass, Inc. v. Zillow Group, Inc. (S.D.N.Y.)

Primary cross-forum contradiction source. Restricted visibility = anticompetitive harm. Platform access demanded. Supports Sections IV–VI and the Forward Lock.

31. Compass, Inc. v. Northwest Multiple Listing Service (W.D. Wash.)

MLS transparency rules challenged. Fair housing justifications called pretextual. Second cross-forum source.

Citation Note: Washington State materials referenced in prior publications are treated as early observable instances, not jurisdiction-limiting authorities. The analytical claims in this document apply across states regardless of statutory variation.